Starbucks (NYSE:SBUX): Can It Overcome Challenges to Hit $105.50?

Operational Reforms and Market Dynamics Shape the Future of Starbucks Stock | That's TradingNEWS

Starbucks Stock Analysis: Challenges, Strategy, and Future Outlook for NYSE:SBUX

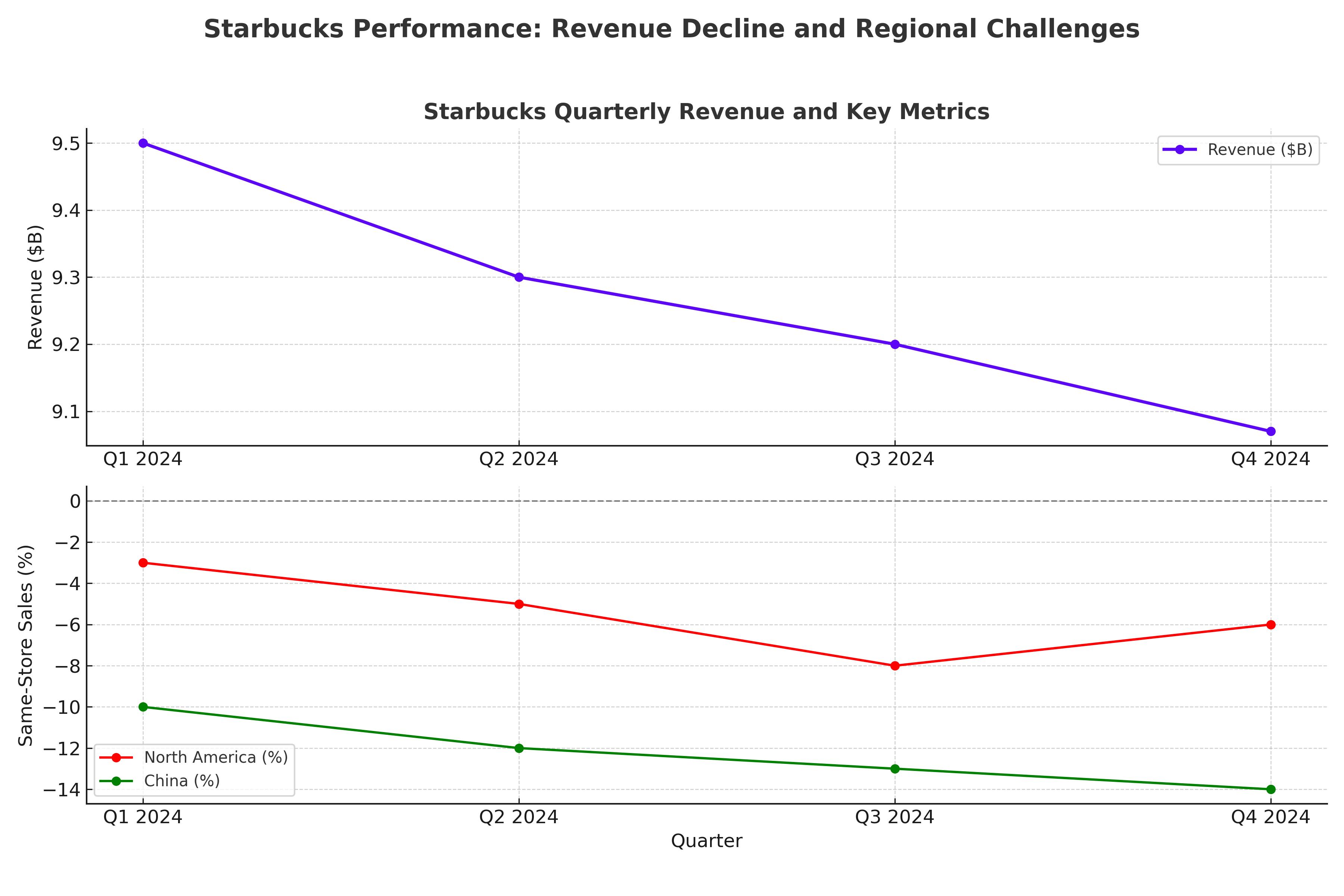

Operational Challenges and Revenue Declines

Starbucks (NYSE:SBUX) has faced notable challenges over recent quarters, with fiscal Q4 2024 revenue slipping 3% year-over-year to $9.07 billion. Same-store sales declined sharply across key markets, with North America down 6% and China plunging 14%. These declines highlight broader operational inefficiencies and competitive pressures, particularly in regions like China, where Starbucks is grappling with a subdued macroeconomic environment and intense market rivalry. Additionally, the complexity of its customizable menu offerings has led to inefficiencies in execution, impacting throughput and overall service quality.

Despite the challenges, Starbucks reported a 7% growth in new stores during FY24, reflecting its ongoing expansion strategy. However, this rapid geographic expansion has been criticized for straining operational resources, especially in underperforming markets. The company’s active rewards membership rose by 4% in the U.S. to 33.8 million, with China achieving a record 23.5 million members, signaling that loyalty programs remain a bright spot for customer retention.

Brian Niccol's Strategic Recalibration

Since his appointment as CEO, Brian Niccol has prioritized initiatives to address Starbucks' key operational challenges. One focus has been on improving customer experience by reintroducing coffee condiment bars and transitioning to customer-friendly policies like eliminating upcharges for non-dairy milk. Niccol also plans to renovate stores to enhance the in-house experience, emphasizing quality over quantity in store expansions.

Niccol's strategy includes slowing down aggressive geographic growth, particularly in markets like China, to stabilize operations and focus on profitability. Starbucks is also revising its menu offerings to reduce complexity and improve efficiency. The planned rollout of the Clover Vertica brewers and reintroduction of coffee condiment stations aims to streamline in-store operations and revitalize transaction volumes.

Stock Performance and Valuation Analysis

Starbucks stock recently traded at $94.43, reflecting a 1.13% daily increase. However, the stock's valuation remains elevated, with a P/E ratio of 28.53, which is higher than sector peers like McDonald’s (MCD) and Domino’s Pizza (DPZ). Analysts have provided a consensus price target of $103.92, implying modest upside potential from current levels. While the company’s dividend yield of 2.62% and 14 consecutive years of dividend hikes offer stability, operational inefficiencies and competitive pressures in key markets like China weigh heavily on investor sentiment.

Challenges in China and Competitive Pressures

China, a crucial growth market for Starbucks, remains a challenge. Same-store sales in the region fell by 14% in Q4 FY24, highlighting the impact of both a slowing economy and increased competition from local coffee chains. Starbucks’ reliance on discounts to drive customer traffic in China has also eroded its pricing power. Niccol’s cautious tone about the region reflects the uncertain macro environment and the need for strategic partnerships to sustain growth.

Domestically, Starbucks is focusing on improving operational efficiencies to offset declining transaction volumes. While average ticket size increased by 4% in the U.S., overall transactions dropped by over 10%, indicating the need for stronger customer engagement strategies during non-peak hours.

Future Growth Drivers and Dividend Stability

Despite current headwinds, Starbucks is doubling down on long-term growth initiatives. The company’s decision to maintain a quarterly dividend of $0.61 per share signals confidence in its financial stability. Over the past 14 years, Starbucks has achieved a 20% compound annual growth rate (CAGR) for dividends, reinforcing its commitment to shareholder returns.

The focus on loyalty programs, with record memberships in both the U.S. and China, remains central to Starbucks’ strategy. These programs not only drive recurring revenue but also provide a platform for introducing customer-centric innovations, such as the elimination of non-dairy milk charges.

Institutional Support and Analyst Ratings

Institutional investors remain optimistic about Starbucks, with hedge funds like Wellington Management and FMR LLC increasing their holdings. Recent reports highlight a “Moderate Buy” consensus rating from analysts, with price targets ranging from $77 to $115. Notable upgrades include Citigroup raising its target to $99 and Royal Bank of Canada assigning an “Outperform” rating with a $115 target.

Conclusion

Starbucks (NYSE:SBUX) presents a mixed investment case. While its focus on operational improvements and customer-centric strategies under Brian Niccol’s leadership offers promise, persistent challenges in China, high valuation metrics, and declining transaction volumes temper the outlook. For long-term investors, Starbucks remains a hold as the company works to stabilize its operations and regain market momentum. With an optimistic price target of $105.50 hinging on consistent revenue growth, Starbucks must deliver tangible results across its core markets to justify its premium valuation. For real-time updates and detailed insights on Starbucks, visit here.