Vita Coco (NASDAQ:COCO): Strong Q3 Results, Growing Market Position, and Institutional Backing

A Closer Look at Vita Coco’s Financial Resilience, Shareholder Confidence, and Strategic Expansion | That's TradingNEWS

Deep Dive into (NASDAQ:COCO)– Vita Coco’s Financials, Market Performance, and Future Growth Prospects

NASDAQ:COCO's Strong Q3 Performance and Earnings Beat

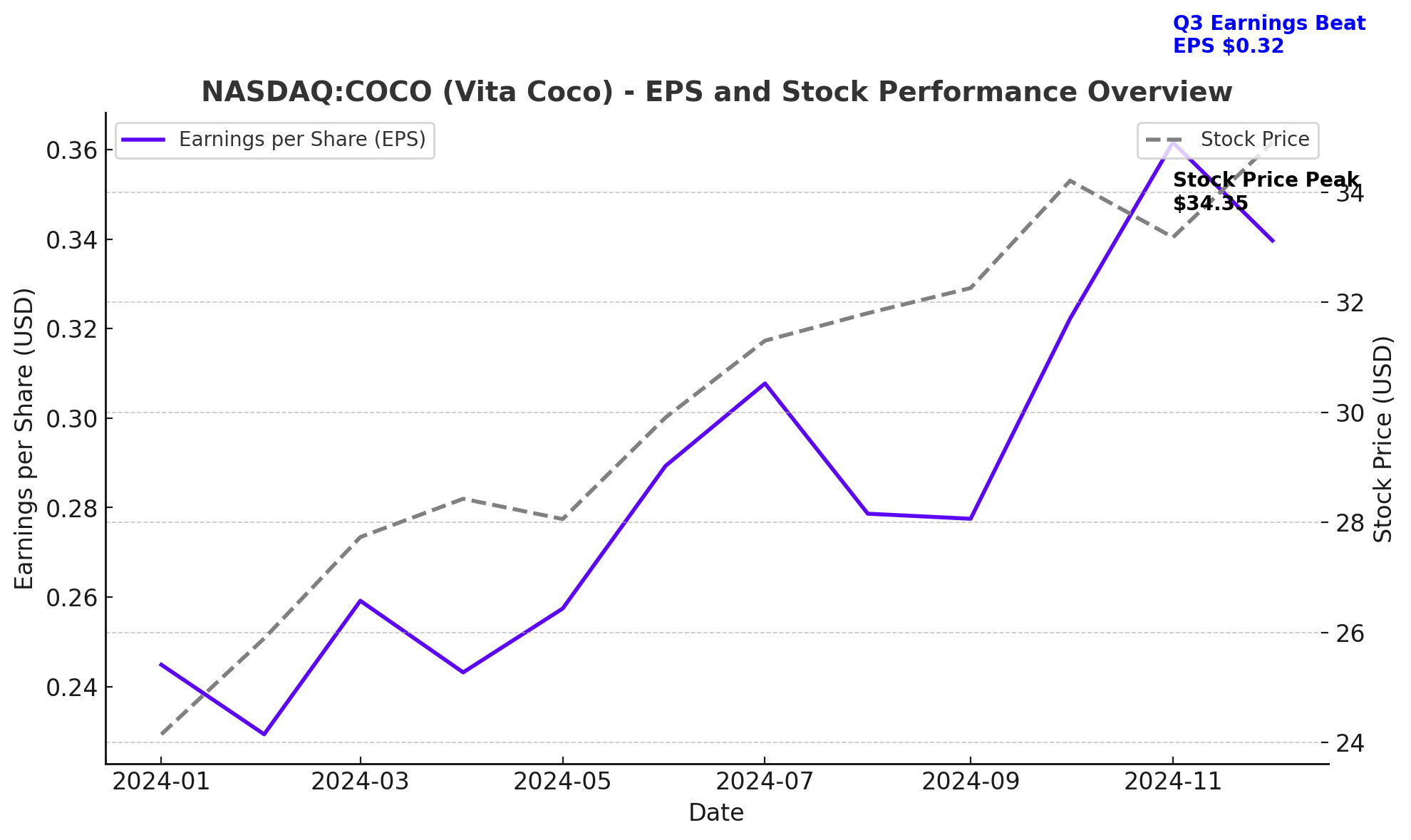

The Vita Coco Company, Inc. (NASDAQ:COCO) delivered an impressive third quarter for fiscal year 2024, surpassing analysts' EPS projections by posting $0.32 per share against an expected $0.26, representing a beat of $0.06. Net sales, however, saw a slight decline, falling 4% year-over-year to $133 million, compared to the projected $138.96 million. This dip, while modest, underscores certain inventory and supply chain constraints faced during the quarter, which the company has since been addressing.

This earnings beat demonstrates Vita Coco's resilience in managing operational costs and optimizing margins despite revenue pressures. Gross profit stood at $52 million, with a gross margin of 39%, down from the prior year's 41%. This decrease in gross margin is attributed to elevated transportation costs and inventory challenges, but the company’s proactive adjustments have allowed it to retain a robust profitability profile.

Upgraded Financial Guidance and Full-Year 2024 Outlook

Vita Coco has raised its full-year 2024 guidance, projecting net sales to land between $505 million and $515 million, aligning closely with analysts' expectations of $506 million. The company also anticipates an adjusted EBITDA range of $80 million to $84 million, showing confidence in its ability to navigate the remaining quarters despite macroeconomic headwinds. Vita Coco’s decision to raise guidance reflects its positive outlook on inventory flow improvements and growth in coconut water demand. The updated forecast accounts for Vita Coco Coconut Water and private label coconut water volume growth, offset by expected decreases in the private label coconut oil sector.

Recent Stock Price Performance and Market Sentiment

The stock price for (NASDAQ:COCO) recently closed at $30.78, marking an increase of 12.54% over the last three months and 13.58% over the past year. Following the Q3 earnings release, shares surged by 5.1%, reaching as high as $34.35 in intraday trading. The strong upward trend in (NASDAQ:COCO) stock aligns with Vita Coco’s improved financial performance and favorable investor sentiment.

The Relative Strength (RS) Rating for NASDAQ:COCO rose to 85, signaling that the stock has outperformed 85% of stocks in terms of price movement over the past year. This high RS rating is significant, as it situates Vita Coco among top-performing stocks in the market, an indicator often linked with continued price appreciation in high-growth companies.

For real-time updates on Vita Coco’s stock performance, you can view its live chart here.

Analyst Ratings and Price Targets for (NASDAQ:COCO)

Insider Transactions Reflect Confidence in (NASDAQ: COCO)

For more detailed information on NASDAQ:COCO insider transactions, visit insider transactions.

Institutional Investments in NASDAQ:COCO

Institutional ownership in NASDAQ:COCO is currently around 88.49%, a robust figure indicating widespread backing from major financial players. This high level of institutional involvement tends to provide a buffer against volatility and lends stability to the stock’s performance.

ROE and Profitability Analysis

Vita Coco’s return on equity (ROE) of 24% stands out, underscoring its profitability and efficient use of shareholder funds. This high ROE ratio indicates that for every dollar of equity, the company generates $0.24 in profit. Comparing this to the beverage industry average of 19%, Vita Coco’s superior ROE underscores its operational efficiency and competitive advantage. Coupled with a five-year earnings growth rate of 20%, Vita Coco’s financial health positions it favorably within the broader consumer goods sector.

Expansion and Strategic Focus on Coconut Water Growth

Vita Coco Coconut Water saw an 8% increase in sales for Q3, even as overall net sales decreased due to supply constraints and reduced private label volumes. This growth within the core product line reflects Vita Coco’s strategic focus on high-margin, health-conscious products that resonate with evolving consumer preferences. The company’s leadership in the coconut water category continues to drive household penetration and new usage occasions, from post-workout hydration to culinary applications.

CEO Martin Roper highlighted improvements in inventory flow, noting that by late September, Vita Coco had addressed ocean freight container shortages that had previously hampered supply. This adjustment is expected to support accelerated growth in Q4 and beyond, further solidifying Vita Coco’s dominance in the coconut water space.

Financial Stability and Cash Position

As of September 30, 2024, Vita Coco’s balance sheet showed a strong cash position of $157 million, with no outstanding debt. This robust cash reserve enables the company to weather economic uncertainties and fund expansion initiatives without the need for additional borrowing. Vita Coco’s prudent cash management and debt-free balance sheet provide it with strategic flexibility to invest in growth areas while safeguarding shareholder value.

Share Repurchase Program and Stockholder Returns

Vita Coco recently authorized a $40 million share repurchase program, reflecting its commitment to returning capital to shareholders. As of Q3, the company had repurchased a total of 534,246 shares, amounting to an aggregate value of $12.8 million, with an average repurchase price of $23.97 per share. This buyback initiative supports stock price stability and demonstrates Vita Coco’s confidence in its intrinsic value, offering a positive signal to investors regarding long-term growth potential.

Valuation and Growth Potential

Vita Coco trades at a price-to-earnings (P/E) ratio of 35.47 and a price-to-earnings-to-growth (PEG) ratio of 2.46, indicating a moderate valuation relative to its growth potential. The company’s beta of 0.22 suggests lower volatility compared to the broader market, making it an appealing choice for risk-averse investors. Vita Coco’s valuation metrics, combined with its growth trajectory, suggest that NASDAQ:COCO remains attractively priced for long-term gains, especially given the expanding demand for health-oriented beverages.

Final Assessment: Buy, Hold, or Sell?

Based on the comprehensive data, (NASDAQ: COCO) presents a promising investment case for growth-oriented investors. Its consistent performance in the coconut water sector, combined with strong institutional backing, an effective insider ownership structure, and strategic inventory management, positions Vita Coco well for continued gains. The upgraded guidance, solid financial health, and positive outlook on product demand suggest a Buy recommendation for long-term investors. However, those prioritizing immediate returns may want to monitor upcoming quarterly reports to assess the impact of ongoing market conditions on revenue and margins.