Analysis of Petróleo Brasileiro S.A. - Petrobras (NYSE: PBR): Strategic Growth, Dividends, and Challenges

Petrobras (NYSE:PBR) has solidified its position as a significant player in the global oil and gas industry, with its strong performance in Q3 2024 highlighting the company’s strategic capabilities and challenges. From expanding its international footprint to maintaining shareholder returns, Petrobras operates at the intersection of robust cash flow generation and governance-related uncertainties.

Key Financials and Shareholder Returns

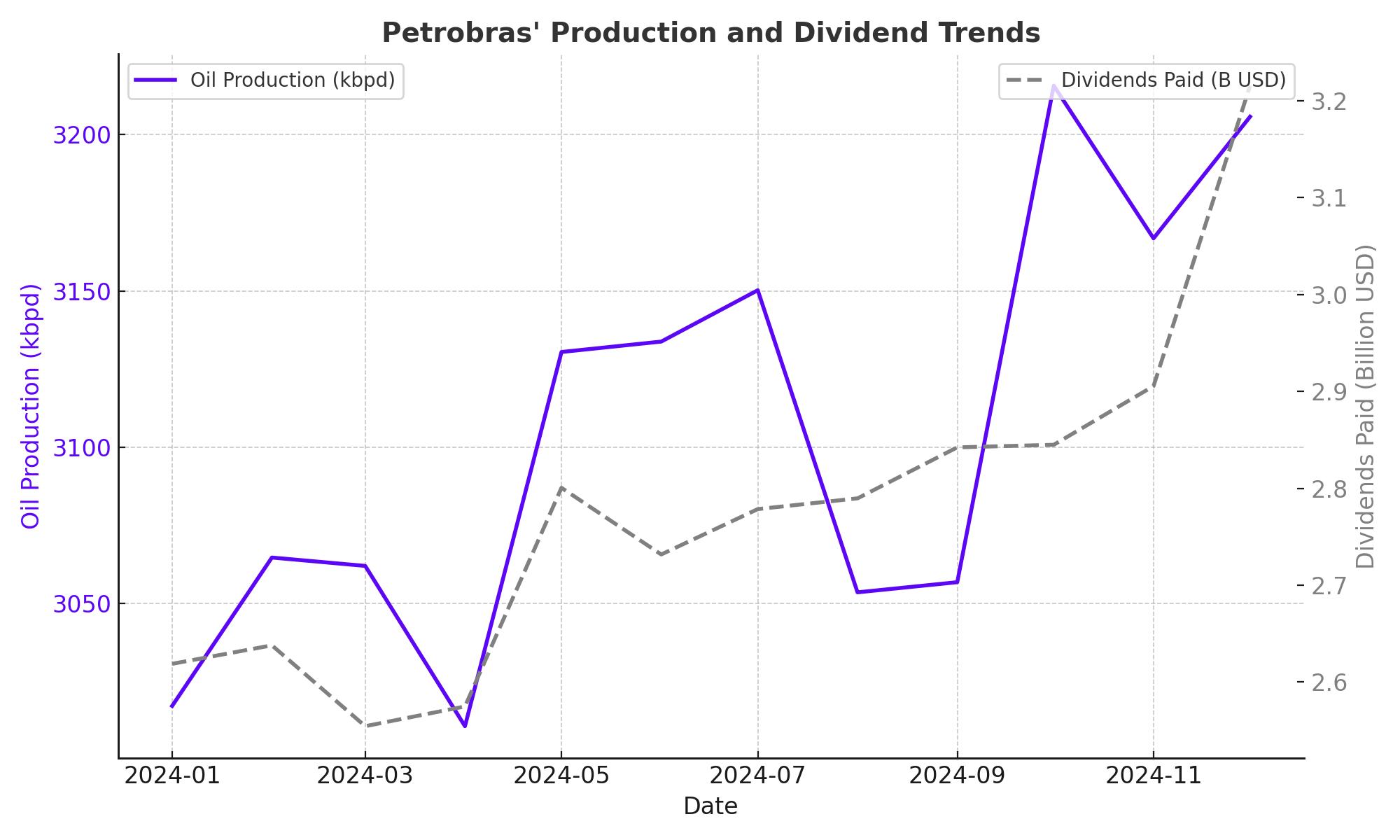

The company generated an impressive $6.9 billion in free cash flow (FCF) in Q3 2024, reflecting its ability to monetize its extensive asset portfolio. The proposed $3 billion dividend for the quarter translates to an annualized double-digit yield, underscoring Petrobras' commitment to returning capital to shareholders. This dividend policy aligns with its broader plan to distribute $45 billion in ordinary dividends and up to $10 billion in extraordinary dividends over the next five years.

Despite the high payout ratio, questions persist about the sustainability of such returns given the company’s ambitious $111 billion investment plan for 2025–2029, which includes substantial allocations to exploration, refining, and logistics.

Expanding Production and International Ventures

Petrobras aims to maintain a steady production target of 3.2 million barrels of oil equivalent (boe) per day by 2029. This includes $77 billion earmarked for exploration and production, with significant investments in Brazil’s offshore assets. Notably, the company has achieved a milestone of 3 billion barrels of production in the Tupi field, reflecting its operational efficiency.

Internationally, Petrobras has diversified its portfolio by acquiring stakes in South Africa, which reduces its dependence on Brazil's regulated pricing policies. This strategic move allows the company to leverage its expertise in ultra-deepwater projects while accessing higher-margin export markets.

Refining and Fertilizer Investments

Petrobras’ refining and logistics segment will receive $20 billion in investments, signaling a shift toward higher utilization rates at its facilities. Refinery utilization peaked at 95% in Q3 2024, reducing the need for imports and contributing to operational efficiency. However, the decision to invest $160 million in restarting the Araucária fertilizer plant, which has been dormant since 2020, has raised skepticism due to the historically poor returns associated with such ventures.

This diversification into non-core segments may dilute the company’s focus on its profitable upstream operations, potentially affecting long-term shareholder value.

Debt and Financial Health

Petrobras has significantly improved its financial health, with net debt reduced to $44.3 billion. The issuance of a $1 billion 10-year bond at the lowest interest rate in a decade exemplifies its enhanced credit profile. However, this financial flexibility hinges on stable or rising oil prices, as a prolonged downturn could constrain its ability to balance dividends and capital investments.

Market Sentiment and Valuation

Analysts have expressed mixed views on Petrobras' stock. Morgan Stanley and Goldman Sachs have raised their price targets to $20 and $17, respectively, citing strong dividend yields and operational improvements. However, the stock remains undervalued, trading at a forward price-to-earnings ratio significantly lower than industry peers.

Petrobras’ discounted valuation reflects investor concerns over governance risks, given the Brazilian government’s controlling stake and history of interference. This includes imposing price controls and using Petrobras as a tool for national development, which may conflict with shareholder interests.

Key Risks and Strategic Outlook

Governance issues remain a significant risk for Petrobras, as government influence could limit its ability to operate autonomously. Additionally, the company’s reliance on Brent crude prices poses dual risks: low prices undermine profitability, while high prices invite regulatory intervention.

Despite these challenges, Petrobras’ robust cash flow, low-cost production, and commitment to shareholder returns make it an attractive investment. Its strategic plan for 2025–2029, set to be unveiled on November 22, will provide further clarity on its growth trajectory.

Petrobras (NYSE: PBR) continues to navigate a complex landscape, balancing operational efficiency, ambitious investments, and governance challenges. Investors should monitor its strategic developments closely, particularly as the company seeks to sustain its industry-leading dividend yield while expanding its global footprint.