Oil Prices Drop: WTI at $74.61, Brent at $78.29 Amid Trump’s OPEC Pressure

Analyzing the Impact of Trump's Policies, OPEC Production Cuts, and Geopolitical Uncertainty on Crude Oil Prices | That's TradingNEWS

Oil Prices Drop Amid Market Uncertainty: WTI and Brent Under Pressure

WTI Crude (CL=F) and Brent Oil (BZ=F) Trade Lower Amid Geopolitical and Economic Turmoil

Oil prices have experienced notable volatility, with WTI crude (CL=F) trading at $74.61 per barrel and Brent crude (BZ=F) at $78.29 per barrel, both showing declines of over 1% from earlier levels. President Donald Trump's recent speech at the World Economic Forum intensified market attention, as his push for Saudi Arabia and OPEC to lower crude prices added a new layer of pressure on an already fragile energy market. Trump claimed that reducing oil prices could potentially end the ongoing Russia-Ukraine conflict, emphasizing that elevated prices are indirectly sustaining geopolitical tensions.

The immediate response in the oil market was negative, with WTI dropping $1.01 (1.34%) and Brent losing 90 cents (1.14%) following Trump's remarks. His call for reduced prices, coupled with a potential energy emergency declaration to expedite U.S. infrastructure development, has left traders uncertain about future policy directions and their impact on global supply-demand dynamics.

OPEC Production Cuts and Market Sentiment

OPEC+ remains a critical player in the oil market, with Saudi Arabia and Russia leading efforts to stabilize prices through coordinated production cuts. Currently, the group is withholding 2.2 million barrels per day (bpd) from the market, a strategy extended until March 2025. However, the effectiveness of these cuts is being questioned as U.S. crude production continues to rise, with output reaching an all-time high of 13.4 million bpd in August 2024.

Market sentiment has been further complicated by OPEC’s dual challenge of balancing declining Chinese demand and surging U.S. output. The decline in active drilling rigs, as highlighted by Baker Hughes’ latest survey, reveals that U.S. rig counts fell by two last week to 478, barely above post-pandemic lows. While this could indicate a future slowdown in U.S. production, current output levels are sufficient to exert downward pressure on prices.

Geopolitical Factors Amplify Market Volatility

Trump’s rhetoric linking oil prices to the Russia-Ukraine war has intensified geopolitical risks. His assertion that Saudi Arabia and OPEC are "responsible" for sustaining the conflict through high crude prices underscores the broader implications of energy policy on global stability. Trump's threat to impose additional sanctions and tariffs on Russia, China, and the European Union has further fueled market uncertainty.

In the Middle East, easing tensions in Gaza and Lebanon have temporarily reduced fears of supply disruptions. However, instability in other key regions, such as Iraq and Libya, continues to pose risks to oil supplies. These geopolitical developments, combined with a lack of clarity on Trump’s broader trade and energy policies, have left the market in a state of flux.

Oil Inventories and Demand Trends

The latest inventory data from the U.S. Energy Information Administration (EIA) revealed a mixed picture. Crude oil inventories declined by 1 million barrels for the week ending January 17, while gasoline stocks increased by 2.3 million barrels. Middle distillate inventories saw a draw of 3.1 million barrels, reflecting robust winter demand.

Despite these draws, total crude and fuel inventories remain below the five-year average for this time of year, suggesting that underlying demand remains strong. However, expectations of increased U.S. production, combined with weak demand growth in China, have tempered bullish sentiment. China, the world's largest oil importer, has seen slower industrial output and domestic consumption, adding to the bearish outlook for 2025.

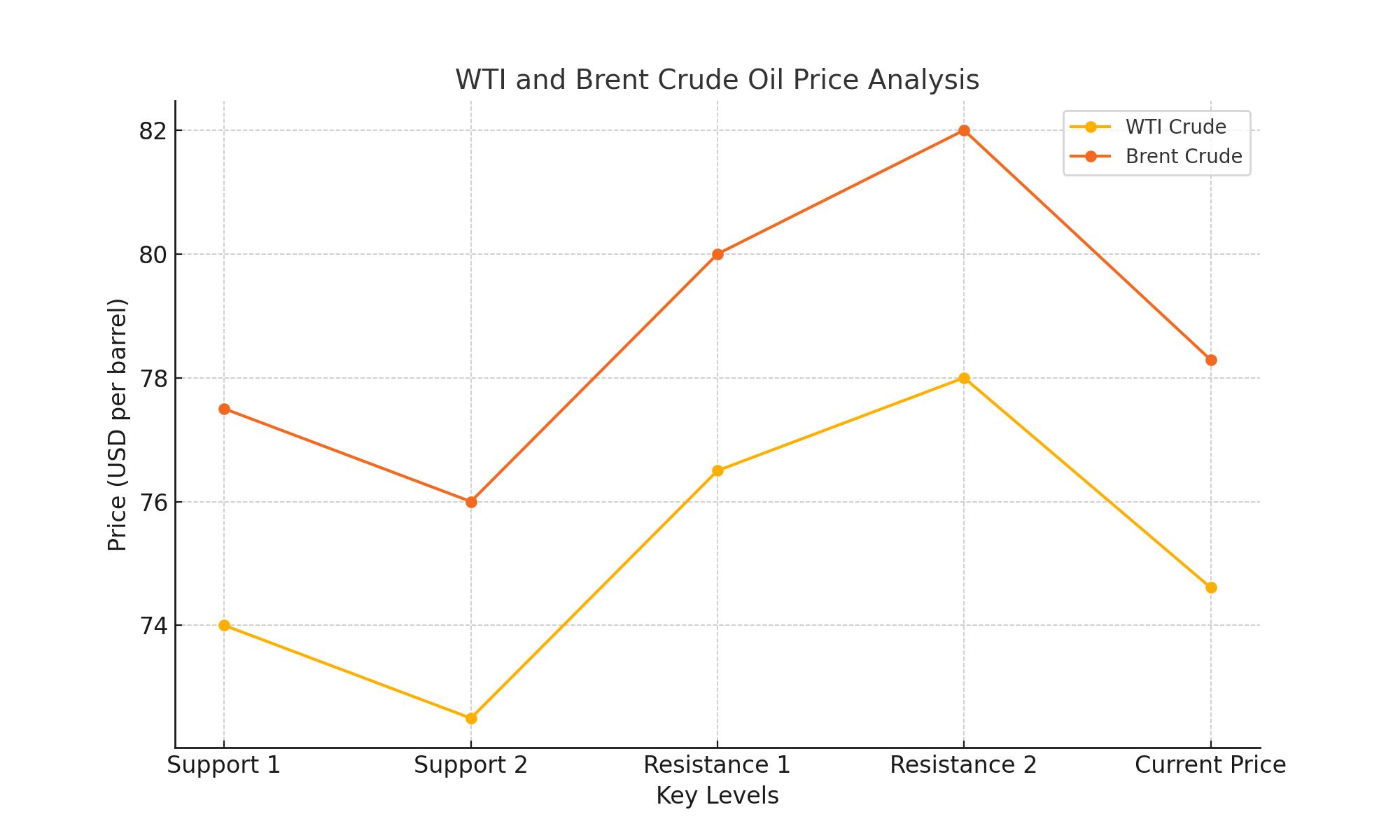

Technical Analysis: WTI and Brent Face Key Support Levels

Technically, both WTI crude and Brent oil are approaching critical support zones. WTI faces immediate support at $74.00, with a break below potentially exposing the $72.50 level. Resistance is seen near $76.50, a level that would need to be breached for a sustained recovery. Similarly, Brent crude has support at $77.50 and resistance at $80.00.

The Relative Strength Index (RSI) for both benchmarks remains in neutral territory, suggesting that prices could consolidate in the near term. However, the broader trend points to further downside risks if geopolitical and economic uncertainties persist.

The Role of Central Bank Policies in Oil Price Dynamics

Central bank actions, particularly from the Federal Reserve and European Central Bank, are also influencing oil markets. The Fed’s decision to hold interest rates steady at 4.25%-4.50% has provided some relief to financial markets. However, speculation about potential rate cuts later in 2025 has introduced additional uncertainty. Lower interest rates typically weaken the U.S. dollar, making oil more attractive to foreign buyers, but the current strength of the dollar remains a headwind for crude prices.

In Europe, the ECB’s ongoing rate cuts and efforts to stabilize energy markets have had mixed effects on oil demand. High natural gas prices, driven by declining Russian exports and increased winter consumption, have forced many European countries to switch to oil as an alternative energy source. This trend has provided temporary support to crude prices but is unlikely to offset the broader bearish factors.

Outlook for 2025: Buy, Sell, or Hold?

The outlook for oil prices in 2025 remains uncertain, with both bullish and bearish factors at play. On the bullish side, supply cuts from OPEC+, potential geopolitical disruptions, and strong winter demand could support prices. However, bearish pressures from rising U.S. production, weak Chinese demand, and policy uncertainty under the Trump administration cannot be ignored.

For WTI crude, the current price of $74.61 suggests limited upside unless key resistance levels are breached. Similarly, Brent crude’s price of $78.29 reflects a market struggling to find direction. Investors should remain cautious, closely monitoring inventory data, central bank policies, and geopolitical developments.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex