US Sanctions Spark Oil Price Rally: WTI and Brent Hit Key Levels

Tighter Russian oil supply, freezing temperatures, and global demand fuel bullish momentum for WTI and Brent crude in early 2025 | That's TradingNEWS

Oil Price and Market Analysis Amid Geopolitical and Economic Shifts

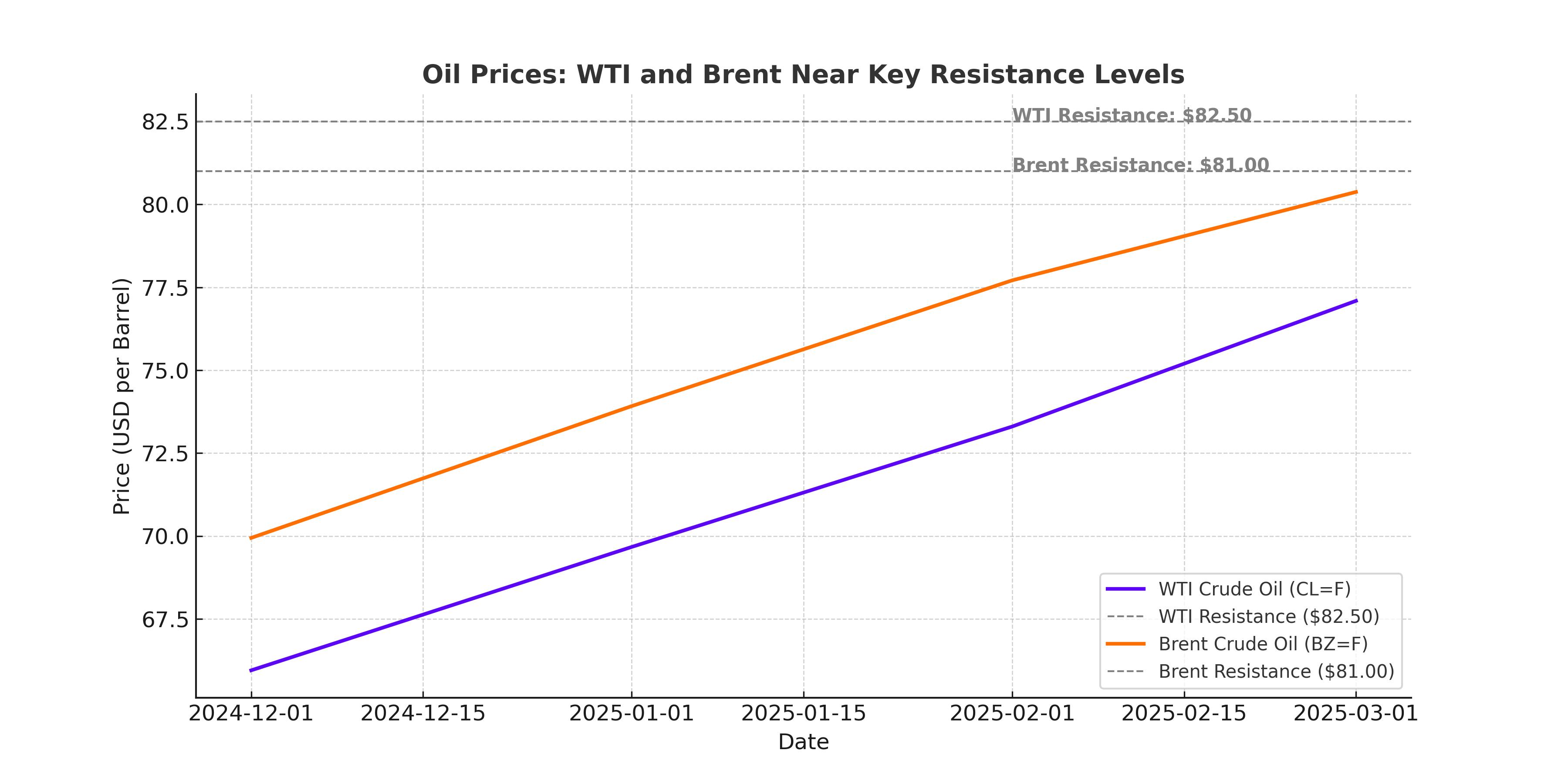

WTI and Brent Prices Near Key Resistance Levels

Oil markets are experiencing heightened activity, with WTI Crude (CL=F) trading around $76.50 per barrel and Brent Crude (BZ=F) testing resistance near $81. These prices reflect ongoing shifts in global supply and demand dynamics, geopolitical tensions, and economic policy adjustments. WTI's rise from $66 in early December to its current level highlights a bullish trend, further supported by technical breakouts above the 200-day SMA. Similarly, Brent's ability to maintain a steady upward trajectory has underscored its resilience in a volatile market.

Geopolitical Risks Elevate Market Tensions

The imposition of new U.S. sanctions on Russia, targeting key players like Gazprom Neft and Surgutneftegas, has intensified supply concerns. The sanctions, which affect over 180 vessels and other critical infrastructure, aim to curb Russian oil revenues amidst the ongoing conflict in Ukraine. This has created a ripple effect, with Hungary citing potential severe price hikes in Central Europe due to reduced supply through the Druzhba pipeline. Concurrently, Iran’s geopolitical position has weakened, with the nation grappling with domestic unrest and reduced regional influence, adding to oil market uncertainty.

Supply Dynamics and Seasonal Demand

Increased demand for heating fuels due to colder-than-expected weather across the Northern Hemisphere has driven short-term bullish momentum. The U.S. Energy Information Administration (EIA) anticipates a 1.6 million bpd growth in global oil production in 2025, primarily from non-OPEC+ countries. However, short-term supply concerns persist, with tighter inventories and backwardation in Brent futures indicating stronger demand than supply. JPMorgan forecasts a 1.4 million bpd year-on-year increase in January oil demand, driven by colder weather and China’s heightened travel activity for Lunar New Year celebrations.

Technical Indicators Suggest Consolidation and Resistance

WTI’s recent price action reflects consolidation near the $76-$78 range. A breakout above $78 would signal further bullish momentum, with resistance at $82.50 acting as a critical level for upward movement. Similarly, Brent’s resistance at $81 marks a pivotal juncture. Both benchmarks show RSI levels approaching overbought territory, suggesting potential near-term corrections if key resistance levels remain intact.

Economic Factors and Federal Reserve Policies

The strength of the U.S. dollar, supported by better-than-expected economic data, continues to weigh on oil prices. Robust service sector performance and a tight labor market have tempered expectations of aggressive Federal Reserve rate cuts, keeping Treasury yields elevated. This monetary environment creates headwinds for commodities priced in dollars, including oil, as higher borrowing costs reduce demand for riskier assets.

Long-Term Trends and Strategic Implications

Despite short-term volatility, the long-term outlook for oil remains neutral, with prices bound by a symmetrical triangle on monthly charts. WTI’s support at $66 and resistance near $92 define the current range. Key drivers include potential shifts in U.S. foreign policy under the incoming Trump administration, which could impact global oil markets through changes in sanctions and geopolitical alliances.

Market Sentiment and Speculative Positioning

Investor sentiment in oil markets is mixed, with ETF flows highlighting cautious optimism. For example, inflows into Bitcoin ETFs have paralleled speculative interest in oil, reflecting broader macroeconomic concerns. Market participants are closely monitoring geopolitical developments, including U.S.-Iran relations, Russia’s export dynamics, and potential supply disruptions in the Middle East.

Conclusion

Oil prices are navigating a complex landscape shaped by geopolitical tensions, seasonal demand, and macroeconomic policies. WTI and Brent’s ability to break above key resistance levels will determine the market’s next phase. Traders and investors must remain vigilant, as economic data, policy shifts, and geopolitical developments continue to shape the trajectory of the oil market. The focus remains on critical resistance at $82.50 for WTI and $81 for Brent, with sustained breaches likely to signal stronger bullish momentum in the months ahead.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex