Oil Prices Strategies Amid Global Risks and Economic Data

Analyzing Current Dynamics and Strategic Investment Opportunities in the Oil Market Amid Economic and Geopolitical Shifts | That's TradingNEWS

Navigating Through Turbulent Markets: Oil Prices, Inflation, and Geopolitical Risks

Current Dynamics in the Oil Market

Recent shifts in the oil market have been primarily influenced by U.S. economic indicators and global geopolitical tensions. As of the latest trading session, Brent crude futures have decreased to $82.81 a barrel, and West Texas Intermediate (WTI) crude futures have also seen a decline to $78.45 a barrel. These changes are closely tied to the latest U.S. producer price data, which suggests a persistently high inflationary environment, thereby affecting investor sentiment and market stability.

Inflation and Its Implications on Monetary Policy

The U.S. economy continues to grapple with high inflation rates, impacting key financial decisions and policies. Recent data indicates a rise in producer prices, which underscores the ongoing challenge faced by the Federal Reserve to manage inflation without stifling economic growth. Market strategists are keenly observing the implications for the Federal Reserve's rate decisions, particularly with consumer price index (CPI) data forthcoming. This economic backdrop is crucial as it directly influences oil demand through its effects on broader economic activities.

OPEC's Role and Market Forecasts

The Organization of the Petroleum Exporting Countries (OPEC) has maintained its forecast for strong global oil demand growth into 2024 and 2025, suggesting a robust recovery in the oil market. However, OPEC's projections also highlight the uncertainty surrounding global economic performance, which could potentially exceed expectations. This report is critical as it helps shape market expectations and strategies in response to supply and demand dynamics.

Geopolitical Influences and Supply Risks Impacting Oil Prices

Recent geopolitical events have profoundly influenced oil markets, highlighting the vulnerability of oil prices to political instability and conflict in key producing regions. For instance, tensions in the Middle East, particularly involving major producers like Saudi Arabia and Iran, often lead to significant price fluctuations due to fears of supply disruptions. As of the latest data, Brent crude has adjusted to $82.81 a barrel, reflecting the market's nervousness.

Moreover, natural disasters pose a critical threat to oil supply chains. In Canada, wildfires near major oil sands operations in Alberta have raised alarms about potential supply disruptions. Historically, similar events have led to spikes in oil prices; for example, the 2016 Fort McMurray wildfires halted production of over 1 million barrels per day, causing a temporary but sharp increase in oil prices.

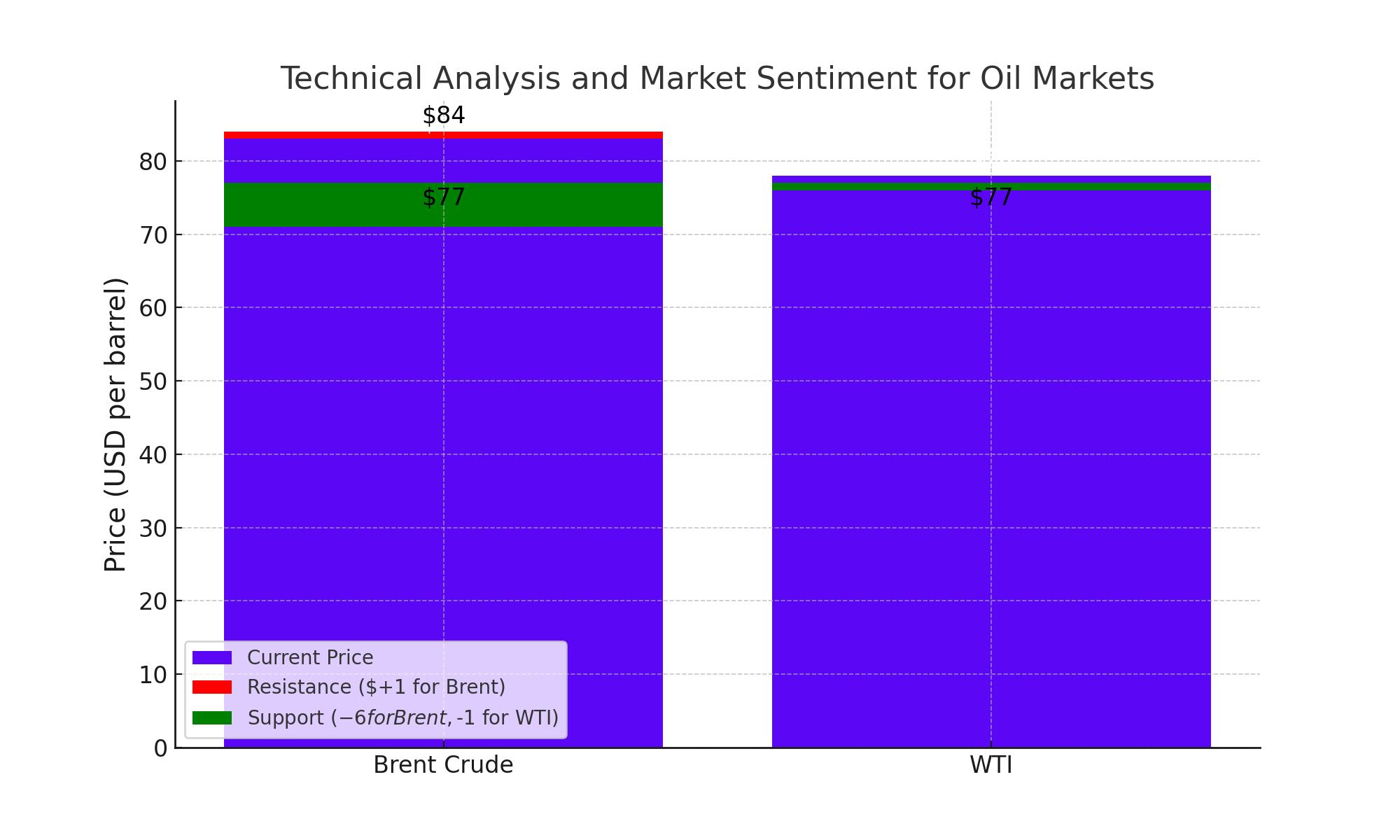

Technical Analysis and Market Sentiment

Oil markets are currently experiencing a period of consolidation, with Brent crude hovering around $83 per barrel and West Texas Intermediate (WTI) at approximately $78 per barrel. Technical indicators suggest a cautious market sentiment, with key resistance at $84 for Brent and support at $77 for WTI. The 100-day Exponential Moving Average (EMA) provides a significant technical barrier that oil prices have struggled to surpass, reflecting the market's hesitancy to commit to higher or lower price bands without further economic clarity.

Strategic Recommendations for Investors

Investors in the oil market should maintain vigilance over upcoming economic indicators, especially U.S. CPI and PPI data, which are expected to provide insights into future interest rate movements and economic health. Given the current price levels and market uncertainty, investors might consider hedging strategies to mitigate risks associated with sudden price movements caused by geopolitical or economic news.

In light of potential market adjustments, investors should also consider the broader energy policy landscape, which could affect long-term supply dynamics. For instance, increased focus on renewable energy sources and carbon reduction commitments by major economies could influence the long-term demand for fossil fuels, including oil.

Conclusion: Strategic Buying Opportunities in the Oil Market

The oil market is currently influenced by a dynamic mix of geopolitical tensions, environmental challenges, and economic signals, presenting a unique buying opportunity for informed investors. With Brent crude trading around $83.48 per barrel and WTI at $79.26, the prices reflect the ongoing global uncertainty yet also hint at potential upward movements. Given the volatile nature of these factors, investors are advised to remain well-informed and agile, ready to capitalize on fluctuations that these complexities might offer.

The prospective bullish signals for oil stem from several key areas. First, geopolitical risks, particularly in oil-rich regions, often lead to sudden supply constraints, pushing prices higher. Additionally, natural disasters like wildfires can temporarily halt production, further tightening the market. Economically, while the macro environment remains uncertain, any positive shifts in inflation data or easing of interest rates could quickly alter investor sentiment towards growth, driving oil demand and prices up.

Over the next few months, strategic investors should watch for key indicators and geopolitical developments that may influence oil prices. By maintaining a flexible strategy that adjusts to these global events, investors can position themselves to buy effectively, leveraging oil's potential for significant returns amidst market complexities. This proactive approach will be crucial in navigating the anticipated market volatility and in making informed decisions that align with the evolving economic landscape.