Shifts in Global Oil Markets: China's Slowdown and US Legislative Changes

Analyzing the Impact of Geopolitical Tensions and Economic Trends on Oil Demand and Market Stability | That's TradingNEWS

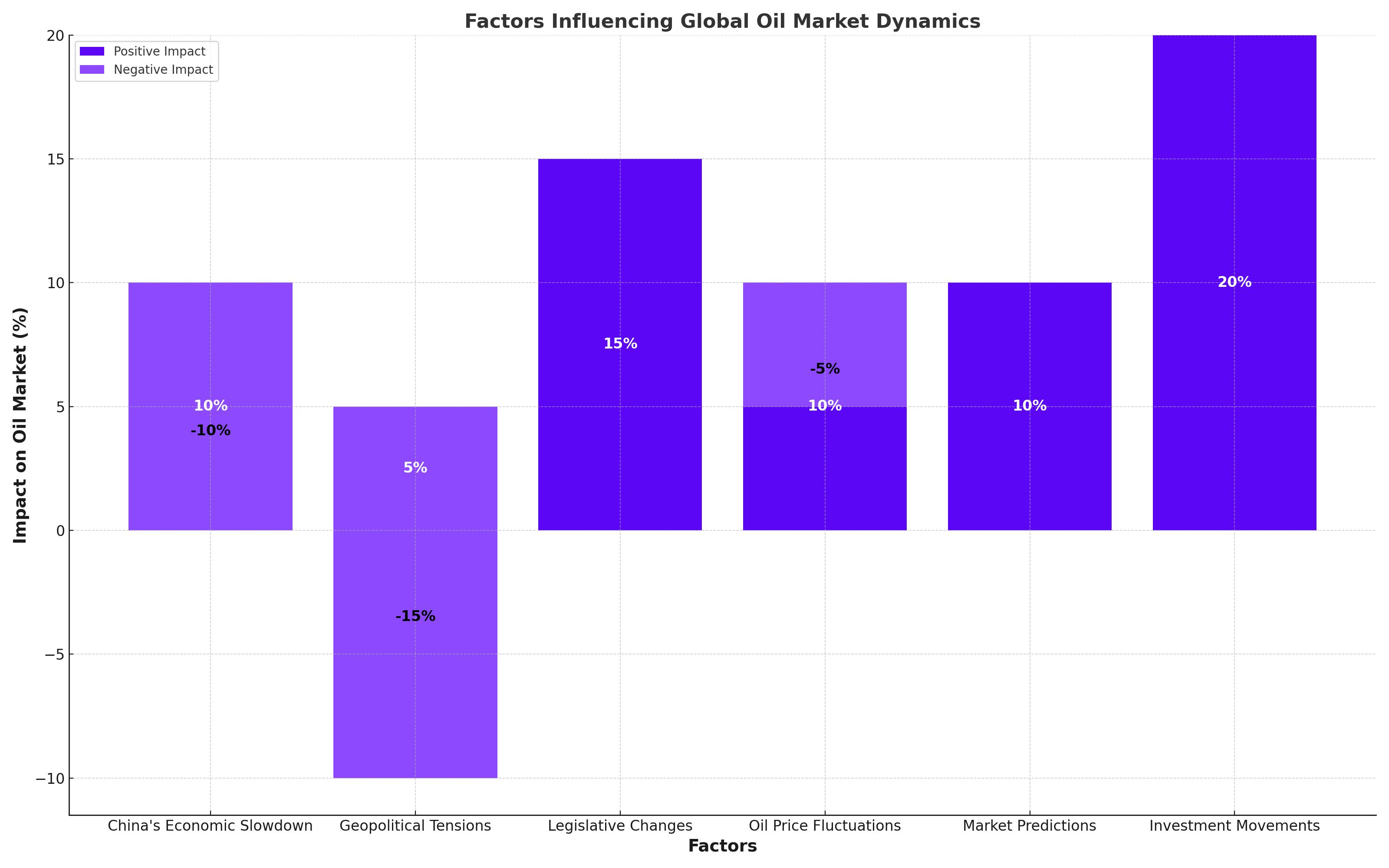

Global Oil Market Dynamics: A Comprehensive Analysis

China's Economic Slowdown and Its Impact on Oil Demand

China, historically a major driver of the commodities supercycle, has seen its economic growth rate falter due to the prolonged effects of COVID-19 and stringent zero-COVID policies. In 2023, China achieved a 5.3% growth rate, barely meeting its official target. However, the Q2 2024 growth rate slowed to 4.7%, missing the expected 5.1% increase. This slowdown raises concerns about China's future oil demand, as it remains the world's largest crude oil importer.

Industrial sectors in China showed a mixed performance with a 5.3% year-over-year increase in June, slightly down from May. Although industrial activity has been robust, the inconsistency in growth between industrial outputs and service sectors suggests potential volatility in oil demand. Additionally, geopolitical tensions and trade policies, particularly with the U.S., continue to impact economic stability and could influence China's oil consumption patterns.

Geopolitical Tensions and Sanctions

The imposition of U.S. sanctions on numerous Chinese and Hong Kong entities on May 1, 2024, marks a significant escalation in the geopolitical landscape, directly affecting international trade dynamics. These sanctions, a response to the entities' support of Russia's military actions in Ukraine, have heightened tensions between major global economies. Specifically, these measures target over a dozen companies, disrupting their operations and complicating China's foreign trade routes. This development threatens to further decelerate China's economic growth, which has already seen a slowdown to 4.7% in Q2 2024, below the anticipated 5.1%. Given China's status as the world's largest crude oil importer, any impact on its economic stability is likely to ripple through global oil markets, potentially suppressing demand and influencing global supply chains.

Legislative Changes in Energy Policy

United States’ energy sector, bipartisan legislation has been introduced to streamline the approval processes for LNG export facilities and other critical energy infrastructure projects. This legislative initiative, though facing an uncertain future in its current format, underscores a determined effort to reduce bureaucratic red tape and accelerate energy project timelines. The proposed bill mandates the Department of Energy to expedite approvals within 90 days, aiming to bolster the nation’s energy export capabilities significantly. Enhancing these facilities is seen as crucial to maintaining the competitiveness of the U.S. in global energy markets, potentially increasing the country's leverage as an energy exporter amidst fluctuating global energy demands.

Oil Price Fluctuations and Market Predictions

The oil market has experienced slight declines in key benchmarks. Brent crude settled at $82.38 per barrel, and WTI crude was priced at $78.32 per barrel. These adjustments reflect the market's response to various factors, including the U.S.'s potential legislative changes, geopolitical tensions, and China's economic performance.

Market analysts remain cautiously optimistic about the stabilization of oil prices, contingent on the resolution of geopolitical tensions and economic recovery in China. Additionally, any significant changes in U.S. energy policy could either stabilize or disrupt global oil supply chains.

Investment and Strategic Movements in the Energy Sector

Occidental Petroleum's strategic acquisition of CrownRock enhances its capabilities in the Permian Basin, promising significant increases in oil production. This move, coupled with increased capital investment in energy infrastructure, underscores a robust commitment to expanding U.S. oil production capabilities amidst fluctuating global oil prices.

Conclusion: Strategic Insights and Market Forecasts

The oil market continues to navigate through a complex landscape influenced by geopolitical developments, economic fluctuations, and strategic industry movements. Investors and market watchers should monitor these factors closely, as they are likely to have significant implications for both short-term price settings and long-term market dynamics. The bullish outlook on oil suggests a cautious optimism, contingent on sustained industrial growth in major economies like China and stability in global geopolitical relations.