Qualcomm (NASDAQ:QCOM) Poised for AI Dominance and Undervalued Potential—Is Now the Time to Buy?

NASDAQ:QCOM Stock Shows Strength as Edge AI and Portable AI Become Key Growth Catalysts

Qualcomm (NASDAQ:QCOM) has been making significant strides in edge AI and portable AI, positioning itself as one of the biggest players in the next phase of artificial intelligence development. The company’s latest earnings report revealed a strong revenue base of $11.67 billion in Q1 2025, up 17% year-over-year, while GAAP earnings per share came in at $2.83, a 15% increase from last year. However, despite these solid numbers, the stock has remained undervalued compared to its semiconductor peers, largely due to concerns over China’s demand and short-term licensing revenue slowdowns.

While the market remains cautious, Qualcomm’s AI-driven future, particularly its dominance in edge computing, suggests the company is in a position of strength. The firm’s focus on on-device AI, 5G expansion, and AI-powered IoT solutions could lead to long-term growth acceleration, making the stock a compelling buy at current levels.

Why Qualcomm’s (NASDAQ:QCOM) Edge AI Strategy is a Game Changer

Artificial intelligence is no longer limited to cloud-based processing. As AI models become more advanced, companies are shifting towards on-device AI, allowing devices like smartphones, wearables, and IoT sensors to process AI models locally rather than relying on cloud servers. Qualcomm is at the forefront of this movement, building custom AI chips that allow powerful machine learning models to run on smartphones, PCs, and IoT devices with significantly lower power consumption.

CEO Cristiano Amon recently highlighted that DeepSeek-R1, a new AI model, was successfully running on Snapdragon-powered smartphones and PCs within just days of its release, demonstrating Qualcomm’s technical superiority in edge AI chips. This shift to local AI inference will drive demand for Qualcomm’s Snapdragon chipsets, which already power most flagship Android devices.

The implications of this are massive. Qualcomm’s dominance in 5G connectivity means it can integrate AI into every aspect of mobile computing. Unlike NVIDIA (NASDAQ:NVDA), which focuses on AI cloud computing, Qualcomm is positioned to dominate the on-device AI revolution, allowing real-time AI applications to run without reliance on external servers.

Earnings Beat Shows Strong Fundamentals, But What’s Next for Growth?

In Q1 2025, Qualcomm beat Wall Street expectations across the board:

- Revenue: $11.67 billion (vs. estimate of $10.94 billion)

- GAAP EPS: $2.83 (vs. estimate of $2.44)

- Non-GAAP EPS: $3.41 (vs. estimate of $2.99)

- Handset revenue up 16% YoY

- IoT revenue up 18% YoY

Despite these strong numbers, guidance for Q2 2025 was cautiously optimistic, with revenue expected between $10.3 billion and $11.2 billion, reflecting a potential YoY growth range of 9.7% to 19.3%. While revenue growth may decelerate slightly, Qualcomm’s long-term thesis remains intact, particularly in the AI-driven smartphone and IoT markets.

How Qualcomm (NASDAQ:QCOM) is Positioned vs. AI Competitors

Many investors view NVIDIA (NASDAQ:NVDA) and AMD (NASDAQ:AMD) as the primary AI beneficiaries, but Qualcomm’s edge AI strategy is structurally different. While NVIDIA focuses on AI cloud computing, Qualcomm dominates mobile and portable AI, where power efficiency is critical.

One of the most overlooked trends is portable AI, where AI models are compressed to run efficiently on smartphones, tablets, and IoT devices. The rise of AI-powered mobile assistants, real-time translation, and on-device AI-enhanced cameras will drive demand for Qualcomm’s next-gen Snapdragon processors.

Why This Matters: Unlike the cloud-based AI boom, which requires massive GPUs, the edge AI revolution will be a high-volume, consumer-driven market. Every smartphone manufacturer will require AI-optimized chips, making Qualcomm the go-to supplier for this technology.

Qualcomm’s Valuation Suggests a Massive Discount vs. Peers

Despite its leadership in edge AI and mobile AI chips, Qualcomm’s stock remains undervalued relative to its tech sector peers.

- Current P/E Ratio: 18.33

- Sector Median P/E Ratio: 33.03

- Discount to Sector: -44%

This discount is massive considering Qualcomm’s strong revenue growth and industry positioning. If QCOM were to trade in line with the sector median, it would imply a potential upside of 40-50% from current levels.

How the Trump Tariffs on China Impact Qualcomm (NASDAQ:QCOM)

One of the biggest investor concerns is Qualcomm’s exposure to China, as over 60% of its revenue in recent quarters has come from Chinese markets. With President Donald Trump’s new 10% tariff on Chinese goods, the market fears potential disruptions.

However, Qualcomm is less exposed than other semiconductor firms due to its focus on mobile and consumer-driven AI chips, rather than high-end cloud-based AI processors. The U.S. government’s restrictions on AI chip exports have mainly targeted NVIDIA and AMD’s AI GPUs, while Qualcomm’s smartphone chips remain in high demand worldwide.

Even if tariffs disrupt certain aspects of Qualcomm’s supply chain, the company is diversifying its manufacturing and remains critical to the global smartphone industry, particularly with its 5G and AI innovations.

What’s Next for Qualcomm (NASDAQ:QCOM)?

Looking ahead, Qualcomm is positioned for strong long-term growth, driven by three major tailwinds:

- AI-Powered Smartphones & PCs – As AI models become more efficient, Qualcomm’s Snapdragon processors will power the next wave of AI-enhanced mobile devices, a multi-billion-dollar market.

- 5G Expansion & Connectivity Dominance – Qualcomm remains the leading supplier of 5G chipsets, securing major contracts with Apple, Samsung, and Xiaomi.

- AI-Powered IoT & Automotive – Qualcomm’s growth in IoT and automotive AI chips is accelerating, providing a long-term revenue stream beyond smartphones.

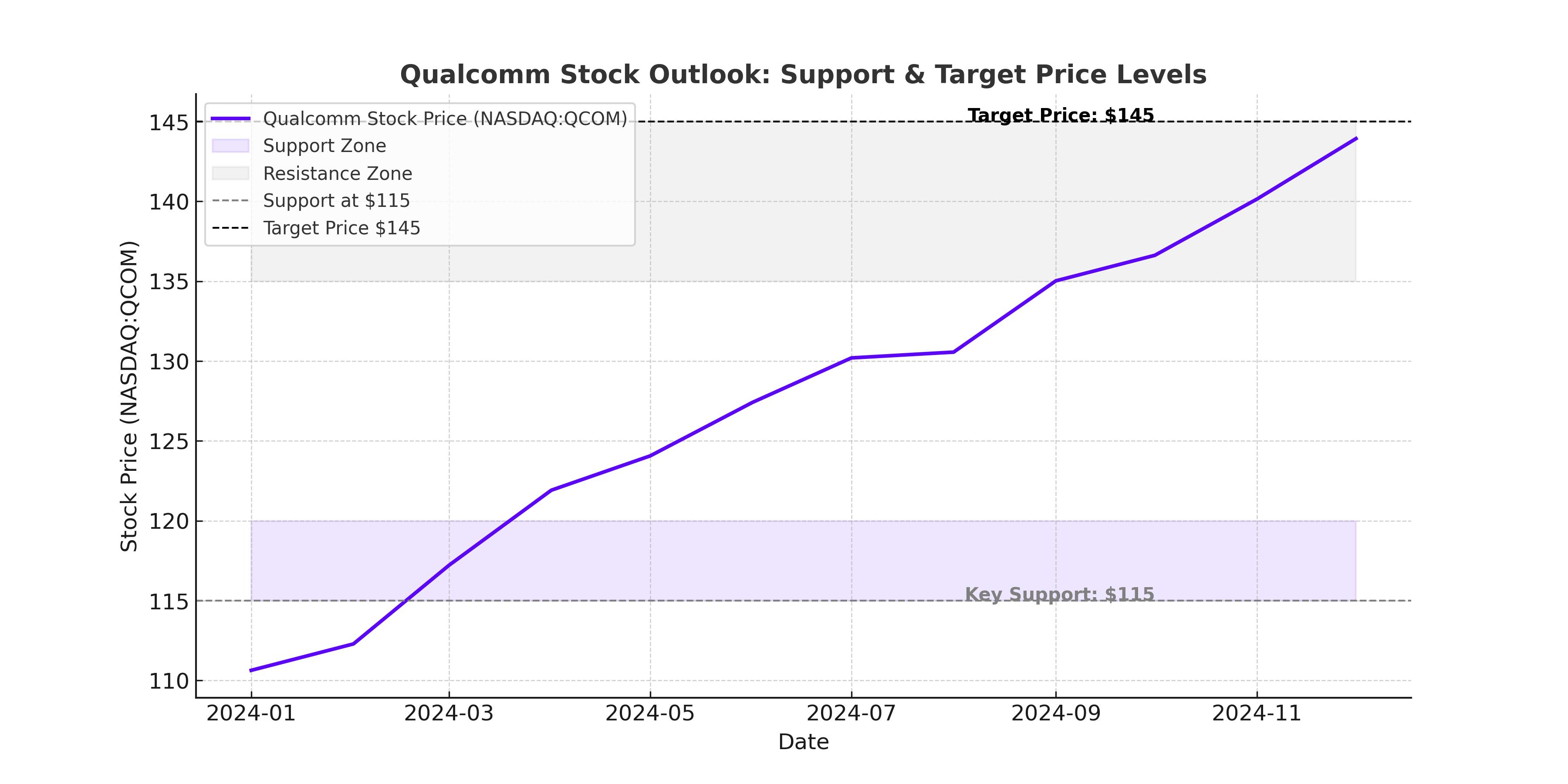

Buy, Sell, or Hold? Why Qualcomm (NASDAQ:QCOM) is a Strong Buy

Despite short-term concerns about licensing revenue and China demand, Qualcomm remains one of the most undervalued AI stocks in the market today. The company’s leadership in edge AI, portable AI, and 5G connectivity positions it as a key player in the next phase of AI-driven computing.

At a massive valuation discount vs. the sector, Qualcomm is an attractive buy for long-term investors. If the stock re-rates to a sector-average P/E ratio of 33, it would imply a price target of $245+ per share, representing 40-50% upside from current levels.

For real-time stock updates on NASDAQ:QCOM, visit QCOM real-time chart. Also, keep an eye on QCOM insider transactions for insight into executive confidence.

Qualcomm is at the center of the AI revolution, and the market hasn’t priced in its long-term potential yet. Investors looking for exposure to AI-driven smartphones, IoT, and 5G should consider accumulating shares before Wall Street catches on.