TradingNEWS Navigating Through Inflation,Growth and Central Bank Policies

Unveiling the Complexities of Global Economies: From Eurozone Inflation to U.S. AI-Driven Growth and Beyond | That's TradingNEWS

The Global Economic Outlook: Inflation and Central Bank Strategies

As the world economy stands at a critical juncture, with major economies grappling with the twin challenges of controlling inflation and sustaining growth, central banks globally are recalibrating their monetary policies in response to evolving economic indicators. This period marks a pivotal moment, notably with the anticipation of rate cuts by central banks including the U.S. Federal Reserve (Fed), the European Central Bank (ECB), and others, signaling a potential shift in the global economic tide.

The European Economic Scenario: A Mixed Bag

Inflation Trends Across the Eurozone

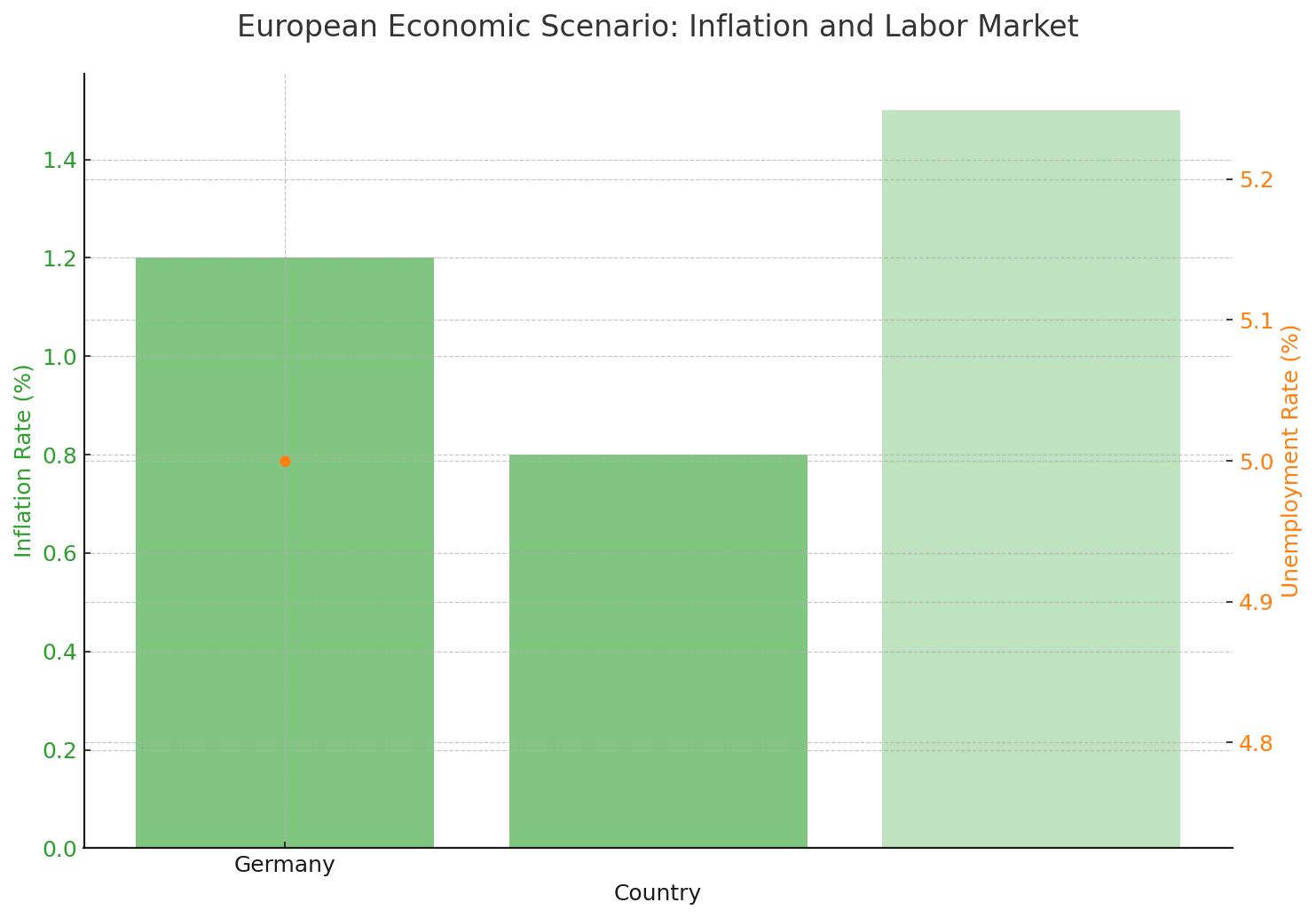

European markets have shown resilience amidst fluctuating economic signals. France and Italy, in particular, have exhibited varying inflationary trends, with France experiencing a deceleration in inflation, attributed to slower growth in food and fresh product prices. Conversely, Italy's inflation has remained subdued, primarily due to a reduction in housing and utilities costs. These divergent trends underscore the complex inflationary landscape across the Eurozone, necessitating nuanced policy responses from the ECB.

Germany's Labor Market Challenges

Germany's labor market has faced significant headwinds, evidenced by a rise in unemployment figures. The persistence of high unemployment rates, despite economic stimulus measures, highlights the underlying structural issues within Europe's largest economy.

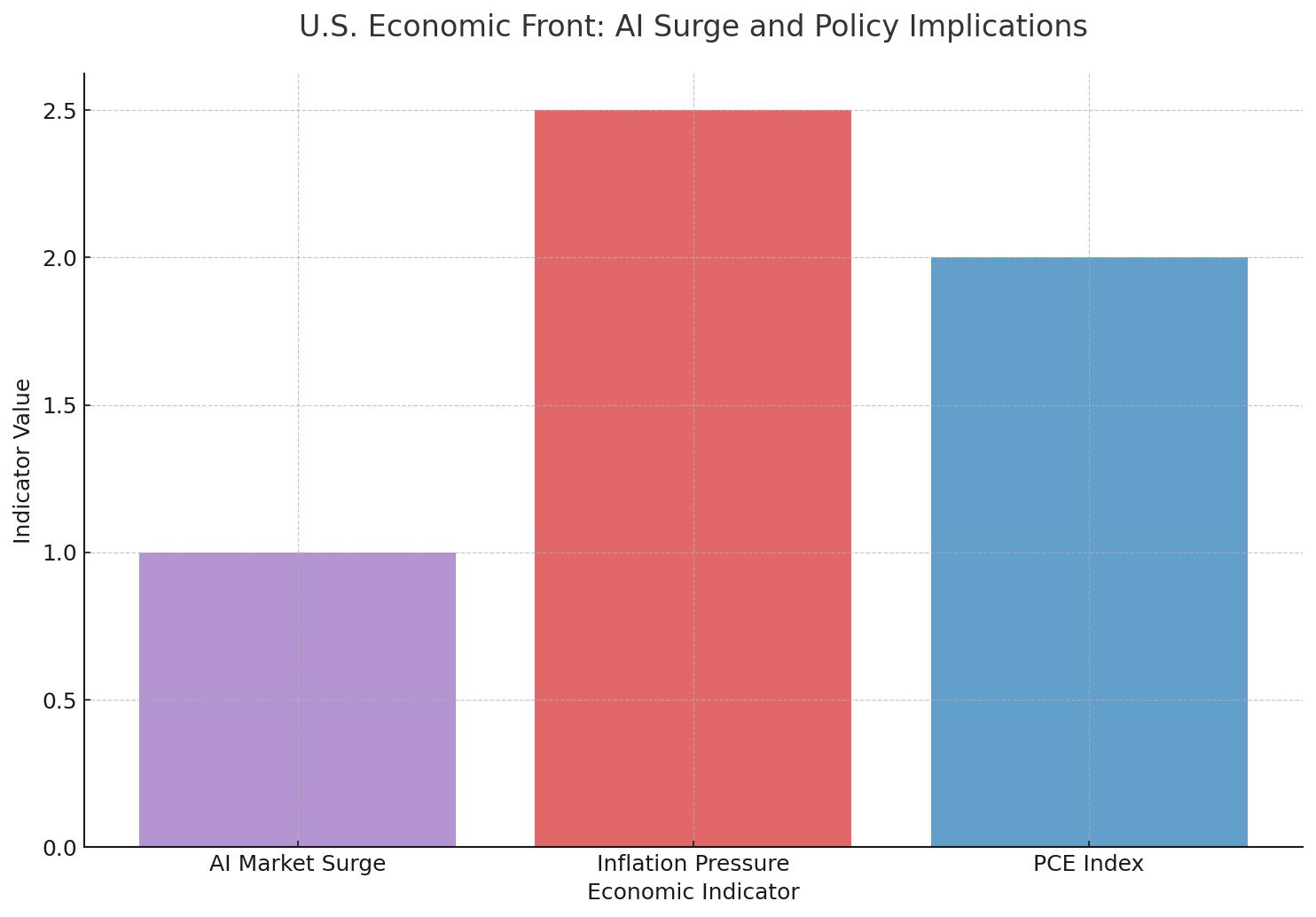

The U.S. Economic Front: AI Surge and Policy Implications

Federal Reserve's Strategic Pivot

The U.S. economy, buoyed by an AI-driven surge in market activity, has prompted the Fed to signal a forthcoming adjustment in interest rates. Despite the re-emergence of inflationary pressures, the Fed's nuanced approach towards rate adjustments reflects its commitment to achieving a 'soft landing', balancing inflation control with economic growth. The Fed's latest projections indicate a cautiously optimistic outlook, with anticipated growth adjustments in light of current economic data.

Inflation and Consumption Trends

The U.S. Personal Consumption Expenditure (PCE) Index, a critical measure of inflation, remains a focal point for policy deliberations. The trajectory of the PCE index will significantly influence the Fed's policy direction in the coming months, with any deviations from expected trends likely to prompt reassessment of rate adjustments.

The UK Economic Landscape: Post-BOE Signal Analysis

The Bank of England's (BOE) recent signaling towards rate cuts has injected a measure of optimism into the UK market. However, the economy's underperformance relative to its European and U.S. counterparts, exacerbated by a downturn in mining stock performance, has cast a shadow over the potential for a robust recovery. The forthcoming GDP data will be pivotal in shaping the BOE's policy trajectory, with a focus on mitigating recessionary pressures.

Asia-Pacific Economic Dynamics: Japan and Australia in Focus

Japan: Monetary Policy Shifts

Japan's economy has demonstrated remarkable resilience, with the Bank of Japan (BOJ) making strategic adjustments to its monetary policy framework. The shift away from negative interest rates signifies a broader recalibration of Japan's economic strategy, aimed at sustaining growth while managing inflationary pressures. The Tokyo Core CPI data emerges as a critical indicator of Japan's inflation trajectory, with potential implications for the BOJ's future policy direction.

Australia's Inflation Outlook

Australia's economy, characterized by a robust labor market and controlled inflation, presents a unique case study in economic resilience. The Reserve Bank of Australia's (RBA) decision to maintain steady interest rates reflects confidence in the economy's underlying strength. However, the evolving inflation landscape, as indicated by upcoming CPI data, will be crucial in guiding the RBA's policy adjustments.

Conclusion: Navigating Uncertainty with Prudent Policy Making

As global economies navigate through a landscape marked by inflationary pressures, labor market challenges, and geopolitical uncertainties, the role of central banks in steering economic policy becomes increasingly paramount. The delicate balance between fostering growth and controlling inflation requires a nuanced understanding of economic indicators and a willingness to adapt policy frameworks in response to emerging trends. The coming months will be critical in shaping the global economic trajectory, with central banks playing a pivotal role in navigating these turbulent waters.