Super Micro Computer (NASDAQ: SMCI) Is Primed for Explosive Growth Despite DOJ Probe

AI-Powered Demand and a Severely Undervalued Stock Create Huge Upside for Super Micro Computer | That's TradingNEWS

Super Micro Computer (NASDAQ: SMCI): Strong Opportunity Amid DOJ Investigation and Market Volatility

Super Micro Computer (NASDAQ:SMCI) has been on a turbulent journey, with a year marked by both impressive growth and significant challenges. SMCI has been a key player in the AI hardware market, benefiting from the increasing demand for AI-optimized servers. However, recent events, including a short-seller report and a DOJ investigation, have cast a shadow over the stock’s performance. Despite this, the fundamental strength of the company remains intact, providing a potentially lucrative opportunity for investors who can navigate the current uncertainty.

DOJ Probe Impact on (NASDAQ: SMCI)

The DOJ investigation into SMCI’s accounting practices is a crucial factor driving recent volatility. Triggered by a whistleblower complaint, this investigation has weighed heavily on investor sentiment, with the stock dropping over 12% in a short period. However, such regulatory actions are not uncommon and do not necessarily indicate significant wrongdoing. In fact, SMCI has publicly stated that it does not expect any material changes to its financial statements as a result of the probe. This was emphasized in their Form 12b-25 filing, where the company explained its decision to delay the FY2024 10-K filing. The company reassured investors that its review of internal controls would not lead to substantial restatements, indicating that the negative sentiment may be overblown.

Despite the short-term concerns, the core business of SMCI remains solid. The investigation may present a temporary setback, but it does not fundamentally alter the long-term outlook for the company, particularly given its leading position in the AI server market.

AI Hardware Growth: A Key Driver for (NASDAQ: SMCI)

SMCI’s growth is being driven by the rapidly expanding demand for AI hardware. The company has established itself as a key provider of AI-optimized servers, leveraging its strong partnerships with major players like Nvidia (NVDA), AMD (AMD), and Intel (INTC). These relationships allow SMCI to offer cutting-edge hardware solutions that cater to the evolving needs of data centers and AI-driven businesses. The global server market is projected to grow to $230.1 billion by 2034, with a CAGR of 8.3%. SMCI is well-positioned to capture a significant portion of this market, particularly in the AI server segment, which is expected to see even faster growth.

The increasing demand for AI servers presents a long-term growth opportunity for SMCI. As businesses continue to invest in AI-driven technologies, the need for specialized hardware will only increase. SMCI’s product offerings, backed by its partnerships with leading tech firms, make it a key player in this space.

Q1 FY2025 Earnings Expectations for (NASDAQ: SMCI)

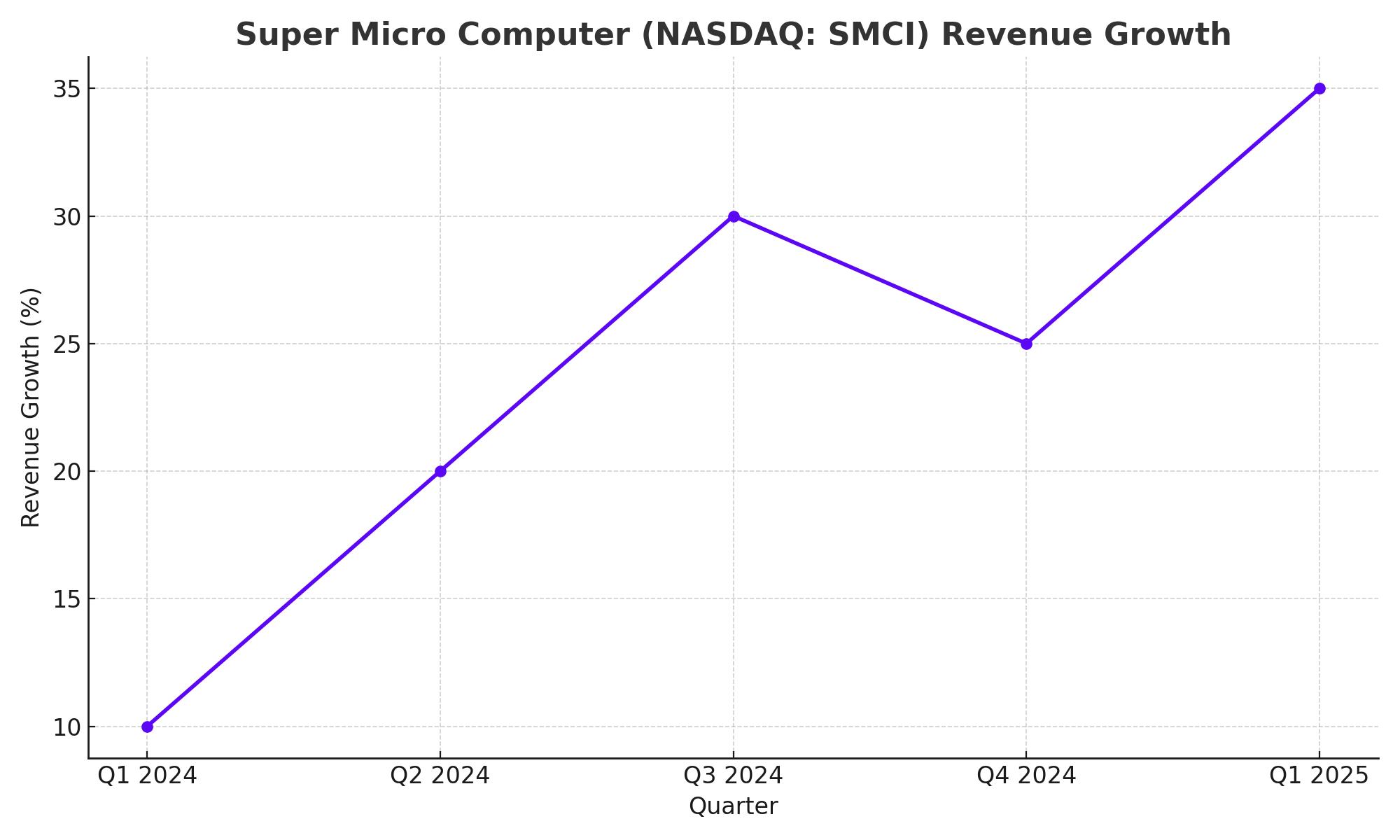

Given the strong demand for AI servers, it is likely that SMCI will deliver a robust earnings report. If the company can meet or exceed expectations, it could serve as a catalyst for a rebound in the stock price. Investors should watch closely for any indications of sustained growth in the AI hardware market, as this will be a key driver of SMCI’s future performance.

Stock Split and Its Implications for (NASDAQ: SMCI)

(NASDAQ: SMCI) Valuation: Is It an Undervalued Opportunity?

Following the DOJ investigation and market sell-off, SMCI is currently trading at a forward P/E ratio of 9.8x, significantly lower than its peers in the AI hardware space. This presents a potential buying opportunity for investors who believe in the company’s long-term growth prospects. If the DOJ investigation does not result in material changes to SMCI’s financial statements, the stock could easily be re-rated to a higher P/E ratio, potentially reaching 15.0x. At this multiple, the stock would trade at approximately $65 per share, representing a 55% upside from current levels.

SMCI’s strong earnings growth potential, combined with its low valuation relative to peers, makes it an attractive investment for those looking to gain exposure to the AI hardware market. The company’s partnerships with industry leaders, its expanding product offerings, and its position in the growing AI server market provide strong tailwinds for future growth.

Risks for (NASDAQ: SMCI) Investors

Despite the attractive valuation and growth prospects, SMCI faces several risks. The DOJ investigation, while not expected to result in significant financial restatements, could continue to weigh on investor sentiment in the short term. Additionally, SMCI operates in a highly competitive market, facing formidable rivals such as Dell, Hewlett-Packard Enterprise, and Lenovo. Any missteps in product execution or a slowdown in the AI hardware market could impact SMCI’s growth trajectory.

There is also the broader economic environment to consider. With JPMorgan forecasting a 45% chance of a U.S. recession by the end of 2025, a downturn could dampen demand for AI hardware. This would be particularly concerning for SMCI, as much of its growth is tied to the continued expansion of AI-driven businesses.

Final Thoughts on NASDAQ:SMCI

In conclusion, NASDAQ:SMCI presents a compelling investment opportunity despite the short-term headwinds. The company’s strong positioning in the AI server market, coupled with its partnerships with industry leaders and its attractive valuation, makes it a strong candidate for long-term growth. While the DOJ investigation has created uncertainty, the company’s underlying fundamentals remain intact.

For investors willing to navigate the short-term risks, SMCI offers significant upside potential. With the stock trading at a deep discount relative to its peers, now may be an opportune time to invest ahead of the Q1 FY2025 earnings report and potential positive developments in the AI hardware market.

Check the Real-Time Stock Chart for SMCI Here

That's TradingNEWS

Read More

-

PPA ETF at $154: Can This Defense ETF Keep Beating ITA and SPY?

14.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Pull In $975M While XRP-USD Fights To Hold $2

14.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hits $4.11 As Warm Winter Outlook Puts $3.913 Support At Risk

14.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Can BoJ’s 0.75% Shock Break The 155–158 Range?

14.12.2025 · TradingNEWS ArchiveForex