Palantir Technologies Inc. (NASDAQ:PLTR): Revolutionizing AI with Unmatched Market Momentum

With a 330% YTD stock surge to $72, Palantir is setting the pace in AI and enterprise analytics | That's TradingNEWS

Palantir Technologies Inc. (NASDAQ:PLTR): A Powerhouse in AI and Defense with Limitless Potential

Palantir Technologies Inc. (NASDAQ:PLTR) is rewriting the playbook for success in the AI and enterprise software industries, leveraging its dominance in government contracts while expanding aggressively into the commercial sector. The company’s meteoric rise from $17 per share at the start of 2024 to $72 reflects a staggering 330% YTD growth, powered by explosive revenues, groundbreaking technological advancements, and surging demand for AI solutions across industries. As Palantir transforms itself into a leader in artificial intelligence and government analytics, its market presence continues to solidify, making it one of the most compelling growth stories in the tech sector.

Dominance in Government Contracts: A Stable Growth Engine

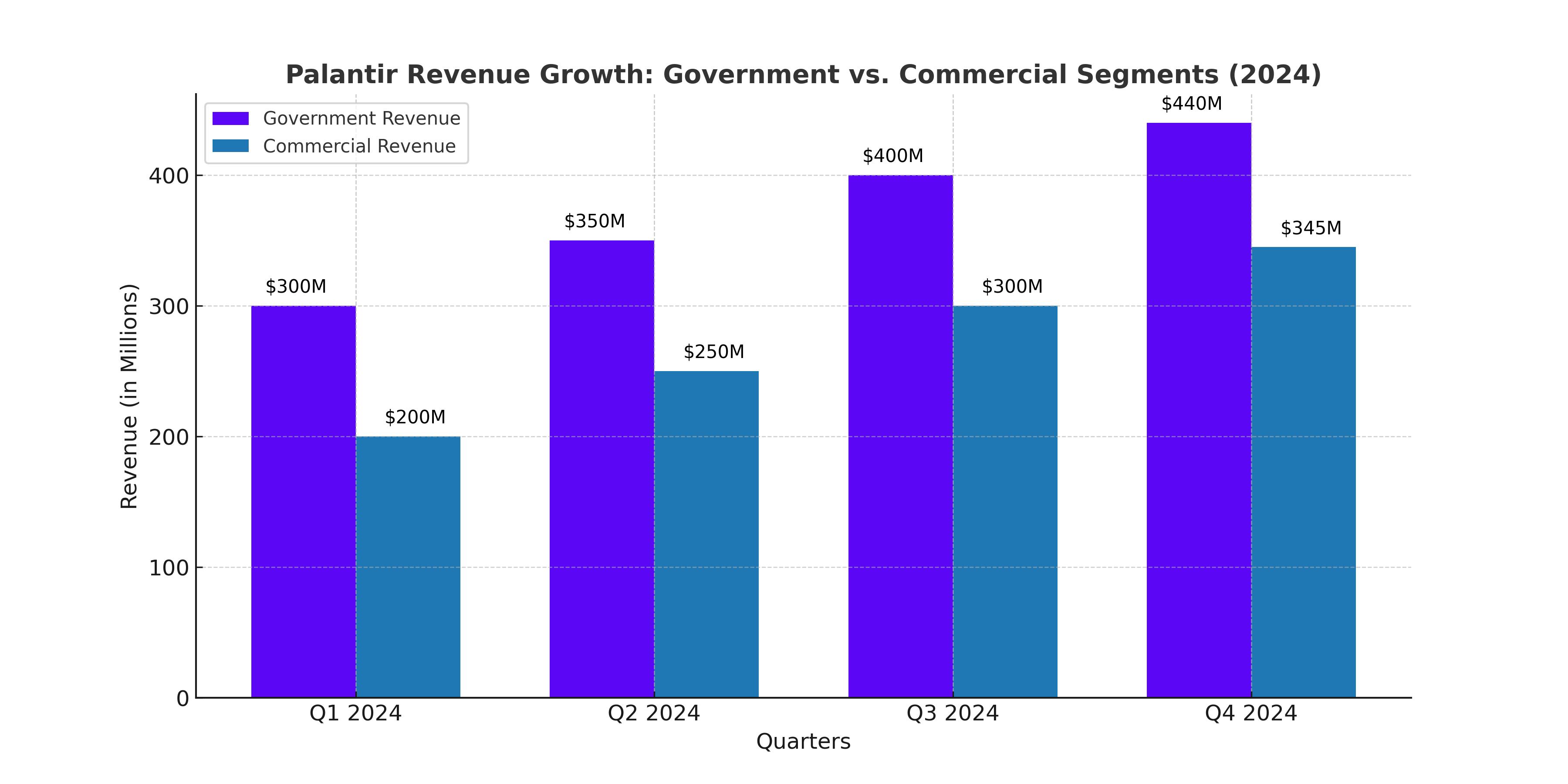

Palantir’s stronghold in government contracts has long been its cornerstone. With deep ties to U.S. agencies like the CIA, DoD, and NSA, Palantir’s government segment delivered a 40% YoY revenue growth in Q3 2024. Federal spending on AI-related projects has skyrocketed, with contracts increasing by over 1,200% in recent years. Palantir’s ability to secure key partnerships ensures a steady revenue stream. In Q3, the company expanded its contract with the U.S. Special Operations Command to deliver advanced AI capabilities and mission-critical tools. Such deals demonstrate its critical role in national defense and the growing reliance on its solutions.

With U.S. defense spending projected to reach $1 trillion by 2031, Palantir is well-positioned to capture a significant share of this budget. R&D and operational segments represent a $200 billion opportunity for data-centric AI solutions. A conservative estimate places Palantir’s share at $10 billion annually by 2031, translating to a 40% compound annual growth rate (CAGR) in government revenues. Further bolstering its position, the recent FedRAMP high baseline authorization allows Palantir to provide secure, full-suite products to a wide array of U.S. government agencies, reinforcing its status as a trusted partner in defense and intelligence.

Explosive Growth in the Commercial Sector

Palantir’s commercial segment is proving to be its next major growth engine. The company has made impressive strides in expanding its customer base, reaching 321 commercial clients by the end of Q3 2024, an astounding 77% YoY increase. Commercial revenue surged 54% YoY, fueled by the successful rollout of the Artificial Intelligence Platform (AIP). Launched in mid-2023, AIP has become a key differentiator for Palantir, enabling organizations to adopt AI solutions efficiently and at scale.

Unlike traditional enterprise software tools, AIP offers unparalleled interoperability, integrating seamlessly across major cloud platforms like AWS, Azure, and Google Cloud. This flexibility has made Palantir’s offerings attractive to businesses seeking to unify their data ecosystems. Furthermore, Palantir’s AIP Bootcamps have expedited onboarding for new clients, reducing the time required to implement its solutions to mere days. With flexible pricing models and an emphasis on small- and medium-sized enterprises, Palantir is poised to penetrate an even broader customer base.

The company’s aggressive R&D investments—totaling $446 million in 2024, twice that of competitor C3.ai—are paying off. New features like Ontology SDK 2.0 and Workflow Builder have enhanced the appeal of its platform, making it indispensable for businesses leveraging data analytics and AI. This focus on innovation, coupled with a commercial total addressable market (TAM) estimated at $230 billion by 2025, sets the stage for continued revenue growth.

Financial Resilience and Operational Efficiency

Palantir’s financial performance underscores its ability to scale effectively while maintaining robust profitability. Q3 2024 revenue reached $725.5 million, a 30% YoY increase, exceeding both internal guidance and analysts’ expectations. Full-year revenue projections stand at $2.8 billion. The company’s government revenue accounted for 56% of the total, while the commercial segment contributed 44%, signaling an increasingly balanced revenue mix.

Palantir’s profitability metrics are equally impressive. Operating margins more than doubled YoY to 15.6% in Q3, and its adjusted free cash flow (FCF) margin hit a record 60%, highlighting its ability to convert revenue into shareholder value. With $3.7 billion in cash and zero debt, Palantir boasts one of the healthiest balance sheets in the industry. This financial flexibility not only supports continued R&D investments but also positions the company to pursue strategic acquisitions that could enhance its technological offerings.

Palantir’s net income has grown triple digits over the last four quarters, and its gross profit margins remain enviably high at 81%. These figures validate its efficient business model and justify its premium valuation. While its forward P/E of 382 may seem daunting, it reflects the market’s confidence in Palantir’s ability to deliver exponential earnings growth. Analysts project revenue to reach $10 billion by 2031, suggesting ample room for long-term appreciation.

Valuation: High Expectations Backed by Strong Fundamentals

Despite its lofty valuation, Palantir’s growth trajectory and market opportunity justify its premium. A discounted cash flow (DCF) analysis, assuming a 23% revenue CAGR over the next five years, supports a fair value of $170 per share, significantly higher than current levels. Palantir’s ability to capture just a fraction of its $230 billion TAM could drive substantial upside, particularly as enterprise AI adoption accelerates.

Risks do exist, including competition from well-capitalized tech giants like Google, Amazon, and Microsoft. Regulatory challenges in the nascent AI industry could also pose hurdles. However, Palantir’s first-mover advantage, technological superiority, and strong government relationships provide a robust competitive moat.

Outlook: Unstoppable Momentum

Looking ahead, Palantir’s dual focus on government contracts and commercial expansion positions it as a leader in the AI and enterprise software markets. Its ongoing innovation in AI solutions, coupled with rising demand across sectors, underscores its growth potential. The commercial segment is expected to outpace government revenue, driven by accelerating enterprise AI adoption and an expanding customer base. Meanwhile, its government segment remains a reliable revenue stream, bolstered by increasing defense spending and trust in its mission-critical tools.

With a TAM projected to exceed $300 billion by 2030 and a market penetration of just 1.2%, Palantir is only scratching the surface of its potential. Investors willing to weather short-term volatility stand to benefit from the company’s long-term growth story. For real-time updates and insights into insider transactions, explore Palantir’s stock chart and insider profile.

Conclusion: A Strong Buy for the Future

Palantir Technologies Inc. (NASDAQ:PLTR) is not merely riding the AI wave; it is at the forefront of creating and defining its trajectory. With its unique dual-revenue model, anchored by a commanding presence in both the government and commercial sectors, Palantir has positioned itself as a transformative force in artificial intelligence, data analytics, and enterprise software. Its combination of unrivaled innovation, robust financial metrics, and expanding market penetration underscores its status as a leader poised to capitalize on one of the most revolutionary technological shifts of the 21st century.

At its current price of $72 per share, Palantir has delivered a staggering 330% year-to-date return, up from just $17 at the beginning of 2024. While the valuation metrics may appear stretched—its forward price-to-earnings (P/E) ratio hovers around 382—the company’s exceptional fundamentals and accelerating growth narrative justify this premium. Palantir’s strategic execution, particularly the 30% year-over-year revenue growth in Q3 2024, has not only met but exceeded the expectations of both analysts and investors. Its free cash flow margin, now at a record-breaking 60%, and an operating margin that has more than doubled year-over-year to 15.6%, are testaments to its ability to scale profitably.

The company's ability to dominate in government contracts is unrivaled, with 56% of its revenue coming from this segment in Q3. Federal spending on AI, projected to exceed $11.2 billion by 2027, offers a long runway for growth. Moreover, Palantir's commercial segment is emerging as an equally powerful growth driver, boasting a 54% year-over-year increase in Q3 and an 83% rise in its U.S. commercial customer base. The successful deployment of the Artificial Intelligence Platform (AIP), combined with its flexible pricing and seamless integration capabilities, has made Palantir a top choice for enterprises seeking data-driven transformation.

Palantir’s valuation, while premium, reflects market confidence in its ability to scale revenues and earnings exponentially. Analysts forecast revenues to reach $10 billion by 2031, fueled by its ability to capture a growing share of the $230 billion addressable market in enterprise software and AI solutions. Even with a modest 5% penetration of its government and commercial opportunities, Palantir’s growth trajectory could outpace that of many of its competitors.

Its healthy balance sheet, with $3.7 billion in cash and no debt, provides the flexibility to sustain its aggressive R&D investments, pursue strategic acquisitions, and weather potential macroeconomic headwinds. These attributes ensure that Palantir is not just surviving the AI revolution but thriving as a market leader. For investors willing to adopt a long-term perspective, the current price of $72 per share may one day be viewed as a bargain, much like NVIDIA’s valuation during its early AI-driven growth phase.

Palantir Technologies represents an unmatched combination of cutting-edge technology, robust financials, and enormous growth potential. While short-term price volatility remains a possibility given its steep valuation and speculative interest, the company’s fundamentals and market leadership make it a compelling long-term investment. Investors should strongly consider Palantir a “buy,” as it continues to redefine the future of AI and data analytics, offering both transformative impact and substantial returns in the years to come.