The Ripple Effect of US Inflation and Federal Reserve Moves on EUR/USD

Analyzing the Interplay Between Economic Trends, Policy Shifts, and EUR/USD Volatility | That's TradingNEWS

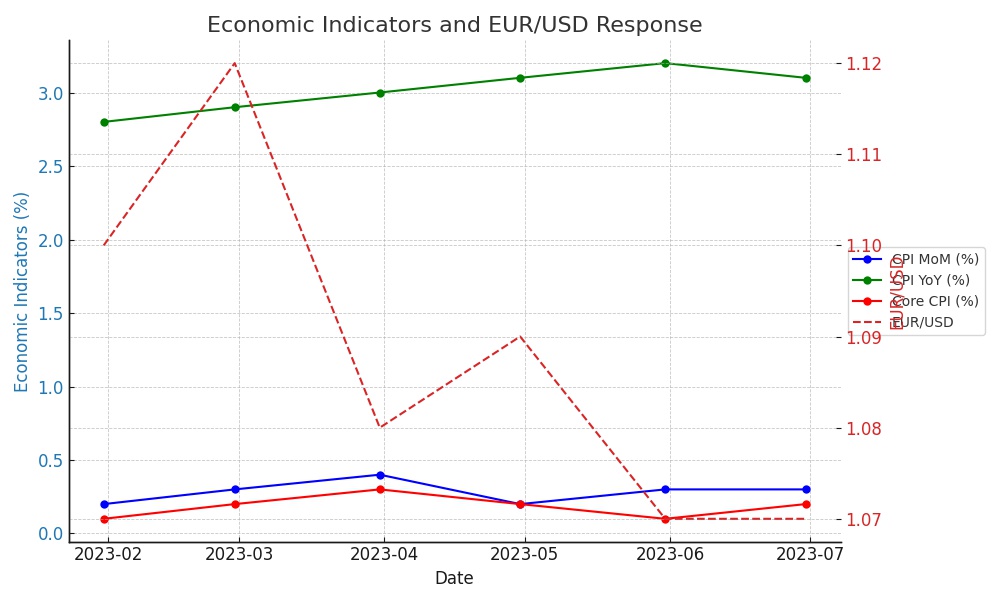

Economic Indicators and EUR/USD's Response

The EUR/USD pair has been a focal point for traders, reflecting broader economic trends and monetary policy shifts. Recently, the pair dipped to around the 1.0700 level, influenced heavily by US inflation figures that outstripped expectations. The Consumer Price Index (CPI) saw a month-on-month increase of 0.3% in January, surpassing the 0.2% growth in December. Notably, the year-on-year CPI accelerated to 3.1%, overshooting the forecasted 2.9%, with Core CPI also exceeding estimates. This data underscores a robust inflationary environment in the US, prompting a bullish sentiment towards the greenback and impacting EUR/USD dynamics.

US Retail and Manufacturing Data: A Catalyst for Movement

The currency pair's trajectory is also swayed by upcoming US economic data, including Retail Sales, Core Retail Sales, and the Philly Fed Manufacturing Index. These indicators are critical for gauging consumer confidence and manufacturing health, potentially influencing Federal Reserve policies and, subsequently, currency valuations. Traders are keenly awaiting these releases to discern future movements in the EUR/USD pair.

Federal Reserve's Stance and Market Speculation

The Federal Reserve's posture on interest rates significantly impacts currency movements. The anticipation around potential rate adjustments, despite the Fed downplaying a March rate cut, stirs market speculation. The relationship between US Treasury yields and the EUR/USD pair highlights the intricate balance between interest rate expectations and currency strength. Notably, a majority of traders currently hold a bearish outlook on the EUR/USD, reflecting broader market sentiment and speculation on the pair's future direction.

Eurozone's Economic Sentiment and Industrial Production

Contrasting the US data, the Eurozone has shown resilience, with the German ZEW Economic Sentiment and Eurozone Industrial Production exceeding expectations. These positive indicators, however, have not significantly buoyed the EUR against a dominant USD, indicating the market's heightened focus on inflation and Federal Reserve policies over regional economic performance.

Technical Analysis: Support and Resistance Levels

From a technical standpoint, the EUR/USD pair exhibits a bearish trend, with key support at the 1.0694 level and potential resistance near the 1.0800 psychological mark. The pair's movement within a bearish flag pattern and subsequent breakdown below minor uptrend lines suggest a continuation of the downward trend, pending reactions at critical support levels like the weekly S1 and the descending pitchfork's median line.

Navigating EUR/USD Amidst Anticipated Federal Reserve Moves

Investors and traders are bracing for further insights from the Federal Reserve, particularly regarding its long-term interest rate trajectory. The market's adjustment to Fed narratives and economic data releases will be pivotal in determining the EUR/USD's path forward. As the currency pair navigates through these economic indicators and policy speculations, market participants must stay attuned to shifts in sentiment and potential triggers for volatility.

Conclusion: A Confluence of Factors Shaping EUR/USD

The EUR/USD pair's recent movements underscore the interplay between economic indicators, Federal Reserve policies, and market sentiment. As the pair teeters above the 1.0700 mark, the forthcoming US economic data and the Fed's stance on interest rates will be instrumental in shaping its trajectory. Traders and analysts alike must consider a spectrum of factors, from inflation figures to manufacturing and retail data, to navigate the complex landscape of currency trading in the current economic climate.

For those keen on delving deeper into EUR/USD's financial dynamics and potential strategies, trusted financial platforms offer comprehensive analyses and real-time data to inform trading decisions.

That's TradingNEWS

EUR/USD Faces Crucial Test: Will the Euro Break Above 1.1455 After ECB Rate Cut?

EUR/USD Breaks Through Key Resistance: What’s Next for the Euro?