TotalEnergies (NYSE: TTE): Fueling Growth with Strategic Investments and High-Yield Dividends

Key Projects in Suriname and Natural Gas Expansion Drive Future Growth as TotalEnergies Balances Profitability and the Energy Transition | That's TradingNEWS

TotalEnergies (NYSE: TTE): A Strategic Overview of Growth, Dividends, and Energy Transition

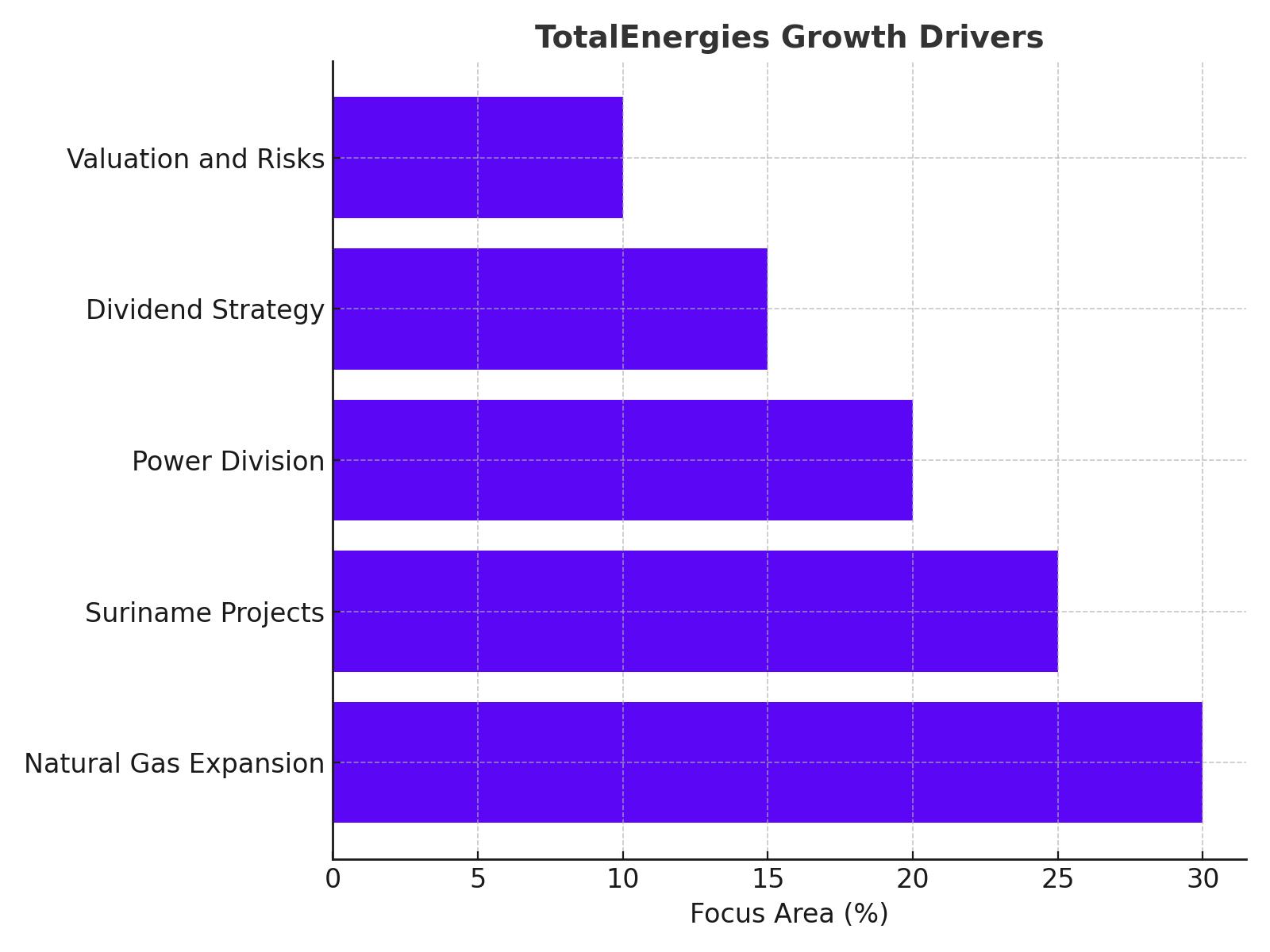

Natural Gas Expansion and Opportunities in North America

TotalEnergies (NYSE: TTE) continues its expansion into the North American natural gas sector, particularly the Eagle Ford Basin. This represents a significant opportunity for the firm as North America boasts some of the world's lowest natural gas production costs. CEO Patrick Pouyanné highlighted the potential in North America during the Q2 earnings call, citing that while Europe’s demand is temporarily stable, North America's cost advantages make it a competitive player in global gas exports.

The strategic entry into the Eagle Ford enhances TotalEnergies' gas portfolio and positions the company to tap into the growing global demand for cleaner-burning natural gas. Despite European gas reserves being full, North America’s lower-cost production base could provide competitive export pricing, making this segment a future growth driver.

Suriname and Venus Projects: A Vision for 2028 and Beyond

The Suriname and Venus offshore oil discoveries stand as major pillars of TotalEnergies' long-term production strategy. Both projects are anticipated to start production by 2028, with the Suriname development alone expected to contribute significantly to the company’s reserves. Recent investor presentations reaffirmed the 2028 timeline, and while rumors of merging the block with other projects circulate, management remains focused on executing these projects independently for now.

In Venus, TotalEnergies has also made progress, with additional data strengthening the project’s viability. Collaborating with smaller companies through carried interest agreements, Total is preparing for first oil in the coming years. These projects reinforce the company’s commitment to its upstream operations, which remain a core revenue generator despite its diversification into renewables.

New Projects Coming Online and Portfolio Management

TotalEnergies has several significant projects expected to come online in 2024, which will further bolster production. However, what sets TotalEnergies apart from many of its competitors is its disciplined portfolio management. The company’s focus on selling mature, higher-cost projects and reinvesting in lower-cost, higher-return ventures ensures continued operational efficiency. This approach allows the company to maintain its reputation as a low-cost producer in the energy space.

The combination of new projects and the sale of older, less profitable assets accelerates the company’s growth trajectory. Technological advancements and reworks help mitigate rising costs, but TotalEnergies strategically sells assets as they mature, contributing to the overall health of its balance sheet.

Integrated Power Division: A Unique Growth Area

Unlike many of its competitors, TotalEnergies has a dedicated integrated power division, which continues to grow in significance. This division, which focuses on renewable energy, power generation, and storage, is a testament to the company’s forward-looking strategy. Notably, TotalEnergies is expanding its power investments even in regions like Texas, where regulatory environments for green energy investments are challenging.

This division is expected to generate significant returns for TotalEnergies in the coming years, especially as global demand for cleaner energy solutions grows. By ensuring these investments are not treated as loss leaders, TotalEnergies is positioning itself as a leader in the energy transition without sacrificing profitability.

Dividend Strategy and Shareholder Returns

For income-focused investors, TotalEnergies remains an attractive choice. The company has consistently returned large portions of its free cash flow to shareholders. The most recent dividend of $0.39 per share reflects its commitment to rewarding investors, with an estimated forward yield of around 5%. Special dividends and share buybacks have also become integral parts of the company’s strategy.

In the first half of 2024 alone, TotalEnergies repurchased $380 million worth of its shares. With an expected free cash flow of $34 billion for the year, the company has ample room to continue these shareholder returns. Management has committed to maintaining a 40% payout ratio, ensuring that dividends remain sustainable while preserving capital for reinvestment in growth projects.

Valuation and Risks

TotalEnergies currently trades at a forward P/E ratio of 7.8x, significantly lower than competitors like ExxonMobil and Chevron, which trade at 14.6x and 14.9x, respectively. This undervaluation provides a margin of safety for investors. However, it is important to note that the lower valuation is partially driven by the company’s exposure to political risks, particularly in Europe and emerging markets like Brazil.

Government intervention remains a key risk, especially considering the Brazilian government’s significant stake in the company. Additionally, fluctuations in commodity prices, particularly oil and natural gas, can materially impact TotalEnergies' profitability

Final Thoughts: Is NYSE:TTE a Buy, Sell, or Hold?

TotalEnergies (NYSE:TTE) presents a compelling investment opportunity for investors seeking a balanced combination of growth and income. The company’s diversified portfolio, strong dividend policy, and strategic focus on high-growth areas like natural gas and renewables make it a solid option in the energy sector.

However, with geopolitical risks and commodity price volatility, TotalEnergies may not be suitable for risk-averse investors. For those willing to navigate these uncertainties, the stock offers both a solid dividend yield and potential for capital appreciation. Given its attractive valuation, strong pipeline of projects, and shareholder-friendly policies, TotalEnergies is a Buy for investors seeking exposure to the energy sector.

Explore more about TotalEnergies' stock and performance here. For insider transactions, click here.

That's TradingNEWS

Read More

-

SMH ETF: NASDAQ:SMH Hovering at $350 With AI, NVDA and CHIPS Act Fueling the Next Move

16.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: Can $1B Inflows Lift XRP-USD From $1.93 Back Toward $3.66?

16.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Falls to $3.80–$3.94 as Warm Winter Kills $5.50 Spike

16.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides, BoJ 0.50% Hike, Fed Cut and NFP Set the Next Big Move

16.12.2025 · TradingNEWS ArchiveForex