Petrobras (NYSE:PBR.A) Stock Analysis: A Hidden Value or Political Risk?

Petrobras (NYSE:PBR.A) remains one of the most undervalued major oil companies in the global market. Trading around $13.81, it has a forward P/E of 6.7 for PBR and 5.7 for PBR.A, significantly below global oil majors like ExxonMobil (NYSE:XOM) at 11x and Chevron (NYSE:CVX) at 10x. This massive valuation gap raises a critical question: Is Petrobras a deep value play with a potential upside of 162%, or are political and macroeconomic risks suppressing its true value?

With a 21%+ dividend yield, Petrobras is one of the highest-yielding large-cap stocks in the world. Yet, the Brazilian government’s influence, debt concerns, and energy price volatility continue to weigh on investor sentiment.

Petrobras (NYSE:PBR.A) Stock Performance: A Massive Discount Compared to Peers

Petrobras’ stock price has significantly lagged behind its Western peers. Over the last year, while ExxonMobil (NYSE:XOM) gained +14% and Chevron (NYSE:CVX) rose +11%, PBR.A is down nearly -18% from its 52-week high. The company’s valuation multiples tell the story of an oil giant trading at emerging-market discount levels.

PBR.A vs. Global Oil Majors (Valuation Comparison):

- PBR.A forward P/E: 5.7

- ExxonMobil (XOM) forward P/E: 11.2

- Chevron (CVX) forward P/E: 10.4

- BP (BP) forward P/E: 8.9

- Shell (SHEL) forward P/E: 9.1

A stock trading at half the valuation of its peers should indicate severe financial stress. But Petrobras has stronger free cash flows than many of these competitors, raising the question: Why is it still so cheap?

Cash Flow Strength and Oil Production Growth

Despite the stock’s underperformance, Petrobras remains a cash flow powerhouse. The company generated $11.3 billion in Q3 2024 operating cash flow, up 24% QoQ, while free cash flow hit $6.9 billion, more than covering its $2.3 billion in dividends and capital expenditures.

Petrobras’ cost structure also remains one of the lowest in the industry, with a $45 per barrel breakeven price—far below the current Brent crude price of $82 per barrel.

Petrobras Q3 2024 Highlights:

- Revenue: $22.76 billion (-9% YoY, but beat expectations by $236 million)

- Net income: $5.9 billion (EPS: $0.90, a 21.8% beat over estimates)

- Debt reduction: $59.1 billion total debt, the lowest since 2008

- Investment plan: $102 billion for 2025-2029, with $77 billion allocated to exploration and production

Why Petrobras (NYSE:PBR.A) Is One of the Highest-Yielding Stocks in the World

One of the biggest attractions for investors is Petrobras’ extremely high dividend yield, which currently sits above 21%. While the payout fluctuates based on free cash flow, management remains committed to distributing 45% of available cash flow to shareholders.

For comparison, here’s how Petrobras’ yield stacks up against other oil giants:

- PBR.A: 21%+ yield

- ExxonMobil (XOM): 3.7% yield

- Chevron (CVX): 4.0% yield

- BP (BP): 4.8% yield

- Shell (SHEL): 4.1% yield

Even if Petrobras lowers its dividend payout, investors are still looking at a double-digit yield in the years ahead, which is rare in today’s market.

Debt Reduction and Financial Stability: A Turning Point for Petrobras?

Debt has historically been a concern for Petrobras, but the company has dramatically improved its balance sheet.

- Total debt: $59.1 billion (lowest since 2008)

- Net debt: $44.8 billion, down 30% from peak levels

- Debt-to-equity ratio: Reduced by one-third in the last five years

- Interest coverage ratio: Improved by 158% in the past five years

With debt levels falling and free cash flow remaining strong, Petrobras is no longer the highly leveraged company it once was. This raises the question: Will Wall Street start recognizing Petrobras as a safer, more investable stock?

Political Risks: How Much of a Threat Is Lula’s Administration?

The Brazilian government owns 50.3% of Petrobras, leading to fears of state intervention and unfavorable policies. Investors still remember past price controls that hurt profitability, and there are concerns that President Lula’s policies could limit Petrobras’ shareholder returns.

However, Petrobras has continued paying large dividends, and its capital investment plans suggest no significant shift toward lower-return energy projects.

A look at Petrobras under Lula’s first term (2003-2011) shows that it actually outperformed most Western oil companies in both free cash flow yield and operating margins.

Key Question: Is Petrobras still a high-risk political stock, or has the government recognized its financial strength and profitability as a national asset?

Brazilian Real (BRL) Valuation: A Hidden Catalyst for Petrobras Stock?

One overlooked factor in Petrobras’ valuation is the Brazilian real (BRL). The currency is currently trading at historically low levels, and history shows that Petrobras stock tends to rise when the BRL strengthens.

When the Brazilian real appreciates, Petrobras’ U.S.-traded stock (PBR, PBR.A) sees stronger returns.

- BRL is currently at its 10-year lows

- Petrobras stock tends to gain when BRL rises

- Global funds could return to Brazil when monetary policy shifts

If the Brazilian Central Bank stops tightening interest rates, foreign capital may start flowing back into Petrobras, acting as a hidden tailwind for the stock.

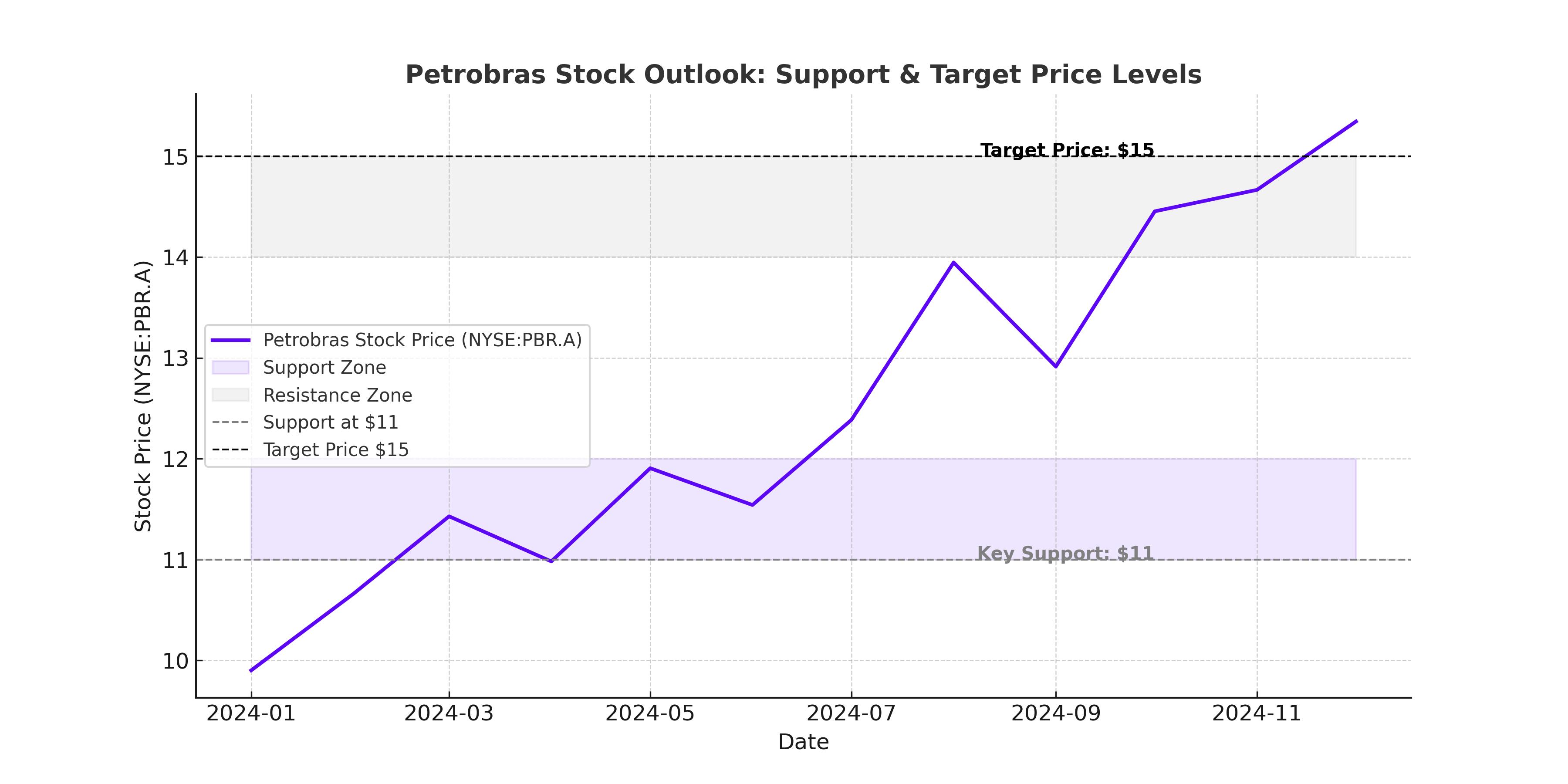

Price Target and Valuation Upside for Petrobras (NYSE:PBR.A)

Wall Street remains skeptical about Petrobras, but its valuation suggests substantial upside.

Price target scenarios:

- Current price: $13.81

- Fair value based on peers (EV/EBITDA at 4x): $19.60 (+42%)

- 2026 target based on historical mean reversion: $36.38 (+162%)

Even using conservative assumptions, Petrobras remains one of the cheapest oil stocks in the world.

Does a 162% upside justify the risks? That depends on whether Petrobras can maintain its capital discipline while navigating political challenges.

Final Thoughts: Is Petrobras (NYSE:PBR.A) a Buy, Hold, or Sell?

Petrobras remains a deep value stock with high dividends, strong cash flow, and improving fundamentals. The stock’s cheap valuation, low debt, and massive oil reserves make it an attractive long-term investment. However, political risks, potential government intervention, and macroeconomic factors could still weigh on its growth.

At 5.7x forward earnings, with a 21%+ dividend yield, and a target price of $36 by 2026, Petrobras offers one of the most compelling risk-reward profiles in the oil sector.

For long-term investors willing to stomach short-term volatility, Petrobras (NYSE:PBR.A) remains a strong Buy. However, traders should be prepared for price swings due to political and currency-related risks.

With a potential 162% upside and a dividend payout that beats nearly every large-cap stock in the world, Petrobras is a stock that value and income investors simply cannot ignore.