Outlook for Gold - Analyzing Market Trends and Federal Influence

From technical forecasts to economic shifts, understand how Federal Reserve decisions and global market sentiments are shaping the future of gold prices | That's TradingNEWS

In-Depth Analysis of Gold's Market Dynamics and Price Projections

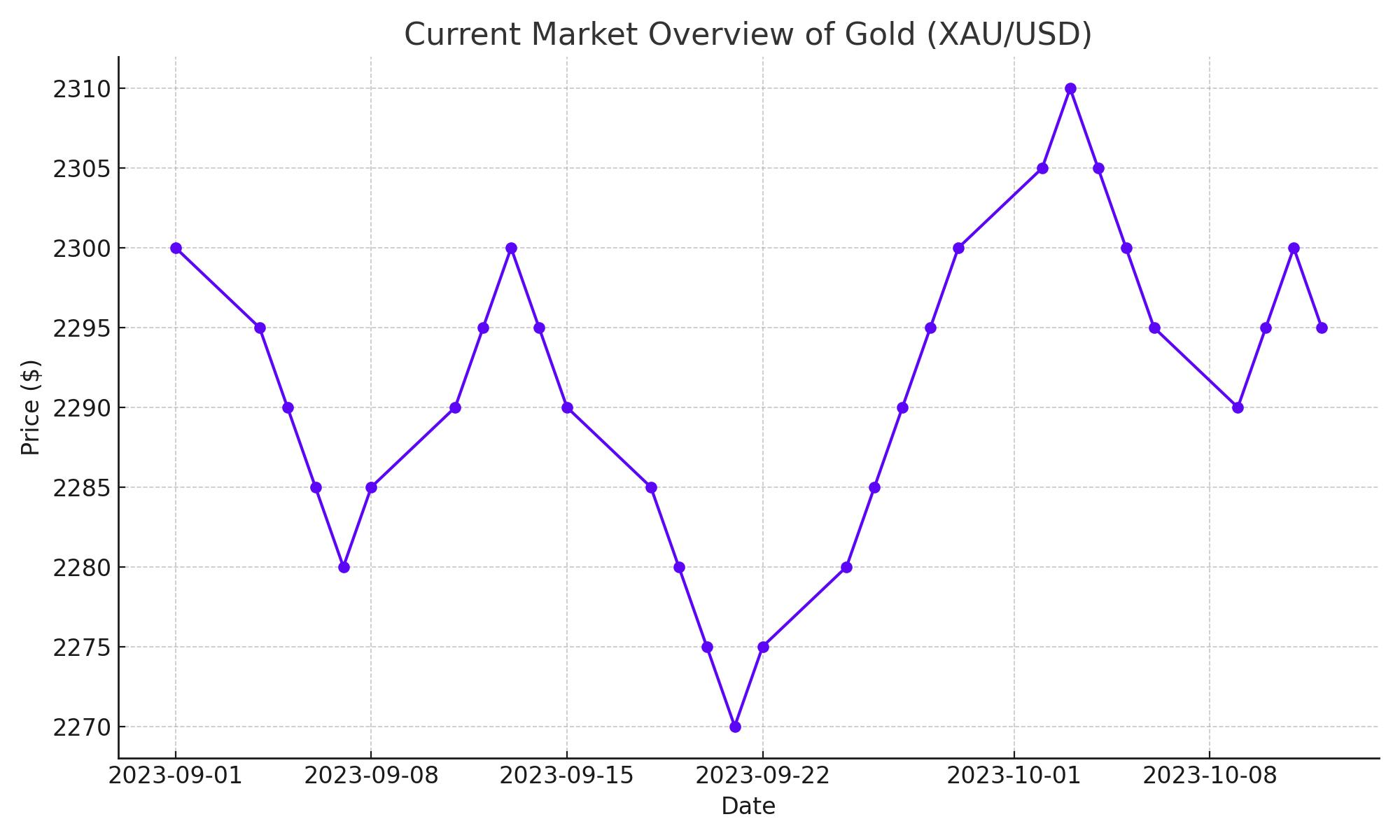

Current Market Overview

In recent trading, Gold (XAU/USD) witnessed a significant dip, currently positioning itself in the $2,290s, following a near 1% decline amidst dwindling safe-haven demand. This shift comes as Asian markets trended upwards, and oil prices dipped to seven-week lows, reflecting a broader market sentiment that favors riskier assets over traditional safe havens like gold.

Federal Reserve's Impact on Gold Prices

The recent Federal Reserve meeting has been a critical catalyst for the fluctuations in gold prices. Despite the Fed's decision to maintain interest rates, it introduced a slightly dovish stance by slowing the pace of its US Treasury holdings reduction. However, the Fed's statement included a hawkish note concerning the persistent issue of US inflation, which remains above the 2% target, causing uncertainty in the gold markets.

Chairman Jerome Powell's remarks indicated that while immediate rate hikes are off the table, the door remains open for future adjustments based on economic data. This mixed signal has led to volatility in gold prices, as traders gauge the potential for higher interest rates, which typically lessen the appeal of non-yielding assets like gold.

Technical Analysis and Future Price Movements

From a technical perspective, gold prices have recently tested the Fibonacci 0.681 price objective at $2,286, suggesting a potential shift towards a bullish trend if it can maintain above this critical support level. Conversely, a break below $2,285 could signal further declines towards the $2,245 level, aligning with the A=C measured move scenario.

The immediate resistance is spotted around the $2,350 mark, which corresponds to previous highs. Surpassing this resistance could set the stage for testing the $2,400 level, provided the market sees sustained bullish momentum, potentially triggered by macroeconomic factors or shifts in investor sentiment towards safer assets.

Economic Indicators and Their Implications

Recent economic data, including the stabilization of the federal funds rate at 5.25-5.50% and the reduction of the Fed's balance sheet adjustments, have had a mixed impact on the markets. While these measures suggest a cautious approach by the Fed, the reduced pace of treasury bond reductions could inject more liquidity into the economy, possibly softening the dollar and making gold more attractive.

The reaction in the US treasury yields and the dollar index post-Fed announcement also underscores a market recalibration. The drop in the 10-year yield by 6.6 basis points and a similar decline in the 30-year bond yield by 5.7 basis points, coupled with a 0.4% decrease in the US Dollar Index to 105.80, highlights a weakening dollar scenario that traditionally benefits gold prices.

Market Sentiment and Investor Behavior: A Quantitative Overview

Market sentiment has exhibited a cautiously optimistic tone, particularly influenced by the Federal Reserve's latest policy announcements. Despite the Fed's decision to hold interest rates steady, the shift towards a slower pace of quantitative tightening has sent mixed signals to the markets. Following these developments, the S&P 500 displayed a slight downturn of 0.3%, while the Dow Jones managed a modest gain of 85 points, reflecting a diverse reaction among major indices. This variability suggests that investors are parsing through the implications of the Fed's stance on long-term asset valuations.

Investor behavior has shown a clear response to Federal Reserve Chairman Jerome Powell's recent remarks. The balance between risk aversion and the pursuit of yields is evident, as demonstrated by the shifts in U.S. Treasury yields: a significant drop in the ten-year yield by 6.6 basis points to 4.618% and the two-year yield by 8.8 basis points to 4.958%. These movements underscore a hedging strategy against potential inflation and currency devaluation risks, positioning gold as a crucial asset in this financial landscape.

Investment Outlook and Strategic Recommendations

As we continue to monitor the evolving economic indicators and the Federal Reserve's policy trajectory, gold's role as both a safe haven and an inflation hedge remains more relevant than ever. The current economic environment, characterized by the Fed's cautious approach and the ongoing adjustments in U.S. monetary policy, suggests that gold will continue to be a vital component of investment portfolios.

Investors in the gold market must remain vigilant to global economic shifts and currency trends. For instance, the recent weakening of the U.S. Dollar Index, which saw a decline of 0.4% to 105.80, typically creates a more favorable environment for gold as it decreases the relative cost of gold for foreign investors. Such currency fluctuations, alongside gold's year-to-date increase of approximately 13%, highlight the metal's attractiveness in times of currency volatility and economic uncertainty.