SoFi Technologies (NASDAQ:SOFI): A Fintech Powerhouse with Upside Potential

At $15 per share, SoFi is positioned for significant growth with a target of $22.8. Will its 10 million members and surging revenue redefine fintech investing? | That's TradingNEWS

SoFi Technologies (NASDAQ:SOFI) Poised for Long-Term Growth: Undervalued Gem or Growth Stock Leader?

Record-Breaking Growth in Membership and Revenue

SoFi Technologies, Inc. (NASDAQ:SOFI) has achieved a significant milestone, crossing 10 million members by the end of 2024, marking a 33% year-over-year growth rate. In Q3 alone, the fintech company added 756,000 new members, reflecting a 35% increase compared to the same quarter last year. Membership growth has been driven by SoFi’s innovative approach, focusing on financial services rather than solely personal loans. The company's CEO, Anthony Noto, remains confident in doubling its member base to 20 million, emphasizing trust and product awareness as core drivers.

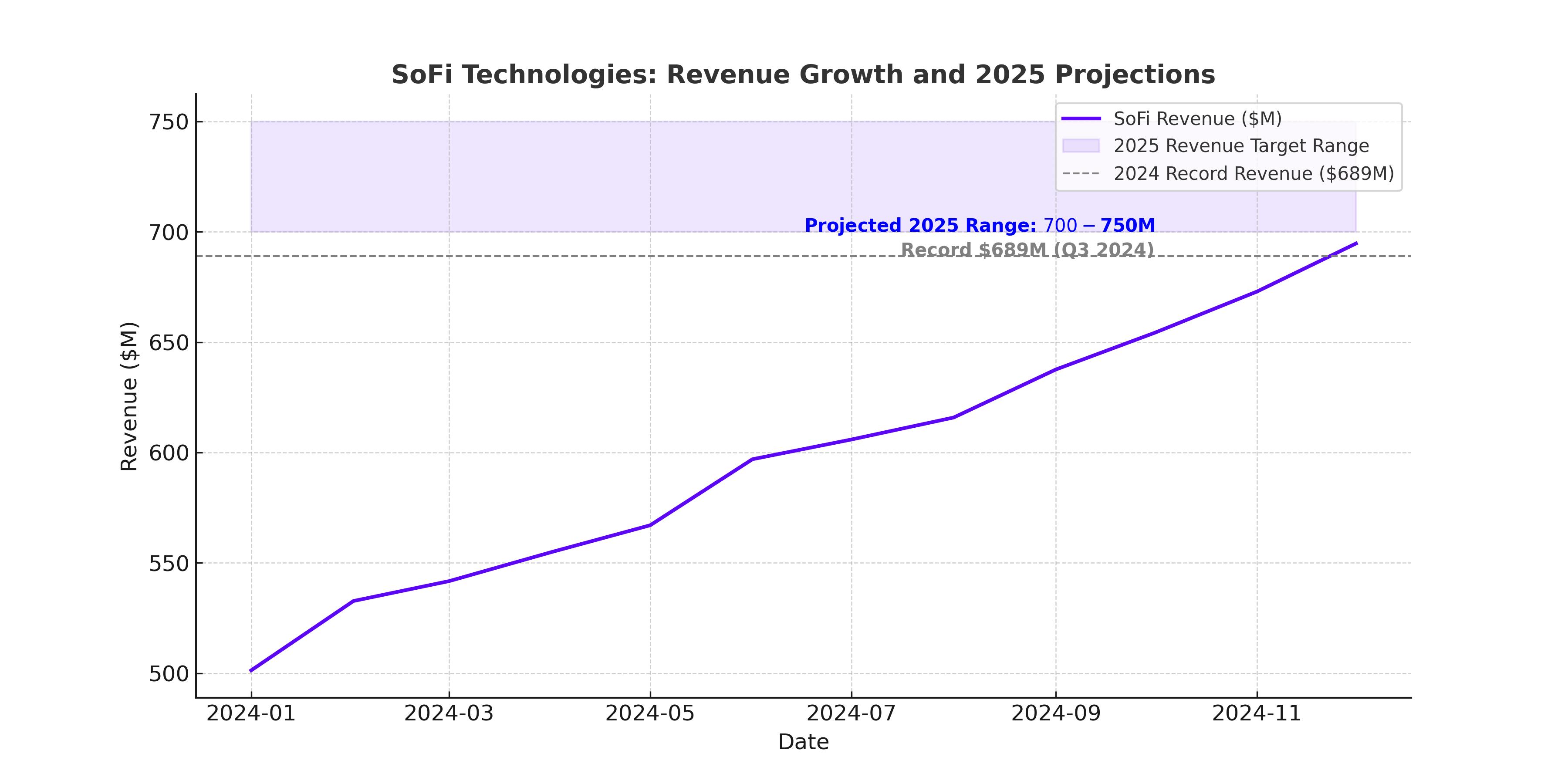

This robust membership expansion contributed to a record $689 million in revenue in Q3 2024, up 30% year-over-year. The Financial Services segment, now accounting for over one-third of total revenue, demonstrated explosive 102% growth, driven by deposit growth, increased member spending, and the expanding Loan Platform Business. Lending, SoFi’s largest business line, saw a 14% revenue increase, with personal loan originations reaching $4.9 billion, up 26% year-over-year.

Beating Analyst Expectations with Strong Financials

SoFi consistently surpasses analyst estimates, outperforming earnings projections in every quarter of 2024. In Q3, adjusted EBITDA reached $240 million, representing a 27% margin—significantly above the industry average. For the full year, SoFi raised its revenue guidance to $2.535-$2.550 billion, up from an earlier estimate of $2.43-$2.47 billion. The company is on track to achieve its ambitious 2026 EBITDA target of $1.3 billion, underscoring the scalability of its business model.

Wall Street consensus for Q4 2024 revenue sits at $677 million, a modest 14% year-over-year growth. However, SoFi’s historical ability to exceed estimates by 3-5% suggests the actual number could be significantly higher. Strong performance across all segments, particularly Financial Services and Lending, is likely to drive another record-breaking quarter.

Key Partnerships and Strategic Moves

SoFi’s $2 billion partnership with Fortress Investment Group exemplifies its shift toward capital-light, fee-based revenue streams. This deal is projected to generate $40-$60 million in upfront fees and an additional $10-$20 million annually from loan servicing. Moreover, the integration of Nova Credit’s Cash Atlas solution will enable SoFi to access enhanced cash flow analytics, broadening its market reach and improving credit decision-making.

The company continues to innovate internally, launching two new credit cards in October. The SoFi Everyday Cash Rewards Credit Card targets daily spenders, while the Essential Credit Card is designed to help users build or improve credit. These additions expand SoFi’s product ecosystem, creating further cross-selling opportunities.

Valuation and Comparison with Peers

At a market capitalization of $17 billion and a forward price-to-earnings (P/E) ratio of 57x for FY2025, SoFi appears expensive at first glance. However, its valuation becomes more attractive when considering its consistent revenue and EPS growth. By FY2026, the stock’s P/E is projected to drop to 28x, with a forward PEG ratio below 1. This positions SoFi as a compelling growth stock compared to peers like Revolut, which trades at a higher price-to-sales (P/S) multiple of 12.1 compared to SoFi's 6.8.

SoFi’s discounted valuation relative to its growth potential suggests significant upside. Analysts project a fair value of $22.8 per share by 2026, implying a 43% increase from current levels. Even under conservative assumptions, the stock could reach $17.86, representing a 12% upside.

Insider Transactions and Institutional Confidence

Recent insider transactions reflect growing confidence in SoFi’s trajectory. Key executives and board members have made significant purchases, signaling their belief in the company’s long-term prospects. Institutional investors, attracted by SoFi’s strong fundamentals and growth potential, continue to increase their holdings. Details on insider transactions are available on SoFi’s Insider Transactions Page.

Risks and Challenges

While SoFi’s growth story is compelling, potential risks include a slowdown in personal loan demand during economic downturns and the possibility of net interest margin compression from secured loans. Additionally, the fintech’s ability to consistently outperform consensus estimates may be tested if macroeconomic conditions deteriorate.

SoFi’s high beta (2.62) suggests volatility, and its current RSI of 74.6 indicates the stock is nearing overbought territory. Investors should prepare for potential short-term pullbacks, particularly as Wall Street maintains a cautious target price of $10.60.

What’s Next for NASDAQ:SOFI?

As SoFi Technologies continues to expand its member base, enhance its product offerings, and deliver consistent financial outperformance, the stock remains an attractive option for growth-focused investors. With strong momentum heading into 2025, the company is well-positioned to capitalize on the digital banking revolution and achieve its ambitious long-term targets.

Will NASDAQ:SOFI sustain its bullish trajectory, or is a pullback on the horizon? Explore real-time stock data and updates on TradingNews.