Ripple (XRP-USD) Faces Critical Test at $2.20 – Will Buyers Defend This Level or Collapse to $1.75?

With large investors exiting, resistance at $2.40 remains unbroken. Can XRP-USD find support and stage a comeback, or is a deeper correction to $1.75 inevitable? | That's TradingNEWS

XRP-USD Struggles as Selling Pressure Mounts – Can Bulls Defend $2.20?

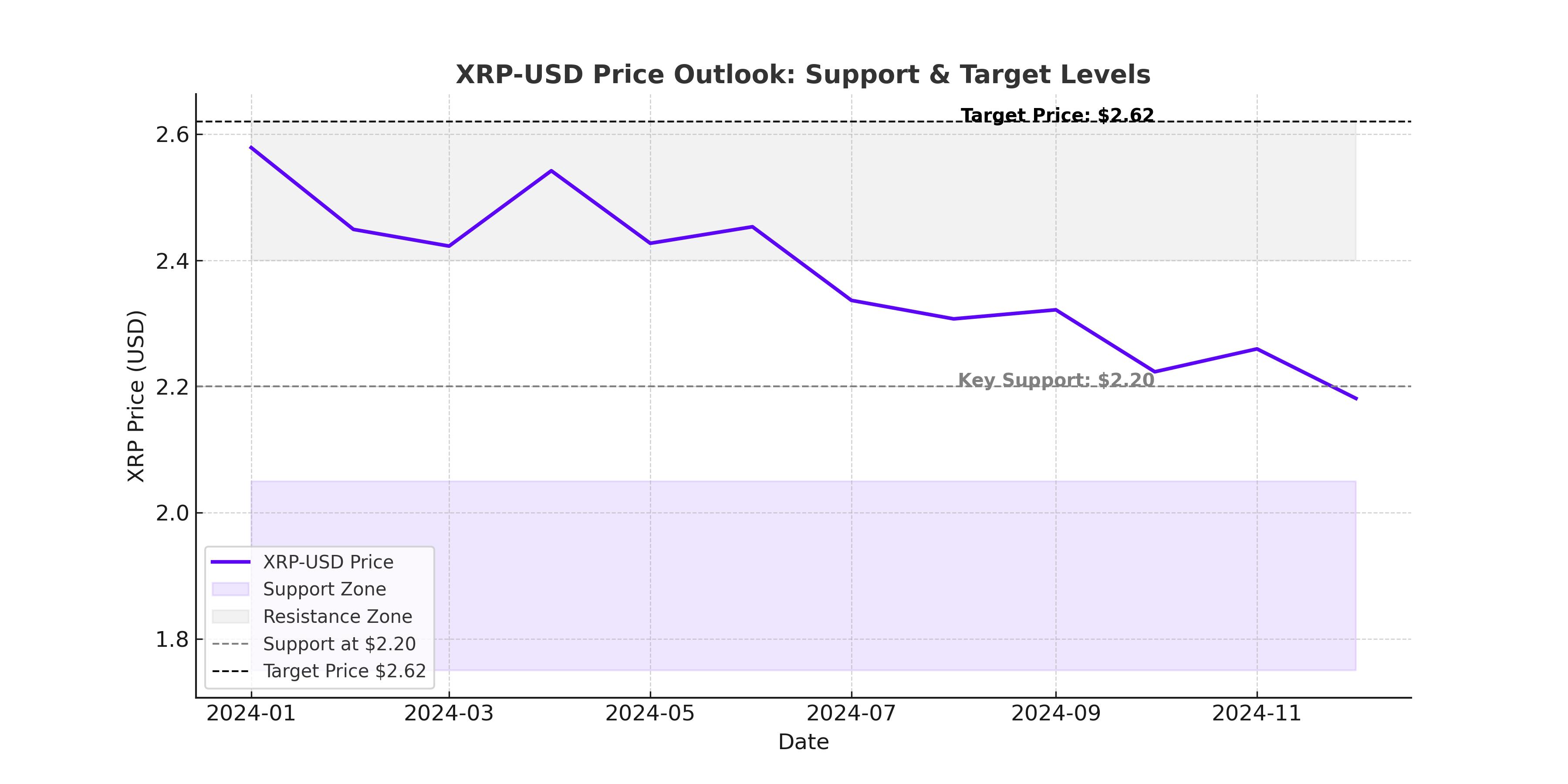

Ripple’s price action remains weak as XRP-USD continues to hover around $2.20, facing increasing pressure from both technical and fundamental factors. After failing to hold above $2.50 and losing momentum near $2.62 resistance, Ripple has been sliding lower, with traders now watching whether the $2.20 support zone will hold or if a breakdown toward $1.75 is coming.

Massive Whale Sell-Off Sparks Fears of Further Losses

A sharp increase in selling pressure has been triggered by large investors exiting their XRP positions. Over 370 million XRP tokens have been dumped in recent days, further weakening sentiment around the asset. Futures open interest has also seen a decline of 2%, indicating reduced speculative interest. These factors raise concerns that XRP may not be able to hold key support levels, putting $2.05 and even $1.75 in play.

Bearish Momentum Gains Strength – Is $1.75 Next?

XRP’s 4% daily decline has intensified fears that the correction is far from over. Traders are closely monitoring key support levels at $2.05, $1.95, and $1.75, as further breakdowns could lead to a deeper bearish cycle. The Relative Strength Index (RSI) has dipped toward oversold territory, signaling that the market remains under significant selling pressure.

Technical analysts point out that XRP’s chart structure has turned bearish after the failed attempt to reclaim $2.50. The moving average convergence divergence (MACD) is deep in negative territory, confirming that downward momentum is still in play. If XRP cannot reclaim the $2.33-$2.40 resistance range, further declines are likely.

XRP Bulls Need to Reclaim $2.40 for Any Meaningful Rebound

Despite the short-term bearish outlook, analysts suggest that XRP must break back above $2.40 to confirm a reversal. If it successfully reclaims this level, the next key targets lie at $2.50 and $2.62, where XRP previously failed to hold. A breakout above these levels could shift sentiment and trigger a potential rally toward $3.00.

For now, however, buyers have struggled to show significant strength, and any failure to push past $2.40 could lead to another wave of selling pressure. A close below $2.20 would likely confirm further losses, putting $2.05 and eventually $1.75 in sight.

XRP’s Legal Uncertainty With the SEC Still a Major Headwind

Beyond technical factors, Ripple’s ongoing legal battle with the SEC remains a key concern. While there have been signs that the case may be nearing an end, uncertainty continues to weigh on XRP’s price. Any negative developments could lead to increased volatility, while a positive resolution may serve as a major catalyst for a bullish breakout.

Market sentiment around Ripple remains cautious, with many traders hesitant to make aggressive bullish bets until regulatory clarity improves. Until then, XRP remains vulnerable to further downside pressure.

Will XRP Hold or Collapse to $1.75?

With strong selling pressure, whale exits, and legal uncertainty, XRP-USD faces a critical test at $2.20. If bulls cannot defend this level, the door opens for a further decline to $2.05, $1.95, and even $1.75.

On the other hand, a breakout above $2.40 could shift momentum, putting XRP back on track for a move toward $2.62 and eventually $3.00. The next few days will be crucial in determining whether Ripple can stabilize or if the selloff will intensify.