TradingNEW Complexities of Global Oil Markets

Unpacking the Interplay Between Geopolitical Developments, Economic Data, and OPEC+ Decisions on Oil Prices | That's TradingNEWS

Analyzing the Impact of Market Dynamics on Oil Prices

Overview of Current Oil Market Trends

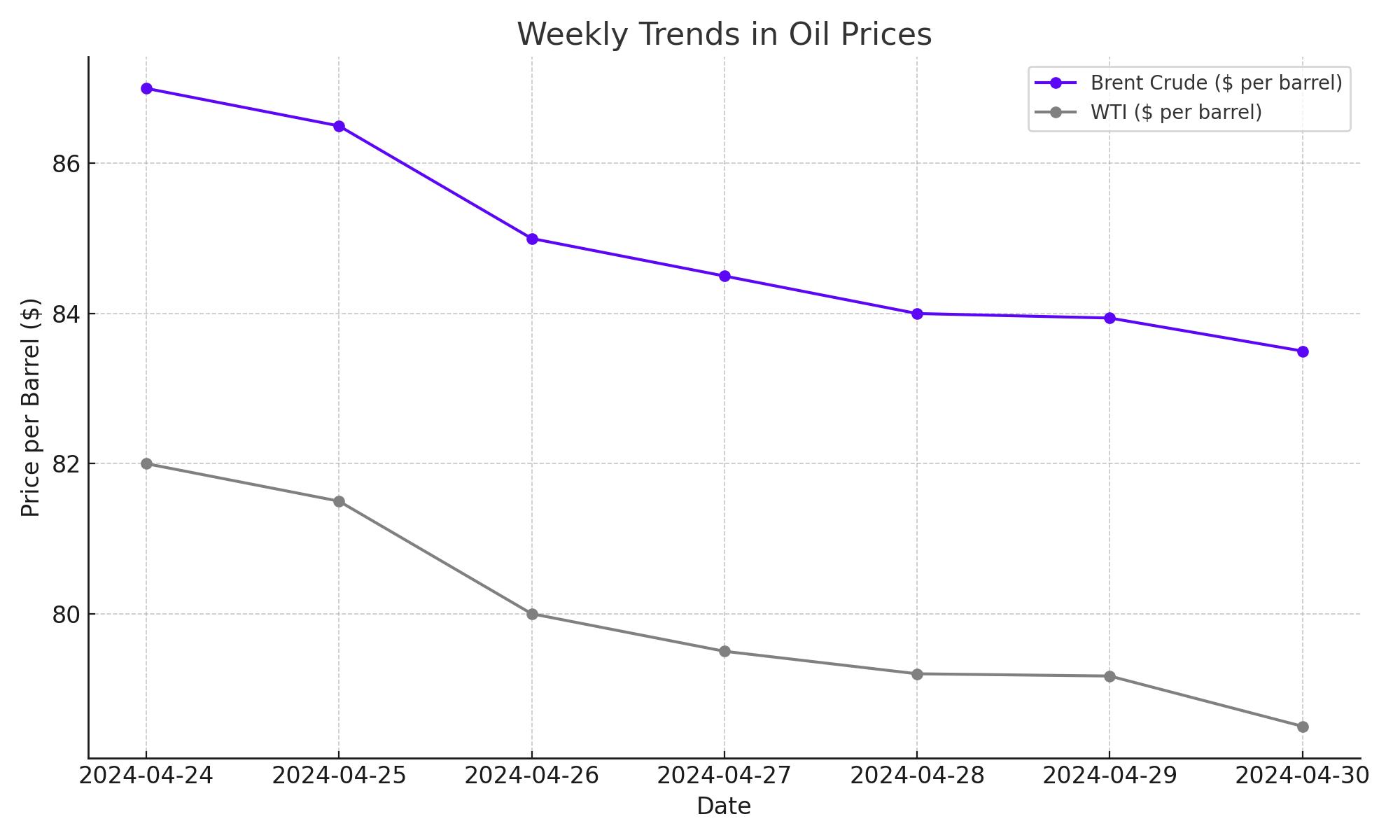

The past week has witnessed a significant downturn in oil prices, with both major benchmarks, Brent Crude and West Texas Intermediate (WTI), experiencing notable declines. As of the last check, Brent Crude fell to $83.94 per barrel, marking a 6.2% decrease, while WTI dropped to $79.17 per barrel, down by 5.6%. These shifts reflect broader market responses to geopolitical developments and economic forecasts.

Geopolitical Influences and Economic Indicators

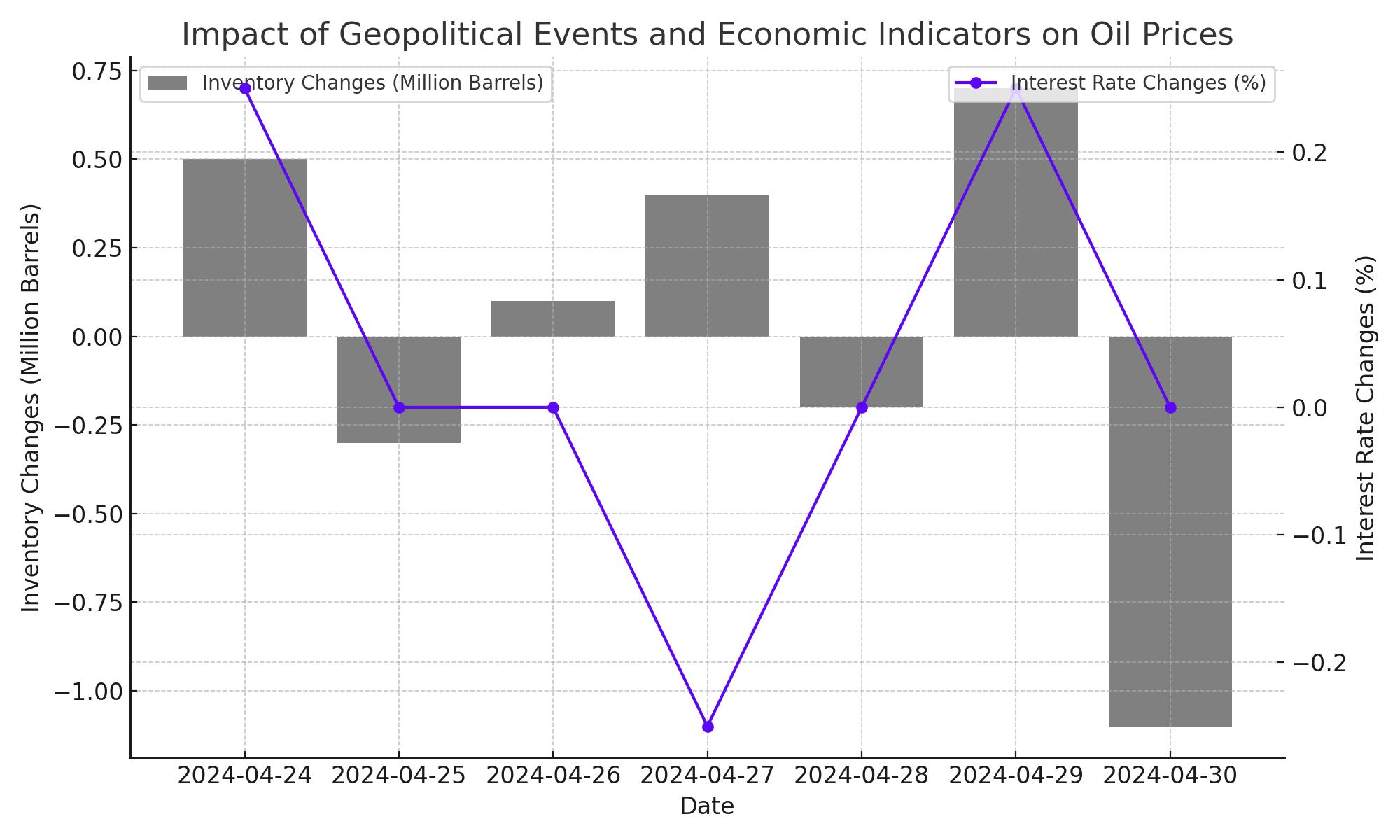

Initial optimism about a potential ceasefire between Israel and Hamas suggested a de-escalation in the Middle East, alleviating fears of supply disruptions that had previously driven prices upward. However, the geopolitical landscape remains volatile, with Israeli Prime Minister Benjamin Netanyahu's recent statements and actions injecting uncertainty back into the region.

In the U.S., the Energy Information Administration (EIA) reported an unexpected increase in crude oil inventories, with a rise of 7.3 million barrels, contrasting with the forecasted decline. This inventory build suggests a softening in U.S. demand, further pressured by the Federal Reserve's decision to maintain current interest rate levels, thereby strengthening the U.S. dollar and making oil more expensive for foreign currency holders.

Market Reactions and Future Projections

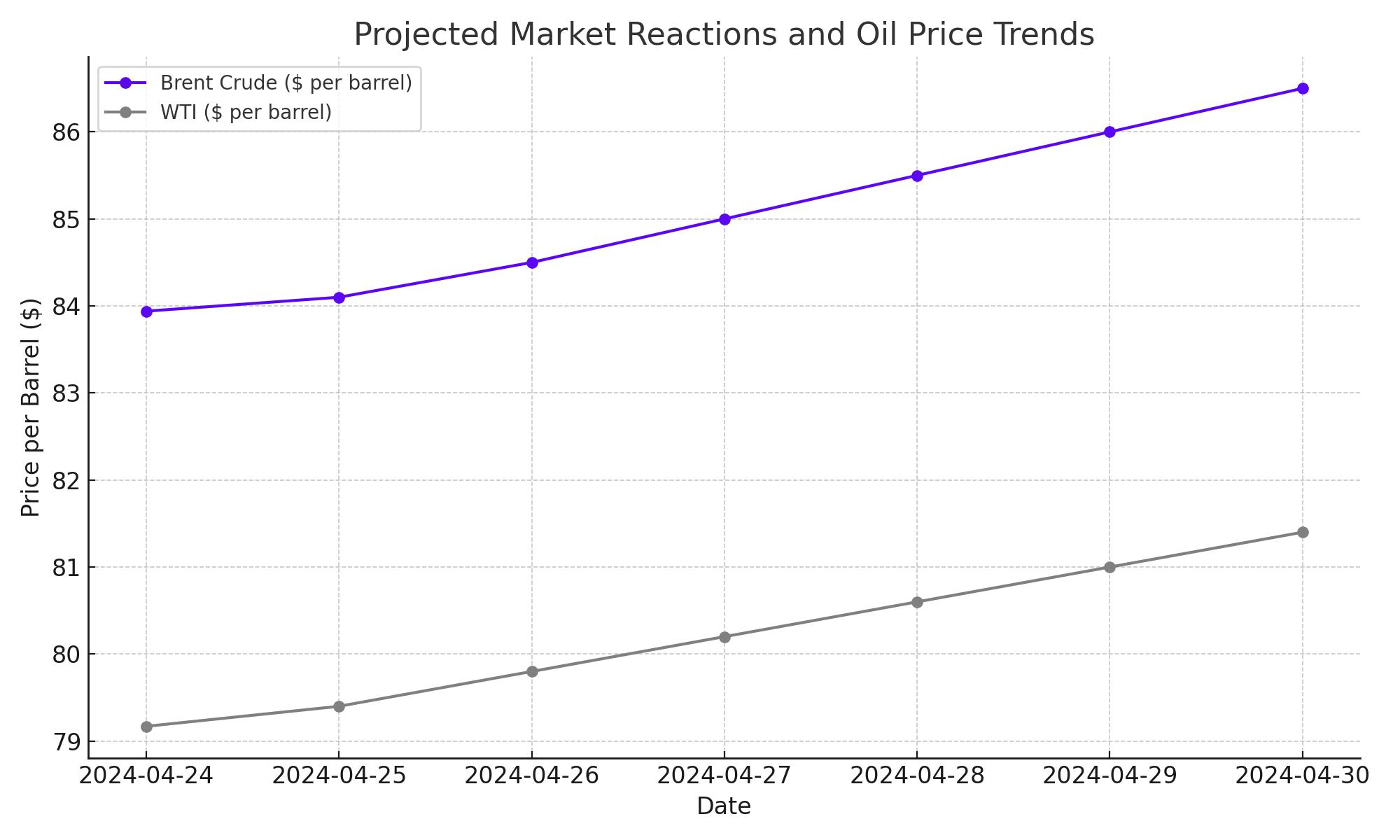

The combination of increasing U.S. oil inventories and high-interest rates has created a challenging environment for oil prices. The potential for reduced global demand, compounded by robust U.S. production levels, has led to the lowest oil prices in seven weeks. Looking forward, the market's focus is on the upcoming OPEC+ meeting. There is speculation that OPEC may continue its current production cuts to bolster prices if demand does not show significant recovery.

Technical Analysis and Market Sentiments

From a technical standpoint, WTI Crude's recent performance has breached several support levels, now testing new lows around the $77.93 mark. Key resistance points are set at $80.33 and $81.89, with further support near $77.52. Market sentiment is cautious, with the Relative Strength Index (RSI) indicating potential oversold conditions, which could presage a pricing correction depending on upcoming market catalysts.

Market Outlook: Bullish Factors Amidst Volatile Oil Prices

Current Trends and Future Expectations

The oil market is at a critical juncture, with Brent crude trading at $83.94 per barrel and WTI at $79.17 per barrel, reflecting significant weekly drops of 6.2% and 5.6%, respectively. These figures underscore a cautious sentiment driven by recent geopolitical developments and economic indicators. However, forward-looking investors and market analysts are pinpointing potential bullish signals amidst the prevailing bearish trends.

Bullish Indicators in a Bear Market

Despite the downturn, several factors could pivot the market towards a bullish scenario:

-

OPEC+ Influence: The OPEC+ alliance has a history of stabilizing the market through strategic production cuts. With the group meeting on June 1st, there is a possibility of extending or deepening cuts beyond the current 2.2 million barrels per day. Such decisions could significantly tighten global supply and bolster prices.

-

Geopolitical Developments: The oil market is notably sensitive to Middle Eastern dynamics. Any positive progression towards a ceasefire between Israel and Hamas could stabilize the region, reducing the risk premium currently priced into oil. Moreover, easing tensions could prevent further disruptions in major oil routes, particularly through the Red Sea, where concerns have spiked due to potential conflicts.

-

Economic Data and Demand Recovery: As countries rebound from pandemic-induced slumps, oil demand is expected to rise. The recent U.S. crude inventory build, while initially seen as a bearish indicator, also reflects a ramp-up in refinery activity, suggesting anticipatory moves for increased fuel demand in the upcoming driving season.

Strategic Considerations for Investors

Given these dynamics, traders should not only brace for short-term volatility but also prepare for potential upswings. Market sentiment can shift quickly with any news indicating a stronger-than-expected global economic recovery or deeper compliance with oil production cuts from major producers. Moreover, the U.S. Federal Reserve's future decisions on interest rates will be pivotal; a dovish turn could weaken the dollar, making crude cheaper on the global market and potentially driving up demand.