U.S. Inventory Surprise: A Glimmer of Hope for Oil Markets

EIA Reports Larger-than-Expected Crude and Fuel Stock Draws, Highlighting Strong Demand and Supporting Bullish Price Projections | That's TradingNEWS

U.S. Inventory Surprise: A Glimmer of Hope

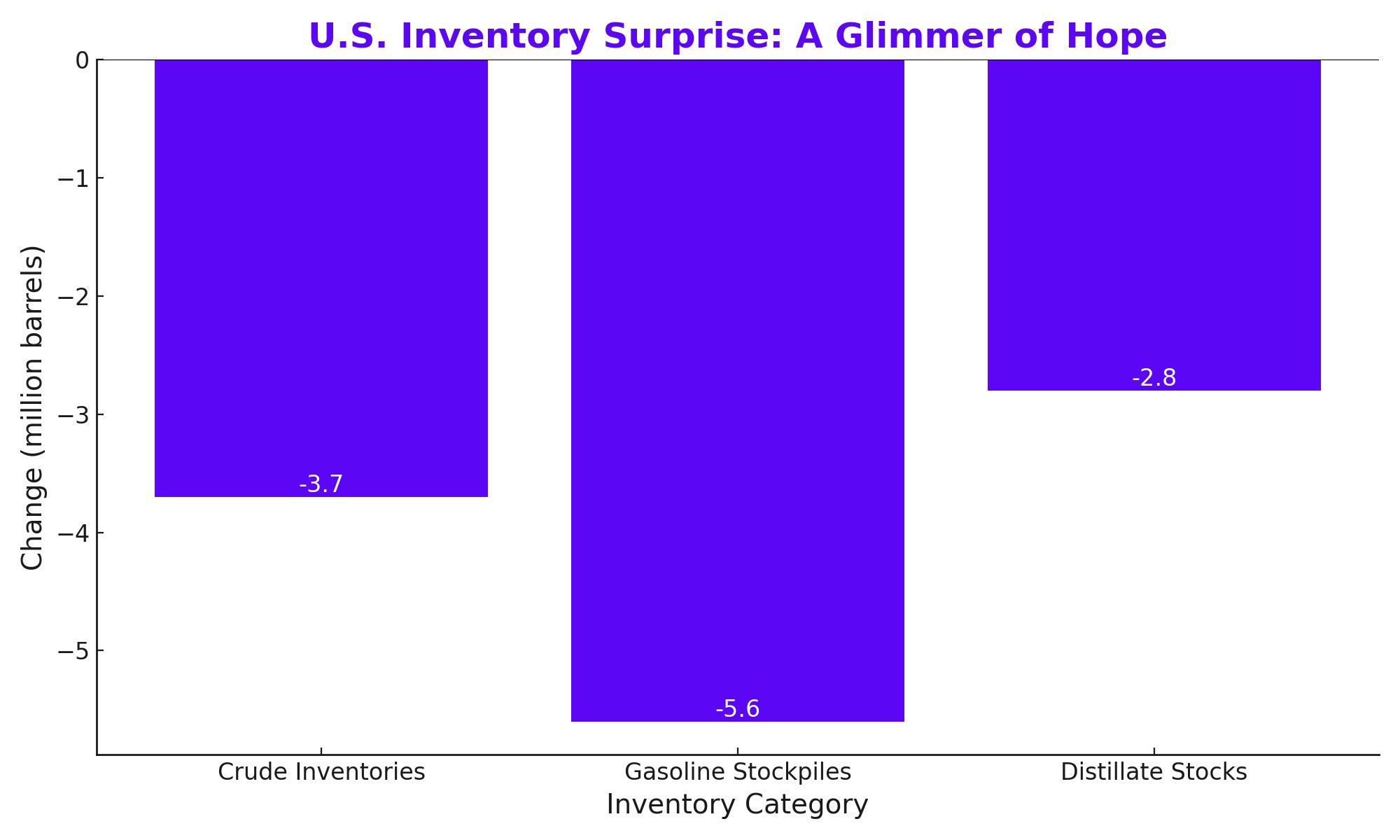

The crude oil market experienced significant turbulence this week, characterized by sharp fluctuations as traders reacted to a mix of economic data, global events, and shifts in supply-demand dynamics. Despite the volatility, one key development stood out: the positive U.S. inventory data. The Energy Information Administration (EIA) reported a larger-than-expected draw in crude and fuel stocks. Specifically, crude inventories fell by 3.7 million barrels, gasoline stockpiles decreased by 5.6 million barrels, and distillate stocks dropped significantly. These figures surpassed market expectations and underscored strong U.S. oil demand, which typically supports higher prices. However, the market's muted reaction to this bullish news indicated that other factors were influencing trading decisions.

Impact of Chinese Economic Slowdown on Oil Prices

Concerns about the Chinese economy, the world's largest importer of crude oil, weighed heavily on oil prices. Data from early July showed that China's total fuel oil imports fell by 11% in the first half of 2024. This decline raised alarms about the broader demand outlook in China. The People's Bank of China's decision to cut interest rates from 2.5% to 2.3% in an attempt to stimulate economic growth added to these concerns. Market analysts, such as Tamas Varga from PVM, highlighted that macroeconomic issues in China are dragging down commodity prices, including oil. This sentiment was echoed by Charalampos Pissouros from XM, who noted that if upcoming Chinese Purchasing Managers' Index (PMI) data continues to show economic weakness, it could further dampen oil demand and pressure prices.

Influence of Geopolitical Factors and Production Adjustments

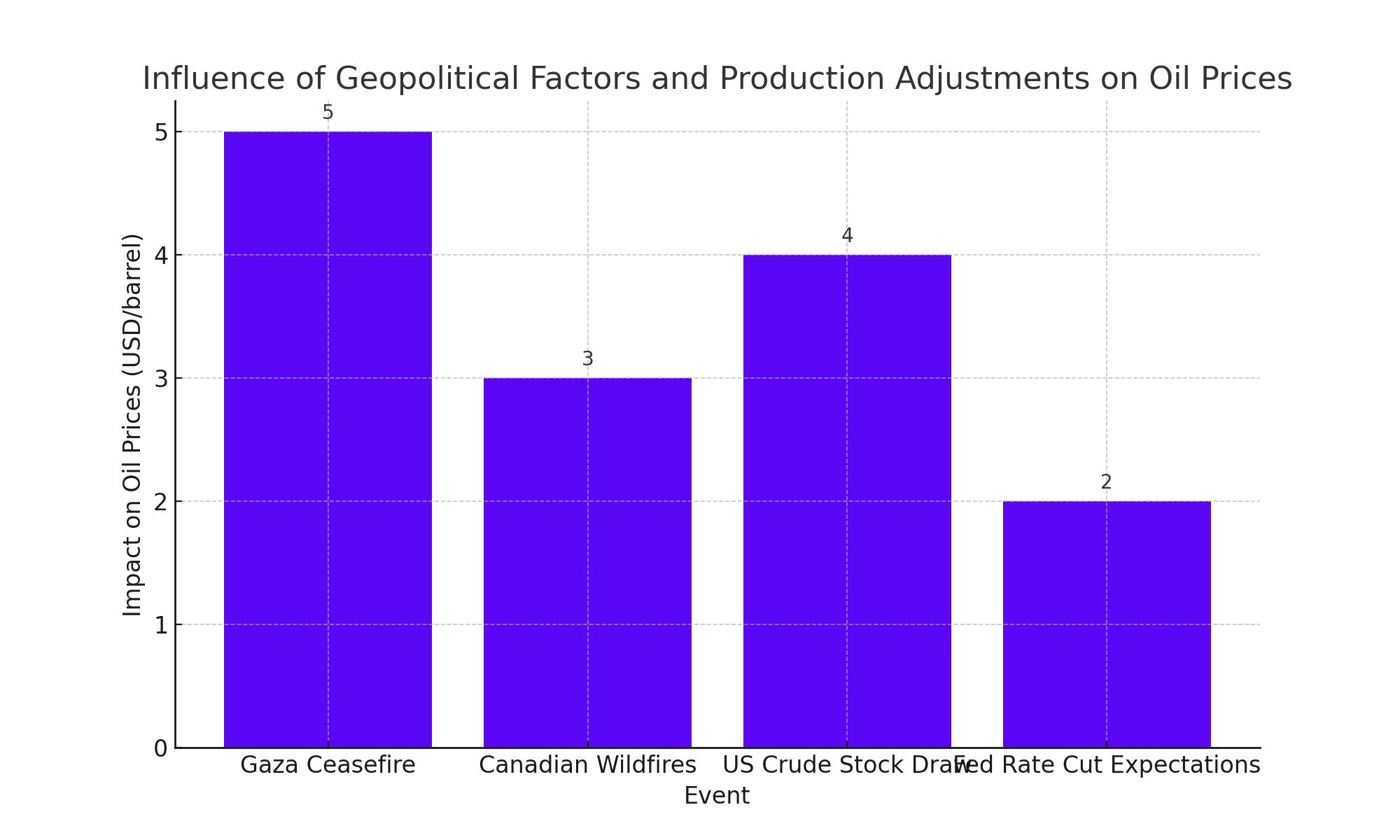

Geopolitical developments also played a crucial role in shaping oil market dynamics. Hopes for a ceasefire in Gaza, which had been under negotiation for months, appeared closer to realization, potentially easing Middle East tensions and reducing supply disruption fears. Despite this, threats to production from Canadian wildfires and significant U.S. crude stock draws provided some support to oil prices. Additionally, expectations of a September interest rate cut by the Federal Reserve, following strong U.S. economic data, further influenced market sentiment.

U.S. Economic Data and Oil Market Reactions

The U.S. Commerce Department's report of a 2.8% GDP growth in Q2 2024, driven by increased consumer spending and business investment, provided a bullish signal for oil markets. This economic strength, coupled with expectations of favorable Personal Consumption Expenditures (PCE) inflation data, bolstered hopes for a Fed rate cut in September. However, Goldman Sachs analysts cautioned that weak demand and slower GDP growth could reduce oil prices by up to $19 per barrel if the Fed delays rate cuts beyond 2025.

OPEC+ Production Strategies and Market Implications

Market watchers are divided on whether OPEC+ will ease production curbs in the next quarter. While some believe the producer cartel might increase supply if prices stabilize, others argue that current price levels do not justify such a move. OPEC's potential rollback of production cuts would be contingent on achieving their desired price targets, which remains uncertain given the current market conditions.

China's Import Strategies and Market Impact

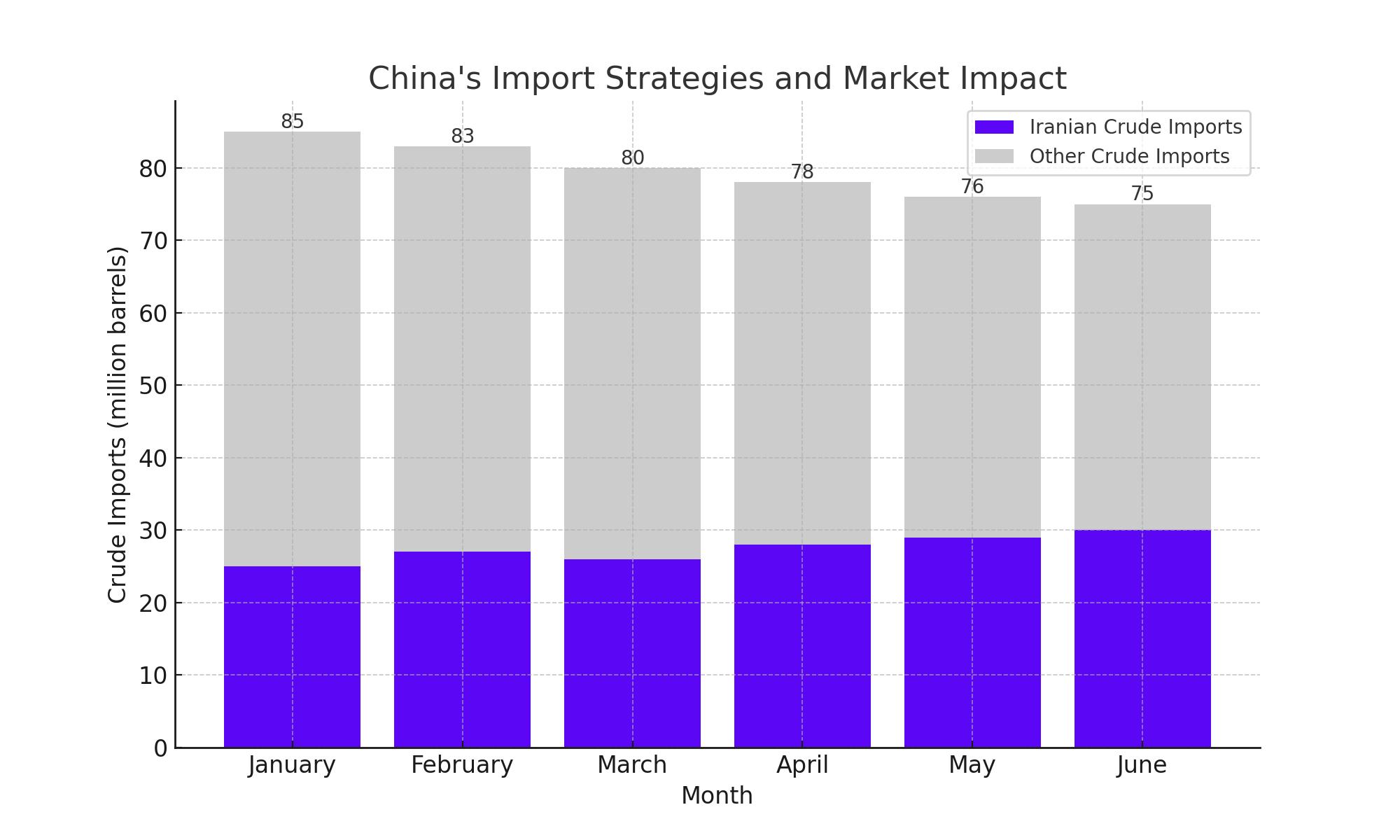

China's strategy of importing near-record levels of Iranian crude oil, despite labeling these imports under different countries such as Malaysia or Oman, highlights the complex dynamics in the global oil market. Independent Chinese refiners, facing low refining margins, have reduced their intake of Iranian crude. However, the port city of Dalian has seen a surge in Iranian crude shipments, compensating for the lower purchases by Shandong province refiners. This shift underscores China's role in supporting global oil demand, even amid economic uncertainties.

U.S. Presidential Election and Oil Market Prospects

The upcoming U.S. presidential election could significantly influence oil supply dynamics. Analysts at Goldman Sachs suggest that regardless of the election outcome, the next president will face challenges in materially boosting U.S. oil supply due to low Strategic Petroleum Reserve (SPR) stocks and regulatory constraints. While a Trump victory might lead to oil-friendly policies and attempts to increase OPEC+ supply, this would likely have a long-term rather than immediate impact on oil production.

Strategic Moves and Production Enhancements

Italian energy major Eni raised its oil and gas production guidance for the year and accelerated its share buyback program following better-than-expected Q2 earnings. Eni's adjusted net profit of $1.63 billion, driven by increased production from projects in Cote d’Ivoire, Congo Floating LNG, and Libya, reflects the company's strategic focus on expanding its upstream portfolio. Eni now expects full-year hydrocarbon production towards the top of its anticipated range of 1.69 - 1.71 million barrels of oil equivalent per day (boe/d) at a forecast Brent price of $86 per barrel.

Carbon Capture Initiatives and Long-Term Outlook

ExxonMobil continues to advance its carbon capture and storage (CCS) initiatives, signing a fourth deal with CF Industries to capture and store 500,000 tons of CO2 annually starting in 2028. This initiative aligns with Exxon's broader strategy to reduce its carbon footprint and support global emissions reduction efforts. The total CCS capacity under Exxon's agreements now stands at 5.5 million tons per year, highlighting the company's commitment to sustainable energy practices.

Brazil's Offshore Production and Strategic Divestments

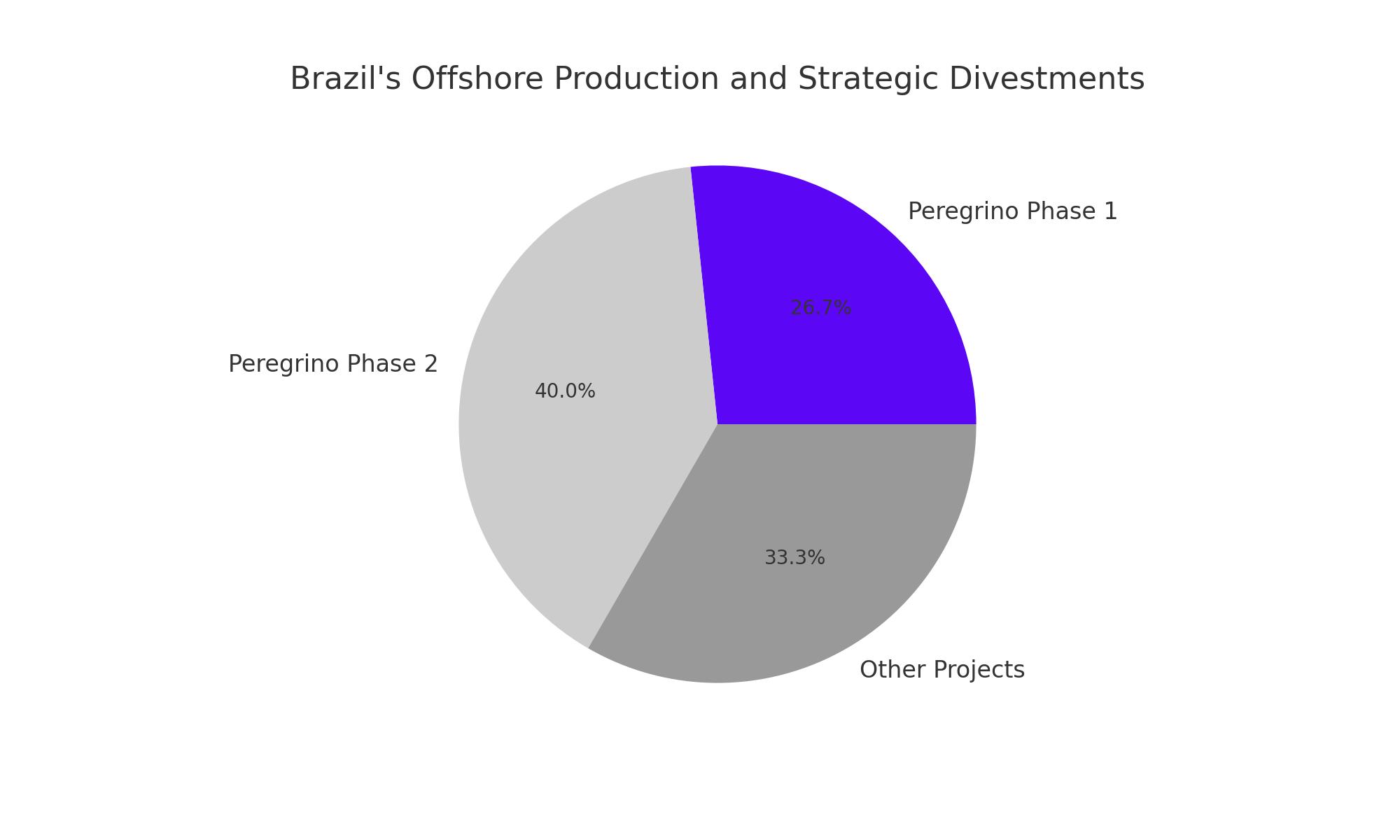

Brazil's oil production has seen a resurgence due to new offshore projects, positioning the country as a significant non-OPEC+ supply contributor. Equinor's Peregrino field, where Sinochem holds a 40% stake, has resumed production after a major maintenance program. The Peregrino phase 2 project is expected to add 250-300 million barrels of oil and extend the field's life to 2040. Meanwhile, Sinochem is in talks to sell its stake in the field to Prio SA, reflecting ongoing strategic adjustments in the global oil landscape.

Investment Recommendations: Buy - Strategic Growth and Market Potential

Crude oil represents a compelling buy opportunity for long-term investors due to a convergence of factors that indicate robust growth potential. The current market dynamics are favorably positioned to support an upward trajectory in oil prices, making it a valuable addition to any diversified investment portfolio.

Strong Market Performance

Recent data underscores the resilience of the oil market. For instance, the Energy Information Administration (EIA) reported a significant drawdown in U.S. crude inventories, with a decrease of 3.7 million barrels. This inventory reduction reflects strong demand and points to a tightening supply environment, which is typically bullish for prices. Additionally, gasoline and distillate stockpiles also saw substantial decreases, reinforcing the narrative of robust consumption patterns.

Positive Economic Indicators

The U.S. economy’s performance in Q2 2024 provides further justification for an optimistic outlook. The GDP expanded at an annualized rate of 2.8%, significantly higher than the 1.4% growth reported in the previous quarter. This economic strength, driven by increased consumer spending and business investment, bodes well for continued high levels of energy consumption. Furthermore, expectations of a Federal Reserve interest rate cut in September could decrease the attractiveness of yield-bearing assets, shifting more investor interest towards commodities like oil.

Geopolitical and Supply-Side Factors

Geopolitical developments continue to shape the oil market. The potential for a ceasefire in Gaza, while easing some supply concerns, is balanced by ongoing threats to production from Canadian wildfires. Additionally, China’s strategic oil imports, despite economic slowdowns, highlight the persistent global demand for crude. Notably, China's continued purchase of Iranian crude oil at near-record levels demonstrates the country’s commitment to securing energy supplies, which supports global oil prices.

Technical Indicators and Price Predictions

From a technical perspective, oil prices have shown resilience by maintaining higher lows and recovering from recent dips. The market's ability to respect key support levels, such as the 50-day Simple Moving Average (SMA) at $2,360 for gold (analogous trends observed in oil), suggests a stable foundation for future gains. Analysts predict a favorable outlook, with Goldman Sachs projecting continued price stability and potential growth.

Strategic Growth and Future Potential

Long-term projections for oil remain positive. The ongoing expansion of production capacities, such as the Peregrino phase 2 project in Brazil and strategic divestments by major players like Eni, highlight the industry's commitment to growth. Additionally, technological advancements in carbon capture and storage (CCS) by companies like ExxonMobil further enhance the sector’s attractiveness by addressing environmental concerns and promoting sustainability.

In summary, the combination of strong market performance, positive economic indicators, strategic geopolitical developments, institutional confidence, and promising technical indicators make crude oil a compelling buy. The strategic growth potential and future market dynamics underscore the value of including oil in a well-balanced investment portfolio.