Should You Buy Netflix Stock Now? Key Insights Behind the $1,107 Price Target

With Netflix (NASDAQ:NFLX) trading at $919, analysts predict a 20% upside by 2025 | That's TradingNEWS

Netflix’s Recent Performance and Growth Drivers

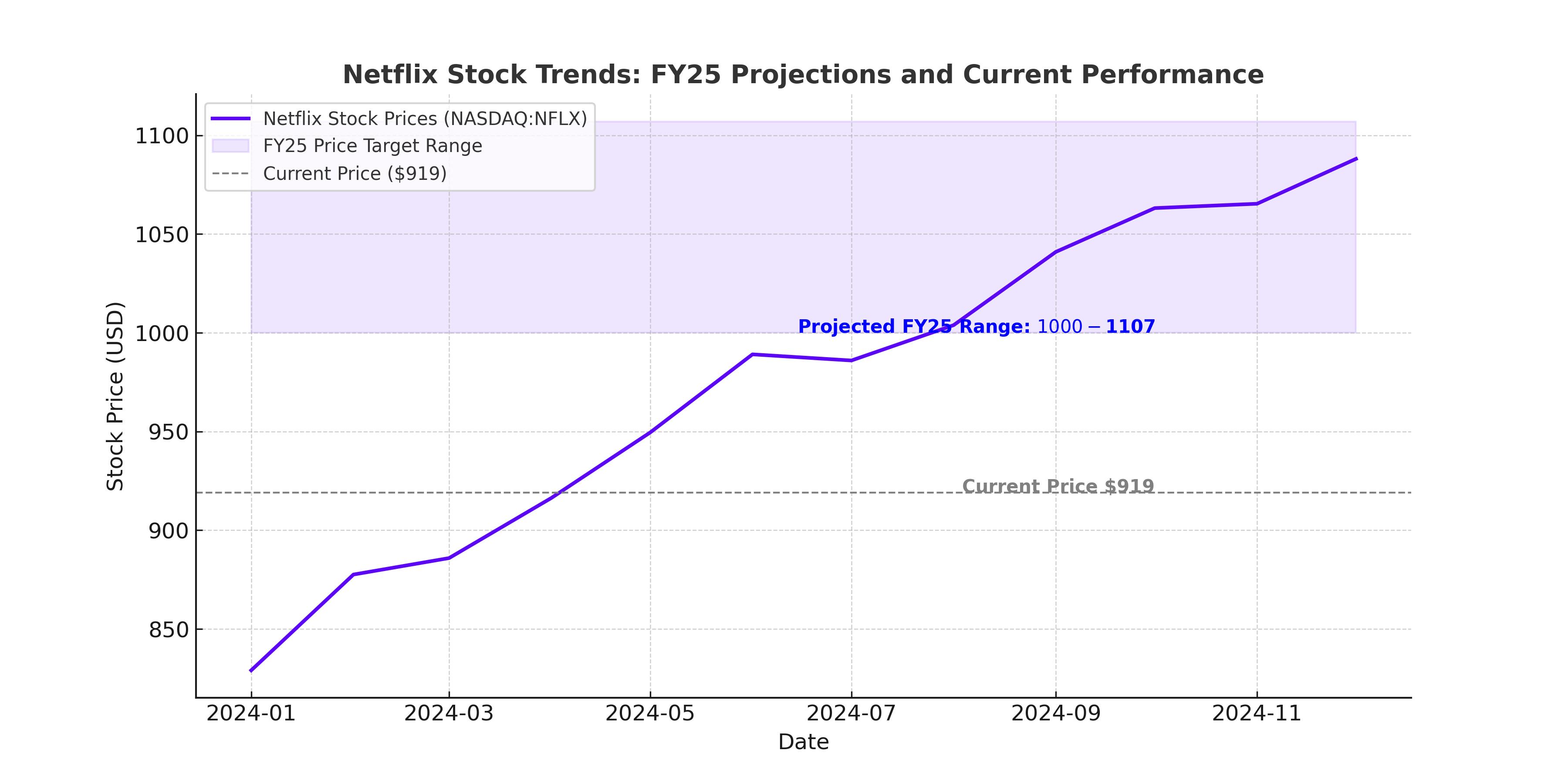

Netflix (NASDAQ:NFLX) has recently demonstrated impressive growth, with its stock trading at $919, reflecting a year-to-date increase of over 30%. This surge follows a string of successful initiatives, including its pivot to ad-supported subscriptions and significant investments in live sports content. Netflix's Q3 FY24 earnings report showcased a revenue increase of 15% YoY, totaling $9.825 billion, while operating income jumped 51% YoY to $2.9 billion. The operating margin also improved to 27%, underscoring the company's efficiency in managing costs while expanding its offerings.

This growth has been driven by strategic pricing adjustments, increased engagement through a diverse content slate, and the rapid adoption of ad-supported tiers. Netflix reported that ad-tier memberships grew 35% QoQ and now account for over 50% of sign-ups in ad-enabled regions, marking a critical milestone in its strategy to boost Average Revenue per Membership (ARM).

KeyBanc’s $1,000 Price Target: A Sign of Confidence

KeyBanc Capital Markets recently raised its price target for Netflix to $1,000 from $785, citing its historical outperformance and potential for revenue and free cash flow growth. Analysts emphasized Netflix’s unique ability to leverage its vast subscriber base and engagement metrics to attract advertisers, especially as live events and high-profile originals continue to bolster viewership. Netflix’s shares are currently trading at a forward EV/S multiple of 9x, a level typically associated with peak valuation. However, analysts argue that the company’s strategic shifts, including its ad model and live content, justify a premium valuation.

Expanding Content Slate: From Originals to Live Sports

Netflix’s success has long been tied to its ability to produce and license high-quality content. In 2024, the company expanded its slate to include live sports and events, such as the Jake Paul vs. Mike Tyson fight, which drew over 108 million viewers globally. Despite technical glitches during the event, it became the most streamed sporting event in history, demonstrating the immense demand for live content on the platform.

Additionally, Netflix secured rights to broadcast two NFL Christmas Day games and WWE’s flagship series Monday Night RAW starting in January 2025. These deals position Netflix alongside competitors like Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Hulu in the live sports market. The move also aligns with the company’s broader strategy to diversify its content portfolio and attract a wider audience base, particularly in regions like EMEA and APAC, which have shown robust membership growth of 14.7% and 23.9% YoY, respectively.

Challenges in Live Streaming and Technical Performance

While Netflix's entry into live content marks a significant milestone, it has faced criticism for technical issues during high-profile events. The glitches during the Jake Paul/Mike Tyson fight highlighted challenges in adapting its infrastructure for live streaming. However, the company has a strong track record of overcoming operational hurdles, and investors remain confident in its ability to refine its technology to meet the demands of live broadcasts.

Advertising Potential and ARM Growth

Netflix’s ad-supported tier has emerged as a key driver of growth, offering a lower-cost entry point for users while generating additional revenue streams. The company’s partnership with major programmatic platforms like The Trade Desk (NASDAQ:TTD) and Google’s (NASDAQ:GOOGL) DV360 has enhanced its advertising capabilities. Although ad revenue is not expected to significantly impact total revenue in FY25, the foundation for long-term growth is being established.

The ad tier's rapid adoption has also helped mitigate potential churn from pricing adjustments, particularly in the US and EMEA. For instance, recent price hikes in select countries and the removal of the Basic plan in key markets have been offset by strong sign-ups for the ad tier, highlighting the effectiveness of Netflix’s dual monetization strategy.

Financial Outlook and Valuation

Netflix has revised its FY24 revenue guidance upward, projecting a 15% YoY growth rate. Operating margins are expected to rise to 28% in FY25, driven by ARM expansion and efficiency gains in content production and distribution. Analysts’ valuation models suggest a bull case price target of $1,197, assuming accelerated growth in ad revenue and improved profitability. A base case scenario estimates a price target of $1,017, reflecting conservative growth projections.

Taking a blended approach, Netflix’s adjusted price target stands at $1,107, representing a 20% upside from current levels. This valuation reflects the company’s ability to maintain double-digit revenue growth while navigating challenges in its transition to live content and advertising.

Strategic Risks and Opportunities

Netflix (NASDAQ:NFLX) operates in a fiercely competitive landscape, where challenges loom despite its dominant position. One of the most pressing concerns is the escalating competition in the live sports segment, an area where giants like Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Disney’s (NYSE:DIS) ESPN+ are vying for dominance. While Netflix’s deals with the NFL and WWE signal its intent to carve out a significant share of this lucrative market, these ventures come with inherent risks. For instance, the Jake Paul/Mike Tyson fight, which suffered from technical issues, underscores the challenges of transitioning from on-demand content to real-time streaming. Such setbacks can strain the brand’s reputation and test consumer patience, especially as Netflix scales its live sports ambitions with high-profile events like its upcoming NFL Christmas Day games.

Additionally, Netflix faces potential regulatory scrutiny over its pricing strategies. Recent moves to phase out the Basic plan in markets like the US, France, and Brazil, combined with price hikes in select regions, may invite closer examination from regulators concerned about market fairness and consumer protections. While these pricing adjustments aim to optimize revenue, they also risk alienating cost-sensitive subscribers, potentially leading to higher churn rates in key geographies like EMEA and LATAM.

Moreover, the increasing reliance on its ad-supported tiers introduces both opportunities and vulnerabilities. Although these tiers are driving significant new sign-ups and diversifying revenue streams, they depend heavily on advertisers’ confidence in Netflix’s ability to deliver consistent viewership and engagement. Any downturn in global ad spending or missteps in scaling its programmatic advertising partnerships with platforms like The Trade Desk (NASDAQ:TTD) could hinder growth in this segment.

Yet, Netflix's strategic investments in technology, content, and geographic expansion offer a strong counterbalance to these risks. Its proactive approach to diversifying content offerings, including live events and gaming, alongside continuous refinement of its pricing models, ensures that the company remains well-positioned to adapt to shifting consumer preferences and competitive pressures. The company’s track record of innovation, coupled with its ability to leverage data-driven insights to enhance user engagement, underscores its potential to navigate these challenges successfully.

Decision: Buy, Hold, or Sell?

Netflix (NASDAQ:NFLX) presents a compelling investment case backed by a blend of robust financial performance, strategic foresight, and market leadership. With a current stock price of $919 and a price target of $1,107, representing an upside potential of over 20%, the stock is unequivocally a Buy. This valuation reflects Netflix’s ability to sustain double-digit revenue growth and expanding operating margins, projected to reach 28% by FY25.

The company’s dual monetization strategy—leveraging both ad-supported and premium subscription tiers—positions it to capture a broader market share while mitigating churn risks. Simultaneously, its investments in high-quality, diverse content and live sports signal its commitment to capturing long-term consumer loyalty.

While risks such as regulatory scrutiny, competitive pressures in live sports, and ad-market fluctuations remain, Netflix’s proven resilience and strategic adaptability underscore its ability to deliver sustained value to investors. For those seeking exposure to a company poised to capitalize on the evolving dynamics of the global streaming market, Netflix remains a definitive choice.

Stay updated with real-time performance at Netflix Stock Chart.

That's TradingNEWS

Interactive Brokers (NASDAQ:IBKR) at $159: Time to Buy, Hold, or Wait?