Preparing for Bitcoin's Next Big Move

Will Bitcoin Surge to $71,000? Key Insights and Market Dynamics Explored | That's TradingNEWS

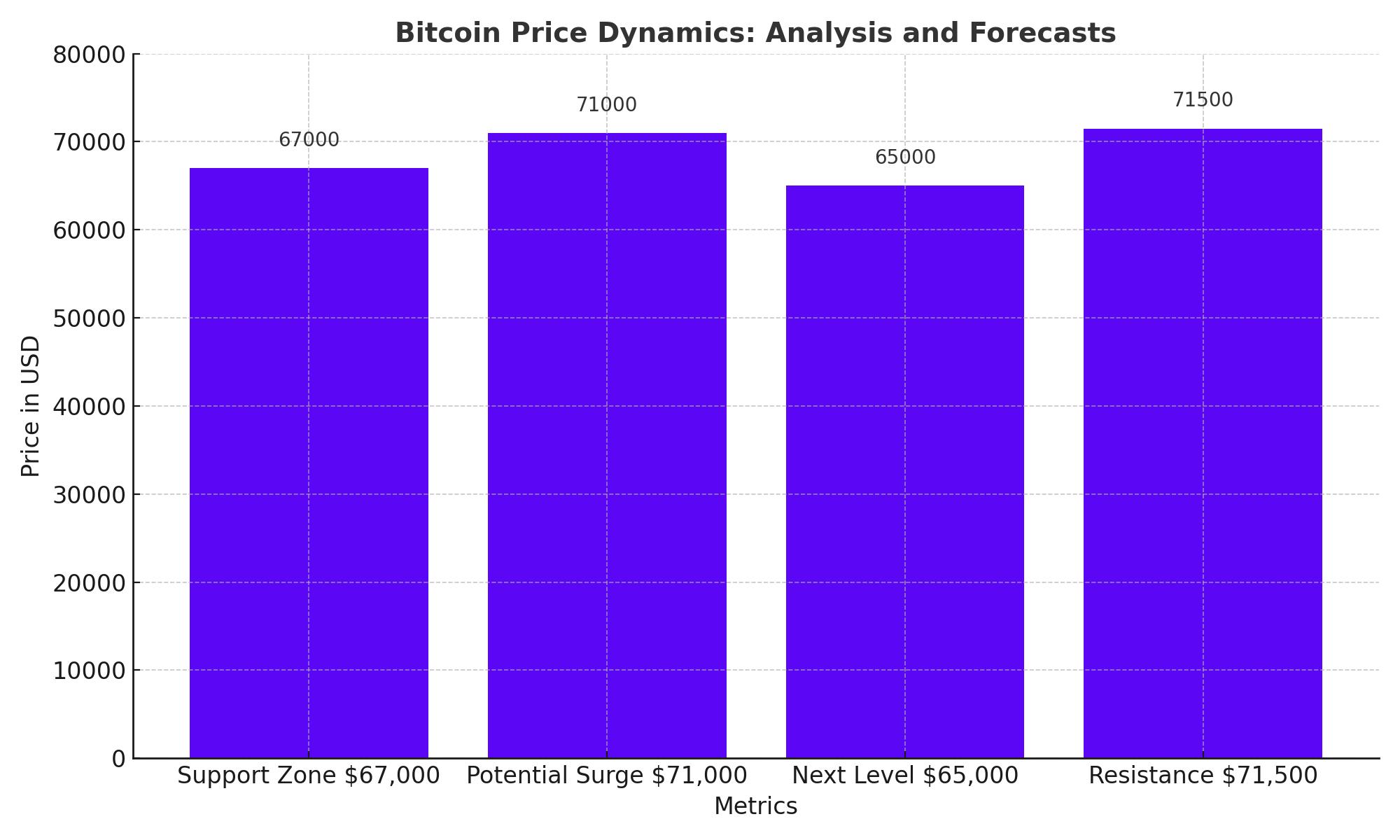

Bitcoin Price Dynamics: Analysis and Forecasts

Current Market Trends and Analyst Insights

Bitcoin (BTC) has faced a downtrend recently, but prominent crypto analyst Capo of Crypto anticipates a potential surge to $71,000. He identifies the primary support zone at $67,000, expecting bullish continuation if this level holds. If it fails, the next level to monitor is $65,000. Capo addressed concerns about recent BTC movements linked to the defunct Mt. Gox exchange, clarifying that the transfers of approximately 43,000 BTC were for repayment preparations extending until October 2024, not immediate repayments.

Arkham Intelligence data revealed the mentioned BTC reserves moved in three significant transactions: 12.24k BTC, 14.05k BTC, and 16.589k BTC. Despite these substantial transfers, Capo's analysis suggests minimal market concern. Michaël van de Poppe, another analyst, echoed this sentiment, noting no breakout at $70K and emphasizing the importance of $66K support.

Bitcoin's May Performance and Resistance Levels

In May, Bitcoin increased by 17%, nearing a new all-time high on May 20 but stalling despite a breakout. The price remains above the previous pattern’s resistance, indicating potential for further gains. The daily BTC price chart shows a steady increase since May 1, with a breakout from a descending parallel channel on May 20, suggesting the correction might be over.

However, BTC failed to clear the critical $71,500 horizontal resistance area. The MACD and RSI provide bullish signals, but their recent downward trends limit confidence. Whether BTC falls back within the channel or bounces and breaks out will determine the future trend. The wave count supports an ongoing breakout, predicting a new all-time high soon.

Wave Count Analysis and Future Price Targets

The wave count indicates BTC is in the fifth and final wave of an upward movement started in September 2023. The first target for the high is $76,950, with further confluence between $84,200 and $87,200. The sub-wave count also supports this target, suggesting BTC is completing sub-wave four, likely leading to another upward movement.

If BTC falls below the wave one high at $65,513, the bullish count will be invalidated, potentially causing a drop to $55,000. However, this scenario remains unlikely as long as BTC trades above the channel.

Post-Halving Trends and ETF Demand

Bitcoin demand from ETFs has increased post-halving, with parallels to trends seen in 2020. The higher timeframe uptrend suggests continuation, with Fibonacci extension levels targeting $79.2k and $88.1k. Liquidation data indicates potential dips to $66.2k-$66.7k, offering buying opportunities. Predictions for a bitcoin cycle high of $150,000 in 2025 and a year-end target of $90,000 reflect strong bullish sentiment.

Ethereum and Broader Crypto Market Implications

Ether (ETH) gained 26% last week following the SEC's approval of eight spot ETH ETF issuers. Once S1 filings are approved, Ether ETF trading will commence on exchanges. Bernstein notes Ether's classification as a commodity rather than a security, paving the way for other blockchain assets to evolve similarly, potentially benefiting tokens like Solana (SOL).

Bitcoin's Long-Term Outlook Amid U.S. Economic Policies

Bitcoin has surged over the past year, with the price currently around $70,000, up almost 400% from its post-FTX collapse lows. Wall Street's anticipation of a Federal Reserve dovish shift has contributed to this surge. Treasury Secretary Janet Yellen has issued warnings about the U.S. debt pile, which some analysts believe could propel Bitcoin to $1 million over the next 18 months.

Jack Mallers, CEO of bitcoin payments app Strike, suggests that continued Fed money printing and currency debasement could drive asset prices higher, with Bitcoin potentially reaching $250,000 to $1 million in the next 10 to 18 months.

Conclusion

Bitcoin's market dynamics reflect a complex interplay of technical factors, market sentiment, and macroeconomic influences. While short-term volatility persists, the long-term outlook remains bullish, supported by strong demand, technical indicators, and favorable macroeconomic conditions. Investors should stay vigilant and monitor key support and resistance levels, as well as broader economic policies, to navigate the evolving market landscape effectively.