Oil Prices at a Crossroads: Will WTI Push Past $75 or Sink Below $70?

Rising inventories, Fed rate policy, and geopolitical tensions shake oil markets—where is crude heading next? | That's TradingNEWs

Oil Price Analysis: Can WTI and Brent Sustain the Rally or Are We Headed for a Reversal?

Crude oil markets are at a crossroads as WTI (CL=F) hovers around $72 per barrel and Brent (BZ=F) trades near $75, struggling to maintain their recent rally amid mixed economic signals, rising inventories, and geopolitical uncertainties. The latest U.S. crude stockpile build of 4.1 million barrels reported by the EIA has pressured prices lower, while the ongoing Federal Reserve stance on interest rates and potential diplomatic developments in Ukraine have further complicated the outlook. The key question now: Will oil break higher toward $80, or is a pullback below $70 more likely?

Oil Market Fundamentals: Inventories and Supply Trends Weigh on Prices

Crude oil prices faced renewed pressure after the American Petroleum Institute (API) reported a staggering 9.04 million barrel build in U.S. crude inventories, far exceeding market expectations. This was followed by EIA data showing a 4.1 million barrel increase, adding to concerns of oversupply. Gasoline inventories fell by 3 million barrels, offering some bullish support, but the build in middle distillates by 100,000 barrels kept sentiment subdued.

Total crude supply in the U.S. has now risen for two consecutive weeks, reflecting seasonal trends but also signaling potential demand weakness. Refinery output averaged 9.3 million barrels per day, slightly higher than the previous week’s 9.2 million barrels, but the overall trend suggests that supply remains robust while demand indicators remain mixed.

Meanwhile, Russia's oil production remains a major variable, as Deputy Prime Minister Alexander Novak insisted that Russia is fully complying with its OPEC+ quota. However, tanker tracking data suggests Russia has been overproducing for much of the past year, creating additional uncertainties around future supply cuts. The OPEC+ group continues to maintain its output strategy, with the cartel expecting global oil demand to rise by 1.45 million barrels per day (bpd) in 2025. However, the latest production adjustments and voluntary cuts by some members have failed to significantly impact market prices.

Federal Reserve Policy and Economic Data Impact Oil Demand Outlook

Fed Chair Jerome Powell's recent statements on interest rates added to oil market volatility. Powell emphasized that the Fed is in no rush to cut rates, citing strong labor market conditions and persistent inflationary pressures. This dampened hopes of a near-term rate cut, which could keep borrowing costs high and potentially slow economic activity, leading to lower demand for crude oil.

The U.S. Consumer Price Index (CPI) increased by 0.5% in January, above market expectations, fueling speculation that the Fed will delay rate cuts until late 2025. Higher interest rates generally reduce business investment and consumer spending, which can directly impact oil consumption in transportation and industrial sectors.

Geopolitical Tensions and Trump's Tariff Policy Influence Oil Markets

Another major catalyst for oil prices is U.S. foreign policy and its impact on global trade and energy flows. Donald Trump’s recent tariff threats on steel and aluminum imports have added uncertainty to markets, potentially affecting industrial demand for oil. Furthermore, Trump's discussions with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky have introduced a new dimension to the oil market, with investors assessing whether peace talks could lead to reduced geopolitical risk premiums on crude prices.

The war in Ukraine has been a significant factor in supporting oil prices, particularly due to the disruption of Russian energy exports. Any resolution to the conflict could ease supply constraints and push oil prices lower. However, with Russia facing ongoing sanctions, the long-term impact on global supply chains remains uncertain.

Technical Analysis: WTI and Brent Face Key Resistance Levels

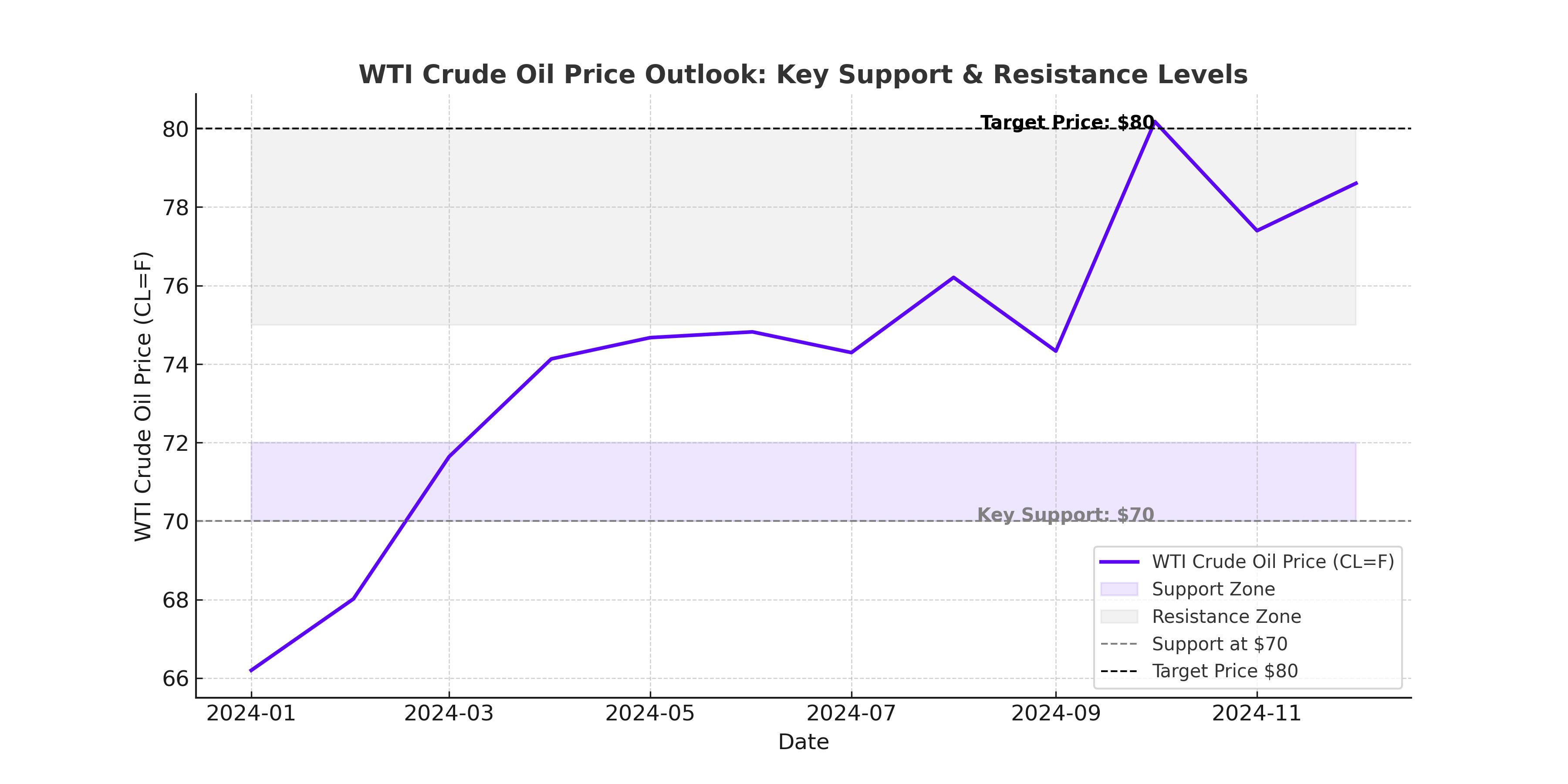

WTI crude has struggled to break above the $73 resistance level, with strong selling pressure emerging each time prices approach this threshold. A successful breakout could see CL=F rally toward $75 and then $80, but failure to hold above $70 could open the door for a decline toward $68 or even $65.

Brent crude faces a similar challenge, currently capped at $76, with a potential upside toward $78-$80 if momentum builds. However, a rejection at these levels could send Brent back toward $72 and lower support at $70.

The Relative Strength Index (RSI) for both WTI and Brent remains neutral, suggesting that neither buyers nor sellers have complete control over the market. However, the 50-day moving average for WTI sits at $71.50, making this a critical pivot point for traders. If oil prices remain above this level, the bullish outlook remains intact; if prices fall below, expect further downside pressure.

Global Oil Demand Forecasts and Industry Developments

Despite near-term volatility, OPEC forecasts global oil demand to increase by 1.45 million barrels per day in 2025, driven by continued economic expansion in emerging markets. China, India, and other developing economies are expected to lead demand growth, offsetting weaker consumption trends in advanced economies.

Meanwhile, in the U.S., ExxonMobil (NYSE:XOM) is ramping up production in Guyana, where it has already produced over 500 million barrels from the Stabroek Block. The company is now seeking environmental approvals for its eighth offshore project, which could bring additional supply into the market. Exxon’s expansion in Guyana, alongside continued U.S. shale production increases, could add downward pressure on oil prices in the coming months.

Market Sentiment: Oil Traders Divided on Future Direction

Hedge funds and money managers have shown mixed positioning in oil markets, with some increasing long bets on expectations of higher summer demand, while others remain cautious due to macro risks and high U.S. inventories. The market remains in contango, meaning near-term futures are trading at a discount to longer-dated contracts—a sign that traders are pricing in potential oversupply.

The International Energy Agency (IEA) has also warned of softer-than-expected demand in early 2025, citing rising electric vehicle adoption, fuel efficiency improvements, and global economic headwinds. This could put a cap on any significant oil price rallies unless supply disruptions or geopolitical shocks emerge.

Oil Price Forecast: Buy, Sell, or Hold?

The outlook for oil prices remains highly uncertain, with both bullish and bearish forces at play. If WTI breaks above $73 and sustains momentum, we could see a rally toward $80, particularly if OPEC+ signals further production discipline or if demand picks up. However, if crude inventories continue to rise and economic conditions soften, oil could fall back toward $68-$70 in the coming weeks.

Long-term investors should watch the Fed's interest rate decisions, OPEC's next move, and geopolitical developments in Ukraine and the Middle East. If economic growth remains stable and global demand holds firm, oil prices could stabilize in the $75-$80 range. However, a slowdown in economic activity or aggressive supply increases from non-OPEC producers could lead to further downside risks below $70.

Short-term traders should monitor technical resistance at $73 (WTI) and $76 (Brent) for breakout signals. A break below $70 for WTI could trigger a sharper decline, while a move above $75 would confirm further upside potential.

Final Verdict on Oil Prices: Cautious Optimism with Downside Risks

Oil markets remain in a delicate balance, with geopolitical developments, interest rate expectations, and supply trends all influencing price action. While near-term volatility is likely, the broader picture suggests that WTI and Brent may struggle to sustain rallies above $80 without a fundamental shift in supply-demand dynamics.

For now, WTI remains in a tight range between $70-$75, and traders should be prepared for sharp price swings driven by economic data, inventory reports, and geopolitical headlines. If crude stocks continue to build and demand shows signs of slowing, a deeper correction toward $65 is not off the table. However, if demand surprises to the upside and OPEC+ holds firm on production cuts, oil could remain well-supported above $70 in the months ahead.