TradingNEWS 2024 Market Analysis:USD and Global Economic Shifts

Decoding the USD Index Surge and Its Global Ripple Effects: A Deep Dive into Currency and Commodity Markets | That's TradingNEWS

Exploring Recent Currency and Commodity Market Trends

Surge in the USD Index: Analyzing the Impact

The U.S. Dollar Index (DXY) experienced a notable surge, reaching new 2024 highs near 103.70. This rise is attributed to the gains in U.S. yields across various maturities. A critical factor to consider is the resilience of the U.S. economy, which will be further tested with upcoming data releases. These include Housing Starts, Building Permits, and the Philly Fed Manufacturing Index. The impact of these indicators on the greenback's strength should be closely monitored.

EUR/USD Dynamics: ECB's Stance and Market Implications

The Euro fell to multi-week lows, hovering around the 1.0840 mark, primarily driven by the strength of the USD. Additionally, European Central Bank (ECB) officials' comments have dampened expectations for interest rate cuts in the first half of 2024. The market awaits the ECB’s Accounts of its latest meeting and President Lagarde's speech at the WEF in Davos, which could provide further insights into the Eurozone's monetary policy direction.

GBP/USD Movement: Influence of UK Inflation Figures

The British pound showed resilience, supported by higher-than-expected UK inflation figures for December. This data helped the GBP/USD pair to register gains. The inflation numbers, rising to 4.0%, indicate underlying pressures in the economy, suggesting that the Bank of England might adopt a more cautious approach to rate cuts.

USD/JPY and AUD/USD: A Tale of Two Currencies

USD/JPY witnessed a significant upward movement, crossing the 148.00 mark. This trend was fueled by the overall strength of the U.S. dollar and the momentum in U.S. yields. Conversely, the Australian dollar faced selling pressure, with AUD/USD falling to six-week lows near 0.6520. This decline reflects the impact of the dollar's dynamics and disappointing data from China.

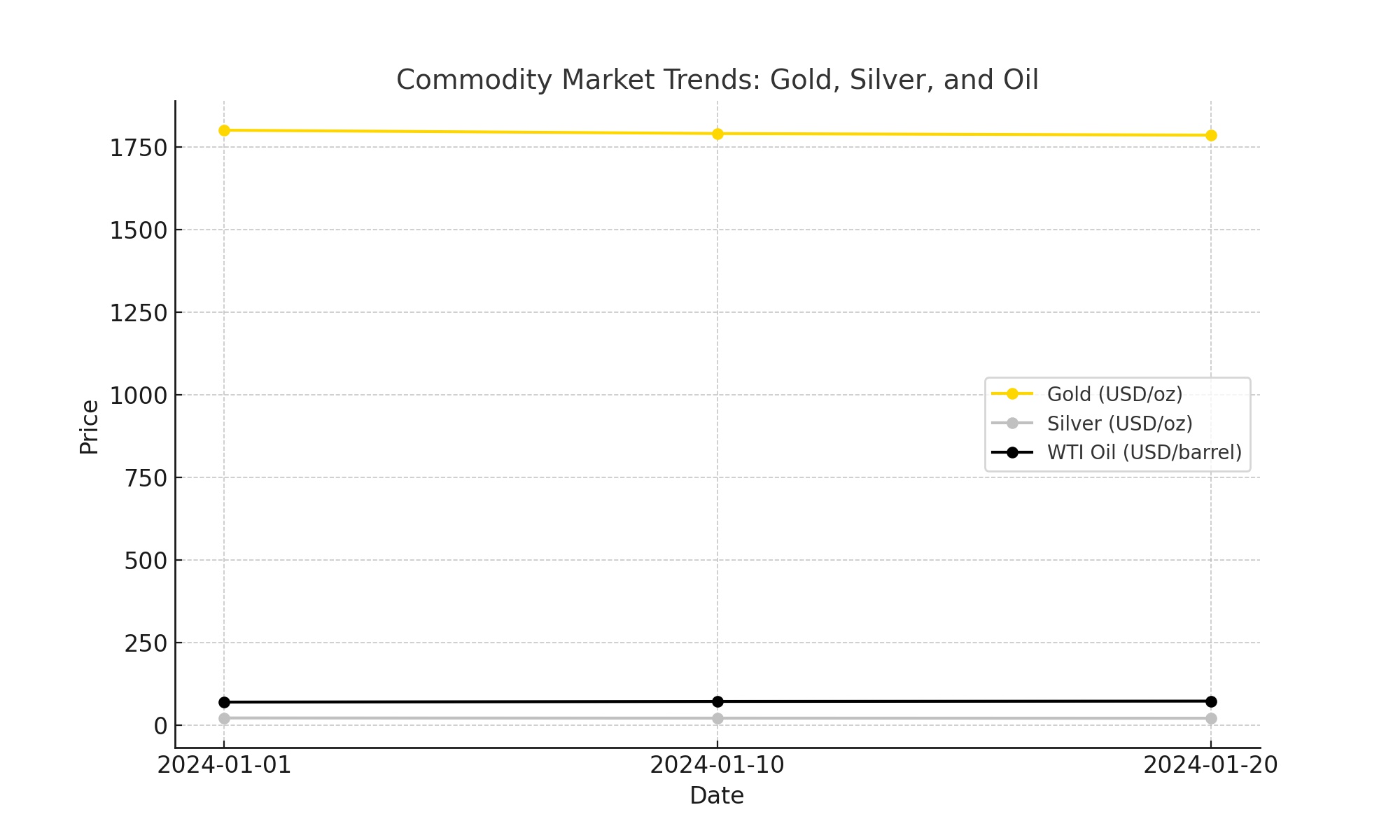

Commodities Overview: Gold, Silver, and Oil Prices

The surge in the U.S. dollar and rising U.S. yields have negatively impacted Gold and Silver prices. On the other hand, West Texas Intermediate (WTI) crude oil prices exceeded the $72.00 mark per barrel. This increase is partially a reaction to positive reports from OPEC, countering the impact of weaker data from China and the stronger dollar.

Fed's Policy and Market Sentiments

The U.S. retail sales data, showing a 0.6% increase, has been a key driver in reinforcing the dollar's strength. This data, indicating economic robustness, has reduced the likelihood of immediate rate cuts by the Federal Reserve. Market participants are reassessing the chances of a rate hike in March, with the CME's FedWatch tool showing a shift in expectations.

Global Market Perspectives: Stocks, Yields, and Cryptocurrencies

Most stock markets, especially in Asia, have trended lower, influenced by disappointing Chinese GDP and retail sales data. In the Forex market, the U.S. Dollar emerged as the strongest major currency, particularly against the Australian Dollar and Japanese Yen. The bond market, particularly the long-end treasuries, remains a critical area to watch, as it may signal broader market movements. Cryptocurrencies like Bitcoin have also seen a downturn, aligning with the overall risk-off sentiment in global markets.

Future Outlook: Anticipating Economic Data Releases

Investors and traders should closely monitor upcoming high-impact economic data releases, including U.S. Retail Sales and Australian Unemployment figures. These reports could significantly influence currency and commodity markets, providing fresh insights into global economic trends.