Tesla Inc. (NASDAQ:TSLA): A Detailed Analysis of the EV Giant's Future Prospects and Valuation

Tesla’s Expanding Influence in the EV Charging Network

Tesla (NASDAQ:TSLA) continues to solidify its dominance in the EV ecosystem, driven by strategic collaborations and innovative technology. The latest development comes from Hyundai's decision to offer its customers complimentary adaptors for Tesla's North American Charging Standard (NACS), a move that could bring at least 112,000 Hyundai EV owners into Tesla’s Supercharger network. This strategic alignment with major automakers like Hyundai, Ford, and GM has positioned Tesla as the default choice for EV charging infrastructure, adding new layers of monetization potential.

Hyundai's contribution is noteworthy, with over 50,000 EV sales in 2024 so far, including popular models like the Ioniq 5 and 6. Combined with Tesla's expansive global charging network, this partnership reinforces Tesla’s leadership in EV infrastructure, providing both a competitive moat and a recurring revenue stream. The cost structure also favors Tesla; while competitors charge for adaptors, Hyundai’s giveaway strategy could accelerate adoption, indirectly benefiting Tesla’s margins and increasing footfall at Supercharger stations.

Vehicle Deliveries and Growth Prospects

Tesla is targeting a record-breaking Q4 2024 with an estimated 515,000 vehicle deliveries, aiming for slight year-over-year growth from 2023’s 1.8 million units. This ambitious target aligns with Elon Musk’s projection of 20-30% growth in 2025, contingent on Tesla's capacity to manage production ramp-ups and meet surging demand. Analysts project 498,000 deliveries in Q4, slightly shy of Tesla’s goal but still reflecting a strong finish to a challenging year.

Tesla’s EV market dominance, however, faces headwinds. U.S. and European deliveries have lagged, and competitors like Rivian and BYD are making significant inroads, particularly in Europe. With 95% of Tesla’s revenue still derived from the Model 3 and Model Y, questions about product diversification remain critical. The anticipated rollout of the Model Q, a compact EV designed for affordability, could potentially reignite Tesla's growth trajectory, particularly in markets where cost-sensitive buyers dominate.

Innovative Products and Long-Term Vision

Tesla’s future is increasingly tied to its forays into autonomous driving and robotics. The company’s Robotaxi project, anchored by the "Cybercab," represents one of its most ambitious initiatives. Elon Musk envisions mass production of 2–4 million Robotaxis annually by 2027, potentially generating $105 billion in revenue by 2030 at $2.5 per mile for 70,000 miles annually per vehicle. This would place Tesla at the forefront of the ride-hailing industry, challenging traditional players like Uber.

Tesla's Full Self-Driving (FSD) feature is another critical revenue driver, with an adoption rate projected to rise to 20% by 2030. At $99 per month, FSD could generate $4.6 billion in annual revenue by the decade's end. While still facing regulatory hurdles, FSD underscores Tesla’s leadership in software-defined vehicles, a critical differentiator in the EV market.

Optimus, Tesla's humanoid robot, adds another layer of innovation but remains a longer-term bet. With mass production expected in 2026 and pricing aimed below $20,000, the potential applications range from hazardous environments to space exploration. Analysts estimate revenue from Optimus to reach $3.6 billion by 2030 under conservative assumptions.

Energy Storage: A Growing Revenue Stream

Tesla’s energy storage business continues to grow at an impressive pace, with Q3 2024 revenue surging 52% year-over-year. The Megapack and Powerwall products are driving this growth, supported by ramped-up production at facilities in the U.S. and Shanghai. Margins have improved significantly, reaching 31% in Q3 2024, compared to 25% in Q2. With a projected annual growth rate of 30%, this segment could contribute $245 billion in valuation by 2030, offering a lucrative diversification from the core automotive business.

Valuation and Market Sentiment

Tesla’s current stock price of $462 implies a market capitalization of $1.45 trillion, far above its fair value based on traditional valuation models. A sum-of-the-parts (SOTP) analysis values Tesla’s automotive and energy storage segments at $370 per share, significantly below the market price. Adding speculative segments like Robotaxi, FSD, and Optimus could push the valuation higher, but these rely on aggressive growth assumptions.

The stock trades at 125 times forward earnings, reflecting immense optimism around future initiatives. While this premium valuation is justified by Tesla’s innovation pipeline, it also leaves little room for error. Regulatory easing under the Trump administration could further bolster Tesla's prospects, particularly for FSD and Robotaxi, but execution risks remain substantial.

Technical Analysis and Price Outlook

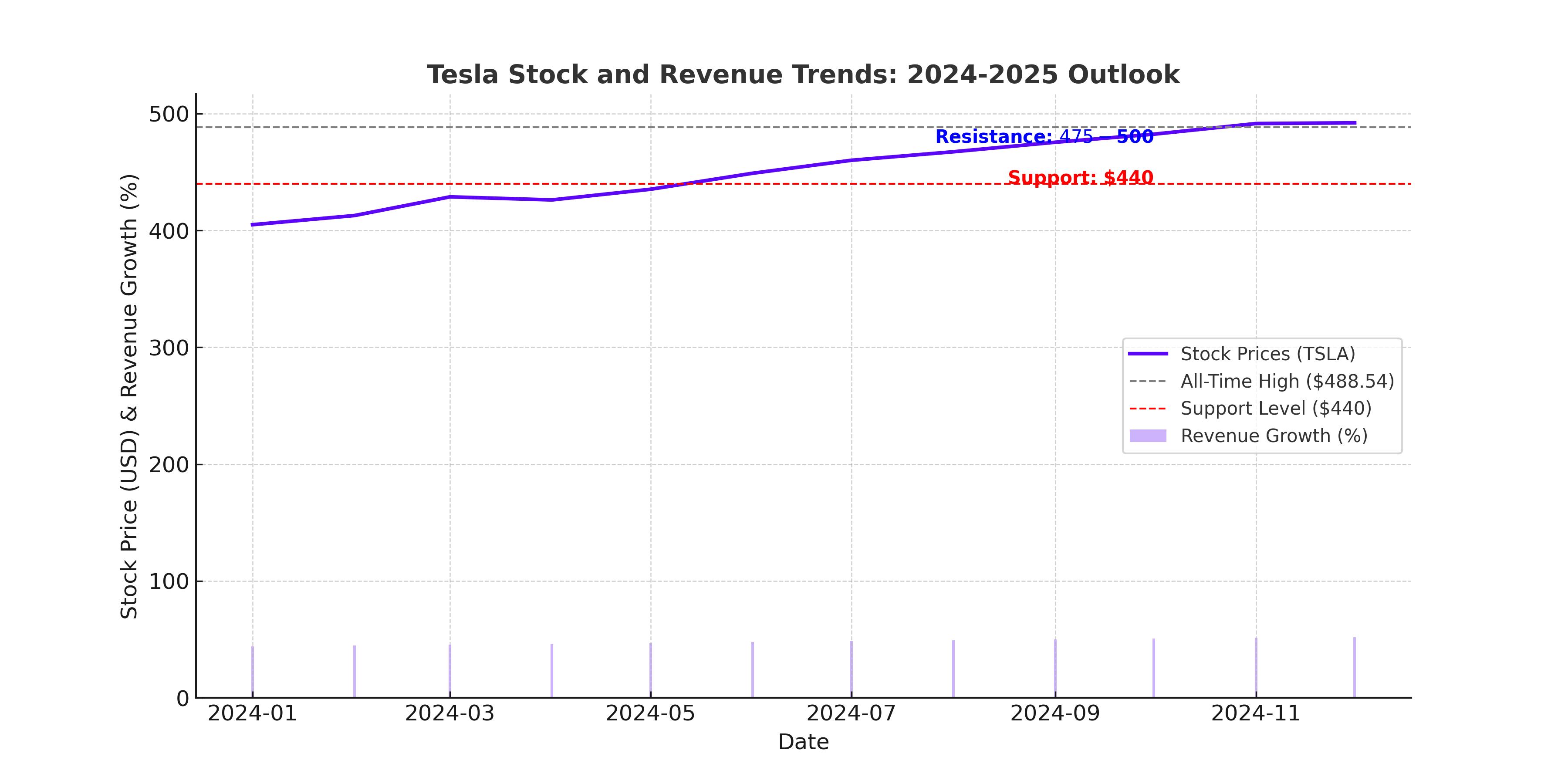

Tesla’s stock has been on a tear, up 90% since November’s presidential election. The stock recently hit an all-time high of $488.54 before retracing to $462. Key resistance levels are observed at $475 and $500, while support lies near $440. Analysts expect continued volatility, with price targets ranging from $400 to $500 depending on the success of Q4 deliveries and broader market conditions.

Conclusion: Strategic Opportunities Amid Challenges

Tesla remains a transformative force in the automotive and energy sectors, with groundbreaking innovations in autonomy and robotics. However, its valuation reflects sky-high expectations, requiring flawless execution across multiple ambitious projects. While current prices may warrant caution, any pullback toward $400 could present a compelling buying opportunity for long-term investors. For now, Tesla (NASDAQ:TSLA) remains a stock to watch closely, as its trajectory will likely shape the future of mobility and energy.