Oil Prices Surge: The Impact of EIA Data, OPEC Cuts, and Geopolitical Tensions

Analyzing the Drivers Behind Rising Oil Prices and Their Implications for the Market | That's TradingNEWS

Oil Market Analysis: Evaluating the Current Trends and Future Prospects

Recent Price Movements and Supply Concerns

Price Movements

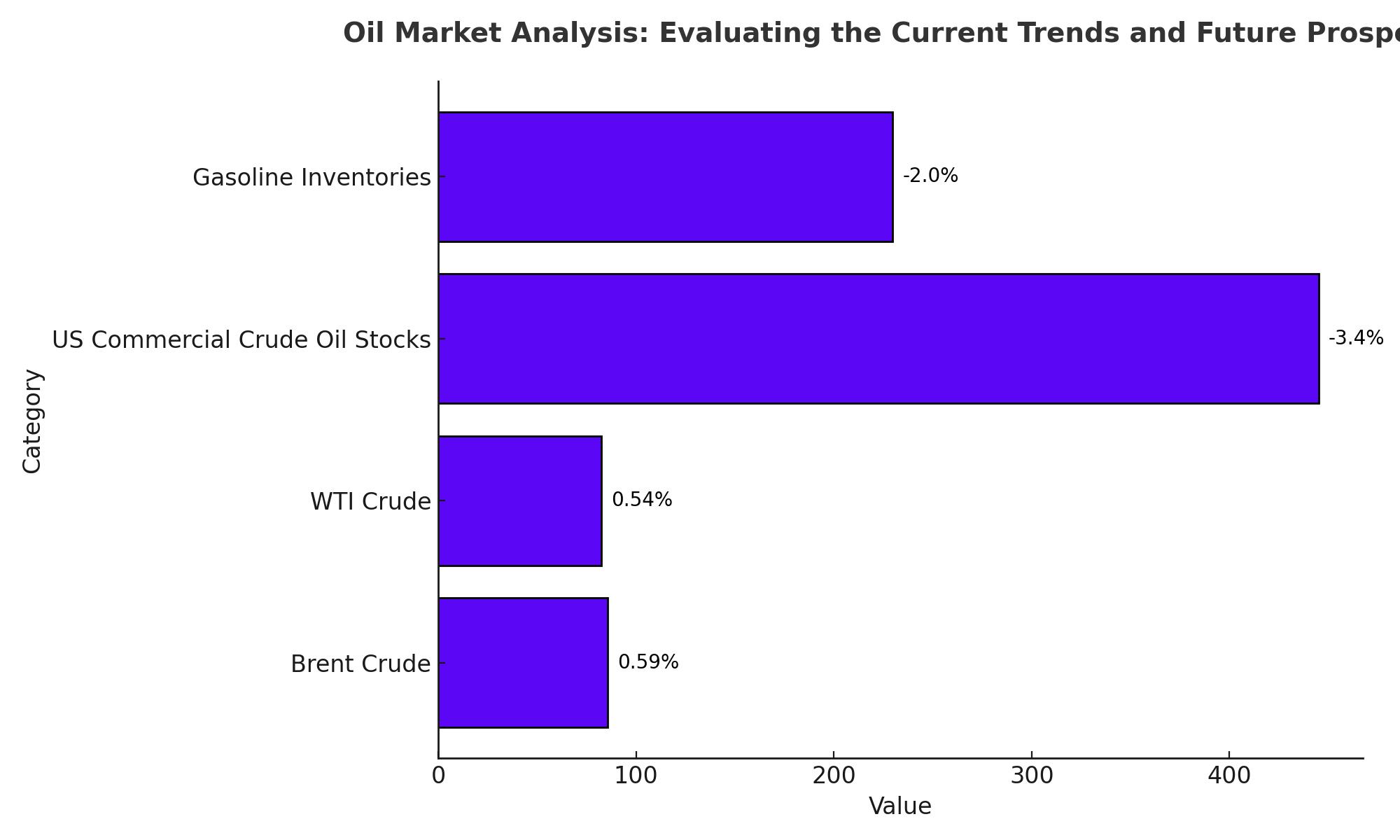

On Thursday, Brent crude traded at $85.58 per barrel, reflecting a 0.59% increase from the previous session's close of $85.08. Similarly, West Texas Intermediate (WTI) saw a 0.54% rise, reaching $82.54 per barrel.

Supply Data

Data from the US Energy Information Administration (EIA) reported a decrease in US commercial crude oil stocks by approximately 3.4 million barrels, bringing the total to 445.1 million barrels. This was contrary to market expectations of a 700,000-barrel increase. Additionally, gasoline inventories fell by 2 million barrels to 229.7 million barrels, indicating robust demand in the US, the world’s largest oil consumer.

OPEC Production Trends

OPEC’s latest monthly report revealed a reduction of 80,000 barrels per day (bpd) in June, lowering total output to 26.57 million bpd. The broader OPEC+ group saw a decline of 125,000 bpd, reducing total production to 40.80 million bpd. These figures have heightened supply concerns and supported the rise in oil prices.

Geopolitical Factors and Market Sentiment

Middle East Tensions

Despite ongoing ceasefire talks, conflicts in the Middle East persist. Recent attacks by Yemen's Houthi group on ships in the Arabian Sea and the Gulf of Aden have exacerbated supply concerns. These geopolitical tensions contribute to the market's apprehension about potential disruptions to oil shipping routes.

Impact of Hurricane Beryl

Hurricane Beryl has caused significant disruptions, with over 1 million households experiencing power outages. The potential impact on oil production in the Gulf of Mexico has further limited declines in oil prices, as fears of supply disruptions loom large.

Macroeconomic Influences

US Dollar and Inflation Data

The weakening of the US dollar ahead of key inflation data has benefited oil prices. Federal Reserve Chair Jerome Powell's comments on a potential soft landing for the US economy and the possibility of rate cuts have put additional focus on the upcoming CPI data, expected to show a cooling in inflation. A softer dollar generally boosts crude demand by making oil cheaper for international buyers.

US Oil Inventory Data

Official data indicated a significant drawdown in US oil inventories, aligning with increased demand due to summer travel. However, the rise in distillate inventories has tempered overall optimism. Traders are positioning for tighter US markets in the coming weeks, anticipating continued summer travel and potential disruptions from Hurricane Beryl.

Technical Analysis and Future Projections

Price Action and Technical Indicators

Brent crude futures for September rose 0.7% to $85.74 per barrel, while WTI futures increased by 0.8% to $81.69 per barrel. The technical outlook for oil prices suggests potential bullish momentum, with Brent crude likely to test the $87.50 resistance level if the current trend continues.

Demand Outlook

OPEC has maintained its forecast for strong global oil demand growth in 2024 and 2025, driven by economic resilience and increased air travel. The International Energy Agency (IEA) has a slightly less optimistic outlook but still expects demand growth to remain robust.

Market Risks and Considerations

Supply Disruptions

Potential disruptions due to geopolitical tensions in the Middle East and adverse weather conditions like hurricanes remain significant risks. These factors could lead to volatility in oil prices.

Economic Indicators

Upcoming inflation data and Federal Reserve policy decisions will play a crucial role in shaping market sentiment. A favorable inflation report could lead to a softer dollar and higher oil prices.

Conclusion

Given the current market dynamics, including strong demand data, reduced OPEC production, and geopolitical tensions, the outlook for oil prices remains bullish. Institutional interest and insider activities further support this view. Investors should monitor macroeconomic indicators and geopolitical developments closely to make informed decisions.