Salesforce (NYSE:CRM) Stock Analysis: AI-Driven Growth, Financial Strength, and Future Outlook

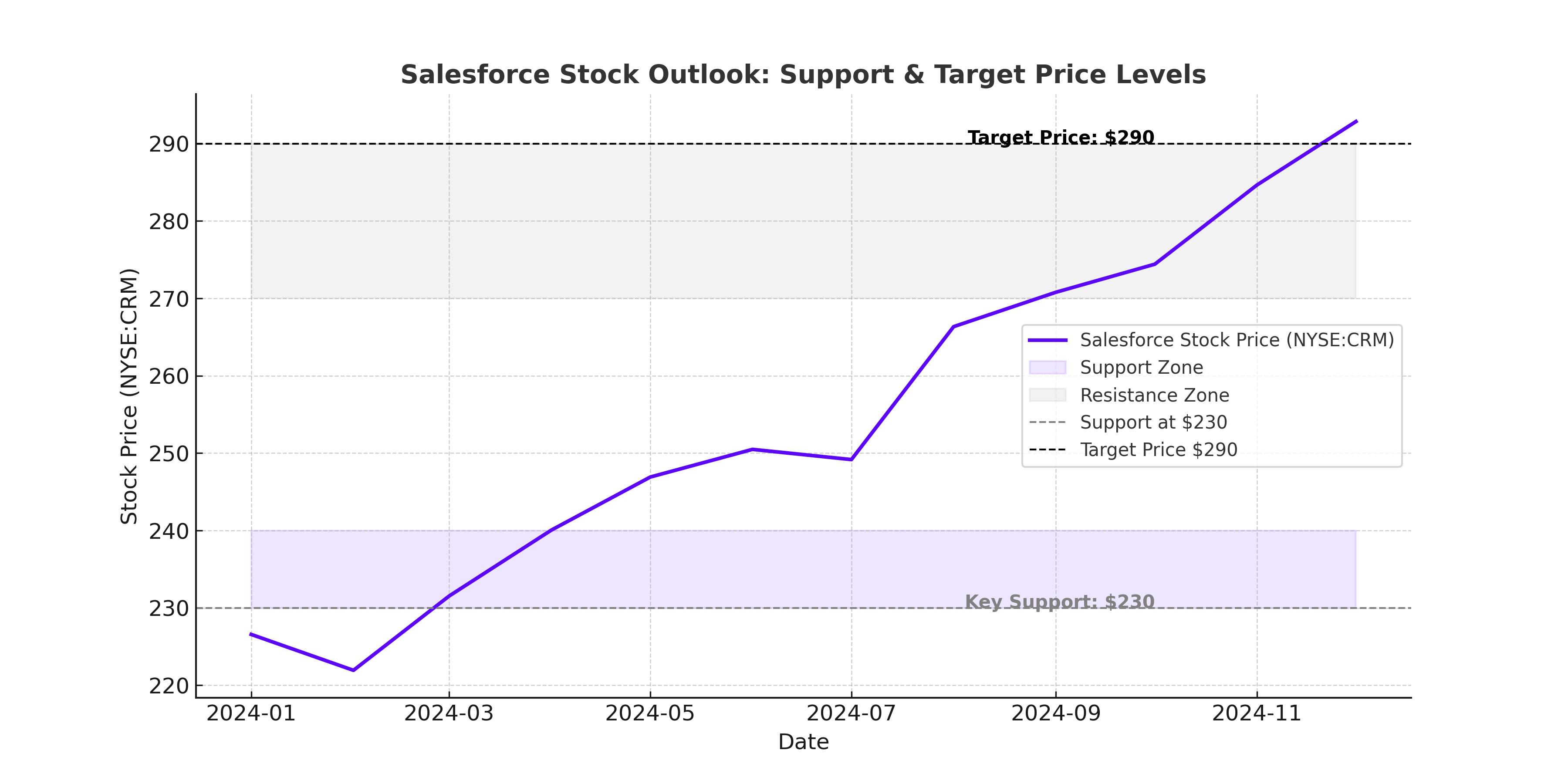

Is NYSE:CRM Positioned for a Major Breakout?

Salesforce (NYSE:CRM) continues to solidify its position as a market leader in enterprise software, with a growing focus on AI-powered solutions. The company’s Agentforce 2.0, set to launch soon, is expected to be a major growth driver, enhancing customer engagement and workflow automation. Despite a recent slowdown in cRPO growth, Salesforce remains a cash-flow powerhouse, generating $2.1 billion in free cash flow in Q3, marking a 10.5% year-over-year increase. The company has also maintained record-high EBIT margins, reinforcing its ability to sustain share buybacks and potential dividend growth.

The big question for investors is whether CRM's valuation accurately reflects its potential or if the stock is still undervalued despite its recent run. With Wall Street expecting a 25% upside and CRM maintaining strong fundamentals, does this make the stock a strong buy before earnings?

Salesforce’s Q4 Outlook: Can It Beat Expectations Again?

After delivering an 8.3% revenue increase in Q3, Salesforce is gearing up for its Q4 earnings release on February 26, 2025. Historically, the company has been a consistent earnings outperformer, but its recent EPS miss in Q3—the first in years—raised some concerns among analysts. Despite this, CRM stock rallied post-earnings, reflecting strong investor confidence in its long-term AI-driven strategy.

One key driver behind the market’s optimism is CRM's relentless focus on cost efficiency, which led to a record 20% GAAP EBIT margin and a non-GAAP margin of 33.1%. This operational strength allowed Salesforce to return $1.6 billion to shareholders in Q3 alone through buybacks and dividends. With a negative net debt position, the company is well-positioned to sustain this capital return policy for years.

At the same time, investors are closely watching cRPO (Current Remaining Performance Obligation) growth, which slowed to 10% in Q3 and is expected to decline further to 9% in Q4. This metric is crucial as it provides insight into future revenue streams. However, analysts believe that Salesforce’s aggressive AI investments—especially in Agentforce—could offset this slowdown in the long run.

Agentforce 2.0: Will AI Dominate Salesforce’s Next Growth Cycle?

Salesforce has bet big on AI-driven productivity tools, and Agentforce 2.0 is expected to be a game-changer for the company. The platform has already secured 200 clients within the first week of Q3, and management has indicated thousands more in the pipeline.

Agentforce essentially integrates AI-powered virtual assistants into Salesforce's ecosystem, automating repetitive tasks and boosting employee productivity. The AI agents market is projected to grow at an astonishing CAGR of 45.8%, reaching $51.8 billion by 2030. Some estimates even suggest the total addressable market (TAM) could be as high as $139 billion by 2033.

This shift positions Salesforce as a key player in AI-driven enterprise solutions, especially given its strong customer base and extensive cloud infrastructure. The company has also invested heavily in AI partnerships, including a $500 million investment in Saudi Arabia and a strategic AI Innovation Center with IBM in Riyadh.

If Agentforce gains mass adoption, it could unlock a significant revenue stream for Salesforce, driving both top-line growth and margin expansion. However, the monetization model remains unclear, and investors should monitor the initial revenue impact from Agentforce in upcoming quarters.

Valuation and Upside Potential: Is CRM Undervalued?

Despite its impressive fundamentals, Salesforce remains undervalued compared to historical levels. The stock is currently trading at a forward P/E of ~40, but analysts expect this multiple to shrink nearly 50% over the next few years as earnings growth accelerates.

Based on DCF (Discounted Cash Flow) models, Salesforce’s fair value is estimated at $402 per share, representing a 23-25% upside from current levels. Wall Street analysts maintain a target price of $396, further supporting the view that CRM is trading at a discount to its intrinsic value.

Another key factor driving CRM’s valuation expansion is its aggressive share buyback program. Salesforce has consistently reduced its share count, which boosts EPS and improves shareholder returns. If the company continues this capital return strategy, the stock’s P/E multiple could remain elevated despite market concerns over cRPO growth.

Risks to Watch: What Could Go Wrong for CRM?

While Salesforce’s AI push is promising, the revenue impact from Agentforce remains uncertain. The initial client adoption is strong, but monetization at scale could take longer than expected, leading to near-term revenue headwinds.

Another concern is the deceleration in cRPO growth, which suggests slowing deal activity and longer sales cycles. If this trend continues, it could pressure Salesforce’s revenue expansion, forcing the company to rely more on margin improvements rather than top-line growth.

Macroeconomic risks also play a role, particularly interest rate uncertainty. The market has been pricing in rate cuts, but if inflation remains sticky, the Federal Reserve could keep rates higher for longer. This scenario could negatively impact high-growth tech stocks like Salesforce, reducing investor appetite for premium valuations.

Additionally, CRM is undergoing workforce restructuring, with 1,000 job cuts planned to redirect hiring efforts toward AI-focused roles. While this move is aimed at long-term efficiency, it could create short-term execution risks, especially as the company scales up new AI-driven initiatives.

Final Verdict: Is Salesforce Stock a Buy Before Earnings?

Despite near-term concerns over slowing cRPO growth and potential AI revenue delays, Salesforce remains one of the best-positioned enterprise software companies for the AI revolution. The upcoming Agentforce 2.0 launch could serve as a major catalyst, driving new revenue opportunities and long-term margin expansion.

With a record-high EBIT margin of 20%, a $2.1 billion free cash flow generation, and an aggressive capital return program, CRM is financially strong and well-prepared to capitalize on AI-driven growth.

Valuation remains attractive, with a potential 25% upside to its fair value of $402 per share. While risks exist, especially related to AI adoption speed and macroeconomic conditions, Salesforce’s long-term growth trajectory remains compelling.

For investors looking to gain exposure to AI-powered enterprise software, NYSE:CRM remains a strong buy ahead of earnings. If the company exceeds expectations, shares could break out toward $400+, making this an attractive entry point.