Super Micro Computer NASDAQ:MSCI Poised for Growth with Strategic AI

An in-depth look at SMCI’s financial achievements, strategic alliances, and future opportunities in the high-performance computing and artificial intelligence sectors | That's TradingNEWS

NASDAQ:SMCI: A Detailed Financial and Strategic Analysis

Robust Financial Performance and Growth Trajectory

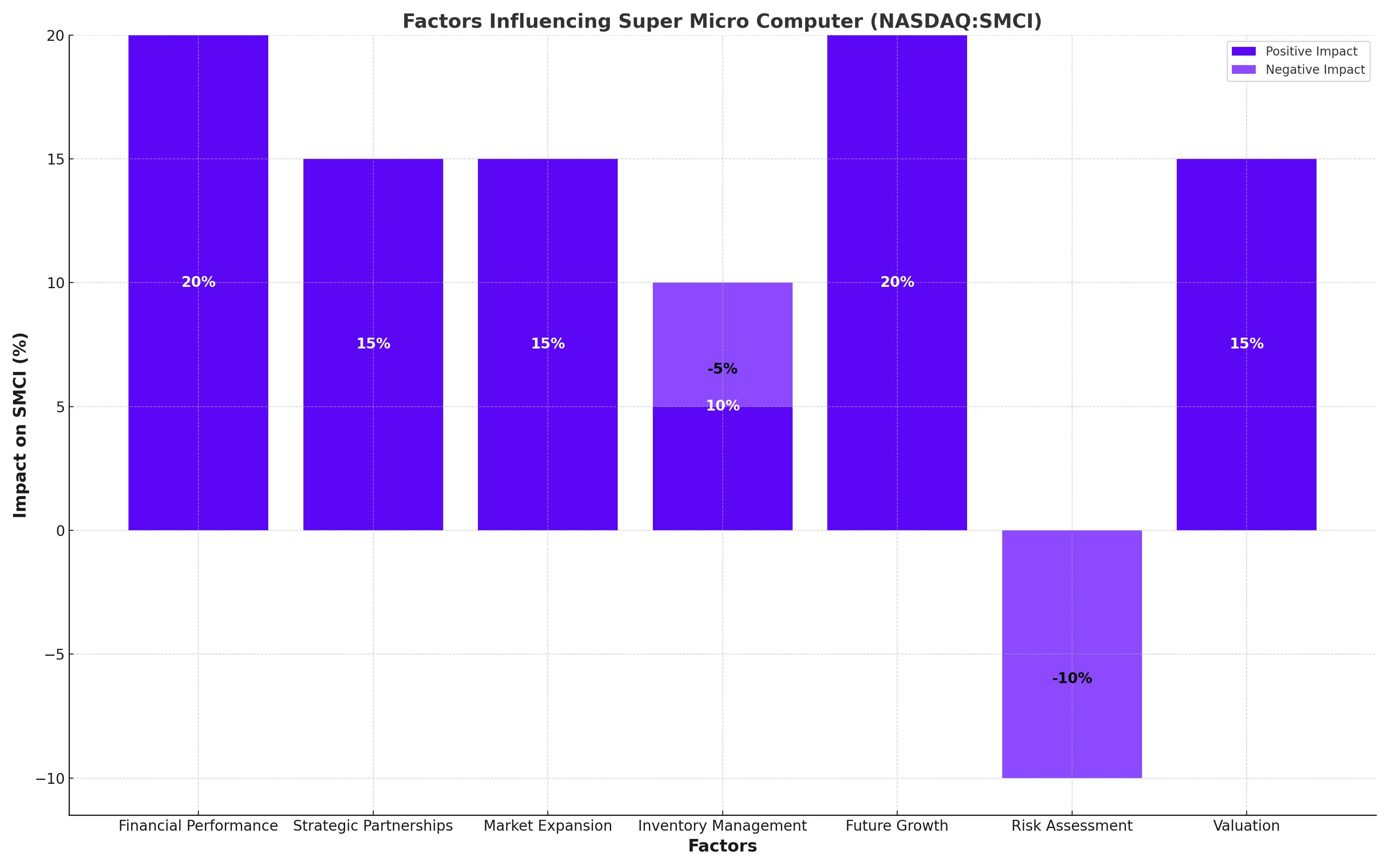

Super Micro Computer, Inc. (NASDAQ:MSCI) has demonstrated remarkable financial growth, underscored by its latest quarterly earnings. The company reported a year-over-year revenue increase of 200%, signaling strong market demand for its server technologies. This surge is primarily driven by the company's strategic pivot towards high-performance computing (HPC) and artificial intelligence (AI) servers, sectors experiencing rapid expansion.

Strategic Partnerships and Market Expansion

SMCI’s collaboration with industry giants like Nvidia, Intel, and AMD has fortified its product lineup with advanced GPUs and processors, pivotal for AI and data center applications. These partnerships not only enhance product capabilities but also broaden SMCI’s penetration in the lucrative AI market. For instance, its partnership with Nvidia involves integrating cutting-edge GPUs into its servers, essential for AI-driven applications.

Inventory Management and Operational Agility

A significant operational move by SMCI has been its aggressive inventory strategy, which has somewhat impacted its short-term free cash flow, showing a decline to -$36.46 per share from a positive $11.84 in the previous fiscal year. Despite this, the approach positions SMCI well against potential supply chain disruptions and aligns with its long-term growth strategy to meet anticipated demand surges, especially in AI and HPC applications.

Future Growth and Market Opportunities

Looking forward, SMCI is strategically positioned to capitalize on federal initiatives aimed at integrating AI technologies across various sectors, which could significantly reduce production costs and have deflationary effects on the economy. This positioning could particularly benefit SMCI, given its strong foothold in AI server solutions, which currently represent about 50% of its revenues.

Risk Assessment and Market Position

While SMCI's market share expansion is notable, increasing from 4.69% to 5.87% within a quarter, the competitive landscape remains intense with key players like Dell and Hewlett Packard Enterprise. Additionally, regulatory challenges, particularly in the AI space, could impose new compliance costs or slow down product deployment, affecting growth dynamics.

Valuation and Investment Considerations

SMCI's current Price-to-Sales ratio stands at 4.2, reflecting a robust growth outlook as it continues to capitalize on emerging tech trends. However, with a forward Price-to-Earnings (P/E) ratio projected at 34.8x, investors are advised to consider the balance between growth prospects and valuation metrics. The company’s strategic investments in AI and server technologies are expected to drive long-term growth, but these come with the usual risks associated with high-growth sectors.

Conclusion: A Balanced Investment Perspective

In conclusion, Super Micro Computer, Inc. (NASDAQ:MSCI) presents a compelling case for investors focused on technology and innovation. The company’s strategic direction, underscored by significant partnerships and a robust financial trajectory, positions it well in the fast-evolving server and AI markets. However, potential investors should balance these growth prospects against the inherent risks associated with rapid expansion and a highly competitive market. SMCI’s ability to navigate regulatory landscapes and maintain technological leadership will be crucial in sustaining its growth momentum and market position.