Palantir Stock Rockets 517% – Can NASDAQ:PLTR Keep Climbing, or Is a Crash Coming?

With PLTR hitting $106 and AI growth accelerating, is this the best time to buy Palantir stock? | That's TradingNEWS

Palantir (NASDAQ:PLTR) Stock Surges 517% – Is There More Upside or a Brutal Correction Ahead?

PLTR Stock Explodes Past $106 – Is This the AI Trade of the Decade or a Bubble Ready to Burst?

Palantir Technologies (NASDAQ:PLTR) has become one of the biggest AI-driven success stories in the stock market. Its stock price has soared over 517% in a year, pushing past $106, as investors bet big on its government contracts, AI dominance, and rapidly expanding commercial business. But the real question now is: Can this stock keep running higher, or is it priced for perfection?

PLTR's Latest Earnings Prove AI is Still Driving Massive Growth

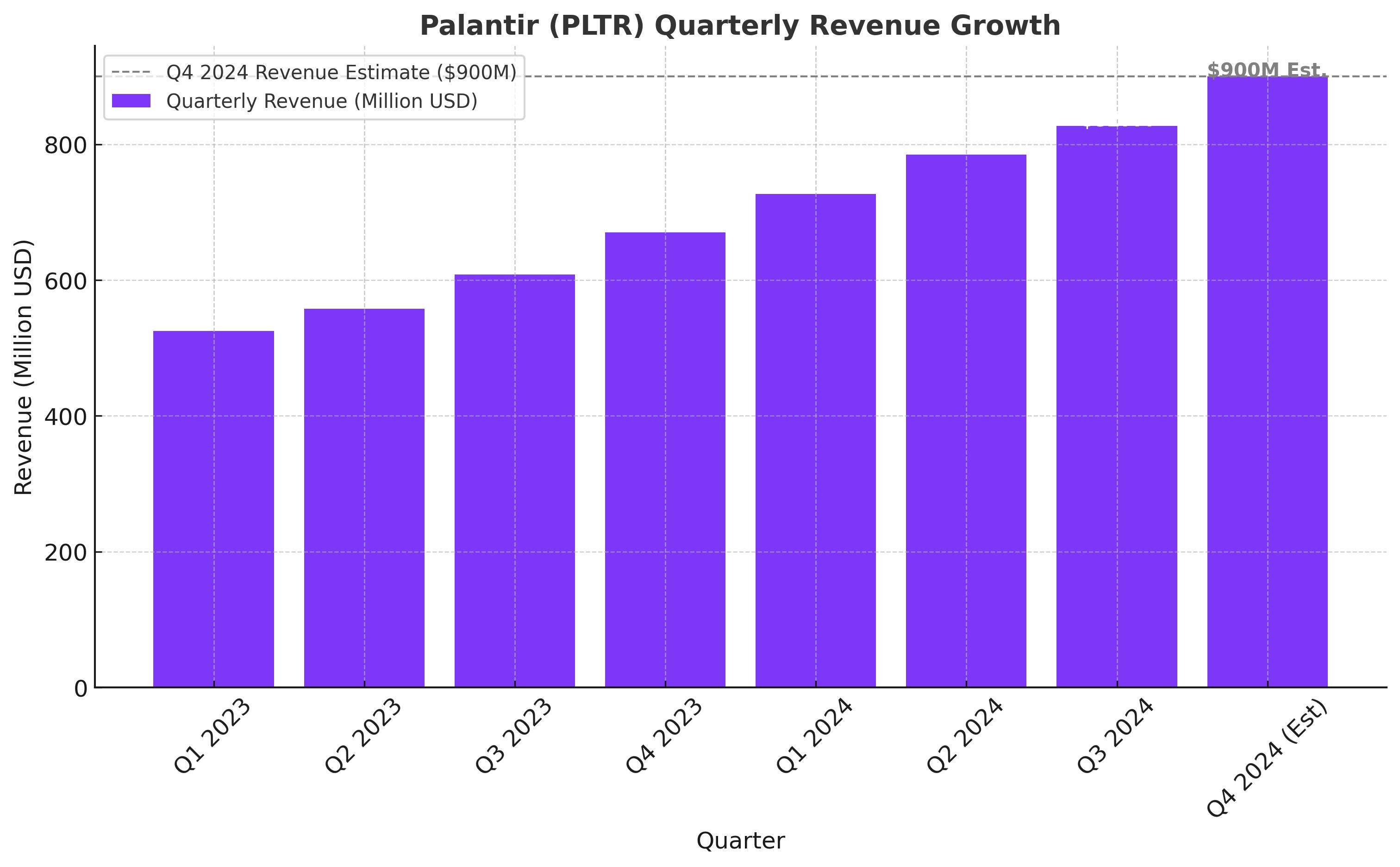

Palantir just delivered a blockbuster Q4 earnings report, sending the stock soaring another 27% after-hours. The company posted $827.5 million in revenue, a 36% year-over-year increase, far outpacing Wall Street’s expectations of $775.9 million. Even more impressive, Palantir projected 31% growth for FY25, signaling no slowdown in its AI-powered momentum.

The company continues to dominate U.S. government contracts, with federal revenue up 45% year-over-year, accounting for 40% of total sales. More importantly, U.S. commercial revenue surged 64% YoY, proving that Palantir is successfully expanding beyond its government roots into the private sector.

PLTR's AI Expansion – A Game-Changer for Future Growth?

Palantir has positioned itself as the leading AI-driven data analytics powerhouse, and its Artificial Intelligence Platform (AIP) is rapidly gaining traction. A key highlight from the quarter was a massive $11 million contract with a global insurance company, allowing it to automate underwriting workflows, cutting down processing time from two weeks to just three hours.

The company is also gaining huge momentum in defense AI, with the Maven AI-powered military system expanding across the U.S. Army, Air Force, and Space Force. This suggests PLTR’s influence in military AI will only grow, fueling further government contracts and long-term revenue stability.

Another highlight is Warp Speed, Palantir’s manufacturing AI solution, which is already enhancing supply chain efficiency by 200x for major defense contractors. With global military spending skyrocketing, Palantir is positioning itself as the go-to AI partner for the U.S. government.

PLTR's Surging Customer Growth – The Key to Long-Term Expansion

Palantir’s customer base is exploding, addressing one of its previous weaknesses. The company grew total customer count by 43% year-over-year, while U.S. commercial customers surged 73% YoY. This is critical because Palantir has historically been reliant on a few big government contracts. A broader customer base means less risk and more consistent revenue streams.

One of the most bullish signals from this quarter was Total Contract Value (TCV) for U.S. commercial revenue skyrocketing 134% YoY, proving that businesses are doubling down on Palantir’s AI solutions.

PLTR's Profitability & Cash Reserves Make It a Powerhouse

Unlike many high-growth AI stocks, Palantir is highly profitable. The company generated $1.25 billion in free cash flow (FCF) in 2024, up 71% YoY, with an incredible 44% FCF margin.

The company has zero debt and holds a massive $5.2 billion in cash, giving it an extremely strong balance sheet. This means Palantir can withstand economic downturns, invest aggressively in growth, and even explore acquisitions to strengthen its AI dominance.

PLTR's Valuation – Is the Stock Too Expensive?

This is where the risks start to emerge. At $106 per share, PLTR trades at a staggering 59.5x EV/FY25 revenue. That’s nearly 3x the valuation of the S&P 500’s average P/E ratio.

Despite its massive growth, the stock’s valuation is now pricing in perfection. If growth slows even slightly, or if AI investment budgets cool down, PLTR could see a sharp pullback.

DeepSeek: The AI Threat from China That Could Shake Up Palantir

China’s AI firm DeepSeek has thrown the entire AI market into chaos, after claiming that its AI models are cheaper and more efficient than U.S. competitors like OpenAI and Palantir. The concern is that if DeepSeek can develop powerful AI models at a fraction of the cost, it could force U.S. firms to lower prices, impacting PLTR’s high-margin business model.

Palantir has already warned U.S. government agencies not to use DeepSeek, citing national security risks, and some agencies like NASA have already banned DeepSeek technology. While this is good news for Palantir’s government contracts, the threat to its U.S. commercial business remains real.

Should You Buy, Sell, or Hold PLTR Stock at $106?

PLTR is one of the strongest AI stocks on the market right now. The company dominates U.S. government AI contracts, is rapidly growing its commercial business, and is highly profitable with a massive cash war chest. However, at 59.5x forward revenue, the stock is incredibly expensive, and any signs of a slowdown could trigger a major correction.

Here’s the bottom line:

- Bull Case: If AI demand keeps rising and Palantir’s government and commercial contracts continue accelerating, the stock could push toward $150 or even higher in 2025.

- Bear Case: If AI spending cools down, DeepSeek gains traction, or government contracts slow, PLTR could plunge back below $80 in a sharp correction.

Right now, PLTR is a high-risk, high-reward stock best suited for aggressive investors. If you believe in the long-term AI boom, buying on dips could be the smartest strategy. But if you’re worried about short-term volatility, taking some profits at $106 might not be a bad idea either.