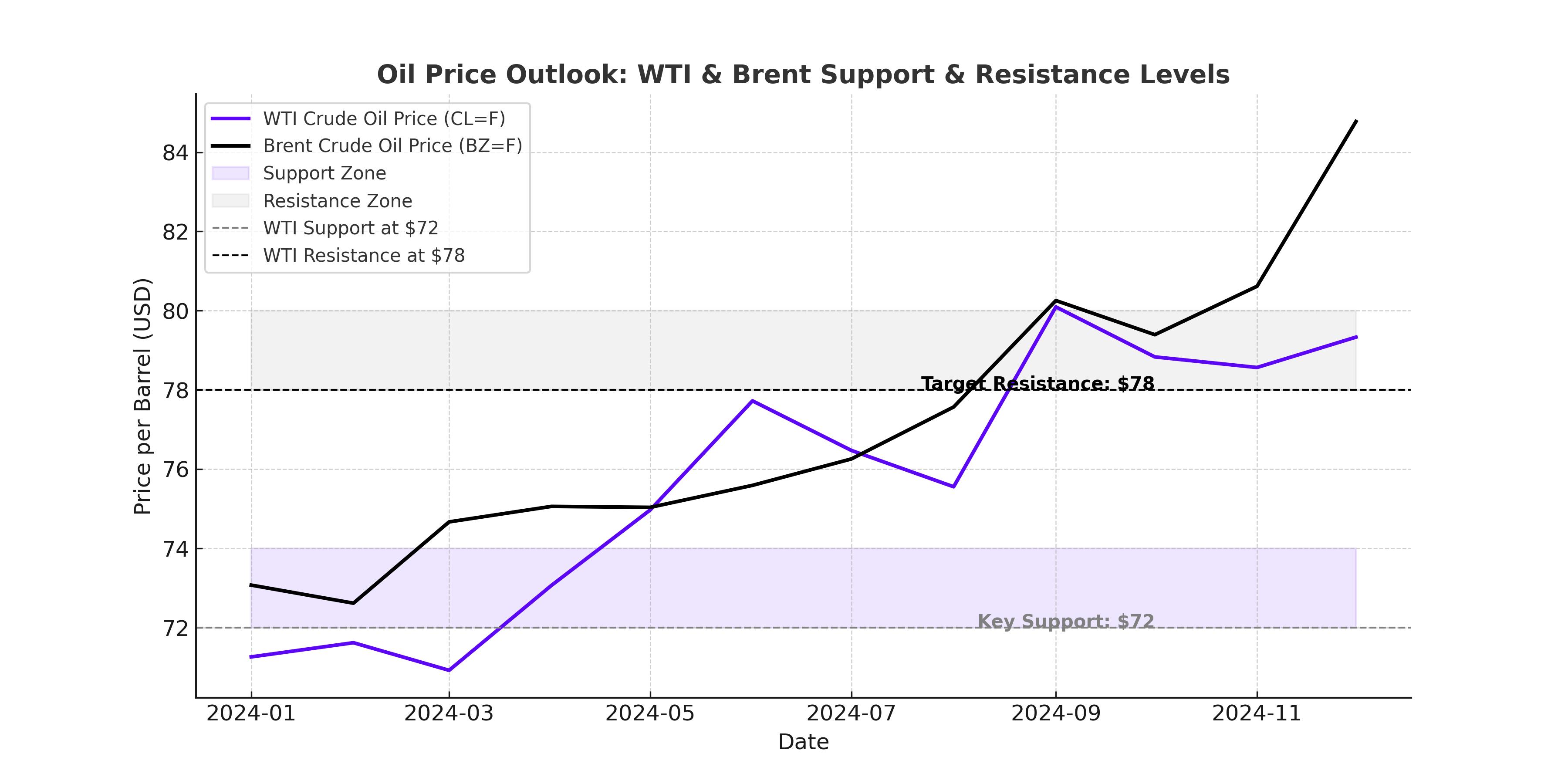

Oil Prices Rally as Sanctions and Supply Fears Shake Markets—Can WTI Hold Above $73?

With WTI at $73.05 and Brent at $76.73, is oil on track to hit $80, or will rising inventories and economic risks send prices lower? | That's TradingNEWS

Oil Price Analysis: Can WTI and Brent Maintain Their Rally or Is a Reversal Coming?

WTI and Brent Oil Prices Surge Amid Sanctions and Geopolitical Tensions

Oil prices have gained upward momentum, with West Texas Intermediate (WTI) (CL=F) trading at $73.05 per barrel and Brent crude (BZ=F) rising to $76.73. The rally has been fueled by supply concerns as U.S. sanctions tighten restrictions on Russian and Iranian oil exports. The sanctions have disrupted shipments to major buyers like India and China, driving uncertainty over global supply availability. This comes at a time when OPEC+ producers, including Saudi Arabia and Russia, have been cautious about increasing production despite growing demand.

The situation has been exacerbated by geopolitical risks in the Middle East. President Donald Trump’s hardline stance on Iran, the renewed focus on the Gaza conflict, and increased tensions with key Arab nations have created a volatile market environment. The U.S. has also doubled down on pressure against Iran’s oil shipments to China, limiting Tehran’s ability to fund its economy through crude sales. As a result, traders are factoring in potential supply disruptions, keeping oil prices elevated despite the threat of weaker economic growth due to rising tariffs.

Russia-India Oil Trade Faces Uncertainty Amid U.S. Sanctions

India, one of the world's largest crude importers, has been forced to adjust its purchasing strategy due to the new U.S. sanctions on Russian oil shipments. While Russia has reassured that its trade with India will remain stable, Indian refiners are struggling to secure non-sanctioned tankers and compliant financial transactions. Previously, India relied heavily on discounted Russian crude, but as compliance risks mount, refiners may need to shift purchases toward alternative suppliers, including Saudi Arabia, the UAE, and even the U.S.

For now, India has received temporary relief, as the U.S. has allowed sanctioned Russian oil tankers to discharge crude at Indian ports until February 27. However, the long-term viability of this arrangement remains uncertain. If Russian shipments to India slow further, oil prices could see renewed upward pressure as Indian buyers look elsewhere to meet their 80% crude import dependency.

Tariffs and Economic Growth Concerns Could Cap Further Oil Gains

While supply disruptions have supported oil’s rally, the latest trade measures by the U.S. pose a risk to long-term demand. President Trump has imposed a 25% tariff on steel and aluminum imports, igniting fears of a broader trade war. The European Union has already signaled that it will respond with countermeasures, raising concerns about slowing industrial activity and overall energy consumption.

Oil markets are particularly sensitive to changes in global trade flows, as economic slowdowns tend to reduce demand for fuel, transportation, and manufacturing output. Analysts at Morgan Stanley have noted that while supply concerns are dominating short-term price movements, the impact of prolonged trade tariffs could gradually weigh on demand, especially if economic growth slows in key markets like China and the EU.

U.S. Federal Reserve Policy and Oil Market Volatility

Another key factor influencing oil markets is the U.S. Federal Reserve’s stance on interest rates. Fed Chair Jerome Powell has signaled that rate cuts may not come as soon as some investors had hoped, given persistent inflation risks. Higher interest rates increase borrowing costs, which can reduce industrial activity and fuel consumption.

The next major test for oil prices will come from the upcoming U.S. Energy Information Administration (EIA) crude oil inventory report. Analysts expect a stockpile build of approximately 2.6 million barrels, marking the third consecutive week of rising inventories. A larger-than-expected increase in crude stocks could apply downward pressure on oil prices, as it would signal weaker demand from refiners.

OPEC+ Production Strategy Remains Key to Oil’s Future Direction

Despite the recent price gains, OPEC+ has remained cautious about increasing output. Saudi Arabia and Russia have reaffirmed their commitment to disciplined production levels, with no immediate plans to flood the market with additional supply. The cartel is likely to extend its current supply strategy beyond March, given the uncertainty surrounding demand trends.

Saudi Arabia’s shipments to China are expected to decline in March due to higher crude pricing, suggesting that the Kingdom is in no rush to boost exports despite China’s rising energy needs. If OPEC+ continues to prioritize price stability over higher production, the market could remain tight, keeping oil prices supported above $70 per barrel.

Buy, Sell, or Hold? Oil's Next Move Depends on Supply and Demand Balance

Oil’s recent gains have been driven by supply-side fears, but growing trade tensions and economic risks could limit further upside. If WTI (CL=F) can hold above $72 and Brent (BZ=F) stays above $76, the market is likely to maintain its bullish momentum, potentially targeting $80 per barrel in the coming weeks.

However, if U.S. crude inventories continue to rise and demand slows due to economic concerns, oil prices could face renewed selling pressure. Traders should closely monitor OPEC+ decisions, Federal Reserve policy signals, and trade developments for clues on whether oil will break higher or face a short-term correction.

For now, oil remains a buy for long-term investors, given the geopolitical risks and supply constraints. But short-term traders should be cautious, as volatility remains high and profit-taking could trigger temporary pullbacks. The key levels to watch are $70 for WTI and $74 for Brent—a break below these levels could signal a bearish reversal, while sustained strength above them would reinforce the bullish case.