Reddit’s Unstoppable Growth of 47%: From DAU Surge to Ad Revenue Domination

How NASDAQ:RDDT is Redefining User Engagement, Ad Monetization, and Data Licensing to Shape a Digital Revolution | That's TradingNEWS

NASDAQ:RDDT – A Growth Powerhouse in the Digital Advertising and User Engagement Space

Revenue Growth Driven by User Expansion and Ad Monetization

Reddit (NASDAQ:RDDT) has cemented itself as a unique platform for authentic user-driven content and community engagement, driving explosive growth in both revenue and daily active unique users (DAUqs). Revenue for 2025 is expected to reach $1.7 billion, reflecting a 52% year-over-year growth from the trailing twelve months (TTM) through Q3 2024. This acceleration is underpinned by a 47% YoY increase in DAUqs, which reached 97.2 million in Q3 2024, and an average time spent of 31 minutes per user per day, rivaling social media giants like Facebook and Snap. The international market represents a vast growth frontier, with non-U.S. users accounting for 50% of Reddit's base. Expansion into markets like India and France, aided by machine translation capabilities expected to roll out in 30 countries by 2025, bolsters the platform's trajectory.

Advertising Revenue Surges With Untapped Potential

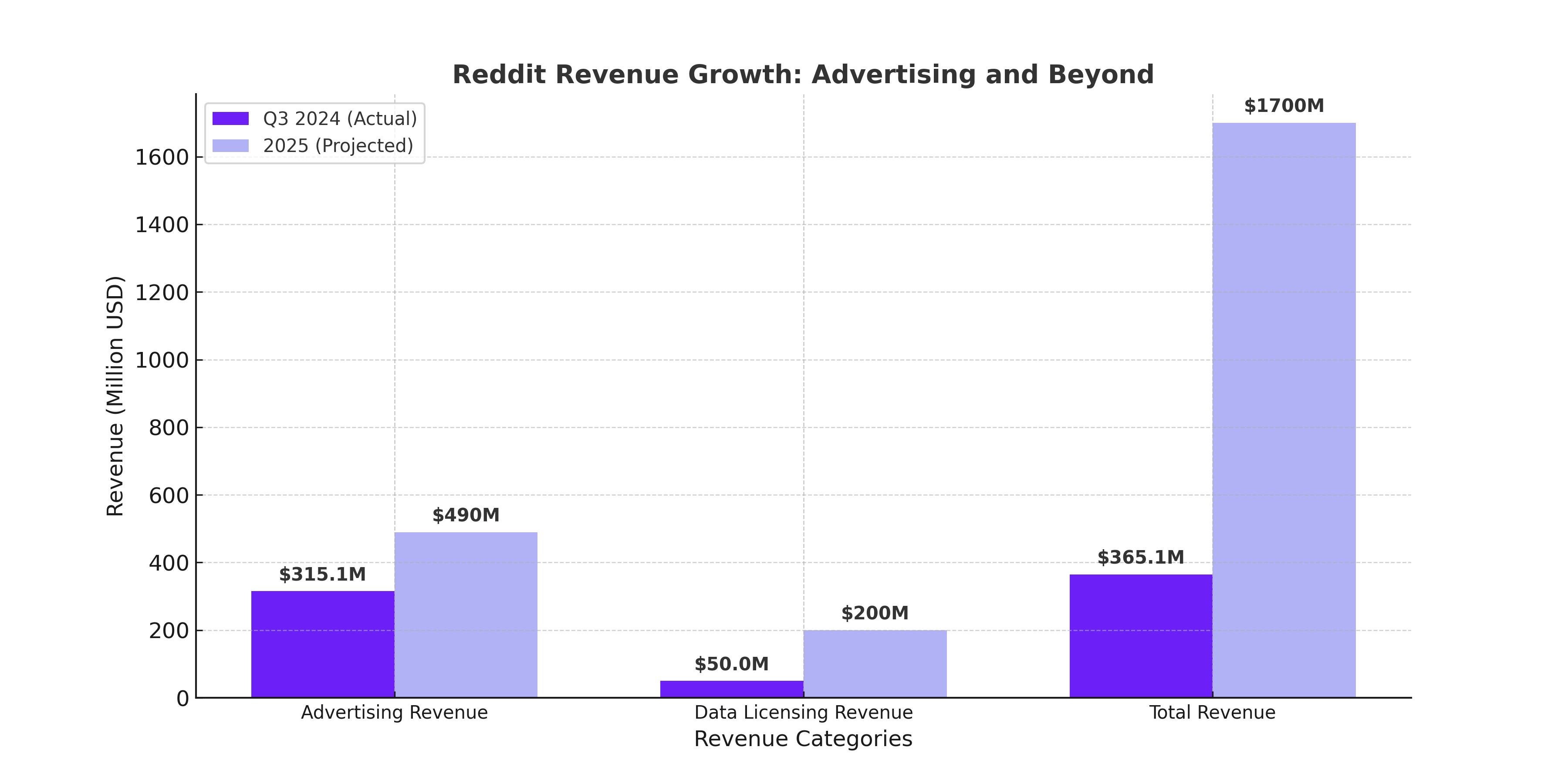

Reddit's advertising revenues, which make up over 90% of its total revenue, grew by 56% YoY in Q3 2024, reaching $315.1 million. Reddit’s ad load remains 30-50% lower than peers like Meta (NASDAQ:META), while its ad pricing is approximately 50% cheaper. These factors position Reddit as an underpriced and scalable advertising option. Adoption of AI-powered contextual targeting, dynamic product ads, and advanced tools like Conversion APIs (CAPI) further enhance ad efficiency, driving return on ad spend. With over one billion monthly search queries still largely unmonetized, Reddit's entry into search ads could unlock substantial new revenue streams akin to Google's dominance in search advertising.

Data Licensing as a High-Margin Growth Engine

Beyond advertising, Reddit is leveraging its rich repository of user-generated content to monetize through data licensing deals. The company has already secured $200 million in partnerships with firms like Google and OpenAI for AI training and analytics. With AI models relying heavily on high-quality data, Reddit's unique content repository makes it a vital partner in this space. Future licensing opportunities could add significantly to revenue while maintaining a high-margin profile, further diversifying Reddit's income streams.

Strong Financial Performance With Expanding Margins

Reddit's TTM gross margin reached 280 basis points, driven by hosting cost efficiencies despite a 31% YoY rise in hosting usage to support user growth. Adjusted EBITDA for Q3 2024 stood at $94.1 million with a 27% margin, up 3,000 basis points from the previous year. As operating leverage increases, Reddit is poised to achieve long-term EBITDA margins exceeding 50%, similar to Meta Platforms. Analysts project Reddit’s revenue to grow at a compound annual growth rate (CAGR) of 35% through 2027, reaching $2.7 billion in annual revenue.

Valuation and Growth Potential

At its current valuation of $165-$170 per share, Reddit's market capitalization of $24.6 billion suggests significant growth expectations. While its forward P/E and EV/EBITDA ratios are higher than peers, the platform’s unmatched engagement, advertising scalability, and high-margin data licensing opportunities justify a premium valuation. A potential target price of $205 reflects an 18% upside based on Reddit’s current performance and forward growth trajectory.

Risks to Monitor: SBC and Competitive Pressures

While Reddit’s growth story remains compelling, the company's high stock-based compensation (SBC), which accounted for 24% of total revenue in Q3 2024, raises concerns about shareholder dilution. Outstanding shares increased by nearly 10% over the past six months, emphasizing the need for cost containment as revenue growth matures. Additionally, intense competition from deep-pocketed players like Google and Meta in both advertising and AI presents challenges.

Conclusion: A Buy for Long-Term Growth Investors

Reddit’s combination of surging DAUqs, robust advertising growth, and expanding high-margin revenue streams positions it as one of the most exciting growth stories in the digital media landscape. Despite its valuation premium, the platform’s ability to capitalize on international expansion, AI integration, and unique monetization opportunities warrants a buy rating with a price target of $205. Investors seeking exposure to next-generation digital platforms with a diversified growth strategy should consider adding NASDAQ:RDDT to their portfolios.

That's TradingNEWS

Read More

-

SPY ETF Price: NYSEARCA:SPY Hovers Near $695 High As $16.1B Exits And Value Rotation Builds

15.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Hit $1.37B As XRP-USD Holds Above $2 And XRPI, XRPR Lock Up Supply

15.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Trades Around $3.10 as Record Supply Threaten The $3.00 Floor

15.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Pair Stalls Near 158 As 160 Wall Collides With Intervention Risk

15.01.2026 · TradingNEWS ArchiveForex