The Rising Tide of Oil Prices: WTI and Brent on a Path to $80

What’s Fueling the Oil Market in 2025? A Deep Dive Into Global Demand, Supply Cuts, and Geopolitical Shifts | That's TradingNEWS

Oil Price Outlook: Drivers, Challenges, and Market Dynamics Shaping Crude (WTI/CL=F, Brent/BZ=F)

The global oil market has entered 2025 with a complex interplay of supply dynamics, geopolitical shifts, and economic pressures. Crude oil prices, including West Texas Intermediate (WTI/CL=F) and Brent (BZ=F), have shown resilience amid varied market conditions, driven by tightening supply, Chinese stimulus efforts, and geopolitical factors.

WTI and Brent Begin 2025 on a Strong Note

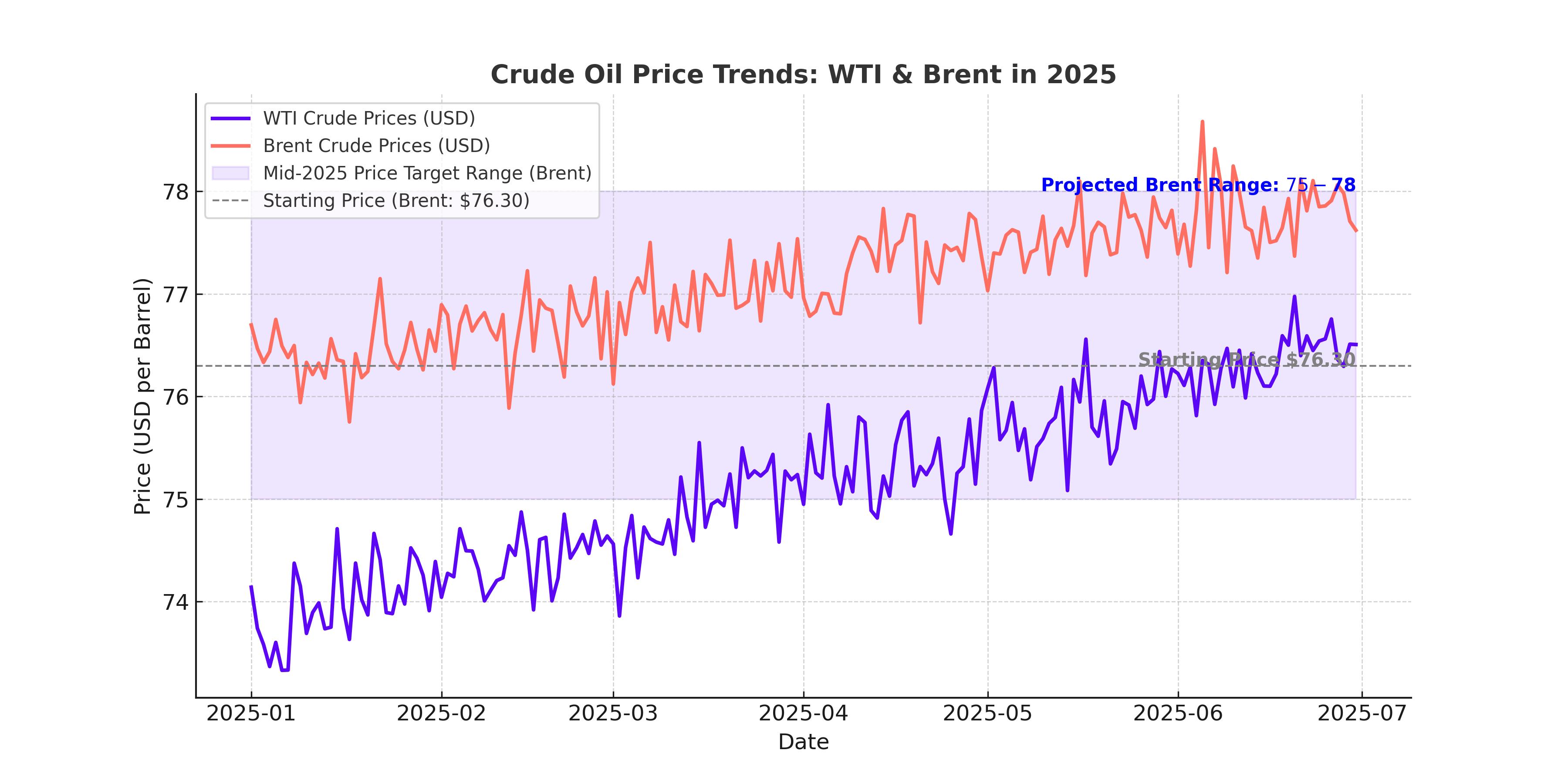

WTI crude started the year trading at $73.77 per barrel, while Brent crude stood at $76.30 per barrel. Both benchmarks have extended gains, supported by expectations of heightened Chinese demand due to recent economic stimulus. The Chinese government’s introduction of ultra-long special government bonds aims to bolster infrastructure spending and consumer demand. Analysts from ING noted that Brent's rise above $76/bbl reflects a stronger physical market, particularly in the Middle East, where supply constraints are tightening prices.

Saudi Arabia and OPEC+ Influence on Oil Supply

Saudi Arabia, the world's largest oil exporter, raised the price of its flagship Arab Light crude for February by $0.60 per barrel. This exceeded market expectations and reflects a tightening supply environment as OPEC+ continues its production cuts. In December, the group postponed its planned easing of production cuts until April 2025, ensuring a more controlled supply scenario. Concurrently, sanctions on Iran and Russia are further limiting global supply, adding upward pressure on prices.

Geopolitical Risks and U.S. Policy Impact

Geopolitical tensions remain a critical factor for oil prices. The incoming Trump administration has hinted at tightening sanctions on Iran, which could reduce Iranian crude exports by as much as 300,000 barrels per day in the second quarter of 2025, according to Goldman Sachs. This development is likely to amplify supply constraints and drive Brent prices toward a predicted peak of $78 per barrel by mid-year.

Venezuelan Oil Exports Rebound Amid Operational Challenges

Venezuela’s oil exports climbed 10.5% in 2024, averaging 772,000 barrels per day. This rebound comes despite persistent operational issues, including refinery outages. U.S. leniency under the Biden administration allowed Chevron to recover Venezuelan crude debts, contributing to a 64% surge in shipments to the U.S. However, the durability of Venezuela’s export momentum is uncertain, especially with potential shifts in U.S. policies under the new administration.

South Sudan and Sudan Oil Pipeline Recovery

In a significant development, Sudan lifted its 10-month-long force majeure on South Sudan’s oil pipeline. This decision followed improved security conditions and agreements between Sudan, South Sudan, and pipeline operator BAPCO. South Sudan, which relies on oil for 90% of its revenue, can now resume exporting crude through Port Sudan, offering some relief to its embattled economy. The pipeline reopening could contribute to additional supply in the market, though its impact on global prices remains to be seen.

Long-Term Price Expectations and Industry Sentiment

The Dallas Fed Energy Survey, encompassing views from 131 oil and gas executives, provides a mixed outlook for WTI prices. By the end of 2025, the average price forecast is $71.13 per barrel, with estimates ranging from $53 to $100 per barrel. This reflects industry uncertainty about demand recovery, geopolitical disruptions, and production costs.

Despite the near-term optimism, some executives expressed concerns about declining crude prices and rising production costs. A consistent theme across responses is the unpredictability of international politics and its ability to "play havoc" with oil prices. These sentiments underscore the fragile balance between supply and demand that will define the market in 2025.

India’s Growing Role in Global Oil Demand

India has emerged as a pivotal player in the global oil market, surpassing China in 2024 as the largest driver of demand growth. The U.S. Energy Information Administration (EIA) projects Indian oil demand to grow by 330,000 barrels per day in 2025. India’s plans to expand its Strategic Petroleum Reserve storage capacity reflect its increasing reliance on imported crude, currently accounting for 85% of its consumption. This rising demand could provide additional support for crude prices in the coming year.

Short-Term Challenges for Oil Markets

Despite the robust start to the year, challenges persist. The U.S. Energy Information Administration (EIA) recently lowered its 2025 WTI price forecast to $69.12 per barrel from $71.60. The revision reflects anticipated demand weakness and rising supply from non-OPEC+ countries like the U.S., Canada, and Brazil. Additionally, the International Energy Agency (IEA) predicts global oil demand to grow by less than 1 million barrels per day in 2025, down from 2 million barrels per day in 2023, signaling potential headwinds for crude prices.

Conclusion: Navigating a Volatile Landscape

The outlook for crude oil prices in 2025 hinges on a delicate balance of supply-side constraints, geopolitical risks, and evolving demand patterns. With WTI trading near $73 and Brent at $76, market participants remain cautiously optimistic. However, the interplay of factors such as OPEC+ policies, Chinese economic activity, and U.S. foreign policy will continue to shape the trajectory of oil prices throughout the year. Whether prices will sustain their upward momentum or face downward pressure from supply increases remains a key question for the months ahead.