Petrobras (NYSE: PBR): A Hidden Gem with Strong Dividends and Undervalued Potential

Brazil's energy giant offers high dividend yields, steady production growth, and an attractive valuation for investors seeking long-term gains in a stable oil market | That's TradingNEWS

Petrobras (NYSE: PBR): Energy Giant’s Performance and Prospects

Dividend Strength and Shareholder Value

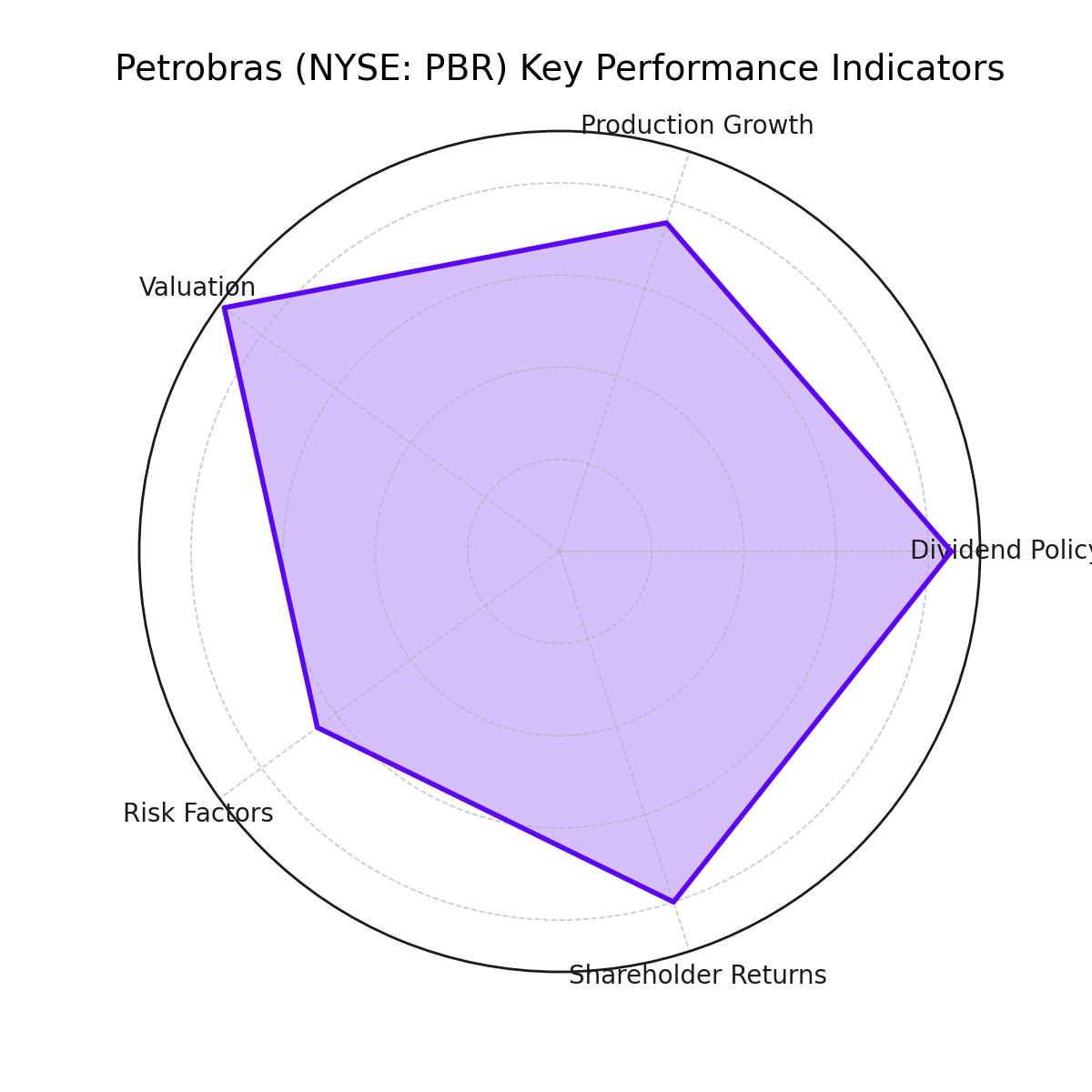

Petrobras (NYSE: PBR) has maintained a robust dividend policy, with its recent announcement of R$ 0.52162113 per share in dividends reflecting its commitment to returning cash to shareholders. This payment, scheduled for September 27, 2024, for ADR holders, further underscores Petrobras' ability to generate substantial free cash flow. Along with dividends, Petrobras has also engaged in buybacks, repurchasing $380M in shares during the first half of 2024. This demonstrates a strong approach to capital allocation, with the potential for even larger buyback programs in the future.

Steady Production and Revenue Trends

Petrobras continues to show steady growth in its production volumes, reporting a total output of 2,737 MBOED in the first half of 2024. This represents a 3% year-over-year increase, largely driven by the company’s focus on expanding its operations through assets like FPSO Almirante Barroso and P-71. Despite this production growth, Petrobras saw a 14% decline in adjusted EBITDA to $21.8B, primarily due to divestments and lower natural gas volumes. Free cash flow during this period remained strong at $12.7B, reflecting the company’s operational resilience.

Petroleum Pricing and OPEC+ Influence

The stability of oil prices, supported by OPEC+ output cuts, has been a crucial factor in Petrobras’ profitability. With Brent crude prices hovering around $72 per barrel, the energy landscape remains favorable for Petrobras. The company benefits from this pricing support as it continues to ramp up production, enhancing its financial outlook for the near future.

Valuation and Investment Appeal

At a price-to-earnings ratio of 4.4X, Petrobras is significantly undervalued compared to its U.S. and European counterparts. ExxonMobil, for example, trades at 13.1X, while Chevron’s valuation sits at 11.2X. This deep discount reflects concerns over Petrobras' government ownership and potential risks related to dividend policies. However, the valuation presents an attractive opportunity for investors willing to navigate these risks, with a potential price target of $16.67 per share, based on a modest revaluation.

Risk Factors for Investors

Investing in Petrobras comes with several notable risks. The company’s majority ownership by the Brazilian government introduces political uncertainty, particularly regarding future dividend distributions. Additionally, Petrobras faces currency risk, as the Brazilian real can be volatile. Dividend investors must also consider the impact of currency fluctuations on their returns.

Production Growth and Future Prospects

Petrobras has a clear roadmap for future growth, with its pre-salt oil fields expected to contribute 81% of its total production. The company is committed to expanding its low-cost assets, which are essential for maintaining profitability in a volatile market. Petrobras' plans for continued production growth align with the rising global demand for energy, positioning it to take advantage of favorable market conditions.

Petrobras’ Shareholder Returns Strategy

Despite the challenges it faces, Petrobras remains committed to returning value to shareholders. In the first half of 2024, the company generated $10 billion in operating cash flow and distributed $7.3 billion in dividends. With a double-digit yield, Petrobras offers one of the most attractive dividend payouts in the energy sector. The company's ability to maintain these high yields while investing in capital projects highlights its balanced approach to growth and shareholder returns.

Balance Sheet Improvements

Petrobras has made significant strides in reducing its debt, bringing its net debt down to $46.2 billion from $63.2 billion in 2020. This reduction, along with an improved debt maturity profile, demonstrates the company’s focus on financial stability. With a solid cash position, Petrobras is well-equipped to continue delivering strong dividends while managing its capital expenditures.

Conclusion: Petrobras (NYSE: PBR) – A Compelling Energy Play

Petrobras presents a compelling investment case for those seeking high dividend yields and exposure to a major player in the global energy market. While risks remain due to government influence and currency volatility, Petrobras’ undervalued stock, robust cash flow generation, and consistent shareholder returns make it a strong contender for income-focused investors. With ongoing production growth and favorable oil prices, Petrobras is well-positioned to deliver both capital appreciation and substantial dividends in the coming years.

For real-time updates on Petrobras (NYSE: PBR), check the real-time chart here. You can also explore insider transactions through the stock profile.

That's TradingNEWS

Read More

-

SCHD ETF at $27.64: High Dividend, Low Multiple and a 2026 Comeback Setup

28.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Trade Near Cycle Lows While $1.25B Flows and $1.87 XRP Position for Q1 2026

28.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Jumps From $3.47 to $3.88 as NG=F Tracks Cold Weather and LNG Flows

28.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY 2026 Price Forecast: Dollar–Yen Near 160.60 With BOJ Shift Threatening Carry Trade

28.12.2025 · TradingNEWS ArchiveForex