Oil Prices Heat Up: China’s Rebound and OPEC+ Moves Push WTI to $68

With Brent nearing $73 and WTI climbing, Middle East unrest and OPEC+ decisions hold the key to the next big price move | That's TradingNEWS

Global Oil Prices: Key Drivers and Market Dynamics

Oil prices continue to dominate financial headlines, with WTI crude (CL=F) trading at $68.36 and Brent crude (BZ=F) at $72.22 per barrel, reflecting gains from last week's close. This price trajectory is influenced by a blend of global economic data, geopolitical tensions, and key decisions looming from OPEC+ meetings. The market remains volatile, caught between bullish supply-demand fundamentals and bearish external pressures.

China’s Industrial Rebound Fuels Optimism

One of the driving forces behind oil's recent price stabilization is robust factory output growth in China. The latest Caixin/S&P Global PMI data for November revealed the fastest expansion in five months, driven by a surge in new orders at rates unseen since February 2023. This uptick in industrial activity signals improving oil demand from the world’s largest crude importer, as stimulus measures appear to yield positive results. IG Market Strategist Yeap Jun Rong noted that China's rebound is a "clear indication that stimulus is working early," offering much-needed support to global crude benchmarks.

Middle East Tensions Rekindle Supply Concerns

Geopolitical unrest in the Middle East continues to underpin supply concerns. Fresh Israeli airstrikes on Lebanon and ongoing clashes in Syria exacerbate the risk of disruptions in a region critical to global energy flows. Despite a ceasefire agreement between Israel and Hamas, violence persists, with Lebanon reporting injuries from Israeli strikes in its southern territories. These developments are likely to keep traders cautious ahead of the December 5 OPEC+ meeting, where supply strategies for 2024 will be discussed. IG analyst Tony Sycamore highlighted that OPEC+ may use the delay in its meeting to better assess geopolitical risks and their impact on oil markets.

OPEC+ Faces Strategic Balancing Act

OPEC+ is under pressure to maintain its production cuts, a strategy implemented to counter bearish market sentiment and stabilize prices. Currently withholding 2.2 million barrels per day, the alliance must weigh the potential benefits of extending these cuts against the risk of losing market share. Analysts warn that any rollback in supply restrictions could send prices spiraling downward, particularly with the market still sensitive to concerns over sluggish demand growth.

ING analysts Warren Patterson and Ewa Manthey underscored the group's challenge: balancing market support with strategic competitiveness. The cartel’s potential decision to indefinitely delay the rollback of production cuts may prove pivotal in sustaining current price levels. However, persistent algorithmic trading and inflated expectations around Chinese demand recovery continue to distort market dynamics, complicating OPEC+'s task.

Shifting Export Dynamics in Asia

November witnessed a notable shift in crude export flows across Asia. Saudi Arabia, leveraging declining shipping costs and lower premiums for its Dubai benchmark crude, increased shipments to the region by 550,000 barrels per day to 5.83 million barrels. In contrast, Russia’s crude exports to Asia fell by 450,000 barrels per day to 3.51 million, as logistical costs and competitive pricing from Middle Eastern suppliers like Saudi Arabia made Russian grades less attractive. Despite a price hike for its Arab Light crude, Saudi Arabia’s share in Asian markets grew, signaling its strategic pricing effectiveness.

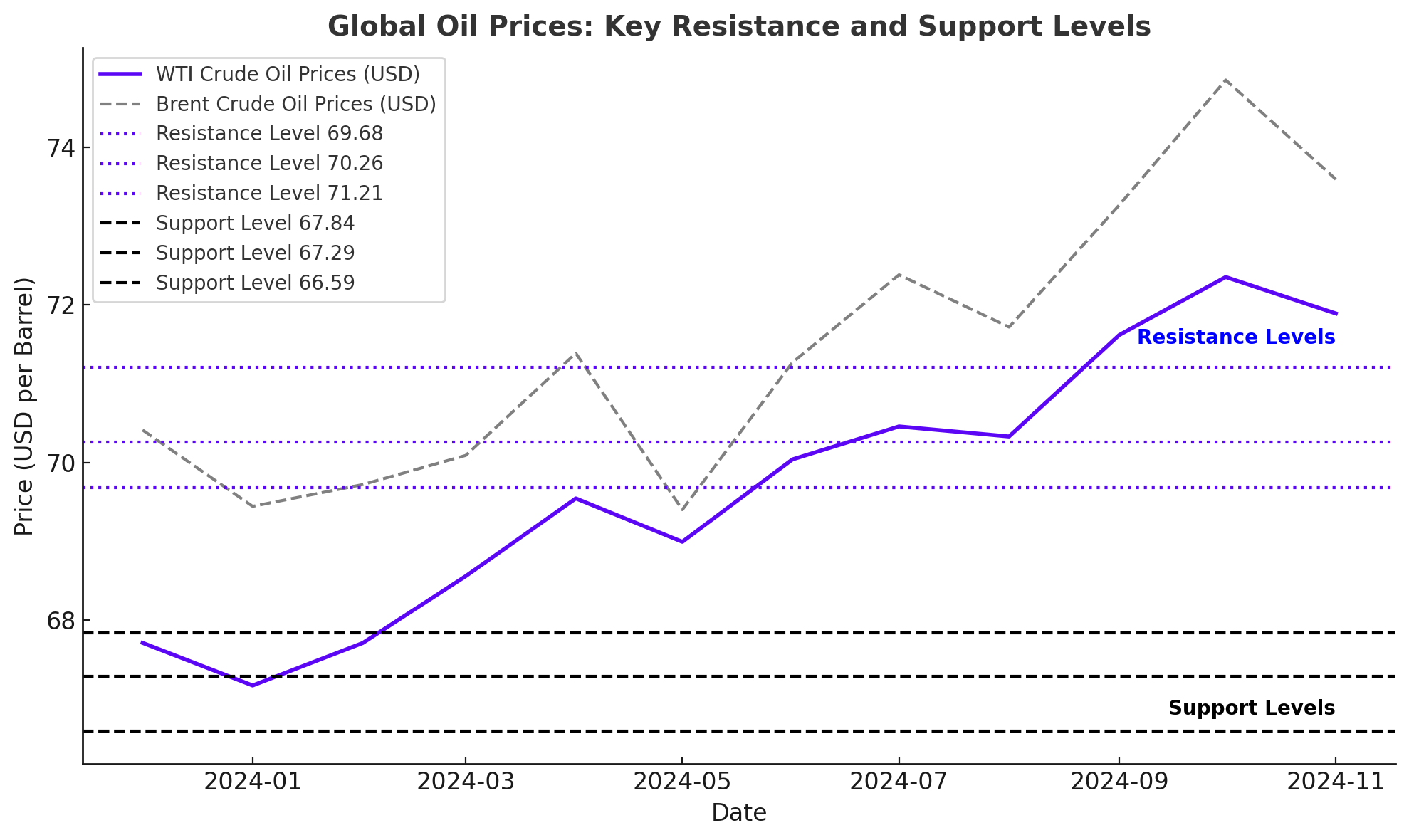

Technical Outlook: WTI Crude Oil

WTI crude continues to trade within a descending triangle pattern, signaling persistent bearish momentum. Immediate resistance levels are observed at $69.68, $70.26, and $71.21, while support is identified at $67.84, $67.29, and $66.59. The RSI at 46.49 indicates neutral to bearish sentiment. A sustained breakout above $69.68 could suggest a reversal, while further declines below $67.84 would likely intensify selling pressure.

Norway Pauses Deep-Sea Mining Licenses

Norway's government recently halted its planned 2025 deep-sea mineral licensing round, bowing to environmental and political pressures. With significant reserves of copper, zinc, cobalt, and rare earth elements identified in Arctic waters, the pause is viewed as temporary, particularly with opposition parties favoring mining activities. The decision reflects growing global scrutiny of resource extraction methods amid environmental concerns.

Key Takeaways for Oil Markets

Despite positive developments such as China's industrial recovery and robust Saudi exports, bearish factors persist. Middle Eastern instability and OPEC+'s cautious approach to production increases highlight the delicate balance required to maintain market stability. Meanwhile, traders are closely watching the $69.02 pivot point in WTI crude for signs of a breakout or further bearish movement.

As Brent crude edges closer to the $75 mark and WTI hovers around $68, the global oil market remains a battleground of competing forces, from geopolitical risks to evolving trade dynamics. The next OPEC+ meeting will be critical in determining the trajectory for crude prices heading into 2024, as traders await clarity on production policies and external factors such as China's demand outlook.