Super Micro Computer (NASDAQ:SMCI) Stock Soars 29% as AI Boom Ignites Unstoppable Growth

From NVIDIA Partnerships to 181% Revenue Growth: Supermicro Dominates AI Infrastructure | That's TradingNEWS

Super Micro Computer Stock (NASDAQ:SMCI) Journey from AI Boom to Accounting Woes: Is It Still a Strong Buy?

Massive AI Growth Propels NASDAQ:SMCI's Revenue

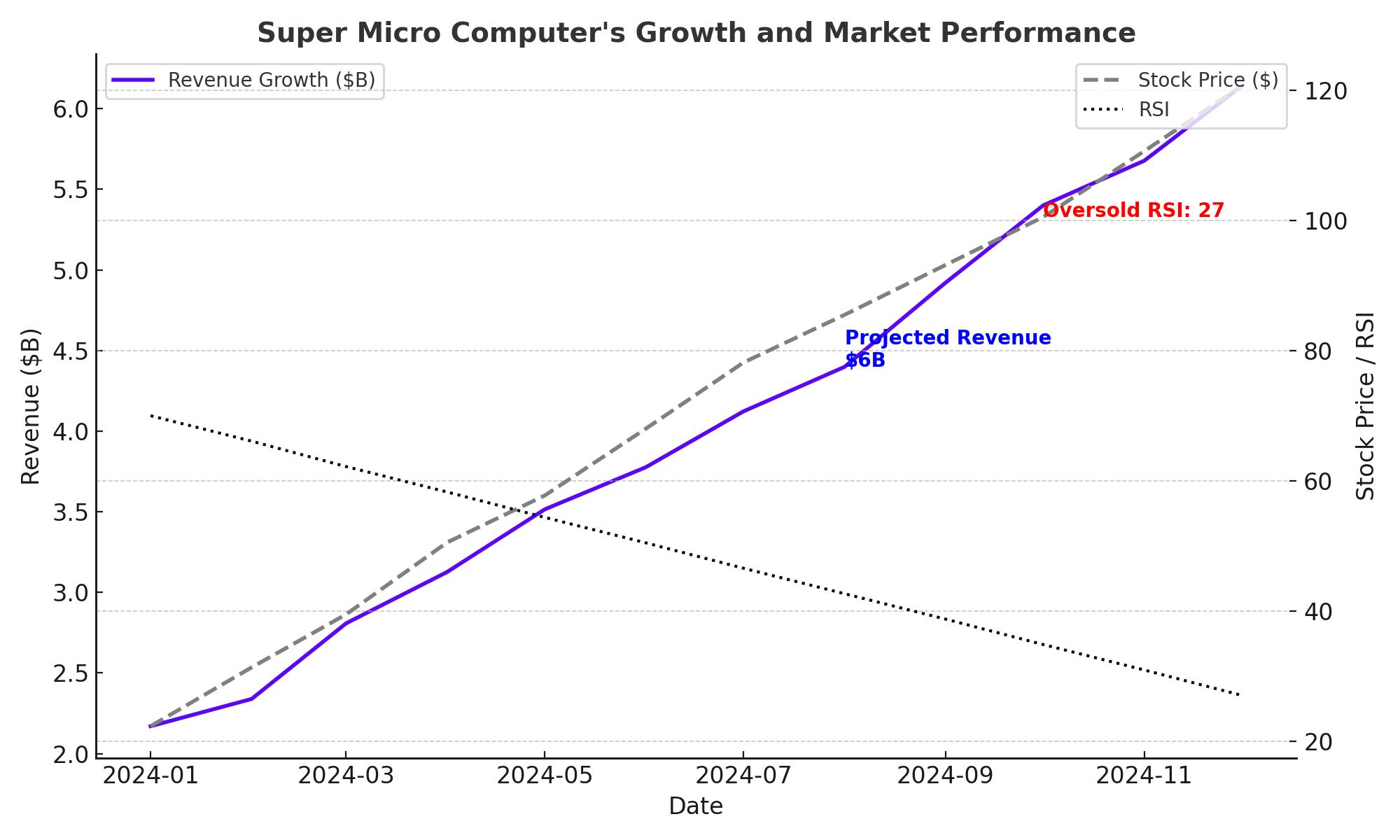

Super Micro Computer (NASDAQ:SMCI) surged as a top AI infrastructure player, capitalizing on explosive demand for its advanced GPU-powered servers. In fiscal year 2024, revenue soared by 110% year-over-year to a staggering $15 billion, driven by the widespread adoption of AI technologies and partnerships with industry leaders like NVIDIA, AMD, and Intel. The company's Q1 2025 preliminary revenue, ranging from $5.9 billion to $6 billion, represents a jaw-dropping 181% year-over-year growth, fueled by strong AI GPU platform demand.

Valuation: Is Super Micro Computer Stock (NASDAQ:SMCI) Undervalued?

At its March 2024 peak, SMCI’s stock was valued at $118.81, but subsequent issues led to a sharp decline, now trading near $25.94. A detailed discounted cash flow (DCF) model suggests a fair share price of $90, reflecting a significant 247% upside. Even with conservative assumptions—such as low revenue growth and limited free cash flow (FCF) expansion—the valuation supports a higher stock price than current levels, making SMCI an undervalued opportunity for long-term investors.

Accounting and Governance Concerns Impact Investor Confidence

Despite its stellar growth, SMCI faced significant reputational challenges. The resignation of auditor Ernst & Young in October 2024, coupled with a delayed 10-K filing, raised red flags. Adding to the concerns, short-seller reports alleged accounting manipulation, and the Department of Justice launched a probe. However, the Special Committee's internal investigation found no evidence of fraud, and the company hired BDO as its new auditor, signaling efforts to rebuild trust.

Strategic Partnerships Cement Market Leadership

Partnerships with NVIDIA, AMD, and Intel affirm SMCI’s credibility and operational excellence. NVIDIA recently strengthened ties with SMCI by integrating its BlueField DPU technology into SMCI's storage solutions, a collaboration announced in October 2024. This partnership highlights NVIDIA’s trust in SMCI’s technological and financial integrity, even amidst public scrutiny.

AI Demand Drives SMCI’s Expansion

The global AI boom continues to drive demand for SMCI's products. Data center expansions by tech giants like Amazon, Google, and Microsoft provide robust tailwinds for SMCI’s AI server business. The company has also embraced next-generation NVIDIA Blackwell GPUs, demonstrating its ability to adapt to cutting-edge technology. However, temporary supply constraints of Blackwell GPUs slightly impacted Q2 2025 guidance, expected at $5.5 billion to $6.1 billion, still reflecting a 58% year-over-year growth.

Dividend Potential Amid Financial Rebuilding

Although SMCI has not announced dividends, its strong cash flow generation positions it to reward shareholders in the future. With $5.9 billion in preliminary FCF and significant CapEx investments in FY2024, the company demonstrates resilience despite challenges. Investors eyeing long-term returns could benefit from SMCI’s potential to initiate shareholder payouts as financial stability improves.

Stock Performance: Oversold or Bearish Opportunity?

Technical indicators like the 14-day Relative Strength Index (RSI) signal that SMCI is oversold, with a reading of 27—its lowest in years. Historically, such levels have presented buying opportunities. Despite short-term bearish sentiment, analysts maintain a $47.04 price target, indicating potential gains of over 153%.

Risks: Can (NASDAQ:SMCI) Stock Rebuild Trust?

Key risks include regulatory scrutiny and potential delisting from Nasdaq. However, SMCI submitted a compliance plan on time, demonstrating its commitment to meeting listing requirements. Historical challenges, such as a delisting in 2019, weigh on investor sentiment, but efforts to enhance transparency and regain compliance provide optimism.

Final Verdict: Buy, Hold, or Sell?

Based on robust revenue growth, strategic partnerships, and undervaluation, (NASDAQ:SMCI) presents a compelling Buy opportunity for risk-tolerant investors. However, governance concerns and regulatory probes necessitate caution. As the AI boom continues to bolster demand, SMCI’s long-term potential outweighs its current challenges, offering substantial upside for patient investors.