Vanguard Value ETF NYSEARCA:VTV 2024 Market Outlook

Evaluating the Performance and Potential of Vanguard Value Index Fund ETF Shares in the Current Market Landscape | That's TradingNEWS

Strong Start to 2024 for Vanguard Value ETF (NYSEARCA:VTV)

In 2024, the Vanguard Value Index Fund ETF Shares (NYSEARCA:VTV) are showing strong potential for upside due to a broad-based growth rally across the S&P 500 sectors. Despite last year's underperformance, VTV, which includes 345 value stocks, has achieved a total return of over 9% year-to-date, closely trailing the S&P 500. This resurgence is a positive indicator for the value category, suggesting increased investor confidence.

Valuation Dynamics Between Growth and Value

A substantial gap between the forward price-to-earnings (PE) ratios of growth and value stocks indicates further upside potential for value stocks. Growth stocks are currently trading at around 27x forward earnings, while value stocks, such as those in VTV, trade at approximately 16.3x forward earnings. This discrepancy highlights the relative undervaluation of value stocks, presenting a buying opportunity.

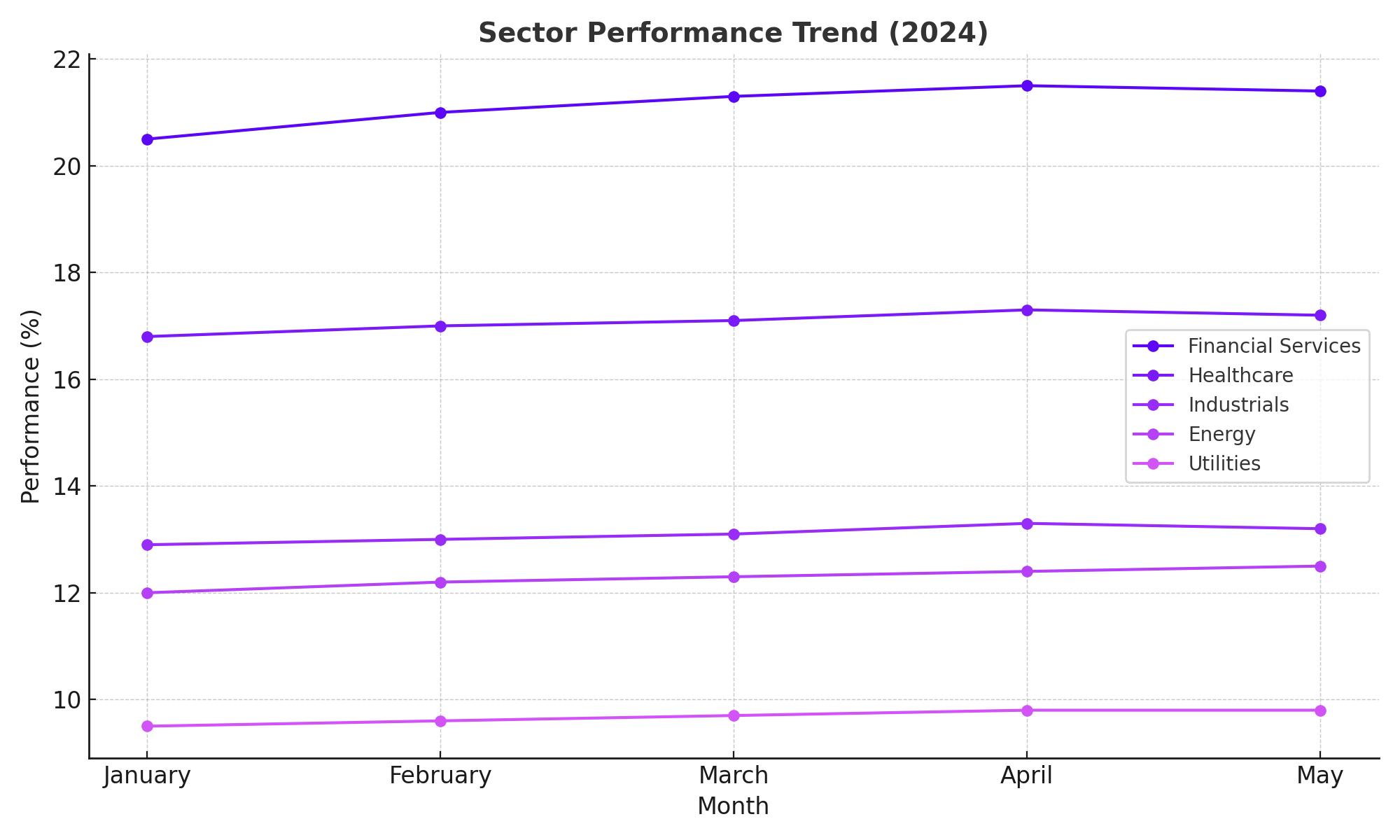

Key Sector Performances Bolstering the Uptrend

The recovery in key sectors such as financials, healthcare, industrials, energy, and utilities is vital for sustained growth in value stocks. These sectors account for nearly 70% of VTV's portfolio weight. The financial sector, in particular, has shown impressive performance due to improving fundamentals like decreasing credit risk and interest rate stability.

Financial Sector: A Pillar of Strength

The S&P 500 financial sector index has experienced significant gains in the past six months. Major financial institutions like JPMorgan Chase (JPM) reported strong first-quarter results, exceeding revenue and earnings expectations. JPMorgan's net investment income outlook for the full year was revised upwards to $91 billion, and provisions for credit losses were significantly lower than expected.

Insurance companies have also shown robust performance. Prudential Financial (PRU) reported a 43% increase in first-quarter revenue, and Progressive Corporation (PGR) saw a 19% increase in net premiums earned. Asset management giant Berkshire Hathaway (BRK.A, BRK.B) reported substantial revenue growth, highlighting the sector's overall strength.

Healthcare Sector: A Return to Growth

After a challenging 2023, the healthcare sector is poised for profitable growth in 2024. Key holdings like UnitedHealth (UNH), Johnson & Johnson (JNJ), and Merck & Co. (MRK) have demonstrated strong financial performance. UnitedHealth reported an 8.6% year-over-year revenue increase, while Merck is expected to continue robust growth in oncology and vaccines.

Industrial and Energy Sectors: Continued Momentum

The industrial sector is projected to achieve 7% earnings growth in 2024, supported by its strong performance over the past year. Energy stocks are also expected to contribute positively, with oil prices stabilizing between $75 and $85 per barrel. Exxon Mobil (XOM), a key holding in VTV, has outperformed the broader market index with a 15% year-to-date gain.

Sector Exposure and Portfolio Composition

VTV's diversified portfolio includes significant allocations to financial services (21.4%), healthcare (17.2%), and industrials (13.2%). This strategic sector exposure supports the ETF's stability and growth potential. The ETF's top ten holdings, which include Berkshire Hathaway, Broadcom (AVGO), JPMorgan, Exxon Mobil, UnitedHealth, Procter & Gamble (PG), Johnson & Johnson, Home Depot (HD), Merck, and Walmart (WMT), represent 22% of total assets, ensuring a robust and balanced investment.

Peer Comparison and Quant Analysis

Compared to its peers, VTV stands out due to its well-diversified portfolio, high liquidity, above-average yield of 2.36%, and low expense ratio of 0.04%. Despite higher returns from some peers like Invesco Large Cap Value ETF (PWV) over the past twelve months, VTV's lower expense ratio and broader diversification make it an attractive option. The ETF's quant rating of 3.63, indicating a buy, reflects its strong fundamentals and low-risk profile.

Market Performance and Future Outlook

VTV's total return has been slightly below large-cap benchmarks, reflecting the broader market's focus on growth stocks. However, value strategies have delivered nearly double-digit returns over the long term. VTV's lower volatility and consistent returns make it a solid choice for investors seeking exposure to value stocks in a diversified portfolio.

The ETF's focus on sectors with improving fundamentals, such as financials and healthcare, and its exposure to stable large-cap companies, position it well for continued growth. As the market adjusts to high valuations in growth stocks, value-oriented funds like VTV offer a compelling investment opportunity.

Investment Outlook for Vanguard Value ETF (NYSEARCA:VTV)

Given the current market conditions, the Vanguard Value Index Fund ETF Shares (NYSEARCA:VTV) present a promising investment opportunity. The ETF's diversified portfolio, strong sector performance, and attractive valuation make it a compelling choice for investors looking for stability and growth in the value category. With expectations for continued earnings growth and economic stability, VTV is well-positioned to capitalize on the potential upside in 2024.