On Holding (NYSE:ONON): Redefining Athletic Wear with Growth, Innovation, and Premium Appeal

Explosive Revenue, Premium Brand Strategy, and Strong Market Position – What’s Next for ONON? | That's TradingNEWS

On Holding AG (NYSE:ONON) – Navigating Growth, Valuation, and Market Position

A Rising Star in Athletic Footwear: Premium Positioning in a Competitive Space

On Holding AG (NYSE:ONON), a Swiss athletic footwear and apparel brand founded in 2010, has established itself as a formidable player in the premium sportswear market. Competing with industry giants like Nike (NKE) and Adidas (OTCQX), ONON differentiates itself through its innovative technology and unique market positioning. The company’s signature CloudTec® technology promises a distinct running experience that resonates with its high-end target audience. By catering to premium consumers willing to pay a premium price, ONON fills a niche that mass-market players often overlook.

Collaborations with high-profile athletes like Roger Federer and marketing partnerships with influencers such as Zendaya further enhance ONON’s brand appeal, connecting it with consumers drawn to an exclusive, performance-oriented lifestyle. This premium positioning, reinforced by ONON's strategic entry into niche markets like tennis, gives it a competitive edge and strengthens its brand in the global athletic industry. Real-time stock data for (NYSE:ONON)

Explosive Financial Growth with Expanding Revenue Streams

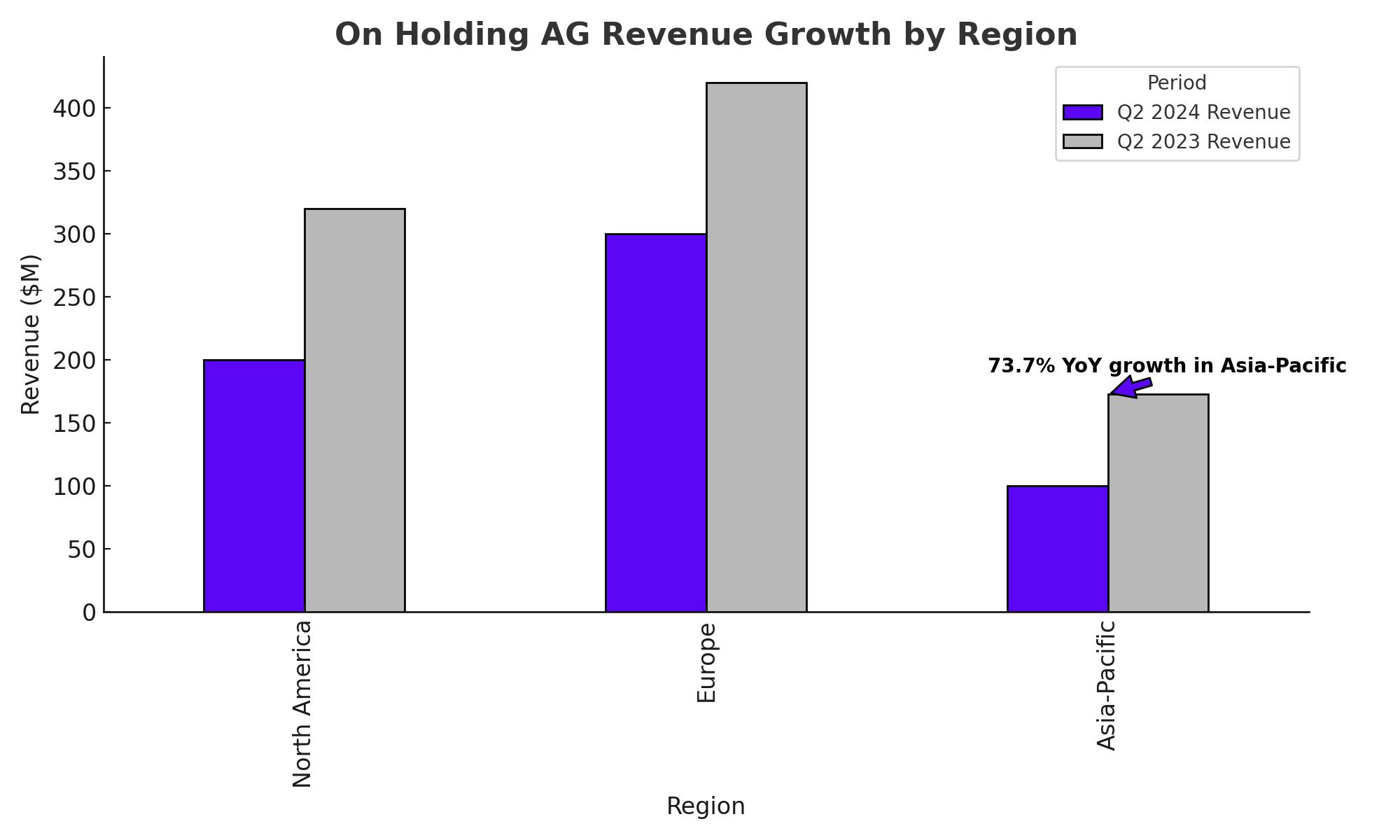

ONON’s growth trajectory over the past few years has been impressive, with the company posting a three-year Compound Annual Growth Rate (CAGR) of 48% as of Q2 2024. The company’s quarterly revenue reached $632 million in Q2, setting its annualized run rate at approximately $2.53 billion. This substantial growth is fueled by both direct-to-consumer (DTC) and wholesale channels, with the brand rapidly expanding its presence in markets across North America, Europe, and Asia-Pacific.

In Q2 2024, ONON opened its first flagship store in Paris, capitalizing on the momentum of the upcoming Olympics. This opening aligns with the company’s expansion goals in the Asia-Pacific region, where revenue grew by a remarkable 73.7% YoY for the quarter. The brand’s appeal in both established and emerging markets underscores its potential for sustained revenue growth, supported by strategic investments in marketing and collaborations that keep it at the forefront of consumer attention.

Solid Profit Margins and Operational Efficiency

ONON has consistently improved its gross profit margin, which rose to 59.9% in Q2 2024, up from 59.5% YoY. Management projects that ONON’s gross margin will reach approximately 60% for the full year, reflecting efficiencies in distribution and logistics. As ONON continues to scale, economies of scale and streamlined operations are expected to bolster margins further, with management indicating that gross margins in the second half of 2024 will exceed 60%.

Additionally, ONON's net income grew dramatically in Q2 2024, surging by 834.3% to $34.3 million. Though this level of earnings growth is partly due to last year’s low baseline, it highlights ONON’s capacity to drive profitability as it scales. With cost control and pricing power coming into play, ONON’s focus on operational efficiency is paying off. As it builds out distribution capabilities and navigates logistical challenges—like its ongoing Atlanta warehouse optimization—the company is positioning itself for long-term margin expansion.

Valuation Expansion: Premium Pricing and Market Comparisons

As a rapidly growing brand, ONON has seen its valuation increase significantly over the past year, with its Forward P/E ratio standing at 48.46. While high, this valuation reflects ONON’s robust revenue growth, strong brand equity, and expanding profit margins. Comparatively, the Consumer Discretionary sector’s average Forward P/E is 16.57, indicating that ONON trades at a substantial premium relative to its peers.

Valuation concerns arise given ONON’s stock price appreciation, as shares are currently trading near their historical valuation high. The EV/Sales ratio, a commonly used valuation metric in the industry, has also increased as investors factor in ONON’s growth potential. Analysts project EPS for ONON’s next earnings report (November 12, 2024) to be $0.24, a 9.09% YoY increase, with revenues projected to reach $718.84 million—an expected 32.18% YoY growth. For FY2024, the consensus forecast suggests EPS of $0.98 and revenue of $2.65 billion, representing a YoY increase of 151.28% and 32.94%, respectively.

Insider Transactions and Institutional Interest

ONON has garnered considerable interest from institutional investors. For instance, Pinnacle Associates Ltd. significantly increased its stake in the company by 165.1% in Q3, ending the quarter with holdings valued at $1.31 million. Additionally, Loring Wolcott & Coolidge Fiduciary Advisors LLP MA boosted its position by 210.5%, while WD Rutherford LLC raised its stake by 62%. These moves underscore confidence in ONON’s long-term potential, despite short-term valuation concerns. View insider transactions for NYSE

Analyst Sentiment and Price Target Revisions

Wall Street analysts remain bullish on ONON’s outlook, with recent ratings upgrades and increased price targets reflecting optimism around its growth potential. Evercore ISI raised its price target for ONON from $43.00 to $47.00, while Truist Financial and Piper Sandler increased their targets to $58.00 and $56.00, respectively. The stock’s current average price target stands at $49.74, with most analysts assigning a “Moderate Buy” rating.

This strong analyst sentiment aligns with ONON’s consistent revenue surprises, as the company has outperformed Wall Street expectations in previous quarters. Analysts, however, remain conservative in their estimates given ONON’s relative youth as a public company and its exposure to the highly competitive consumer fashion space.

Risks and Challenges: Supply Chain and Macroeconomic Factors

Despite its strong fundamentals, ONON faces risks tied to its valuation and potential operational challenges. Any disruption in the global supply chain, particularly the ongoing warehouse transition in Atlanta, could impact product availability and weigh on growth targets. Rising material costs and inflationary pressures pose additional risks that could hinder margin expansion, especially if ONON encounters further logistical delays or capacity constraints.

Geopolitical uncertainties and fluctuations in consumer spending also present challenges, though ONON’s premium market focus may buffer it from significant demand fluctuations. However, the high-end positioning of the brand may limit its ability to scale to broader markets, potentially capping its growth if broader consumer demand weakens in economic downturns.

Strategic Long-Term Position: Buy, Sell, or Hold?

Based on ONON’s financial growth, strong market positioning, and innovative product strategy, (NYSE:ONON) currently presents an attractive long-term buy opportunity, albeit with some caution on valuation. Investors should consider the premium valuation justified by ONON’s brand strength and expanding market reach, but remain mindful of potential valuation risks as the company approaches its historical valuation highs. For investors with a long-term horizon, ONON’s premium position in the athletic wear market and proven growth trajectory make it a compelling choice, provided they are prepared for near-term volatility and the possibility of price consolidation.

In summary, On Holding AG (NYSE:ONON) represents a high-potential investment in a competitive market, bolstered by its innovative technology, solid financials, and expanding market share. While risks exist, particularly around supply chain and valuation concerns, ONON’s brand and operational efficiency position it well for sustained growth.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback