Oil Prices Decline Amid US Inflation Concerns and Fed Policies

Economic Pressures and Geopolitical Tensions Shape Oil Market Dynamics | That's TradingNEWS

Oil Market Analysis: Pressures and Trends

Oil Prices Under Pressure from Economic Concerns

Oil prices fell in early Asian trade on Tuesday as investors grappled with the prospect of sustained high US inflation and interest rates, which could depress consumer and industrial demand. Brent crude futures dropped 12 cents to $83.34 a barrel, while US West Texas Intermediate (WTI) eased 8 cents to $79.72 a barrel. Both benchmarks had fallen less than 1% on Monday after US Federal Reserve officials signaled they were waiting for more signs of slowing inflation before considering interest rate cuts.

Impact of Federal Reserve Policies

Federal Reserve Vice Chair Philip Jefferson and Vice Chair Michael Barr emphasized that it was too early to determine if the inflation slowdown is enduring. This cautious stance contributed to fears of weaker demand, leading to selling pressure in oil markets. Lower interest rates typically reduce borrowing costs, potentially boosting economic growth and demand for oil. However, the delay in rate cuts has kept demand concerns alive, weighing on oil prices.

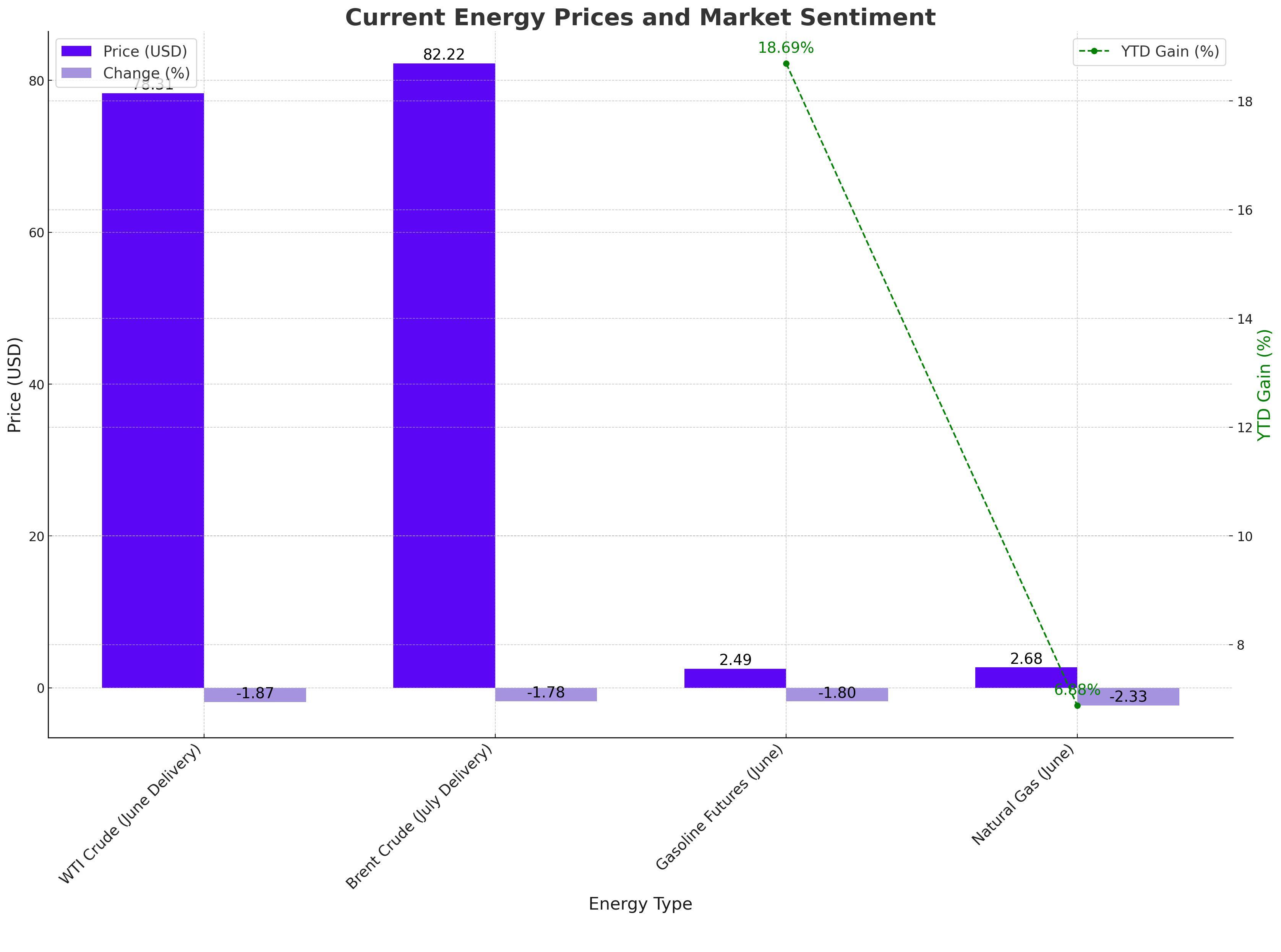

Current Energy Prices and Market Sentiment

West Texas Intermediate crude for June delivery fell to $78.31 a barrel, down 1.87%, while Brent for July delivery declined to $82.22 a barrel, down 1.78%. Gasoline futures for June dropped 1.8% to $2.49 per gallon, and natural gas for June slipped 2.33% to $2.68 per thousand cubic feet. Despite these declines, year-to-date gains show a mixed picture, with gasoline futures up 18.69% and natural gas up 6.88%.

OPEC+ Production Cuts and Market Stability

OPEC+ production cuts have provided a floor for oil prices following last month's sell-off. The cartel is set to review its production policy next weekend, which could influence market dynamics. RBC forecasts that US oil will average $79.50 a barrel and Brent $84 a barrel for the rest of the year, highlighting the current balance between supply and demand factors.

Geopolitical Tensions and Supply Risks

Geopolitical tensions, particularly in the Middle East, have influenced oil prices. The recent helicopter crash that killed Iranian President Ebrahim Raisi has added to the uncertainty. Although this event did not cause a significant immediate market reaction, ongoing political instability in major oil-producing regions continues to pose supply risks.

US Inflation and Demand Concerns

The lingering US inflation, poised to keep interest rates higher for longer, has potential implications for consumer demand. Despite the upcoming Memorial Day holiday marking the start of the US peak summer driving season, retail gasoline prices have been falling, indicating potential consumer cutbacks. The Energy Information Administration (EIA) reported that retail gasoline prices fell to $3.58 per gallon, the fourth consecutive weekly decline.

Federal Reserve's Stance and Market Reactions

Comments from Federal Reserve officials have reinforced the expectation of prolonged higher interest rates. Governor Christopher Waller emphasized the need for several more months of good inflation data before supporting an easing in monetary policy. This stance has contributed to a cautious outlook for oil demand.

Future Outlook and OPEC+ Meeting

Investors are now focusing on the upcoming OPEC+ meeting on June 1, where output policy will be set. The group may decide to extend voluntary supply cuts if demand fails to pick up, which could provide some support for oil prices. The market also awaits the American Petroleum Institute's forecast for US commercial crude oil inventories, followed by the EIA's official stockpile data.

That's TradingNEWS

Read More

-

SMH ETF: NASDAQ:SMH Hovering at $350 With AI, NVDA and CHIPS Act Fueling the Next Move

16.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: Can $1B Inflows Lift XRP-USD From $1.93 Back Toward $3.66?

16.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Falls to $3.80–$3.94 as Warm Winter Kills $5.50 Spike

16.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides, BoJ 0.50% Hike, Fed Cut and NFP Set the Next Big Move

16.12.2025 · TradingNEWS ArchiveForex