Strategic Insights: Why Buying the Bitcoin Dip Could Be a Smart Move

Analyzing Bitcoin’s Current Price Performance, Market Sentiment, and Future Prospects | That's TradingNEWS

Why Buy the Dip? Analyzing Bitcoin's Market Dynamics and Future Prospects

BTC Price Weakness Sees $64,000 Return

Bitcoin (BTC) is currently experiencing volatile price movements, with recent trading sessions showing significant fluctuations. After reaching local highs of $67,250, sellers took control, pushing Bitcoin down to $64,050. This marks the lowest level since May 15, highlighting the market's sensitivity to selling pressures.

Economic Indicators and Market Sentiment

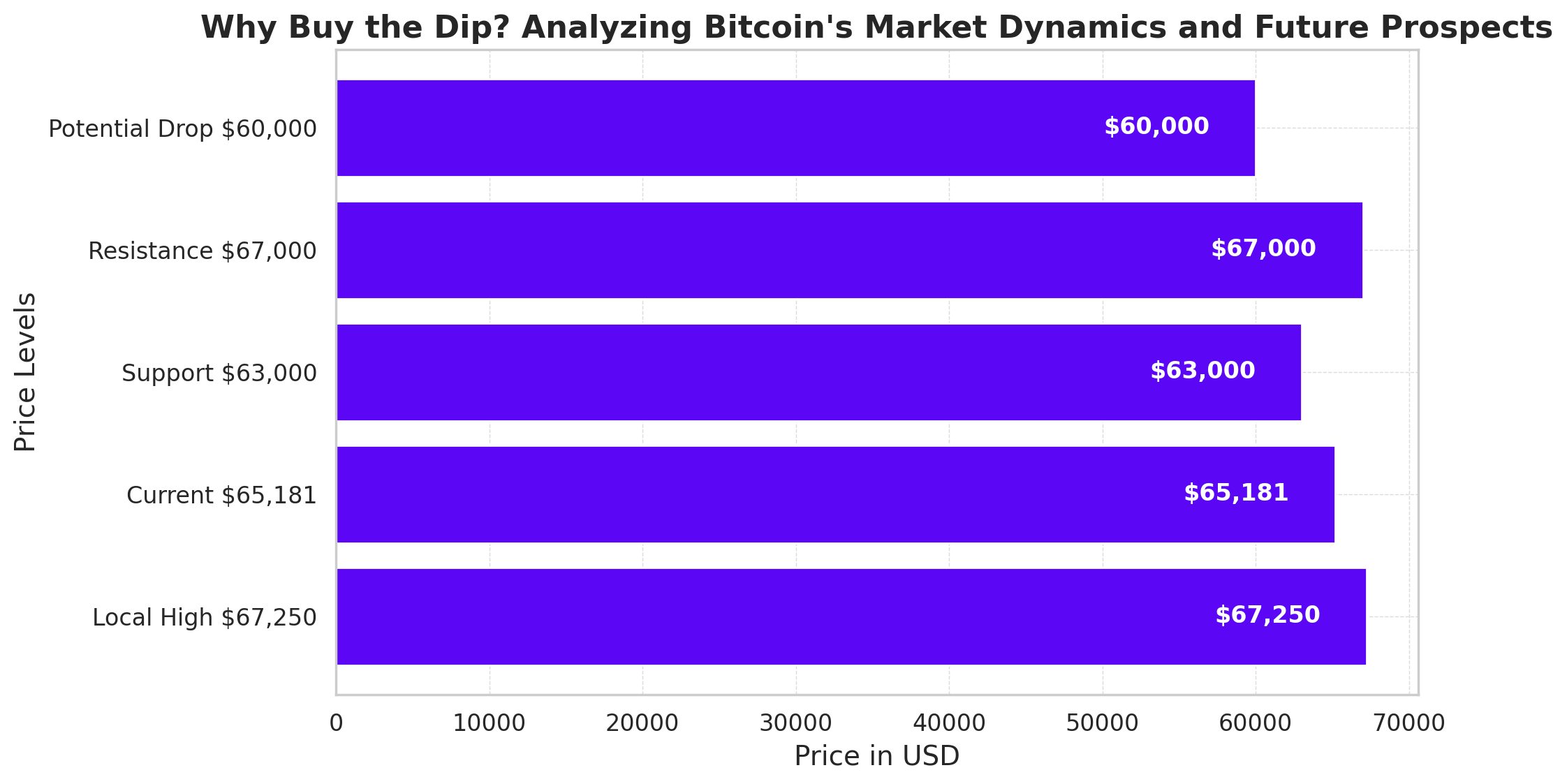

The upcoming U.S. Retail Sales data, expected to show a modest 0.2% month-on-month increase for May, could influence market sentiment. Additionally, remarks from Federal Reserve officials, including Barkin and Goolsbee, are likely to impact the US Dollar's strength and subsequently, Bitcoin prices. The strengthening Dollar has already pushed BTC down, with current prices around $65,181.

Technical Analysis: Resistance and Support Levels

From a technical perspective, Bitcoin is facing significant resistance around the $67,000 to $66,000 levels. The BTC/USD order book shows persistent selling pressure, particularly on Binance. Immediate support is noted at $63,000, with the potential to drop further to $60,000 if selling pressures continue. The Relative Strength Index (RSI) below the neutral 50 mark suggests a bearish outlook in the near term.

Derivatives Market and Liquidation Data

The derivatives market shows fluctuating open interest and funding rates. A drop in open interest to $34.31 billion, coupled with increased liquidation activities, indicates strong speculative interest but also significant selling pressure. Recent data revealed $72.60 million worth of BTC liquidated, with a substantial portion from long positions, signaling forced liquidation at lower prices.

Long-Term Holder Activity and Accumulation Trends

Long-term holders (LTH) and whales have been actively selling, contributing to recent price declines. Despite this, on-chain data reveals substantial accumulation, with 12.7K BTC, worth approximately $840 million, moved to accumulation addresses. This activity underscores a "buy-the-dip" sentiment among savvy investors, betting on future price recoveries.

Future Prospects: Resistance and Recovery

Bitcoin's price action indicates potential resistance at $67,000 and significant support around $65,000. If BTC can sustain above this support, a recovery towards $72,000 is possible, challenging previous highs. However, failure to hold above $65,000 could see prices dropping to $60,000 or lower.

Conclusion

Bitcoin's current price dynamics present a mixed outlook. While short-term pressures remain, the accumulation by long-term holders and significant support levels offer a bullish perspective. Investors should closely monitor key price levels and economic indicators. Buying the dip around $65,000 could be a strategic move, anticipating a potential rebound towards higher resistance levels.