Qualcomm's Dividend Sustainability and Future Growth Prospects

Examining Qualcomm Inc's Dividend History, Market Expansion, and AI Initiatives | That's TradingNEWS

Exploring Qualcomm Inc's Dividend Sustainability and Growth Prospects

Qualcomm's Dividend Announcement

Qualcomm Inc (NASDAQ: QCOM) has declared a dividend of $0.85 per share, payable on June 20, 2024, with an ex-dividend date of May 30, 2024. This announcement has drawn attention to the company's historical dividend performance, yield, and growth rates. Using data from various sources, this analysis examines the sustainability and growth potential of Qualcomm's dividends.

Qualcomm's Business Model and Market Position

Qualcomm's Business Model and Market Position

Qualcomm designs and licenses wireless technology and manufactures chips for smartphones. Its essential patents cover CDMA and OFDMA technologies, integral to all 3G, 4G, and 5G networks. Qualcomm's intellectual property is licensed by nearly all wireless device manufacturers. The company is also the world's leading wireless chip vendor, providing advanced processors to major handset makers and marketing RF-front end modules for smartphones, along with chips for the automotive and Internet of Things sectors.

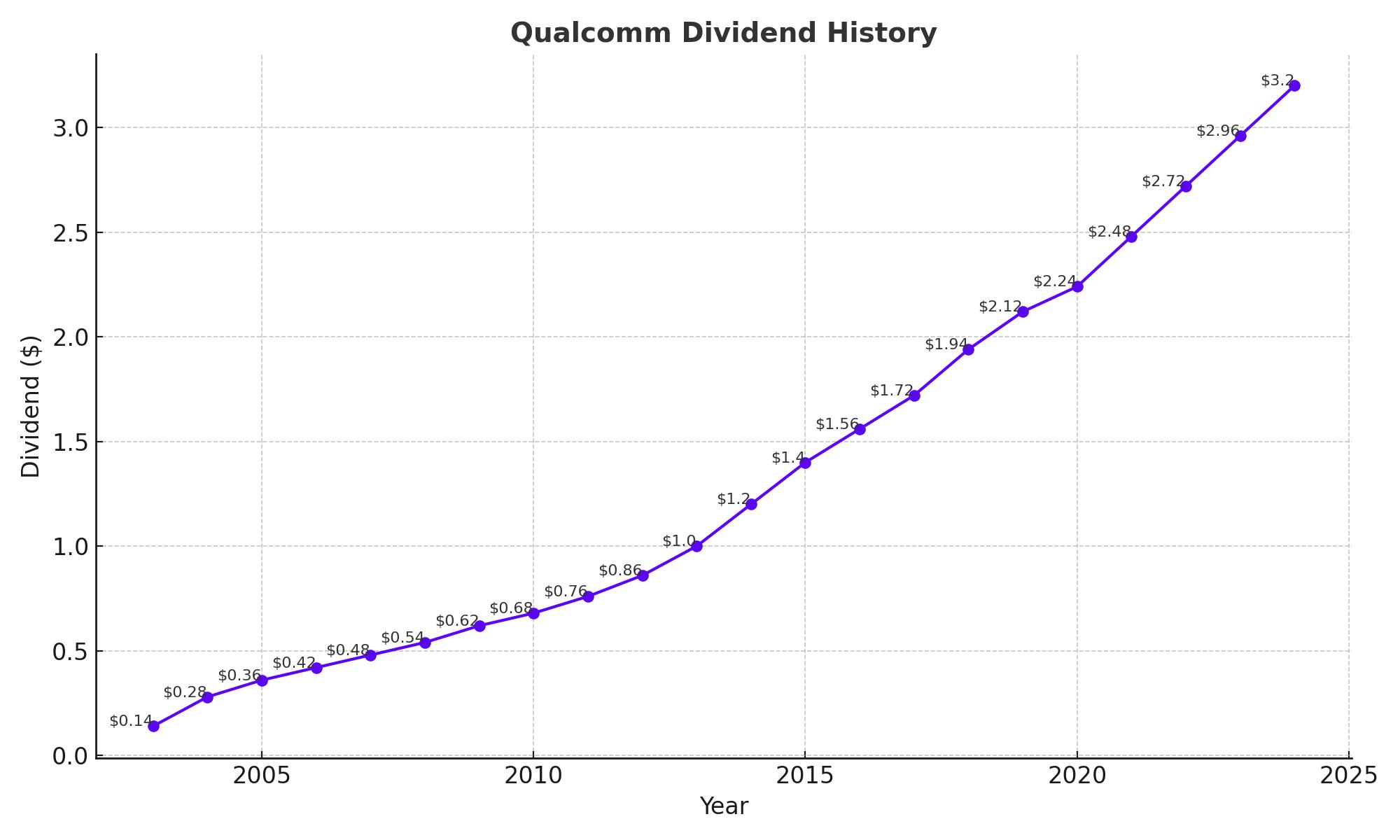

A Glimpse at Qualcomm Inc's Dividend History

Since 2003, Qualcomm has consistently paid dividends, increasing them annually. This track record has earned it the status of a dividend achiever, a recognition given to companies that have raised their dividends for at least 21 consecutive years.

Breaking Down Qualcomm's Dividend Yield and Growth

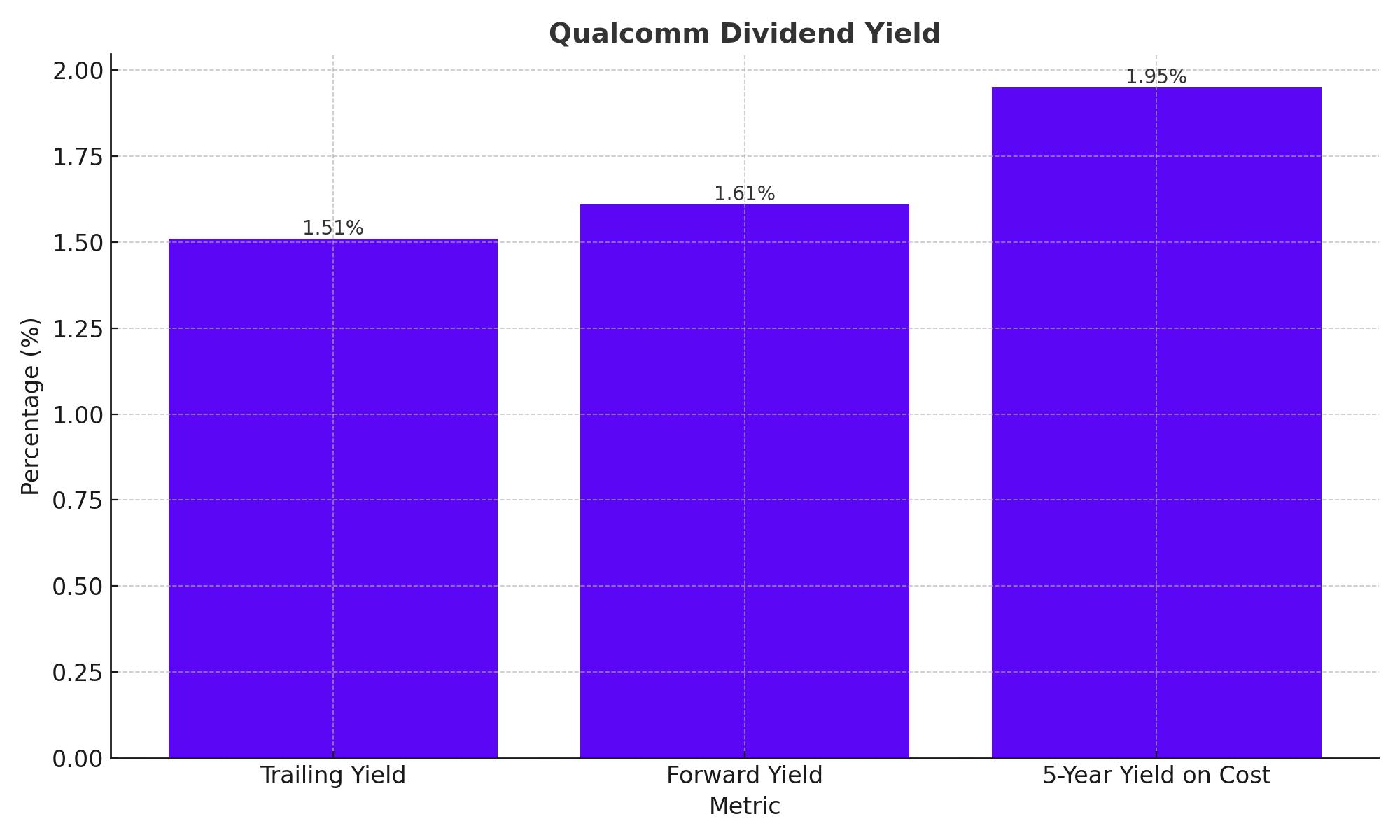

Currently, Qualcomm boasts a trailing dividend yield of 1.51% and a forward dividend yield of 1.61%, indicating expected dividend increases over the next year. However, this yield is near a 10-year low and underperforms 46.95% of global competitors in the Semiconductors industry, potentially reducing its appeal to income-focused investors.

Over the past three years, Qualcomm's annual dividend growth rate was 6.90%, which slowed to 5.30% over five years and averaged 8.50% over the past decade. The 5-year yield on cost for Qualcomm stock is approximately 1.95% today.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio stands at 0.40 as of March 31, 2024, suggesting that Qualcomm retains a substantial portion of its earnings for growth and stability. The company's profitability rank is 9 out of 10, highlighting its earnings strength relative to peers, with net profit reported in 9 of the past 10 years.

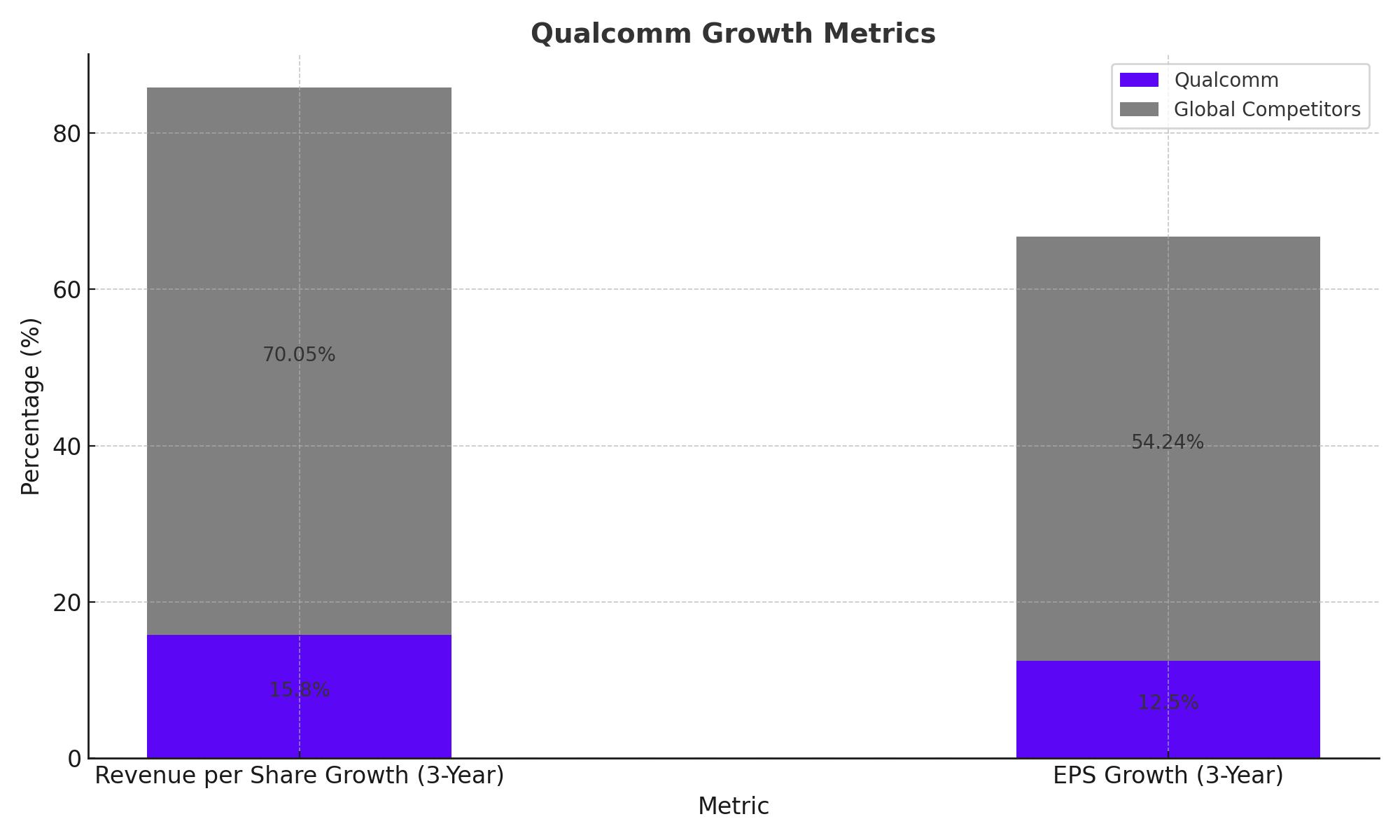

Growth Metrics: The Future Outlook

Qualcomm's robust growth rank of 9 out of 10 reflects its favorable growth trajectory compared to competitors. Its revenue per share and 3-year revenue growth rate of approximately 15.80% per year outperform about 70.05% of global competitors, indicating a strong revenue model. Additionally, Qualcomm's 3-year EPS growth rate of about 12.50% per year surpasses about 54.24% of global peers, essential for sustaining long-term dividends.

Qualcomm's AI Initiatives and Market Expansion

Qualcomm has been advancing in the artificial intelligence (AI) domain with power-efficient on-device AI, edge cloud AI, and 5G technologies. The Qualcomm AI Hub features a growing library of over 100 pre-optimized AI models covering various domains, including IoT, mobile, and compute solutions. This push towards ubiquitous AI is expected to drive future growth, with total sales forecasted to rise 6% in FY24 and another 9% in FY25 to $41.85 billion. Annual earnings are projected to leap 17% in FY24 and increase another 10% in FY25 to $10.88 per share.

Autos in Overdrive and PC Market Expansion

Qualcomm is benefiting from a stabilization in the smartphone market this year. Though sales are far from all-out growth, Qualcomm's high-end 5G connectivity chips fetch more dollars per unit than in the past. Additionally, Qualcomm's PC business is poised for growth with its Snapdragon X Elite laptop chips, set to launch this summer. The Snapdragon X for Microsoft Windows laptops represents a new potential growth market for Qualcomm, currently dominated by Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD).

Qualcomm’s Operating Margin and Profitability

Despite severe cyclical downturns, Qualcomm remains highly profitable. Elevated investment in the PC and automotive chip businesses has impacted profits, but as sales from these segments grow, profit margins are expected to improve. With higher average selling prices (ASPs) on smartphone chips and new growth outlets like Windows laptops and auto chips, Qualcomm is projected to experience low-teens growth in earnings per share (EPS) over the next few years.

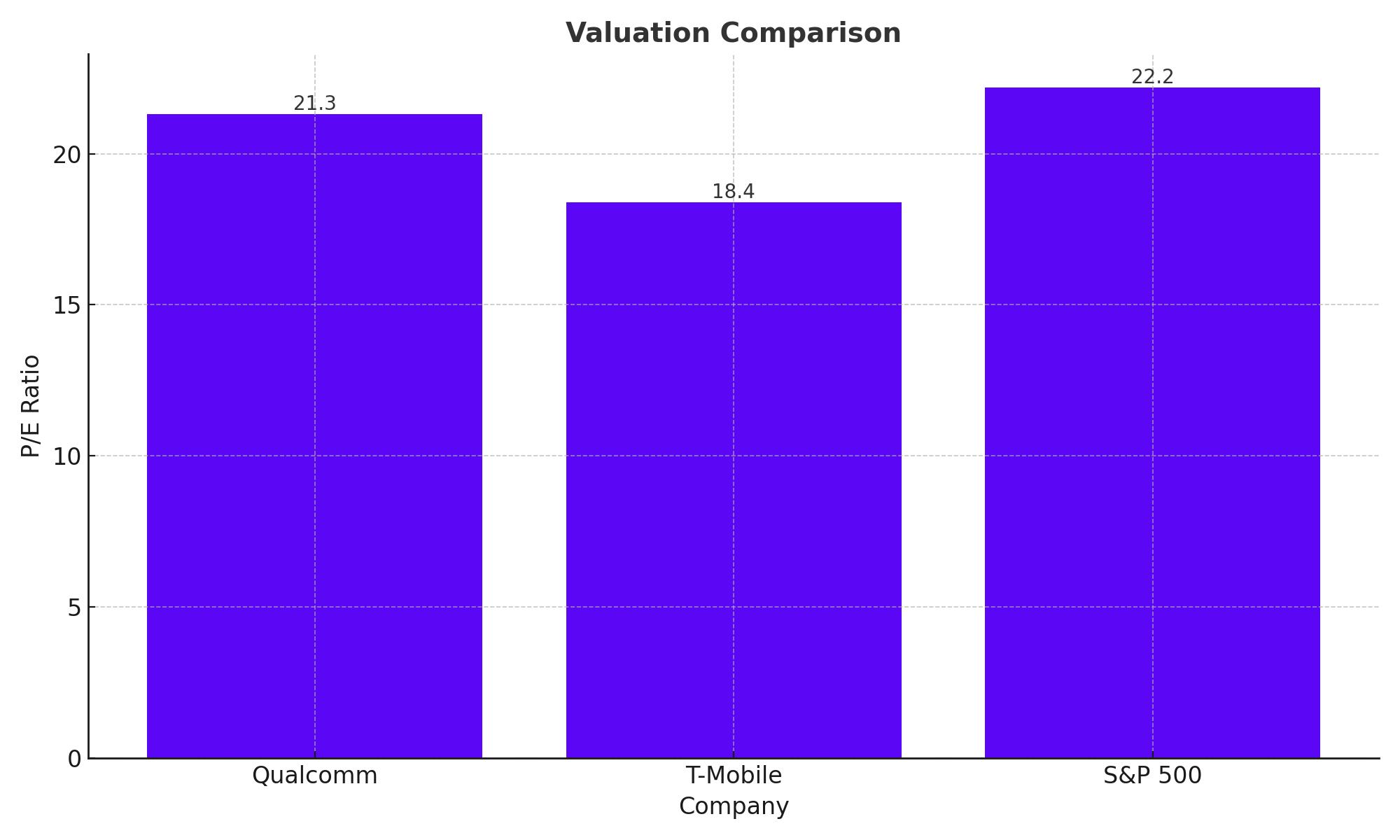

Valuation and Dividend Comparison

At current levels, T-Mobile’s stock trades at 18.4X forward earnings compared to Qualcomm's 21.3X, with their P/E valuations still beneath the S&P 500’s 22.2X. Both companies offer annual dividend yields of just over 1.5%, topping the S&P 500’s 1.27%.

Qualcomm’s Stock Performance and Technical Analysis

Qualcomm's share price has surged nearly 40% so far in 2024, driven by strong quarterly results and growth prospects. The company's adjusted per-share earnings for the second quarter were $2.44, surpassing analyst expectations of $2.32 per share, with adjusted revenues of $9.39 billion.

Technically, Qualcomm's stock has broken past long-term resistance levels, indicating strong bullish momentum. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) readings support the continued uptrend, suggesting limited downside risk and potential for further gains.

Conclusion

Overall, Qualcomm's share price performance this year has been impressive, with strong earnings growth and robust technical indicators supporting a bullish outlook. Investors should consider buying on dips to capitalize on Qualcomm's growth prospects and favorable valuation.

For real-time updates and detailed stock analysis, visit Qualcomm Inc Real-Time Chart.

For insider transaction details, check Qualcomm Insider Transactions.