Palantir Stock (NASDAQ:PLTR) Eyes $89 – Can It Keep Running, or Is a Pullback Coming?

With Palantir (NASDAQ:PLTR) at $75.44 and surging AI demand, will it smash through $89, or is the rally running out of steam? Let’s break down the real numbers behind the hype | That's TradingNEWS

Palantir Technologies (NASDAQ:PLTR): AI Powerhouse or Overvalued Bet?

Palantir (NASDAQ:PLTR) Expands AI Dominance Amid Market Volatility

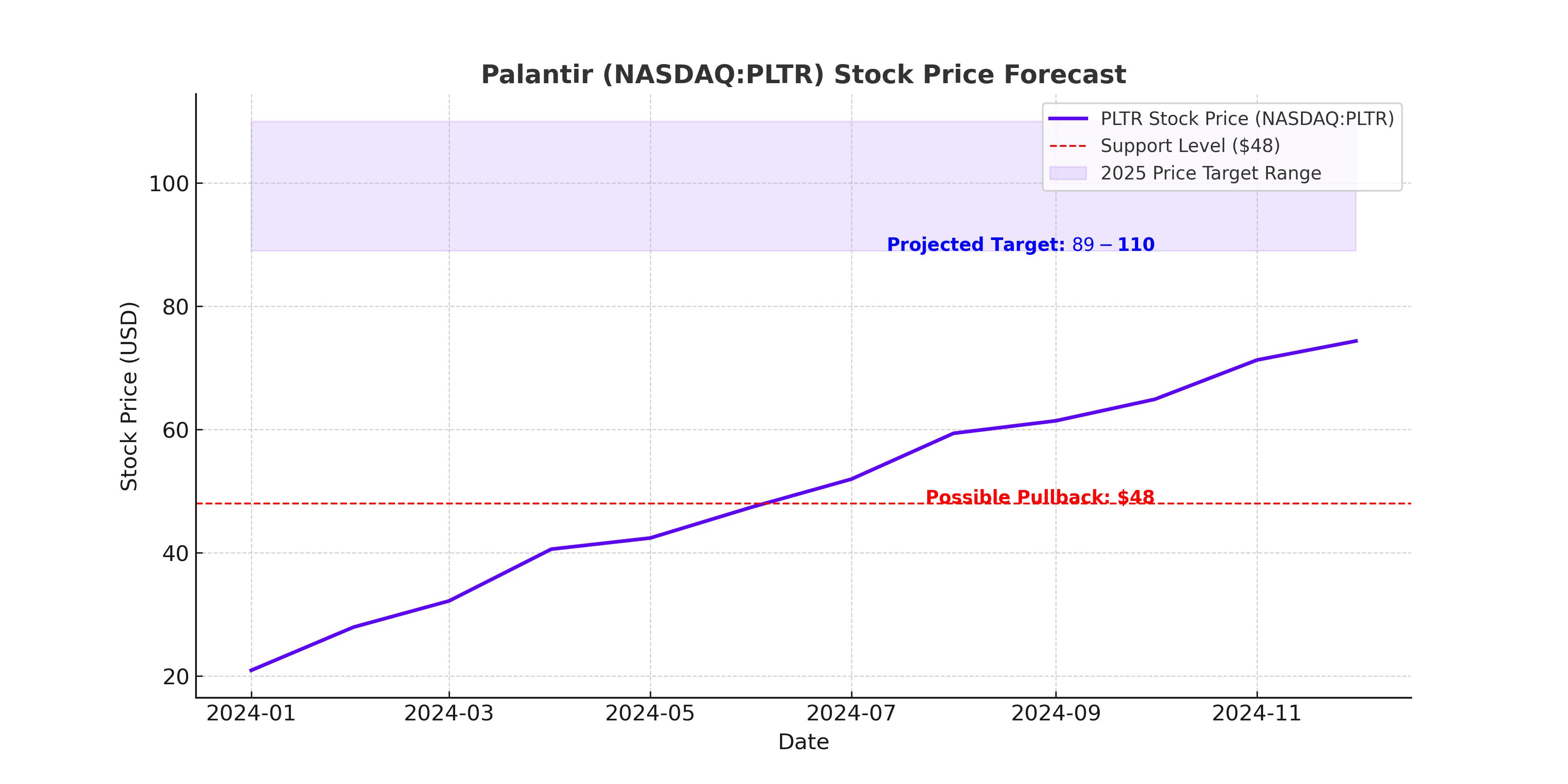

Palantir Technologies Inc. (NASDAQ:PLTR) remains one of the most controversial yet promising AI-driven companies. With shares currently trading at $75.44, up significantly from $24 in early 2024, analysts and investors are debating whether PLTR is still a strong buy or if it has reached unsustainable valuation levels.

AI adoption continues to scale at unprecedented rates, with spending projected to exceed $250 billion by 2027, according to McKinsey. Palantir, positioned as a leader in AI-powered government and enterprise solutions, is poised to capture an outsized share of this growth. Despite market fears surrounding cheaper AI models like DeepSeek, the reality is that Palantir’s core strength lies in its ability to integrate AI at scale for mission-critical applications.

Palantir’s AI Evolution: Moving Beyond LLMs to AI Agents

Since the launch of Large Language Models (LLMs) like ChatGPT in 2021, AI’s potential has dramatically expanded. However, Palantir’s leadership, including CEO Alex Karp, has been highly critical of LLMs, dismissing them as largely "self-pleasuring" tools with limited real-world business applications. Instead, Palantir is focused on AI agents that automate complex decision-making processes, moving AI beyond chatbots to fully operational AI systems that replace or enhance human decision-making at scale.

This transition aligns with Nvidia’s (NASDAQ:NVDA) recent AI roadmap, which highlights a shift from basic LLMs to Agentic AI—AI that acts autonomously in real-world environments. The potential here is vast: AI-powered agents will revolutionize defense, finance, and healthcare, and Palantir is already deeply embedded in these sectors.

DeepSeek’s Disruption: A Threat or a Boon for Palantir?

Recent fears about DeepSeek’s low-cost AI model have led to short-term volatility in PLTR shares, but this concern is largely overblown. DeepSeek claims to have developed its R-1 AI model for just $6 million, a fraction of what companies like OpenAI and Meta (NASDAQ:META) typically spend on AI research. While this news triggered panic selling across AI stocks, the actual implications for Palantir are bullish rather than bearish.

If AI models truly become cheaper and more efficient, this only accelerates AI adoption, benefiting companies like Palantir that integrate AI solutions at scale. With cheaper AI infrastructure, enterprises will increase their reliance on AI-powered decision-making systems, precisely where Palantir dominates. Unlike companies that build AI models, Palantir provides AI operationalization—turning raw AI models into functioning, enterprise-grade solutions.

Palantir’s Financial Growth: Record Government and Commercial Expansion

For Q4 2024, Palantir expects revenue between $767M and $771M, marking a 28% YoY increase. Adjusted operating income is forecasted between $298M and $302M, reinforcing strong margin expansion. Notably, Palantir’s U.S. government business grew by 40% YoY, reaching $320M in revenue, a clear sign of increasing reliance on Palantir’s AI solutions within federal agencies.

Several key contracts further solidify Palantir’s position:

-

$618.9M U.S. Army Vantage Program Expansion: This four-year contract cements Palantir as a core provider for the U.S. military’s digital transformation. With over 100,000 users and 180+ integrated data sources, this platform’s adoption is reaching record highs.

-

$36.8M U.S. Special Operations Command Deal: Enhances Palantir’s role in high-stakes military intelligence and operations.

-

FedRAMP High Baseline Authorization: Allows Palantir to deliver AI-driven solutions at the highest security levels across federal agencies, unlocking new revenue streams.

AI's Role in National Security and the Trump Administration’s Favorable Policies

Palantir’s close government ties put it in a favorable position under the Trump administration, which has emphasized deregulation and expanding U.S. technological dominance. The administration’s national security strategy prioritizes AI integration, a clear tailwind for Palantir’s government business. The administration has actively sought to align government contracts with private AI companies, and Palantir is a major beneficiary of this shift.

PLTR Stock Technical Analysis: Next Target at $89

From a technical perspective, Palantir is showing strong upward momentum, with an average price target of $89 for Q1 2025. The 1.618 Fibonacci extension level aligns with this projection, while a breakout could push the stock to $110. However, a pullback to $48 remains possible in the event of macroeconomic downturns or AI sector revaluations.

RSI levels are approaching overbought conditions at 66.57, suggesting near-term consolidation before another breakout. Volume Price Trend (VPT) remains stable at 1.93B, indicating a healthy balance between buying and selling pressure. Seasonality data also suggests a 40% probability of positive returns in January, reinforcing the bullish outlook.

Insider Transactions: Are Executives Buying or Selling?

Tracking insider activity is crucial in understanding executive sentiment. Over the past six months, Palantir insiders have sold $130M worth of shares, signaling potential profit-taking. However, historical trends show that insider selling at Palantir is not always a bearish indicator, as executives have frequently sold shares while the stock continued rising.

For real-time insider transaction data, visit Palantir’s Insider Transactions Page.

Is Palantir (NASDAQ:PLTR) a Buy, Sell, or Hold?

Despite its high valuation, Palantir remains one of the strongest AI investment opportunities in the market. Its dominance in government AI, accelerating commercial adoption, and expansion into AI agents create a compelling growth story. While short-term volatility remains a risk, long-term investors could see PLTR exceed $250 per share if AI adoption continues at its current trajectory.

For real-time stock movements, visit Palantir’s Live Price Chart.

Final Verdict: STRONG BUY for long-term investors, but new buyers should wait for a pullback before adding more shares. If Palantir successfully executes its AI vision, it could be one of the biggest winners of the AI revolution.