Thermo Fisher TMO Stock Growth and Challenges in Life Sciences

Unveiling Thermo Fisher's Financial Journey: Organic Growth, Market Challenges, and Strategic Acquisitions - A Comprehensive Review | That's TradingNEWS

Thermo Fisher Scientific Inc.: An In-Depth Financial Analysis

Overview of Thermo Fisher Scientific (NYSE:TMO)

Thermo Fisher Scientific stands as a prominent player in the life sciences industry, offering a broad spectrum of medical devices, diagnostics, analytical instruments, and laboratory products. The company is notable for its significant presence in the pharmaceutical and biotech sectors, contributing to 58% of its revenue. This positioning allows Thermo Fisher to actively engage in biological and medical research, drug discovery, and vaccine production.

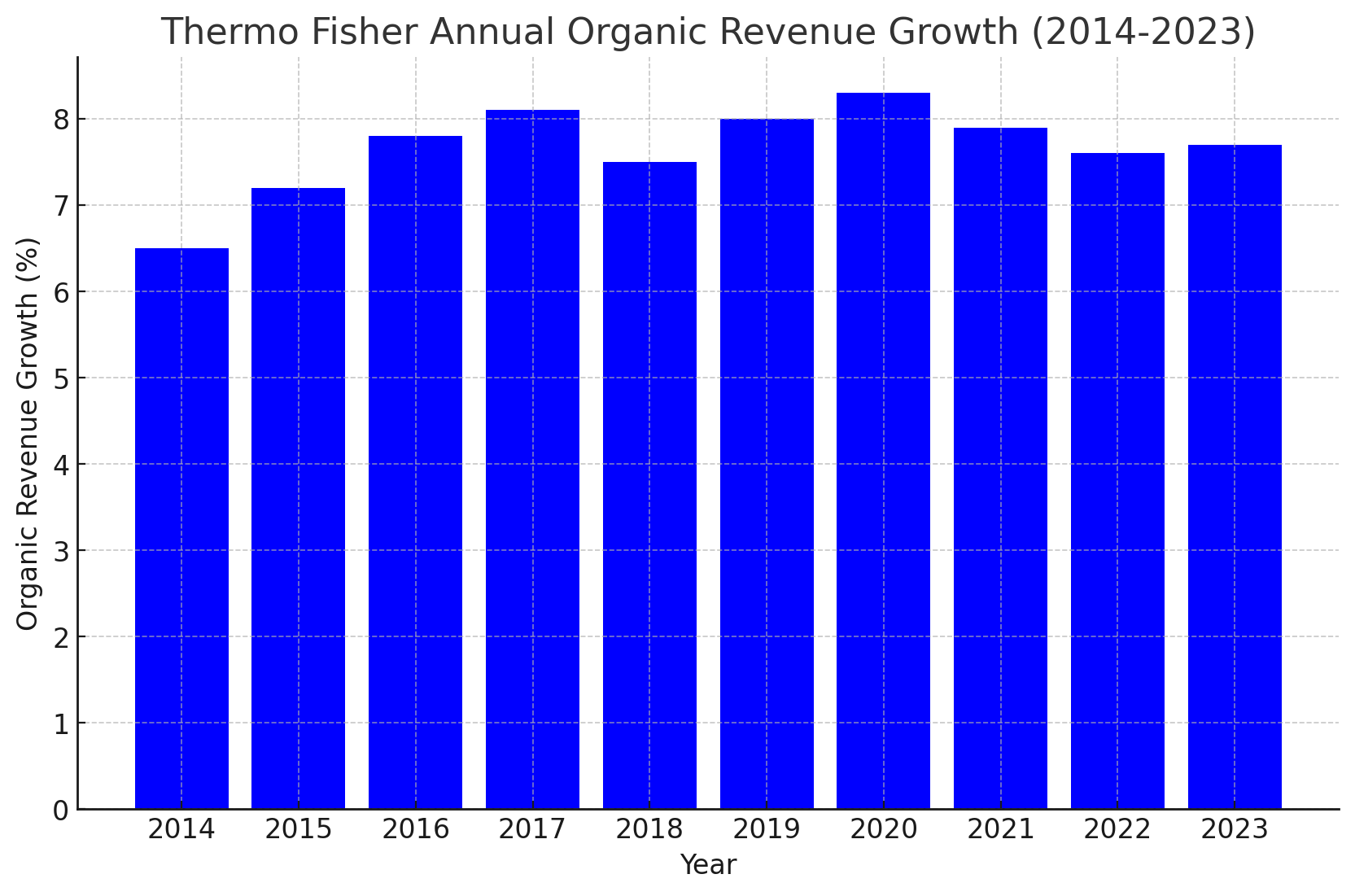

Solid Organic Growth Driven by Pharma and Biotech

The company's organic revenue growth, averaging 7.7% annually over the past decade, is a testament to its robust performance in the life sciences domain. This growth is propelled by its diverse product portfolio, which includes reagents, instruments, and consumables vital for research and development in the life sciences sector.

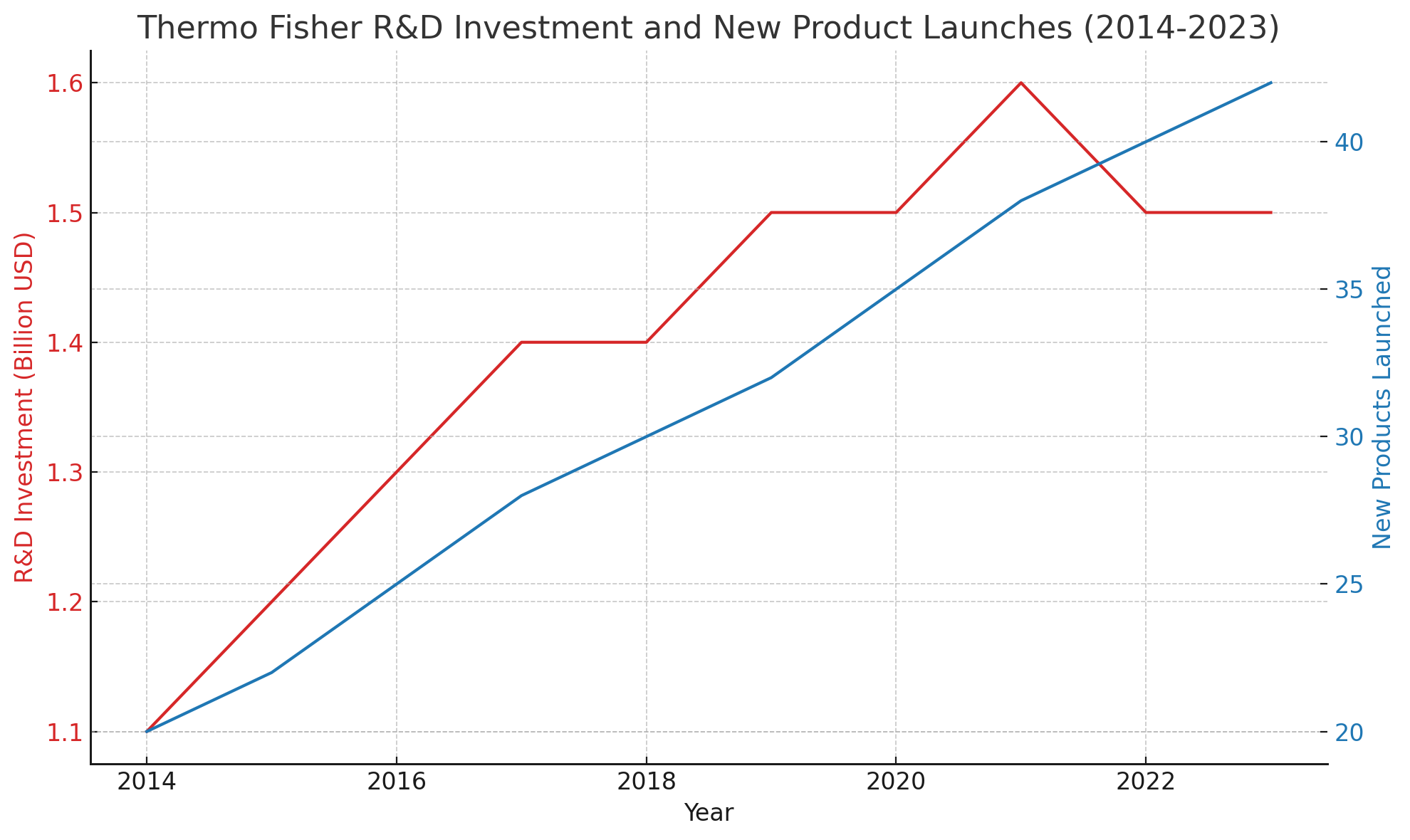

Innovation and New Product Launches

Thermo Fisher's dedication to innovation is evidenced by its significant R&D investments, amounting to almost $1.5 billion annually, and its team of over 7,300 scientists and engineers. The company’s consistent introduction of new products has not only allowed it to gain market share but also improve its gross margins.

COVID-19 Impact and Subsequent Revenue Decline

The global pandemic initially boosted Thermo Fisher's growth, especially in COVID testing and vaccine-related demands. However, the post-pandemic period has seen a decline in these revenues, with a projected drop of $1.3 billion in COVID-related revenue by FY24.

Challenges in the Chinese Market

China, which historically contributed significantly to Thermo Fisher's revenue, has seen a decline in healthcare spending post-COVID. This downturn in the Chinese economy has led to negative growth for Thermo Fisher in this region, posing a significant challenge for the company.

Acquisition Strategy and Growth

Thermo Fisher’s growth strategy includes significant acquisitions, such as the purchase of PPD for $17.4 billion and Olink for $3.1 billion. These acquisitions have expanded Thermo Fisher's global footprint and capabilities, particularly in clinical research and lab services, and next-generation proteomics.

Financial Review and FY24 Outlook

Despite a cyclical downturn, Thermo Fisher's long-term growth trajectory remains positive. The company’s historical performance, including a decade-long average organic revenue growth of 7.7%, positions it as a growth-oriented entity. The FY24 projections anticipate similar growth levels to FY23, considering market downturns and growth headwinds.

Valuation and Stock Performance

The fair value estimation of $510 per share for Thermo Fisher reflects its consistent margin expansion and potential for gross margin enhancement through new product offerings. The valuation considers a 10% discount rate, 4% terminal growth, and a 10% tax rate.

Key Risks and Future Outlook

Key risks include the challenges in the Chinese market and the impact of the current high-interest rate environment on the pharmaceutical and biotech industry. Thermo Fisher's heavy debt leverage, with $35.3 billion in total debts, is another area of concern.

Given these considerations, Thermo Fisher, with its robust history and strategic acquisitions, faces near-term challenges but maintains a solid foundation for long-term growth. The 'Hold' rating is a cautious stance, reflecting the balance between the company's inherent strengths and the external challenges it faces.

Connecting to Real-Time Data

For the latest stock information and insider transactions, visit Thermo Fisher's stock profile at NYSE:TMO Stock Profile and Insider Transactions.

Closing Thoughts

Thermo Fisher's journey, marked by strategic acquisitions and a strong foothold in the life sciences industry, is met with both opportunities and challenges. While navigating through the post-pandemic revenue adjustments and regional market fluctuations, the company's innovative edge and acquisition-driven growth strategy position it as a key player in its domain, warranting a balanced investment perspective.

That's TradingNEWS

Read More

-

VOO ETF Price Near Record Highs: Is Vanguard’s S&P 500 Engine Still a Buy?

21.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Boom: XRPI at $11.07 and XRPR at $15.76 Ride a $1.21B Wave

21.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.60 Support After $4.12 Winter Rally

21.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Near 158 as BoJ’s “Dovish Hike” Supercharges Yen Selling

21.12.2025 · TradingNEWS ArchiveForex