Oil Prices in Focus: Navigating a Volatile Landscape Amid Geopolitical Shifts and Policy Changes

US Oil Production at Record Highs

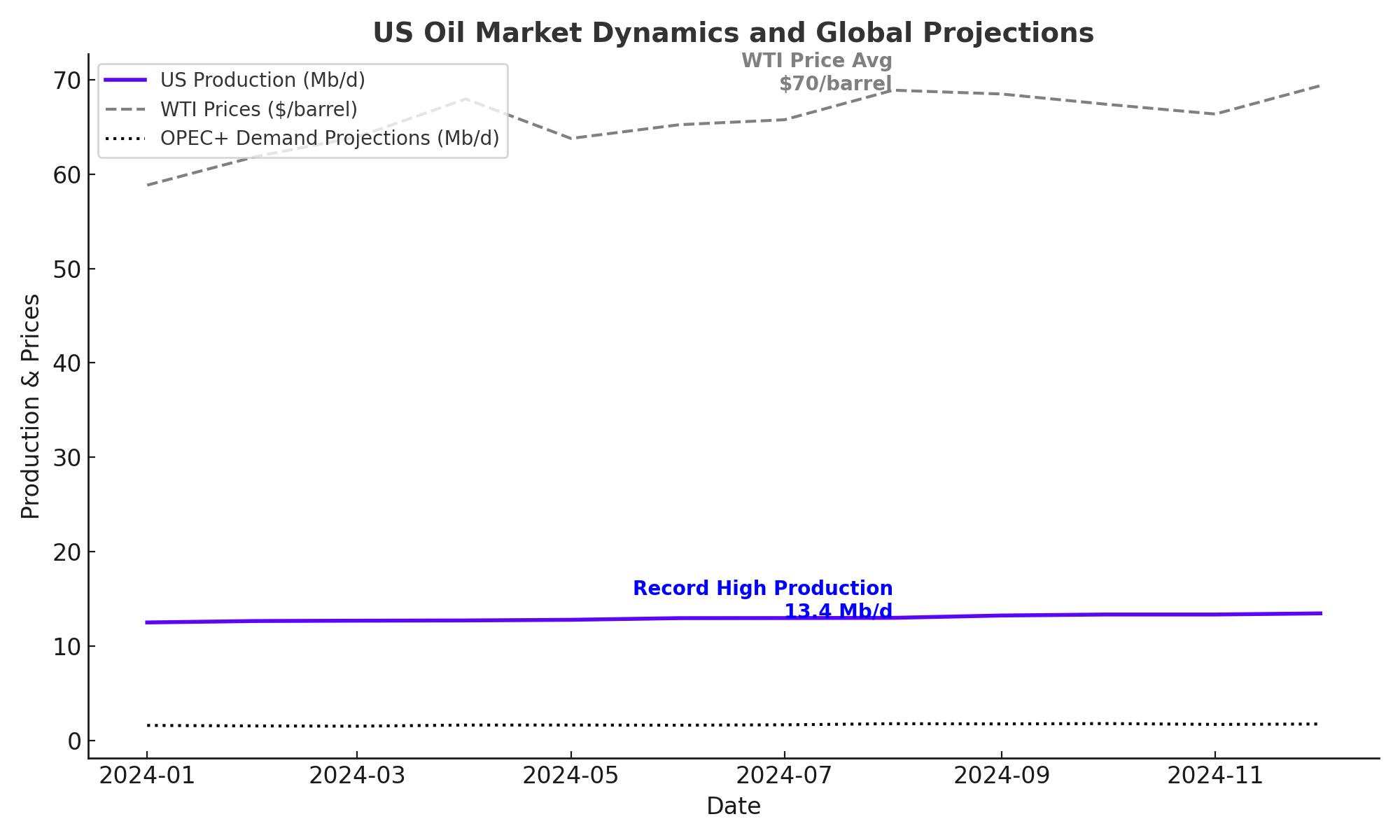

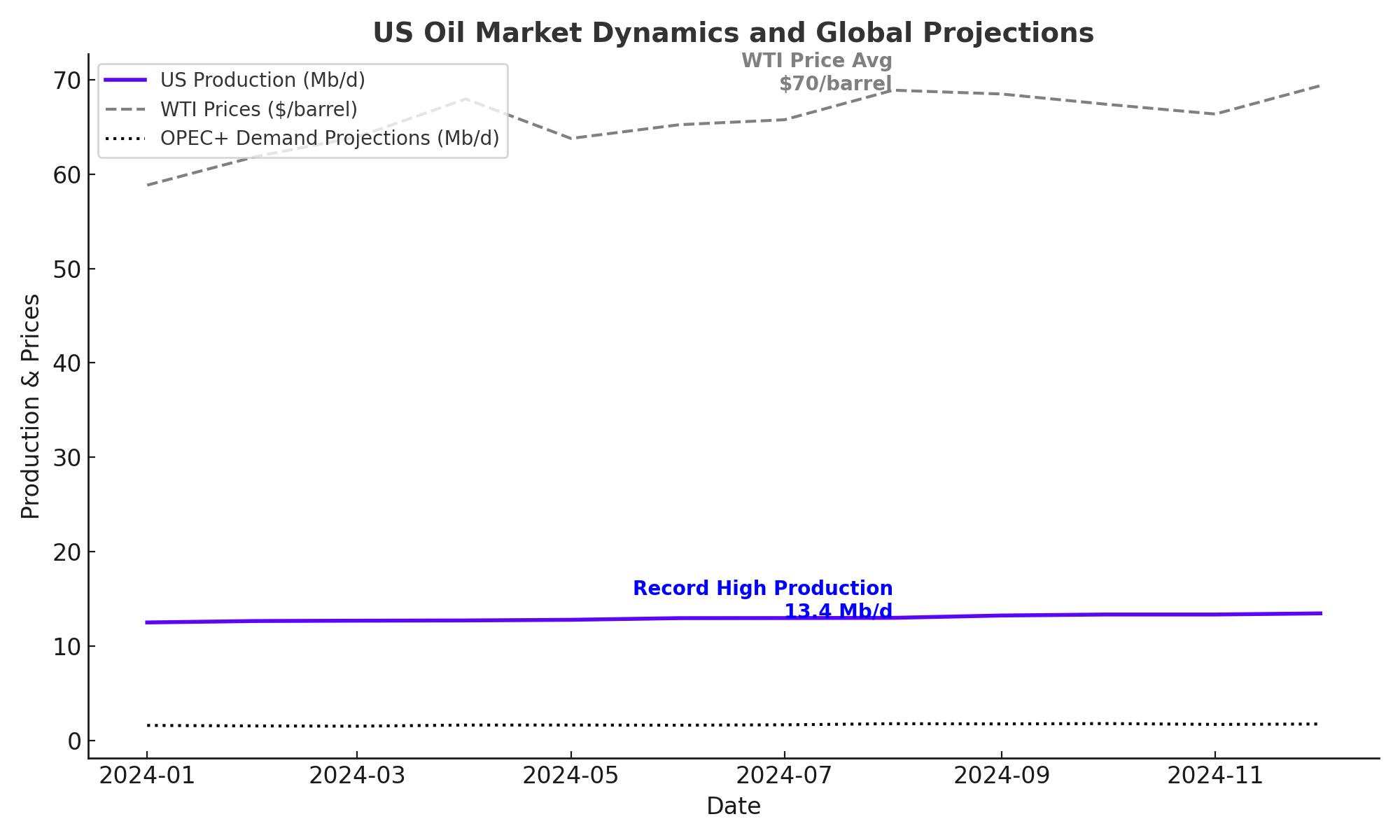

Oil production in the United States has reached unprecedented levels, averaging 13.4 million barrels per day as of August 2024. This figure cements the nation’s position as a global leader in crude oil output. Despite this robust production, the industry remains cautious about accelerating drilling efforts. While the benchmark price of West Texas Intermediate (WTI) crude hovers around $70 per barrel, the push for "drill, baby, drill" policies under the Trump administration has drawn skepticism from industry executives. ExxonMobil’s CEO, Darren Woods, highlighted that increased drilling may not align with market fundamentals or company strategies, noting that the futures market offers little incentive for aggressive production growth.

Trump’s Pro-Oil Agenda and Its Implications

President-elect Donald Trump’s return has reignited discussions on deregulation and energy independence. Trump has pledged to boost domestic oil production, promising lower energy prices and reduced reliance on imports. However, industry analysts and executives are tempering expectations, suggesting that while deregulation may ease operational costs, it does not guarantee a surge in production. For example, current refinery infrastructure limits the processing of lighter shale oil produced in the US. Refineries, designed decades ago to handle heavier crude imports, require significant investment to adapt to the composition of domestic supplies.

Additionally, Trump’s proposed tariffs on imported oil, which could range from 10% to 60%, may disrupt international supply chains, potentially driving up costs for refiners and consumers. This could lead to higher gasoline prices, particularly in regions dependent on Canadian crude.

Global Oil Markets Face Mounting Uncertainty

The global oil market is grappling with several headwinds, including waning demand from China, geopolitical tensions, and OPEC+ production strategies. China’s economic slowdown has dampened oil consumption, with refinery throughput dropping by 4.6% year-over-year in September. This decline in demand has compounded concerns about oversupply, with the International Energy Agency (IEA) forecasting a surplus of over one million barrels per day in 2025.

OPEC+ has slashed its demand growth projections for 2025 to 1.8 million barrels per day, though this figure remains optimistic compared to the IEA’s estimates. The group faces tough decisions regarding output cuts, as any unwinding of current restrictions could exacerbate the oversupply, potentially sending crude prices plummeting to $40 per barrel.

Geopolitical Tensions and Their Impact on Oil Prices

While geopolitical risks typically support oil prices, recent developments have had mixed effects. Trump’s administration is expected to adopt a hardline stance on China, including the imposition of tariffs that could further strain global trade relations. Meanwhile, easing tensions in the Middle East, such as reports of a potential Hezbollah ceasefire, have reduced the risk premium on crude prices.

The Russia-Ukraine conflict remains another critical factor. The Biden administration’s authorization for Ukraine to use US-made long-range missiles has escalated tensions, but the impact on oil markets has been muted due to the current supply-demand dynamics.

Market Performance of Oil Majors

Amid these challenges, major oil companies have demonstrated resilience. ExxonMobil (NYSE: XOM) reported strong financial results in 2023, supported by rising oil prices and strategic investments in carbon capture technologies. Chevron (NYSE: CVX) similarly posted robust earnings, driven by its exploration and refining segments. Both companies have diversified their portfolios to include renewable energy projects, positioning themselves for long-term sustainability while capitalizing on the current oil market dynamics.

LNG and Export Opportunities

Liquefied Natural Gas (LNG) exports represent a significant growth area for the US energy sector. The Trump administration is expected to expedite LNG export permits, reversing the Biden administration’s temporary pause on approvals. Companies such as Sempra and Venture Global stand to benefit from this policy shift, with analysts predicting that new permits could be issued by mid-2025. However, delays in finalizing environmental reviews may hinder the pace of approvals.

Economic and Environmental Considerations

Trump’s energy policies emphasize economic growth and energy independence but face criticism for potential environmental repercussions. The relaxation of methane emission regulations and other environmental standards could reduce costs for oil producers but may draw backlash from environmental groups and international stakeholders.

Future Outlook: Opportunities and Risks

The oil market’s trajectory remains uncertain, with multiple factors influencing supply, demand, and pricing dynamics. Key opportunities include increased domestic production, expanded LNG exports, and potential deregulation under the Trump administration. However, risks such as geopolitical instability, fluctuating demand from China, and environmental challenges could weigh on market sentiment.

Oil investors should monitor policy developments, OPEC+ decisions, and global economic trends to navigate this complex landscape. While the short-term outlook may favor increased production and profitability, the industry must also prepare for long-term shifts toward renewable energy and sustainability.

That's TradingNEWS