Oil Prices Surge: Brent at $74.49, WTI at $71.29 – What’s Driving the Market?

Geopolitical tensions, sanctions on Iran and Russia, and China's rising demand fuel a volatile energy landscape | That's TradingNEWS

Oil Market Dynamics and Strategic Shifts: Analyzing the Global Energy Landscape

Rising Oil Prices Amid Geopolitical and Market Pressures

Global crude oil prices have seen a notable uptick recently, driven by a combination of geopolitical tensions, supply constraints, and shifts in energy policies. Brent crude futures closed at $74.49 per barrel, reflecting a 5% gain over the week, while West Texas Intermediate (WTI) crude settled at $71.29, up 6%. This upward trend marks the highest close for WTI since November 7 and underscores the complex interplay between geopolitical developments and market fundamentals.

The European Union’s 15th sanctions package on Russia, targeting its shadow tanker fleet, alongside the United States’ consideration of similar measures, has heightened supply concerns. Additionally, ongoing sanctions on Iran have disrupted shipping capacities, contributing to tighter global oil markets. Iranian crude prices have risen significantly, with discounts narrowing to $2.50 per barrel for Iranian Light and $4 for Iranian Heavy, compared to earlier months. This price surge highlights the ripple effects of constrained logistics and geopolitical instability.

China's Role in Shaping Global Demand

China, the world’s largest oil importer, has played a pivotal role in sustaining demand. Recent data shows that Chinese crude imports increased annually in November for the first time in seven months, rising by more than 14% year-over-year. Independent refiners in Shandong province have ramped up purchases, driven by additional import quotas and recovering profit margins. Gasoline and diesel shipments from Shandong to other Chinese ports hit a three-year high in November, indicating robust domestic demand despite broader economic uncertainties.

The International Energy Agency (IEA) projects global oil demand growth of 1.1 million barrels per day (bpd) in 2025, a revision from the previous estimate of 990,000 bpd. This growth is underpinned by China’s economic stimulus measures and increased refinery activity. However, new bank lending data from China revealed weaker-than-expected credit demand, signaling potential headwinds for sustained economic recovery.

US Oil Production and Domestic Market Trends

The United States remains the world’s largest crude oil producer, recently hitting a record output of 13.6 million barrels per day. The Biden administration’s policies have supported this growth without significant new drilling, emphasizing efficiency in existing wells. However, the incoming Trump administration has pledged to boost domestic energy production further, with plans to expedite drilling permits and reopen restricted federal lands for exploration.

Despite these ambitions, experts caution that increased production may have limited impact on global prices due to the interconnected nature of the oil market. Current WTI prices hover around $71 per barrel, a level sufficient for profitability among US producers. However, if prices fall significantly, new drilling activity could slow, given that the cost of developing new wells ranges between $45 and $65 per barrel.

Refining Constraints and Export Dynamics

One of the key challenges facing the US oil industry is refining capacity. Most US refineries are optimized for processing heavy crude imports, while the country’s light sweet crude production has outpaced domestic refining capabilities. This structural mismatch has necessitated substantial exports, with the US shipping 4 million barrels of light crude daily to international markets. Conversely, the country continues to import 6.5 million barrels per day of heavy crude, highlighting the limitations of existing infrastructure.

Building new refineries or retrofitting existing facilities to process lighter crude would require significant capital investment, making it an unlikely solution in the near term. As a result, the US oil market remains heavily reliant on a balance of imports and exports to optimize its refining mix.

Iranian and Russian Oil Challenges

Sanctions on Iran and Russia have introduced additional complexities to the global oil market. Iranian oil shipments to China fell by 524,000 bpd in November, reflecting logistical challenges and tighter US sanctions. The Biden administration has sanctioned 45 tankers involved in transporting Iranian crude, further straining shipping capacities. This has led some Chinese refiners to diversify their supply sources, increasing purchases from the Middle East and West Africa.

Meanwhile, Russian oil flows face mounting pressure from Western sanctions. The EU’s targeting of Russia’s shadow tanker fleet is expected to tighten global supply further, with analysts predicting that these measures will exacerbate market volatility in the coming months.

Geopolitical Implications and OPEC+ Strategies

OPEC+ nations, including Saudi Arabia and the UAE, have maintained a cautious approach to production increases, prioritizing market stability over aggressive output growth. The UAE has announced plans to reduce shipments in early 2025, reflecting OPEC+’s commitment to tighter discipline. However, non-OPEC+ producers, including Argentina, Brazil, Canada, and Guyana, are projected to boost supply by 1.5 million bpd next year, potentially offsetting some of the supply constraints from sanctioned nations.

The Trump administration’s energy policies, including potential drilling in the Alaska National Wildlife Refuge, aim to reinforce US energy independence. However, critics argue that these measures may have limited impact on global prices, as additional US output could prompt counterbalancing production adjustments by other major producers like Saudi Arabia and Russia.

Market Outlook and Long-Term Trends

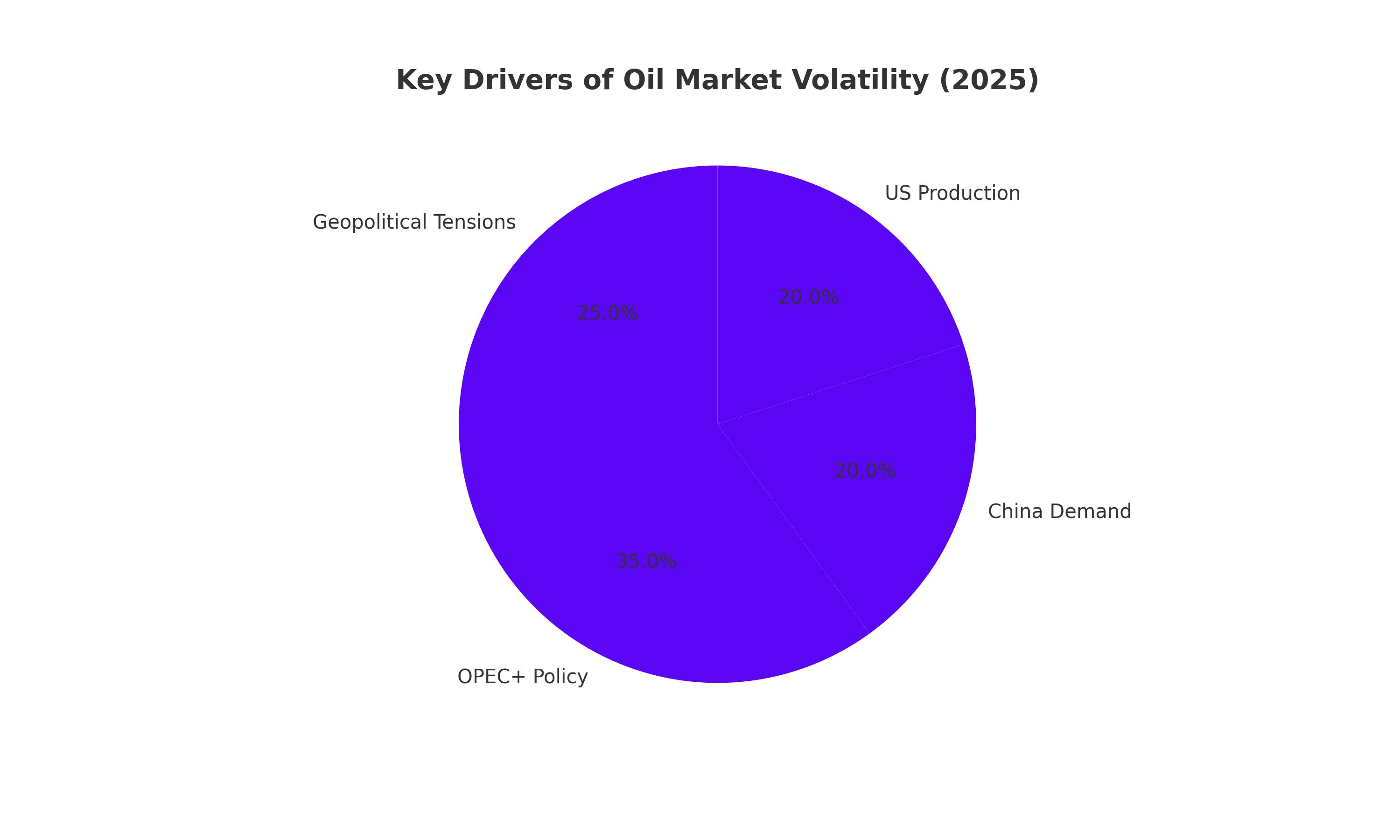

Looking ahead, the oil market faces a mix of opportunities and challenges. On the demand side, China’s economic recovery and increased refinery activity are expected to support prices. On the supply side, geopolitical tensions, including sanctions on Iran and Russia, remain key variables. Additionally, OPEC+’s disciplined production strategy and non-OPEC+ supply growth will shape the market balance.

The IEA anticipates a moderate surplus in 2025, driven by non-OPEC+ supply growth and slower demand increases. Fitch forecasts an average oil price of $70 per barrel for 2025, down from previous estimates, citing moderate demand growth and ample supply. However, regional dynamics, including Gulf countries’ fiscal resilience and diversification efforts, could influence long-term price stability.

The US oil sector’s focus on efficiency and shareholder returns, coupled with limited refining capacity, underscores the structural challenges of sustaining production growth. Meanwhile, geopolitical uncertainties and evolving energy policies will continue to drive market volatility, making strategic adaptation essential for industry stakeholders.

That's TradingNEWS

Read More

-

FTEC ETF Climbs to $226.76 as Tech Bid Targets $240 High

22.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.97, XRPR Near $15.8: XRP-USD Stalls at $1.94 as $82M XRP ETF Inflows Hit the $2 Wall

22.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Stays Pinned Near $4 as LNG Pull Beats Warm Weather

22.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Pulls Back to 156.95 After 157.75 Spike as BoJ Hike Triggers Intervention Alarm

22.12.2025 · TradingNEWS ArchiveForex