Taiwan Semiconductor Manufacturing Company (NYSE:TSM) Stands Strong Amid Geopolitical Risks and AI Boom

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has cemented itself as an indispensable player in the semiconductor industry, particularly as the demand for advanced chips surges in the face of growing artificial intelligence (AI) adoption. The company’s exceptional manufacturing capabilities, market-leading 3nm and 5nm chips, and technological expertise place it in the prime position to capture a significant share of the AI market. Yet, with its dominant position comes risk, especially from increasing geopolitical pressures and competition. Despite these challenges, TSMC’s robust financials and market share provide a solid foundation for future growth, with the company positioned to continue benefiting from the AI arms race.

TSMC's Unmatched Manufacturing Capabilities: A Competitive Moat in the AI Industry

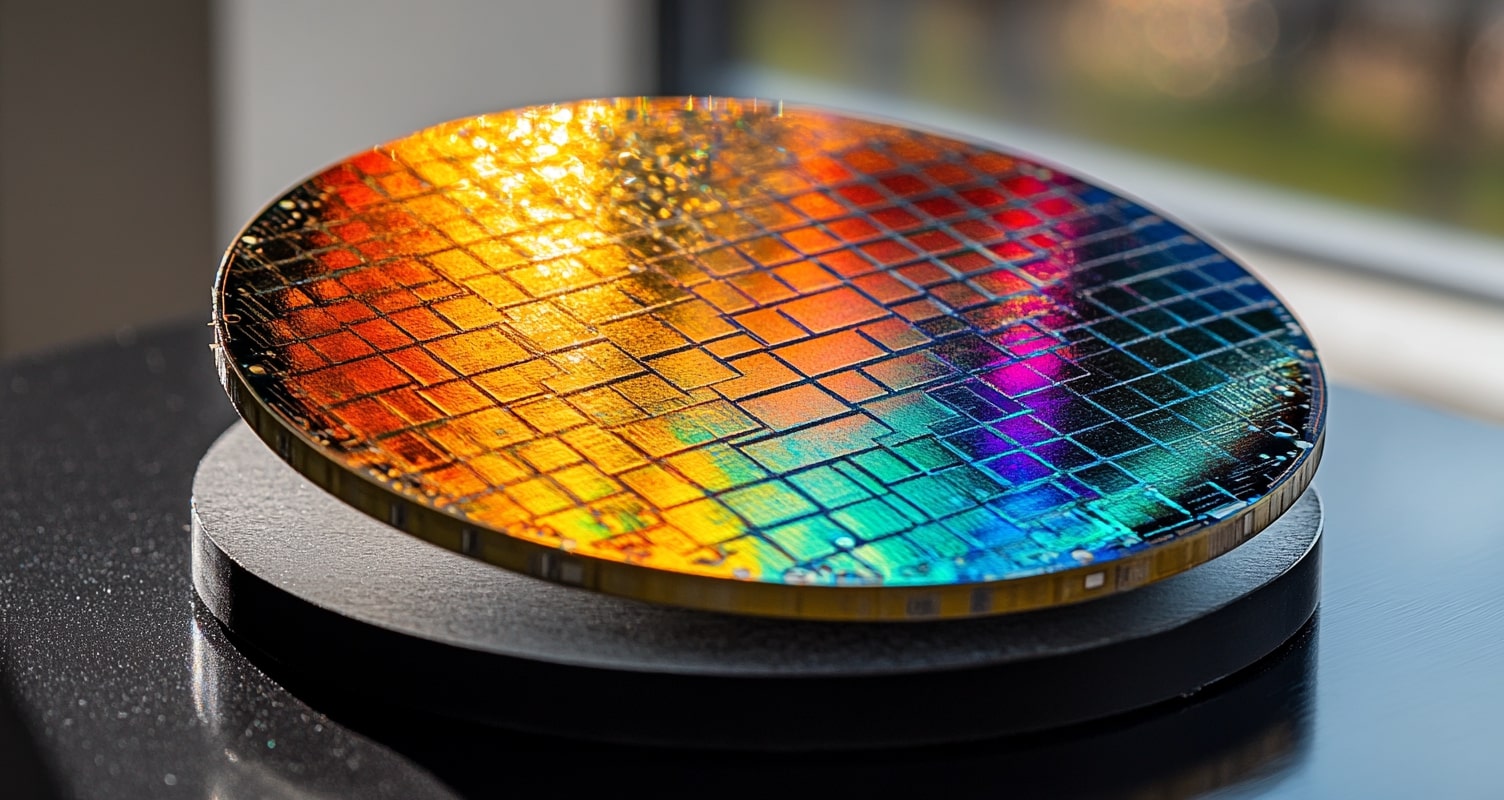

TSMC’s dominance in semiconductor manufacturing is unrivaled, largely due to its cutting-edge technology and extensive experience. The company has over three decades of expertise in refining semiconductor manufacturing processes, which has led to its ability to mass-produce advanced chips with remarkable yields. Unlike many of its competitors, TSMC has mastered the complex art of manufacturing 3nm and 5nm chips, which are in high demand due to their efficiency and performance, crucial for AI, robotics, and defense applications.

The company's technological edge is built on its unique combination of intellectual capital and massive capital investments, which are difficult for competitors to replicate. For instance, the cost of building and operating advanced semiconductor fabrication plants (fabs) has skyrocketed, with the price of a modern fab now exceeding $20 billion. Despite these enormous costs, TSMC’s financial strength, with capital expenditures exceeding $38 billion in 2024, allows it to maintain a dominant position in the market, expanding its capacity while staying ahead of competitors like Samsung and Intel.

Moreover, TSMC’s continued investment in R&D and process node development ensures it stays ahead of competitors, further cementing its leadership in the sector. The company’s 3nm and 5nm chips accounted for 26% and 34% of its wafer revenue in Q4 2024, demonstrating the increasing dominance of TSMC's advanced manufacturing in the high-performance computing sector.

The AI Boom: A Catalyst for TSMC’s Future Growth

As AI technologies like machine learning, natural language processing, and autonomous vehicles continue to advance, the demand for high-performance semiconductors has skyrocketed. TSMC is ideally positioned to capitalize on this demand due to its unmatched ability to manufacture the chips required for AI applications. The company’s 3nm chips, which are more efficient and powerful than older generations, have become essential for AI workloads, making TSMC the go-to foundry for companies like Nvidia, AMD, and Apple.

AI is fundamentally reshaping chip design, and although chip design processes have become more accessible through AI-driven design tools, the complexity of manufacturing these advanced chips remains immense. As chip design becomes easier, the demand for TSMC’s high-end manufacturing capabilities will only grow. TSMC’s ability to scale production and its strong relationships with major customers provide a solid foundation for long-term growth.

For example, TSMC’s advanced nodes accounted for 74% of its sales in 2024, a testament to its ability to dominate the high-performance chip market. With AI expected to grow at a compound annual growth rate (CAGR) of 40%, TSMC is poised to benefit immensely from the continued expansion of AI-related applications.

Geopolitical Risks: The Growing Threat of Taiwan-China Tensions

Despite its market dominance, TSMC faces significant geopolitical risks, particularly from the ongoing tensions between Taiwan and China. Taiwan is home to TSMC’s main operations, and any escalation in cross-straits tensions could have profound implications for the company’s business. A potential Chinese military action to seize Taiwan would likely disrupt TSMC’s operations and severely impact the global supply chain for advanced semiconductors.

In response to these risks, TSMC has taken steps to diversify its operations, including investing $100 billion in a new manufacturing facility in Arizona. This move aims to reduce the company’s reliance on Taiwan and mitigate potential risks arising from geopolitical instability. However, Taiwan will continue to be the hub for TSMC’s most advanced chip manufacturing, with 2nm and 1.6nm chips remaining in production at its Taiwanese facilities for the foreseeable future.

The political situation in Taiwan remains a significant risk for TSMC, and any escalation in tensions could lead to disruptions in its operations, affecting not only its financial performance but also its long-term strategic plans. As TSMC expands its presence in the US, it is attempting to strike a balance between geopolitical concerns and the need to maintain its leadership in semiconductor technology.

Financial Strength: Robust Earnings and Impressive Profit Margins

TSMC’s financial performance underscores its leadership in the semiconductor industry. In Q4 2024, the company reported net revenue of $26.88 billion, a 38.8% increase year-over-year, while net income grew by an even faster pace of 57%. TSMC’s gross margin stood at 59%, with an operating margin of 49%, both of which are exceptional figures for a manufacturing company of its size. The company’s strong profitability and high margins are a testament to its operational efficiency and technological leadership.

The company's balance sheet is also robust, with $73.7 billion in cash and no significant liquidity concerns. TSMC’s ability to generate substantial free cash flow allows it to continue investing heavily in R&D and expansion projects, further strengthening its competitive position.

Looking ahead, TSMC’s financial outlook remains strong, with the company expected to continue benefiting from the growth of AI and other high-performance computing applications. The company’s 3nm and 5nm chips are set to drive revenue growth in the coming years, with AI, high-performance computing, and mobile devices all contributing to TSMC’s growth trajectory.

Valuation and Investment Opportunity

Despite its dominance in the semiconductor market, TSMC’s stock is trading at a relatively attractive valuation. With a market capitalization of $777 billion and a forward P/E ratio of 19, TSMC is trading at a discount compared to other AI-focused hardware companies like ASML, which has a forward P/E of 39. Given the company’s dominant position in advanced chip manufacturing and its strong financials, TSMC presents an excellent investment opportunity for long-term investors.

The recent market sell-off has driven TSMC’s stock price down by over 20%, offering an attractive entry point for investors. As AI adoption accelerates and the demand for advanced chips continues to grow, TSMC’s stock is well-positioned for significant upside in the coming years. Analysts have a consensus price target of $235, representing a 35% upside from current levels, with some projections suggesting the stock could reach $250 in the next 12 months.

Conclusion

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) remains a dominant force in the semiconductor industry, poised to capture a significant share of the growing AI market. With its unmatched manufacturing capabilities, strong financial position, and strategic investments in the US, TSMC is well-positioned for long-term growth. However, the company must navigate significant geopolitical risks, particularly in Taiwan, while continuing to fend off competition from other industry giants. Despite these challenges, TSMC’s solid fundamentals, high margins, and attractive valuation make it an appealing investment for long-term investors.