Toyota Motor Corporation (NYSE:TM): Is This Stock a Buy, Sell, or Hold?

Toyota’s Financial Strength and Market Performance

Toyota Motor Corporation (NYSE:TM) continues to dominate the global automotive industry with strong financials, technological advancements, and strategic positioning in key markets. Despite facing economic headwinds, the company has demonstrated exceptional resilience, reporting a net profit of ¥4.1 trillion ($27.5 billion) for the nine-month period ending December 2024. This impressive figure came despite a 4.2% decline in vehicle deliveries, proving Toyota’s ability to navigate industry challenges effectively.

The third-quarter results were particularly striking, with net profit soaring 62% year-over-year to ¥2.193 trillion ($14.21 billion), significantly exceeding analyst expectations. Revenue increased 2.9% to ¥12.391 trillion ($80.4 billion), reflecting the company’s ability to maintain growth despite market volatility. As a result, Toyota raised its annual earnings forecast, now expecting an operating profit of ¥4.7 trillion ($30.7 billion) for the fiscal year.

One of Toyota’s key financial advantages is its disciplined cost management. The automaker has leveraged its global supply chain to maintain stable margins, benefiting from a weakened Japanese yen, which has improved export competitiveness. Free cash flow remains strong, supporting continued investments in new technologies and shareholder returns through dividends and share buybacks.

Toyota’s Innovation in Hybrid and Electric Vehicles

Toyota has long been a leader in hybrid technology, and this segment continues to be a major growth driver. Hybrid sales exceeded 3.5 million units in 2024, reinforcing the company’s dominance in fuel-efficient vehicles. Unlike many competitors, Toyota has balanced its approach to electrification by focusing on both hybrid and battery-electric vehicles (BEVs), giving it an edge in markets where charging infrastructure remains underdeveloped.

Looking forward, Toyota is aggressively expanding its BEV lineup. A key development is the establishment of a wholly owned subsidiary in Shanghai dedicated to producing Lexus-branded EVs. The facility, set to begin operations in 2027, will have an annual production capacity of 100,000 vehicles. This move signals Toyota’s commitment to strengthening its position in China, the world’s largest EV market.

Another groundbreaking advancement is Toyota’s work on solid-state batteries. The company has over 1,000 patents related to this next-generation technology, positioning it as a leader in the space. Toyota plans to start production of solid-state batteries by 2026, promising significantly longer range and shorter charging times compared to conventional lithium-ion batteries. This technology could be a game-changer, giving Toyota a substantial competitive advantage over rivals like Tesla (NASDAQ:TSLA), which is still focused on lithium-ion solutions.

Comparing Toyota (NYSE:TM) to Tesla (NASDAQ:TSLA) on Valuation

Toyota’s P/E ratio of 7.7x is shockingly low compared to Tesla’s 175x TTM P/E, highlighting the significant valuation gap between the two automakers. Tesla’s high valuation is largely driven by its growth narrative, whereas Toyota’s stability and profitability make it a strong long-term investment.

Looking at market cap per vehicle produced, Toyota trades at $24,478 per car, whereas Tesla is valued at $650,084 per car—a staggering 24.5x premium. This suggests that Tesla’s stock price factors in unrealistic future growth expectations, while Toyota remains a fundamentally strong, undervalued company.

Another critical metric is R&D spend as a percentage of market cap. Toyota dedicates 3.25% of its valuation to R&D, investing significantly in AI, solid-state batteries, and hydrogen technology. In contrast, Tesla’s R&D spend is only 0.39% of its market cap, indicating that Toyota is delivering more innovation per dollar spent.

Toyota’s Position in the Global Trade Landscape

With the escalating U.S.-China trade war, Toyota is well-positioned to navigate potential tariff-related disruptions. The company’s global manufacturing footprint, particularly its U.S. production facilities, shields it from the 25% tariffs on imported vehicles that could impact competitors like Nissan (OTCPK:NSANY) and European automakers.

In contrast to Tesla, which relies heavily on China for production, Toyota benefits from a diversified supply chain. The weak Japanese yen further strengthens its global competitiveness, making its exports more attractive in international markets.

Could Toyota’s Global Strategy Make It the Biggest Winner in the Auto Industry?

Toyota’s multi-pronged strategy—which includes hybrid dominance, EV expansion, and solid-state battery leadership—positions the company for long-term success. The auto industry is evolving, and Toyota’s decision to balance hybrid and EV production while investing in next-gen battery technology could make it the most profitable automaker of the next decade.

While Tesla and BYD (OTCPK:BYDDY) battle for dominance in the battery-electric market, Toyota’s diversified approach ensures it remains a powerhouse regardless of which technology wins. Hybrid sales continue to surge, and its solid-state battery advancements could leapfrog Tesla by delivering superior EV technology before the end of the decade.

Should Investors Buy, Sell, or Hold NYSE:TM?

Toyota’s low valuation, strong financials, and leadership in emerging technologies make it a compelling BUY for long-term investors. The 7.7x P/E ratio, 3.25% R&D-to-market-cap investment, and solid-state battery advancements position it as one of the most undervalued stocks in the auto industry.

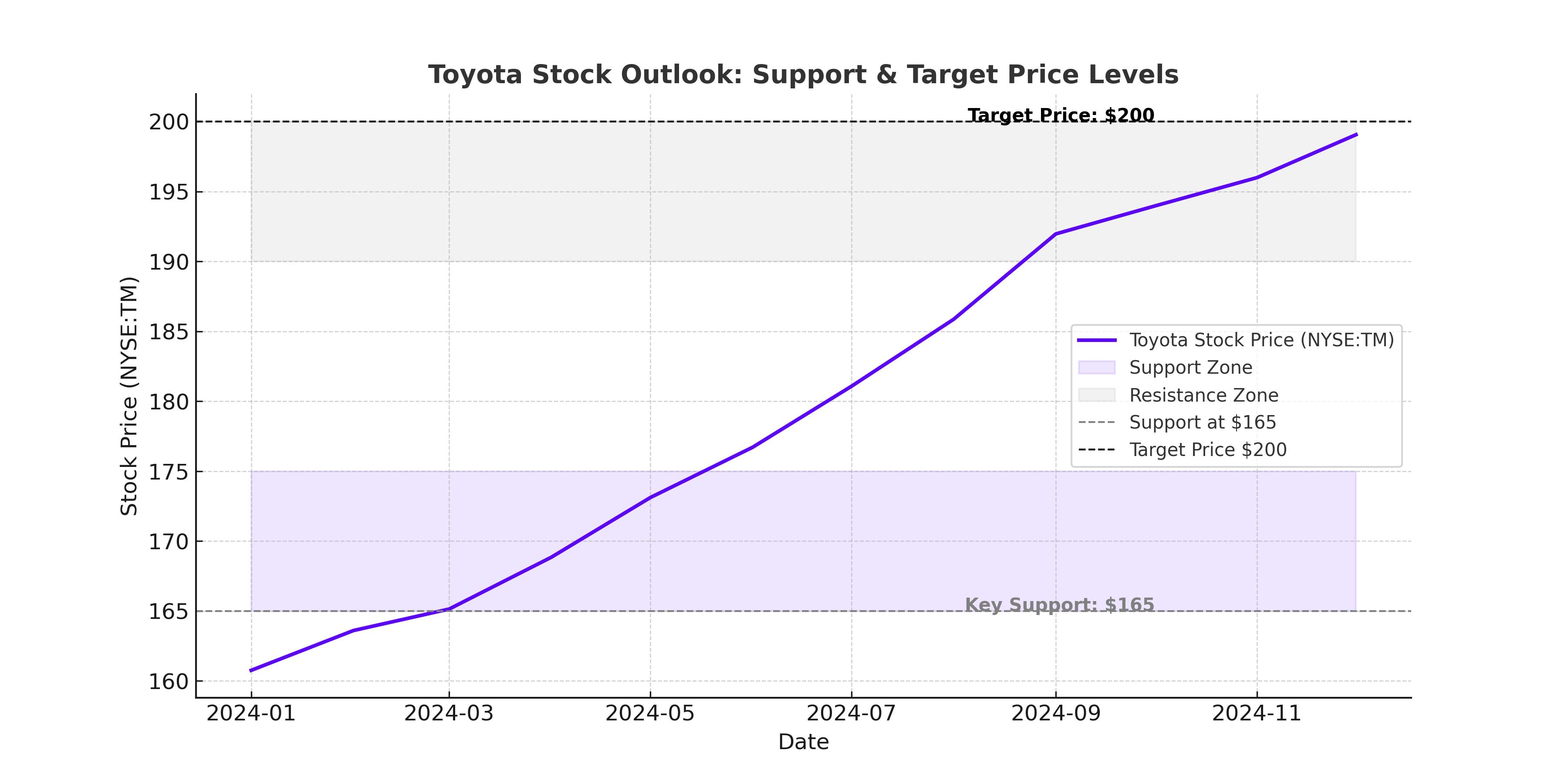

Short-term risks include potential macroeconomic headwinds and global trade uncertainty, but Toyota’s global footprint and strategic positioning provide a buffer against these challenges. If the stock remains undervalued while executing on its EV expansion plans, Toyota could see 25-30% upside over the next two years.

For investors looking for a fundamentally strong automaker with long-term growth potential, Toyota (NYSE:TM) is a buy. Its innovation in hybrid technology, AI-powered automation, and solid-state batteries make it one of the most strategically well-positioned companies in the industry. With a 2.8% dividend yield, share buybacks, and a market-leading R&D budget, Toyota is a stock that offers both stability and high-growth potential.