Schlumberger NYSE:SLB Innovation and Growth in the Global Energy

An Analytical Deep-Dive into Schlumberger's Market Positioning, Financial Strength, and Strategic Adaptation in a Shifting Energy Paradigm | That's TradingNEWS

Analysis of Schlumberger Limited (NYSE:SLB): Navigating the Evolving Energy Landscape

Corporate Profile & Market Positioning

Schlumberger Limited (NYSE:SLB), a global leader in oilfield services, is navigating the dynamic energy sector with strategic agility. The company, based in Houston, Texas, was founded in 1926 and has a rich history in technology innovation for the energy industry. As of December 2023, Schlumberger boasts a robust market capitalization of $74.68 billion, signifying its substantial impact and presence in the sector.

Financial Health and Stock Valuation

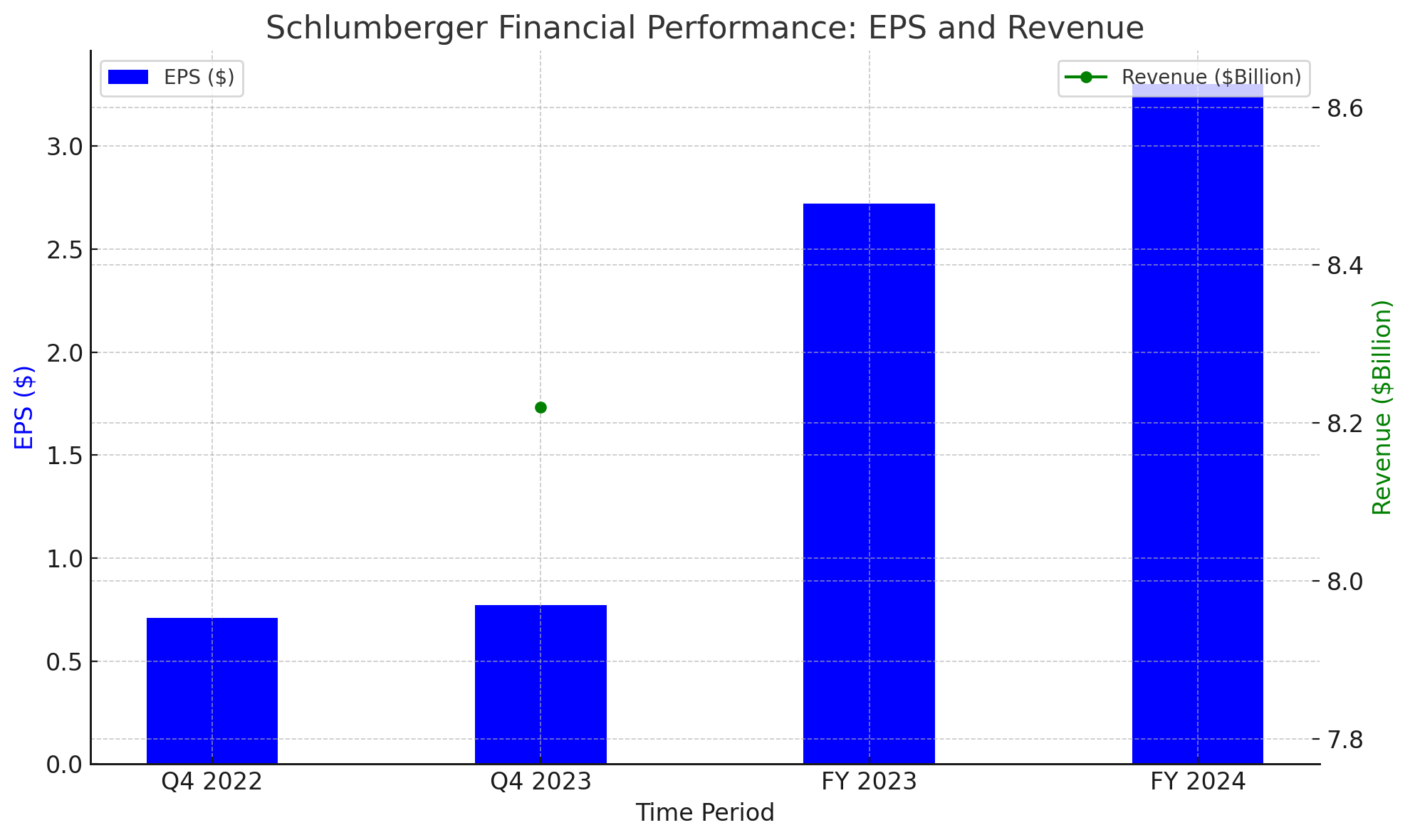

Schlumberger's financial health is a tapestry of resilience and strategic adaptation. The company's revenue and earnings trajectory reveal a consistent pattern of growth, particularly in the post-pandemic recovery phase. The forecast for Q4 2023 indicates an EPS of $0.77, reflecting an 8.50% increase compared to the previous year. The anticipated revenue of $8.22 billion for the same quarter marks a 4.40% year-over-year growth.

Looking at the broader fiscal landscape, Schlumberger is expected to reach an EPS of $2.72 in 2023, climbing to $3.3 in 2024, signaling a robust year-on-year growth. These figures underline the company’s effective strategy and execution in a challenging market environment.

Growth Prospects: Adapting to a Shifting Energy Paradigm

Schlumberger's growth trajectory is intrinsically linked to global energy trends. The company's focus on technology and innovation in oilfield services is pivotal in navigating the challenges and opportunities within the energy sector, particularly in the context of the global shift towards sustainable energy sources.

Dividend Payout and Shareholder Returns

The company’s commitment to shareholder value is evident in its dividend strategy. With a forward annual dividend yield of 1.91%, Schlumberger maintains a balance between rewarding its shareholders and reinvesting in business growth.

Institutional Confidence and Insider Activities

Institutional investments in Schlumberger underscore market confidence in its strategy and future prospects. The purchase of 217,292 shares by Comerica Bank in Q2 is a testament to this confidence. However, insider activities, including sales by key executives, present a nuanced picture of the company's internal confidence levels.

Analyst Perspectives and Market Sentiment

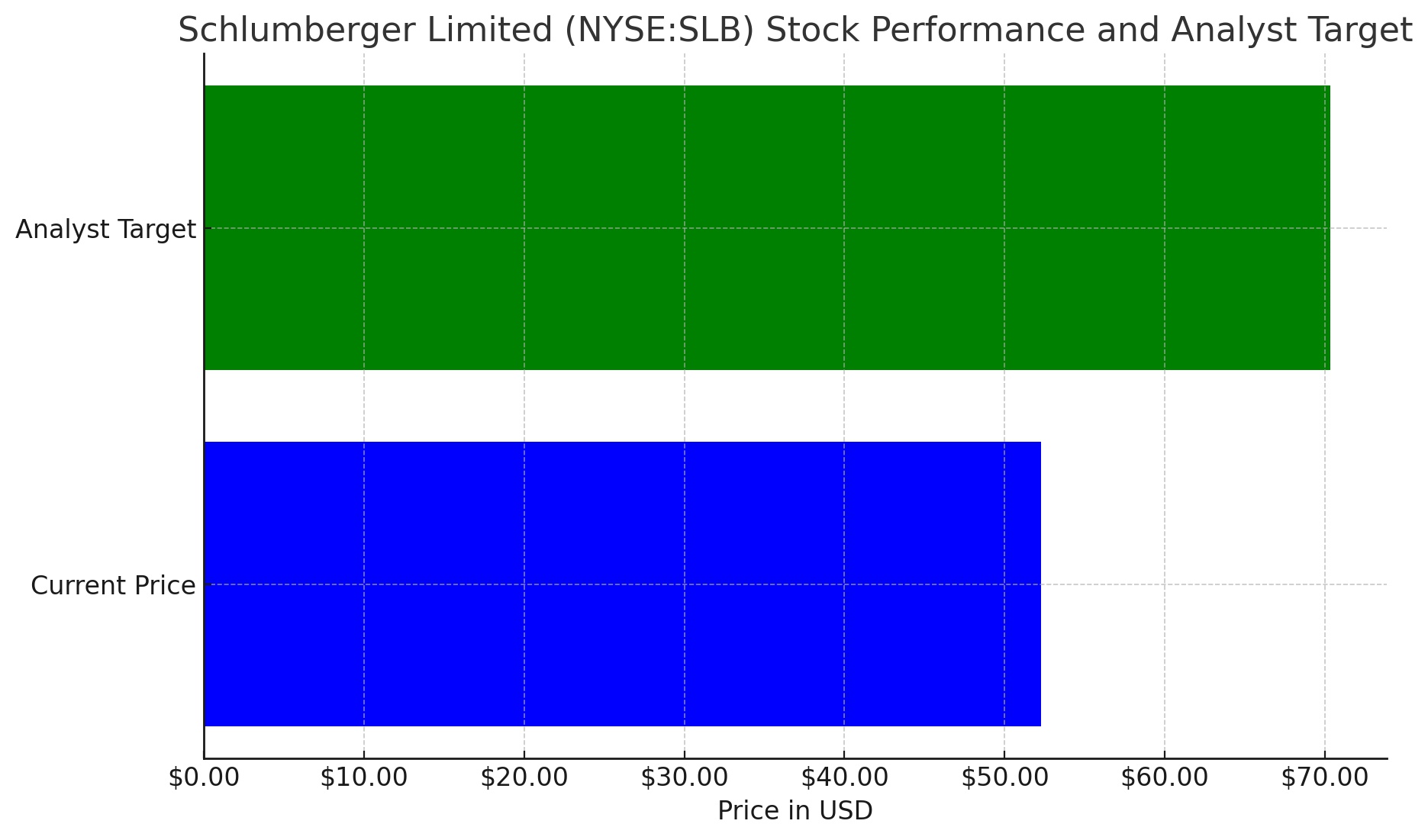

Analyst ratings for Schlumberger are predominantly positive, with a consensus price target of $70.36, suggesting a significant upside potential. The stock’s performance, with a modest decline for the year, reflects the market’s cautious optimism and the broader volatility in the energy sector.

Financial Acumen and Market Adaptability of Schlumberger (NYSE:SLB)

Strategic Cost Management and Profitability

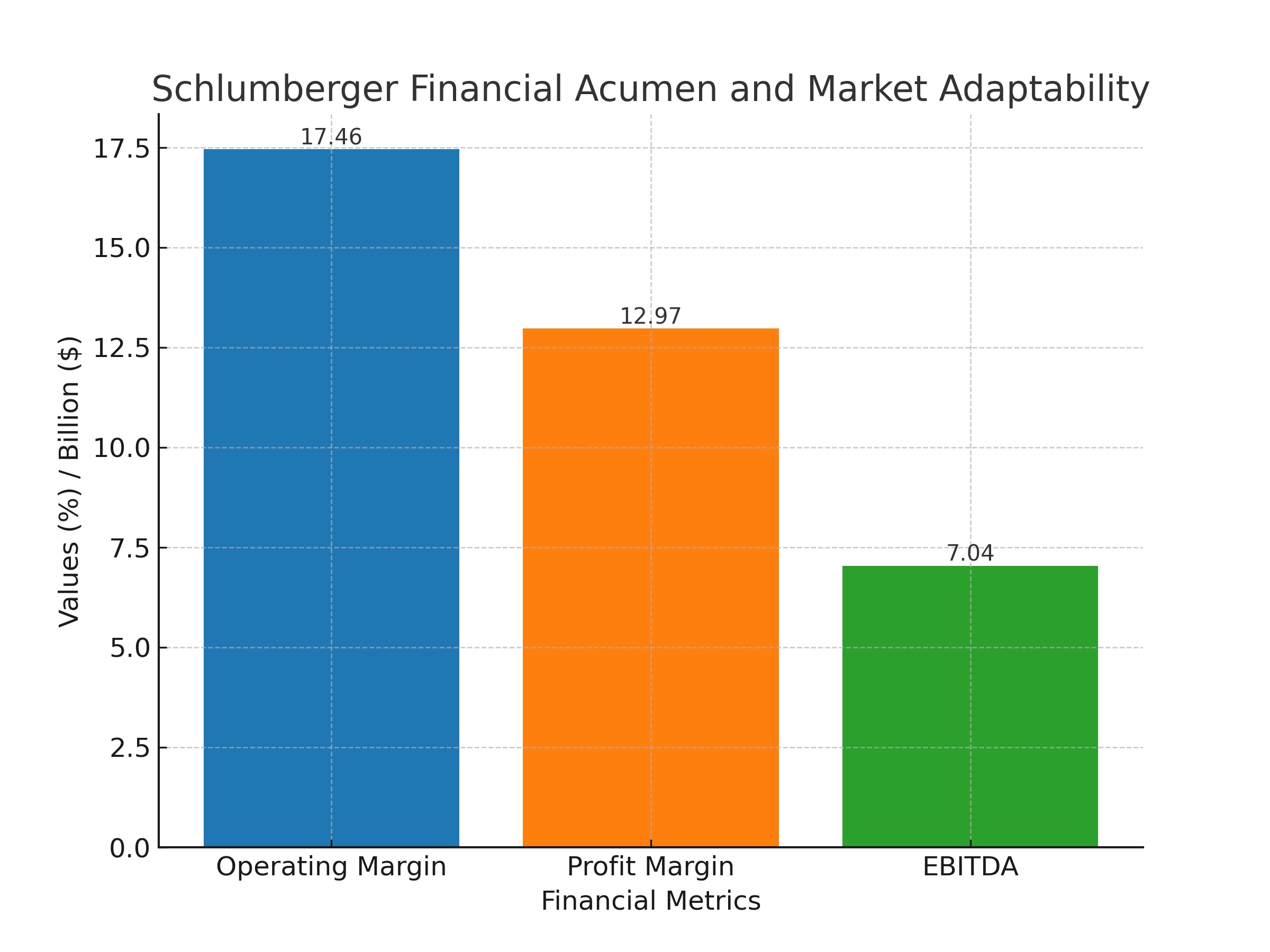

Schlumberger's prowess in maintaining profitability is a function of its adept cost management strategies. Despite the volatile nature of energy prices, Schlumberger reported an operating margin of 17.46% and a profit margin of 12.97% as per the most recent quarterly data. These margins are a testament to the company's capacity to effectively manage expenses and extract value even in challenging market conditions. Its EBITDA stands at a robust $7.04 billion, illustrating a well-oiled operational model.

Future-Focused Diversification: Tapping into Renewable Energy

In its long-term strategy, Schlumberger is not just cementing its legacy in traditional energy but also branching into renewable energy solutions. This shift is not only a strategic diversification but also aligns with the company’s sustainability goals. The global push towards carbon-neutral energy sources is creating new market opportunities, and Schlumberger's engagement in climate technologies and decarbonization efforts positions it to capture this emerging demand. This pivot is expected to contribute significantly to revenue streams in the coming years, marking a transformative era in the company’s history.

Revenue Projections and Market Expectations

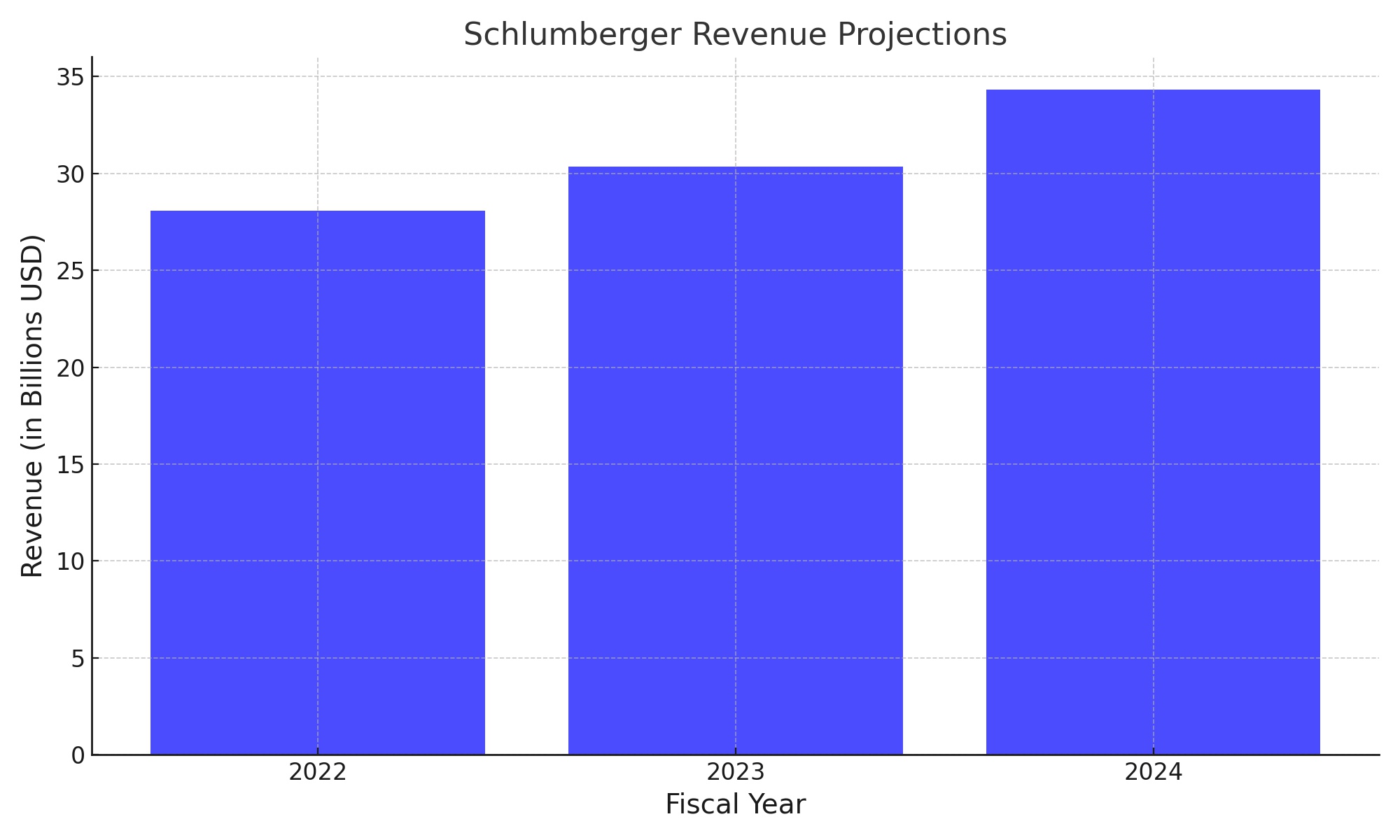

Schlumberger's forward-looking strategy is reflected in its revenue projections. For the fiscal year 2023, the company is expected to generate $30.35 billion, a notable increase from the previous year's $28.09 billion. This upward trend is projected to continue into 2024, with expected revenues of $34.32 billion. These figures underscore the market’s confidence in Schlumberger’s growth trajectory and its ability to adapt to evolving energy landscapes.

Shareholder Value and Dividend Policy

The company’s commitment to shareholder value is evident in its dividend policy. With a forward annual dividend rate of $1.00, yielding 1.91%, Schlumberger demonstrates a balance between rewarding shareholders and investing in future growth. Its dividend payout ratio stands at a prudent 34.60%, ensuring that dividends are sustainable and reflective of the company’s financial health.

Insider Trading and Institutional Ownership

Schlumberger’s stock activities by insiders and institutional investors offer insights into the company’s internal and external confidence levels. Insider sales, including those by key executives, suggest a complex narrative about their confidence in the company's future trajectory. Meanwhile, the high level of institutional ownership, at 84.44%, indicates strong market confidence in Schlumberger’s strategy and future prospects.

Stock Performance and Analyst Ratings

The company's stock performance, with a modest decline over the year, reflects the broader volatility in the energy sector. However, analyst ratings for Schlumberger are predominantly positive. The consensus price target of $70.36 suggests a significant upside potential, underlining the optimism around the company’s strategic initiatives and market positioning.

Environmental, Social, and Governance (ESG) Initiatives

Schlumberger's ESG initiatives are integral to its corporate ethos. The company’s focus on sustainable practices, including efforts in carbon offset and climate technologies, not only addresses global environmental challenges but also opens new business avenues. These initiatives are likely to enhance the company's reputation and appeal to a broader base of environmentally conscious investors.