Seize the Moment: Alphabet Inc. (GOOGL) Stock Poised for Significant Growth

With a current price of $168.80, Alphabet Inc. (GOOGL) offers investors a unique chance to capitalize on its undervaluation and future potential | That's TradingNEWS

Alphabet Inc. (NASDAQ: GOOGL): Unpacking Growth, Challenges, and Regulatory Crossroads

Alphabet Inc. (NASDAQ: GOOGL) has long been a cornerstone of the global technology sector, with its innovative ecosystem spanning search engines, cloud computing, digital advertising, artificial intelligence, and more. Despite its dominance, the company now finds itself at a crucial juncture, balancing robust financial performance with intensifying regulatory scrutiny and evolving market dynamics. Alphabet’s third-quarter 2024 results, which included revenue of $88.27 billion and earnings per share of $2.12, surpassed Wall Street expectations and reaffirmed the company's operational strength. However, external pressures such as antitrust investigations, heightened competition in AI, and shifting economic conditions make this a defining period for the company.

Google Search: The Core of Alphabet’s Success and Challenges

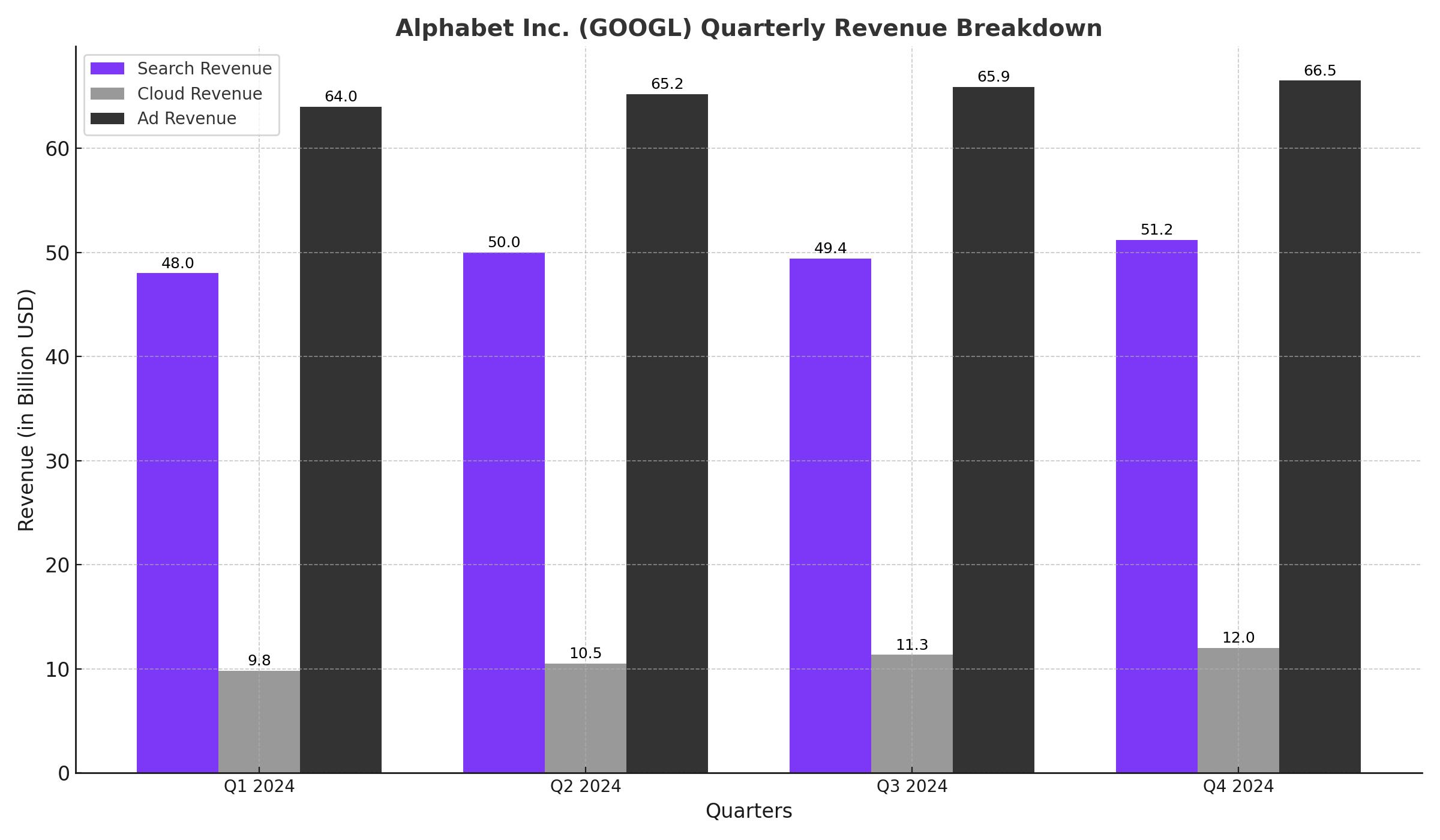

Google Search has been Alphabet's crown jewel for over two decades, powering its unparalleled dominance in the digital advertising industry. In Q3 2024, Search generated $49.4 billion in revenue, accounting for approximately 56% of Alphabet's total revenue and reflecting a healthy 12.3% year-over-year growth. This growth underscores the enduring value of Google’s search engine, which commands nearly 89.34% of global market share.

However, the very dominance of Google Search is at the center of the U.S. Department of Justice's antitrust case against Alphabet. The DOJ alleges that Alphabet’s control of key distribution platforms such as Chrome and Android stifles competition, giving Google Search an unfair advantage. The DOJ’s proposed remedies, including divesting Chrome or even Android, represent a direct challenge to the mechanisms that sustain Google’s leadership in search and advertising. If enacted, these measures could disrupt Alphabet’s advertising revenue streams, forcing the company to reimagine its distribution strategy.

Despite these challenges, Search remains a cornerstone of Alphabet’s business model, driving advertiser interest and enabling Alphabet to monetize its vast troves of user data. The business is supported by a robust ecosystem that includes services like Google Maps, Gmail, and Google Play, all of which contribute to Alphabet's broader network effects. In a best-case scenario, Alphabet could negotiate a settlement with the DOJ that preserves its core business while addressing antitrust concerns. Even in a more restrictive regulatory environment, the depth of Alphabet’s technological and operational resources provides a buffer against potential disruption.

Google Cloud: A Growth Engine Outpacing Competitors

Alphabet’s Google Cloud segment continues to be a bright spot, with Q3 revenue of $11.35 billion marking an impressive 34.96% year-over-year growth. This performance not only exceeded Wall Street’s expectations but also outpaced key competitors such as Amazon Web Services (12% growth) and Microsoft Azure (33% growth). With a market share of approximately 11.5%, Google Cloud has solidified its position as the third-largest cloud provider globally.

The cloud business benefits from Alphabet’s significant investments in artificial intelligence and proprietary hardware, such as the Dojo supercomputer. These assets enable Alphabet to offer cutting-edge solutions for enterprise clients, from AI-driven analytics to enhanced data storage and processing capabilities. The segment’s profitability is also improving, with operating margins rising from 3.5% to 11% year-over-year, highlighting economies of scale and disciplined cost management.

Looking ahead, Google Cloud is poised to remain a critical growth driver for Alphabet. Its focus on AI integration and partnerships with enterprises positions the segment to capitalize on the growing demand for cloud-based solutions. Moreover, as businesses across industries increasingly adopt AI to enhance their operations, Google Cloud’s expertise and infrastructure could unlock new revenue streams, further diversifying Alphabet’s business.

Digital Advertising: Evolving Market Dynamics

Advertising has historically been Alphabet’s largest revenue contributor, with Q3 ad revenue totaling $65.9 billion. While this represents a 10.39% year-over-year increase, the growth rate has moderated compared to previous quarters. This deceleration reflects broader market trends, including increased competition from platforms like Meta, TikTok, and Amazon, as well as the rise of AI-driven alternatives such as ChatGPT.

Despite these headwinds, Alphabet’s advertising business remains resilient, supported by innovations in ad targeting and measurement. YouTube, for example, continues to grow as a platform for both user-generated content and premium video, attracting advertisers looking to reach diverse audiences. YouTube ads generated nearly $10 billion in Q3 revenue, reflecting a 15% year-over-year increase.

Alphabet’s ability to maintain its leadership in digital advertising will depend on its capacity to adapt to changing consumer behaviors and regulatory environments. Innovations such as AI-enhanced ad targeting and augmented reality ads could help Alphabet stay ahead of competitors while delivering value to advertisers.

AI Leadership: Opportunities and Threats

Artificial intelligence represents both a significant opportunity and a competitive risk for Alphabet. The company has been a pioneer in AI development, with DeepMind and Google Brain driving advancements in machine learning, natural language processing, and robotics. Alphabet’s integration of AI into its core products, from Google Search to Google Cloud, has enhanced its value proposition for consumers and businesses alike.

However, the rapid rise of AI-driven competitors such as OpenAI’s ChatGPT and Microsoft’s Bing AI has introduced new challenges. These platforms leverage conversational AI to offer an alternative to traditional search engines, potentially eroding Google’s market share. While Alphabet has responded with its own generative AI tools, such as Bard, the competition underscores the need for continued innovation.

Alphabet’s AI initiatives also extend to new business opportunities, such as autonomous vehicles (through Waymo) and robotics. These ventures, while still in their early stages, represent potential long-term growth drivers. The challenge for Alphabet will be balancing these investments with the need to maintain profitability and shareholder returns.

Antitrust Challenges: Navigating Regulatory Uncertainty

The DOJ’s antitrust case against Alphabet has raised significant concerns among investors. The DOJ’s proposed remedies, including divesting Chrome and limiting exclusive partnerships, could undermine Alphabet’s business model. For example, losing Chrome’s distribution network could reduce Google Search’s visibility, while restricting partnerships with manufacturers like Apple could weaken Alphabet’s competitive edge.

Despite these risks, a forced breakup remains unlikely. Historical precedents, such as the Microsoft antitrust case in the 1990s, suggest that negotiated settlements are more common than structural remedies. Alphabet has the financial resources and legal expertise to navigate this process, and a settlement could mitigate the worst-case scenarios.

Financial Strength: Undervalued Among Peers

Alphabet’s financial strength is a key differentiator, with $73 billion in cash and equivalents and $17.6 billion in free cash flow reported in Q3. This robust liquidity provides Alphabet with the flexibility to invest in innovation, repurchase shares, and weather economic uncertainties. Alphabet’s valuation also appears attractive, with a forward price-to-earnings ratio of 18.6x—significantly lower than peers such as Microsoft (31.84x) and NVIDIA (48.38x).

A discounted cash flow analysis estimates Alphabet’s fair value at $198 per share, suggesting a 20% upside from its current trading price of $164.50. This valuation reflects Alphabet’s growth potential in cloud computing, advertising, and AI, as well as its ability to navigate regulatory challenges.

Conclusion: Balancing Opportunity and Risk

Alphabet Inc. (NASDAQ: GOOGL) remains a cornerstone of the technology sector, with a wide economic moat, strong financial performance, and leadership in AI and cloud computing. However, the company faces significant challenges, including regulatory scrutiny, intensifying competition, and evolving market dynamics. For investors, Alphabet represents a compelling opportunity, but one that requires a long-term perspective and a willingness to navigate near-term volatility.

The stock’s attractive valuation, combined with its growth potential and resilience, supports a buy recommendation for long-term investors. However, close monitoring of the DOJ case and competitive developments will be essential in assessing Alphabet’s future trajectory.