Tesla (NASDAQ:TSLA): Is the Stock’s 77% Rally Just the Beginning?

Model Q, Cybertruck Success, and FSD Tech: What’s Driving Tesla’s Explosive Growth? | That's TradingNEWS

Tesla’s Explosive Growth: An In-Depth Analysis of NASDAQ:TSLA Stock Performance and Future Potential

Introduction: Tesla’s Dominance and Record Surge

Tesla Inc. (NASDAQ:TSLA) is dominating the EV market, setting benchmarks in autonomous driving, vehicle production, and market capitalization. With its stock rallying 77% since early 2024, Tesla has demonstrated exceptional growth, supported by advancements in Full Self-Driving (FSD), the launch of the Cybertruck, and the promise of the upcoming Model Q. This analysis dissects Tesla's market trajectory, technological innovation, and whether its stock, currently priced near $424, remains a compelling buy.

Model Q: Revolutionizing the Budget EV Market

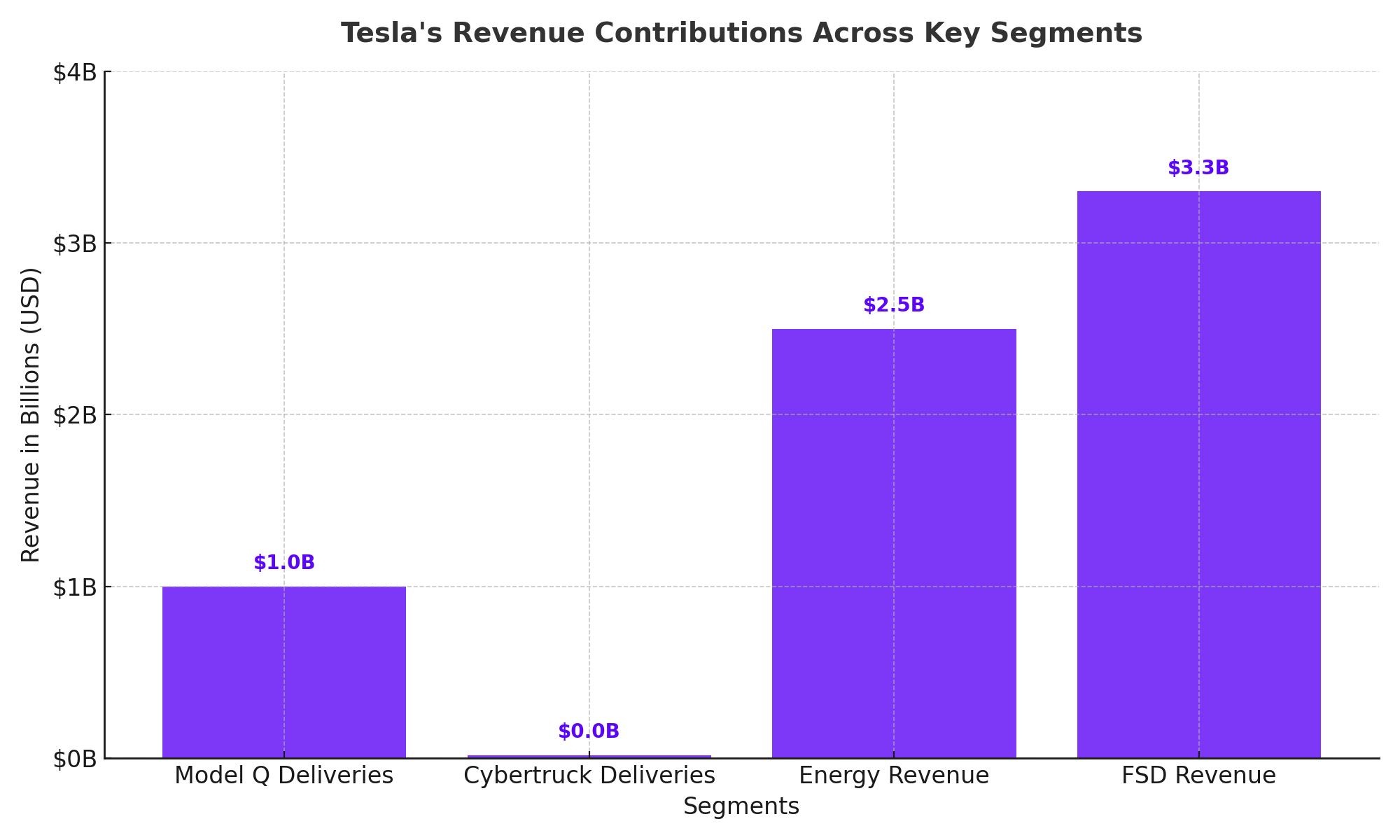

The forthcoming Tesla Model Q represents a strategic leap into the affordable EV market, priced under $30,000 after-tax credits. The Model Q is set to rival the Toyota Corolla, the world’s best-selling car, which has delivered over 50 million units globally. Tesla’s Model Y has already shown its dominance, becoming the best-selling passenger car worldwide in 2023. With Model Q targeting price-sensitive consumers, Tesla could achieve an additional one million deliveries annually, potentially contributing $3.3 billion to its net income, a 20% boost to its current $12.7 billion TTM earnings. This makes Model Q a pivotal growth driver for Tesla.

Cybertruck: Tesla’s Foray into the Pickup Market

Tesla’s entry into the pickup market with the Cybertruck is proving successful. With approximately 17,000 deliveries in Q3 2024, the Cybertruck has outpaced competitors like Ford's F-150 Lightning and Rivian's R1T. This rapid adoption places Tesla in a strong position to lead the EV pickup segment, an industry projected to grow at a compound annual growth rate (CAGR) of 30.75% through 2030. The Cybertruck’s unique design and functionality, coupled with Tesla’s branding, have created a robust demand pipeline, solidifying its role in diversifying Tesla’s revenue streams.

Energy Segment: Expanding Beyond Automobiles

Tesla’s energy division, often overlooked, is scaling rapidly. Its solutions, including solar panels, Powerwalls, and Megapacks, are gaining traction in both residential and commercial markets. The Shanghai Megafactory is on track to begin shipping Megapacks in Q1 2025, potentially unlocking new revenue streams. As the renewable energy market is projected to double in value by 2030, Tesla’s Energy segment is poised for sustained growth. Already profitable, this division adds a layer of stability and diversification to Tesla’s earnings portfolio.

Autonomous Driving: FSD Advancements and Market Opportunity

Tesla's advancements in Full Self-Driving (FSD) technology are reshaping the landscape of autonomous vehicles. The release of FSD V13.2 has shown exponential improvements, with Tesla aiming for FSD capabilities to surpass human safety standards by 2025. This innovation not only enhances Tesla’s value proposition but also taps into a market expected to grow at a CAGR of 33% over the next decade. FSD is anticipated to be a major revenue driver, contributing significantly to Tesla’s valuation as adoption rates increase.

Financial Metrics and Valuation Analysis

Tesla’s fundamentals remain robust, with total revenue projected to hit $99.82 billion in 2024. While Tesla has faced margin compression, with operating margins dropping to 8.5% in September 2024 from 15.5% in early 2022, its commitment to cost-efficient manufacturing, including the 4680 battery cells, indicates a focus on long-term profitability. Tesla’s DCF valuation suggests a fair share price of $445, representing an 11% upside from current levels, making the stock attractive even after its recent rally. This is supported by Tesla’s ability to scale production without additional CapEx, projected to reach a capacity of 3 million vehicles annually.

Risks and Governance Challenges

Despite its strengths, Tesla faces risks, including elevated production costs, macroeconomic pressures from high interest rates, and governance issues tied to CEO Elon Musk's influence. Musk’s $56 billion compensation package has raised concerns about shareholder transparency, potentially affecting institutional investor confidence. Additionally, Tesla's reliance on international supply chains makes it vulnerable to geopolitical tensions, particularly in its key markets like China.

Catalysts for a $2 Trillion Market Cap

Tesla’s ambitions extend beyond EVs. The potential of its autonomous driving program alone is valued at $1 trillion, according to Wedbush, while innovations like the Cybercab and further penetration into energy markets could propel Tesla toward a $2 trillion market cap by 2025. These advancements, coupled with increased production efficiency and expansion into new segments, position Tesla as a frontrunner in sustainable technology.

Is NASDAQ:TSLA a Buy?

Tesla’s stock remains a compelling buy, supported by its diversified growth drivers and innovation leadership. The Model Q’s entry into the affordable EV market, the Cybertruck’s success, and advancements in FSD technology highlight Tesla’s ability to capitalize on multiple revenue streams. While short-term risks exist, Tesla’s long-term trajectory suggests significant upside potential. Trading below its fair value of $445, Tesla offers a unique investment opportunity for those seeking exposure to EVs, renewable energy, and autonomous driving technologies.

For live updates on Tesla’s stock performance, visit TSLA Real-Time Chart.

Conclusion

Tesla Inc. continues to lead the charge in EV innovation, energy solutions, and autonomous driving. With robust fundamentals, promising product pipelines, and favorable market dynamics, Tesla is well-positioned to sustain its growth and deliver strong returns for its shareholders. As it stands, Tesla (NASDAQ:TSLA) remains a must-watch stock with immense potential.