Summer Demand and Geopolitical Tensions Propel Oil Prices to New Highs

Brent Reaches $85 Per Barrel, WTI Climbs Amid Hurricane Risks and Falling Inventories | That's TradingNEWS

Summer Demand Lifts Oil Prices

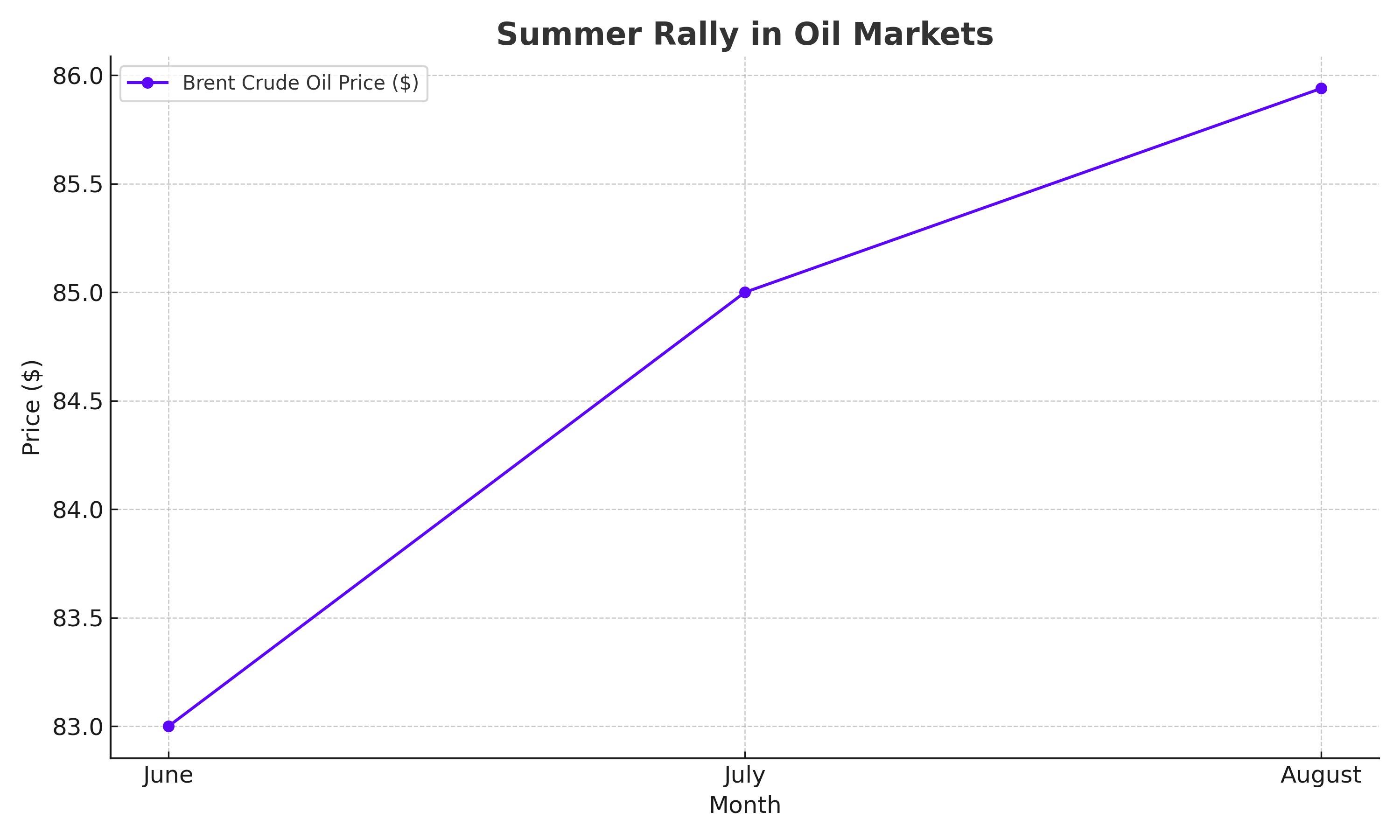

The summer rally in oil markets has materialized, with ICE Brent creeping up to $85 per barrel. This surge is even higher than pre-OPEC+ meeting levels, and the contango in the North Sea paper market has disappeared. European sentiment is buoyed by the unwinding of bearish bets on crude oil and robust physical trading. Brent contracts for difference (CFDs) have swung into backwardation, with the W1-W6 spread now at almost $2 per barrel.

Hurricanes have significantly influenced this bullish trend across the Americas. Tropical Storm Alberto, sweeping across Mexico, has prompted U.S. refiners to stock up on crude, especially from the Gulf of Mexico. Consequently, the arbitrage of U.S. crude into Europe has weakened, potentially pushing European prices higher.

Hedge Funds Bullish on European Natural Gas

Investment funds are increasingly betting on a rise in European natural gas prices due to future supply concerns and intensified competition for LNG cargoes with Asia. European TTF gas futures recently rose to €35 per MWh, spurred by Norwegian supply disruptions. Despite the Nyhamna gas processing plant resuming operations, gas prices have remained elevated.

Improving Demand and Supply Concerns

The onset of the hurricane season in the U.S., improving demand figures corroborated by shrinking crude and product inventories, and more visible Chinese buying have all contributed to the rise in oil prices, reaching their highest levels since early May. The dysfunctional Red Sea navigation, highlighted by the Houthis sinking another bulker, has added upward pressure to oil prices.

Major Industry Movements

Chevron-Hess Merger Delays

The $53 billion merger between Chevron and Hess has stalled due to arbitrage delays, with no final arbitrator selected three months after filing for contract arbitration.

Formation of New PE-Backed Gas Giant

The Carlyle Group (NASDAQ: CG) plans to form a new Mediterranean-focused oil and gas company after purchasing Energean’s (LON: ENOG) assets in Italy, Croatia, and Egypt for $945 million, appointing former BP boss Tony Hayward as CEO.

European and Global Sanctions and Production

European Sanctions on Russia

The European Union has approved its 14th package of sanctions against Russia, banning re-exports of Russian LNG within the EU while blocking financing for Russia’s planned Arctic and Baltic LNG terminals.

Iran's Increasing Oil Production

Iran’s oil minister Javad Owji announced that the country’s crude output has reached 3.6 million barrels per day (bpd), the highest level since the 2018 reimposition of U.S. sanctions. Of this, 1.5 million bpd is allocated for exports, primarily to Chinese buyers.

Key Energy Developments

Italy’s ENI in Ivory Coast

ENI (BIT: ENI) is reportedly seeking to divest up to 30% of its offshore exploration activities in the Ivory Coast, aiming to garner $1.1 billion from its holdings in the region.

Nigeria’s Supply Jeopardized by Oil Leaks

Nigerian firm Aiteo has shut down all oil production at its 50,000 bpd Nembe Creek facility due to a pipeline leak feeding the Bonny oil export terminal.

China's Surge in Hydropower Generation

Heavy rains have led to a resurgence in Chinese hydropower generation, which skyrocketed to 115 billion KWh last month, a 40% year-over-year increase.

Strategic Investments and Market Impact

Chevron’s New Angola Opportunities

Chevron (NYSE: CVX) has signed two risk service contracts for offshore blocks 49 and 50 in Angola, pledging to undertake seismic surveys in these previously untapped areas.

China’s Coal Production Tapers Off

After rapid growth in 2022-2023, China’s coal production has decreased by 3% year-over-year in the first five months of 2024, reflecting a more comfortable energy supply outlook for the country.

Geopolitical Tensions and Market Dynamics

Suriname’s Oil Production Goals

Suriname expects to produce 400,000 bpd of oil equivalent from its offshore fields by 2030, led by TotalEnergies’ Block 58, which is set to start producing in 2028.

Mexico’s Commitment to Dos Bocas Refinery

Pemex CEO Octavio Romero reiterated the promise to launch crude processing at the new Olmeca refinery by the end of 2024, despite being almost three years overdue.

U.S. Oil Futures and Market Sentiment

Crude oil futures remained relatively unchanged on Friday but were on track for a second week of gains amid signs of improving demand and falling inventories in the U.S. Brent futures for August rose 23 cents to $85.94 per barrel, while WTI crude futures for August delivery increased by 31 cents to $81.60 per barrel. Both benchmarks are set for nearly 4% gains over two consecutive weeks, marking the highest levels in more than seven weeks.

The latest EIA data showing a drawdown in U.S. crude stockpiles by 2.5 million barrels and a significant fall in gasoline inventories have bolstered prices. Additionally, improving demand in Asia and ongoing geopolitical tensions, such as Ukraine's military actions and threats from Hezbollah, further support the bullish market sentiment.

Technical Analysis and Future Outlook

WTI crude oil prices hit a new seven-week high on Friday, maintaining a firm tone and on course for a second consecutive weekly gain. Bulls are focused on targets at $81.82 and $82.15, but increased headwinds are expected as daily studies are overstretched. Strong support levels at $80.23 and $80 should ideally contain dips, with fundamentals remaining supportive for a bullish outlook.

Conclusion: Navigating the Oil Market Dynamics

The oil market is experiencing a robust summer rally driven by improving demand, geopolitical tensions, and strategic investments. Investors should stay informed and leverage technical indicators to navigate this dynamic environment effectively. As prices reach new highs and market conditions remain favorable, the outlook for oil continues to be bullish.