Current Oil Market Dynamics: Iraq, Global Supply, and Demand

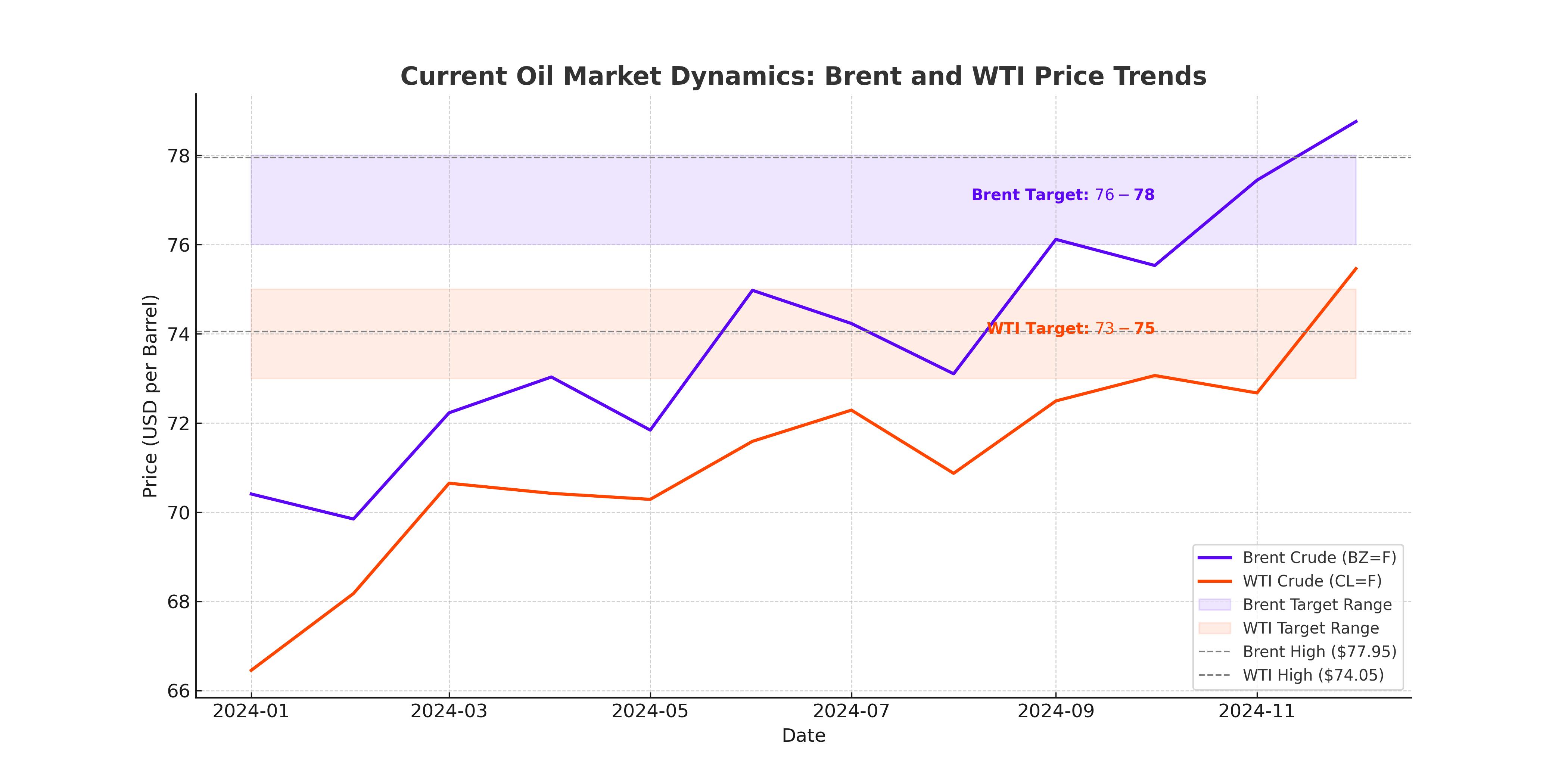

The crude oil market, represented by benchmarks such as WTI (CL=F) and Brent (BZ=F), reflects ongoing geopolitical, supply, and demand challenges. As of January 2025, Brent crude trades at $76.98 per barrel, while WTI is priced at $74.05. This modest uptick of over 1% reflects heightened winter fuel demand across the U.S. and Europe, juxtaposed against recent U.S. refinery activity and geopolitical tensions.

U.S.-China Energy Strategy in Iraq's Oil Sector

The U.S. and its allies are counteracting China's influence in Iraq’s oil and energy infrastructure, leveraging projects like the Kirkuk oil fields, where BP recently finalized agreements. These fields, holding approximately 9 billion barrels of recoverable oil, have historically contributed significantly to Iraq's production. BP’s existing Rumaila field development ties strategically into TotalEnergies' Common Seawater Supply Project (CSSP), designed to expand Iraq’s production capacity to over 6 million barrels per day (bpd) and potentially up to 13 million bpd in the coming years.

China’s involvement, framed through its Belt and Road Initiative (BRI), has positioned it as a dominant investor in Iraq and Iran’s energy sectors. Agreements such as the Iraq-China Framework Agreement have enabled Beijing to secure energy resources via long-term contracts. However, U.S.-backed projects like TotalEnergies’ gas-flaring reduction initiatives aim to reduce Iraq’s dependence on Iranian imports, addressing up to 40% of its energy shortfall.

Winter Weather and Fuel Demand Boost WTI and Brent Prices

The crude oil price increase this winter correlates with harsh weather across the U.S., boosting heating oil demand. The Energy Information Administration (EIA) reports refinery utilization rates climbing to 93.3%, the highest since December 2018. With global demand surging to 101.4 million bpd this January, forecasts expect consumption to remain robust due to China's Lunar New Year travel boom and continued European heating needs.

JPMorgan analysts highlight a 1.4 million bpd year-over-year increase in global oil demand, signaling resilience despite elevated prices. Concurrently, Brent's backwardation—where near-term contracts are priced higher than longer-term ones—reflects tight supply dynamics. For instance, the six-month Brent spread recently widened, underscoring fears of supply reductions.

Alberta Oil Exports and U.S.-Canada Energy Relations

Canada’s oil sector, particularly Alberta, continues to capitalize on pipeline expansions like the Trans Mountain Pipeline (TMX), which tripled capacity to accommodate increased U.S. West Coast imports. Alberta’s Premier Danielle Smith has doubled down on expanding production to address the U.S.’s crude deficit, where domestic production meets only 13 million bpd of its 20 million bpd consumption.

However, potential tariffs from the incoming U.S. administration threaten this trade. President-elect Donald Trump’s proposed 25% tariff on Canadian crude seeks to incentivize domestic production, potentially complicating Alberta’s export growth strategy.

Iraq’s Infrastructure Development and Its Oil Market Role

In Iraq, the CSSP, led by TotalEnergies, marks a pivotal shift toward increasing production while reducing gas flaring. Gas flaring, currently at 17.3 billion cubic meters annually, positions Iraq as the second-largest flaring nation after Russia. By eliminating this waste and integrating advanced water injection for reservoir pressure maintenance, Iraq could significantly stabilize and expand its production. These efforts also align with its commitments to the Zero Routine Flaring Initiative by 2030.

BP’s renewed focus on Kirkuk complements these efforts, aiming to rejuvenate fields with historically low recovery rates. Water injection, requiring 6 million bpd of treated seawater from the CSSP, will be a critical enabler. Despite ongoing challenges with agricultural water usage competition, experts remain optimistic about TotalEnergies’ and BP’s capabilities to implement these solutions.

LNG Prices and the Shift Toward Oil-Based Fuels

Asia’s recent spike in LNG prices, trading at a rare premium over Brent crude, highlights potential shifts in fuel preferences. The Japan-Korea LNG benchmark was recently 22% higher than Brent on an energy-equivalent basis, pushing price-sensitive markets toward oil-based alternatives. LNG’s premium stems from tight European supplies, exacerbated by the suspension of Russian pipeline flows.

Norway’s Record Natural Gas Exports and European Dependency

Amidst the tightening global gas market, Norway exported a record 117.6 billion cubic meters of natural gas to Europe in 2024, accounting for 30% of the continent’s imports. This surge follows reduced Russian gas transit, further solidifying Norway's strategic importance to Europe’s energy stability. Gassco reports stable production levels expected through the decade, albeit with potential declines toward the late 2020s.

Canadian Oil Industry and Trudeau's Exit

The resignation of Prime Minister Justin Trudeau has bolstered Canadian energy optimism. Alberta’s focus on doubling oil production aligns with Enbridge’s pipeline expansions, enhancing North American energy security. However, the sector faces headwinds from environmental policy shifts and potential tariffs under U.S. trade policies.

Geopolitical Implications for Oil Prices

As global oil markets navigate evolving geopolitical landscapes, sanctions on Russian oil remain a focal point. Potential U.S. sanctions targeting Russia’s economy under the Biden administration could exacerbate supply disruptions, further influencing WTI and Brent prices, projected to range between $67.55 and $77.95 in February.

Increased refinery utilization in the U.S., alongside TotalEnergies' and BP's strategic projects in Iraq, underscores the interconnected dynamics of global oil markets. With oil prices reacting to demand, geopolitical events, and infrastructure investments, Brent and WTI benchmarks remain pivotal indicators of market direction.